Small Form Factor (SFF) Board Market Size 2025-2029

The small form factor (SFF) board market size is forecast to increase by USD 16.66 billion at a CAGR of 30.1% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. The rapid increase in mobile data traffic is driving the demand for compact and efficient electronic components, making SFF boards an attractive solution. Key applications include M2M communication, Internet of Things (IoT), Data centers, Mobile phones, Tablets, LTE cellular networks, Transportation, Healthcare, Industrial, Computer, Desktop computer, and various IoT devices. Additionally, the growing need for data centers to accommodate expanding digital infrastructure is boosting the market. Furthermore, the increasing technological complexity of SFF boards is enabling advanced functionality in various applications, from telecommunications to consumer electronics. These trends are expected to continue shaping the SFF board market In the coming years.

What will be the Size of the Small Form Factor (SFF) Board Market During the Forecast Period?

- The market encompasses a range of technologies, including M2M communication, IoT devices, and computer components, designed for compact applications in various industries. This market exhibits significant growth, driven by the increasing demand for advanced computing in sectors such as data centers, mobile phones, tablets, LTE cellular networks, transportation, healthcare, industrial automation, and computer systems.

- SFF boards come in various form factors, including SFF cases, shoeboxes, cubes, and book-sized PCs, and incorporate technologies like SSDs, HDDs, 3D Nand, relational analytics, smart SSDs, optical transceivers, and smart devices. The market's expansion is fueled by the surging data traffic and the adoption of cloud-based services, as well as the emergence of 5G networks, which require high-performance, compact components.

How is this Small Form Factor (SFF) Board Industry segmented and which is the largest segment?

The small form factor (SFF) board industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Industrial

- Retail

- Healthcare

- Transporation

- Others

- Type

- Shoebox shapes

- Cubes shapes

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- APAC

By Distribution Channel Insights

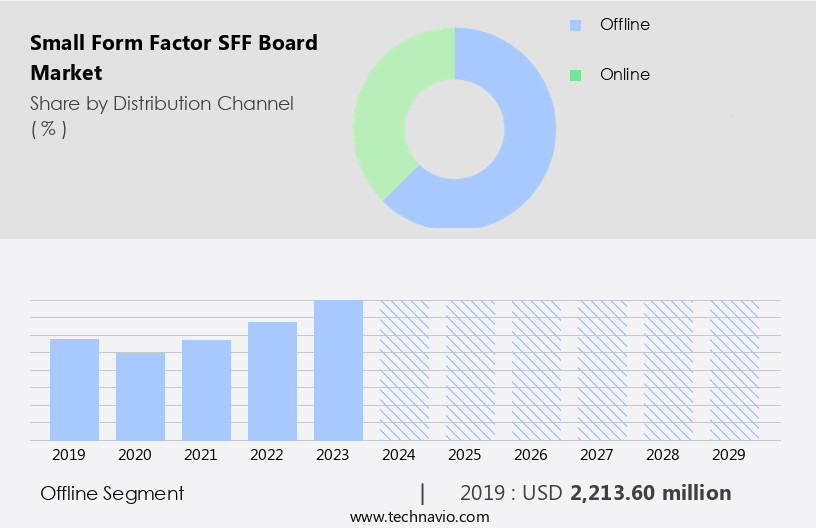

- The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses various distribution channels, with offline distribution being a significant segment. Offline distribution refers to the traditional method of selling products through physical stores, enabling customers to interact with the product before purchasing. This distribution channel caters to a broad customer base, particularly those preferring a tactile experience and personal interactions. Intermediaries, such as distributors, wholesalers, and retailers, play a crucial role in connecting manufacturers to end-users within the SFF board market.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 2.21 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 72% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in the Asia Pacific region is expected to experience significant growth due to several factors. One of the primary drivers is the Chinese government's Broadband China Strategy and Implementation Plan, which was initiated in 2013. This plan has led to the designation of 120 cities in China as Broadband China Pilot Cities in 2022, fueling the development of high-speed transmission networks and increasing Internet penetration. India also presents a significant growth opportunity for SFF board manufacturers due to government initiatives such as the National Optical Fiber Network and Network for Spectrum. Additionally, the growing adoption of IoT devices, M2M communication, and 5G networks In the region will further boost market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Small Form Factor (SFF) Board Industry?

Rapid increase in mobile data traffic is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for IoT devices, M2M communication, and data center applications. The Internet of Things (IoT) is revolutionizing various industries, including transportation, healthcare, industrial, and computer sectors, by enabling connectivity for an array of devices. In data centers, SFF boards are being used to support SSDs and HDDs with advanced technologies like 3D Nand and Relational analytics. Smart SSDs and Optical transceivers are also gaining popularity for their energy efficiency and high-speed data transfer capabilities. The rise of LTE cellular networks and the impending adoption of 5G networks are driving the need for connectivity ICs and network complexity.

- Silicon photonics and alternative materials are being explored to address the challenges of power consumption and thermal management techniques In these applications. The industrial automation industry is also leveraging SFF boards for machine learning, artificial intelligence (AI), and deep learning applications, requiring high-performance computing in compact form factors. Cloud-based services and hyperscale data centers are also major contributors to the SFF board market growth. With the increasing data traffic and the need for faster and more efficient data processing, the operational range of SFF boards is being extended to support single mode fibers and meet the demands of these applications.

What are the market trends shaping the Small Form Factor (SFF) Board Industry?

Growing demand for data centers is the upcoming market trend.

- The market is experiencing significant growth due to the increasing demand for managing and storing vast amounts of data generated by Internet of Things (IoT) devices. With the proliferation of M2M communication, IoT applications are generating copious data, necessitating efficient data management in numerous data centers globally. As cloud computing platforms and services expand exponentially, telecom network operators and cloud service providers are investing heavily in constructing data centers to accommodate this data influx. SFF boards are a popular choice for data centers due to their high-density computing power within confined physical spaces. The global SFF board market will witness strong expansion as a result of this trend, as well as the increasing adoption of LTE cellular networks, 5G networks, and the integration of smart devices into various industries such as transportation, healthcare, industrial, and computer applications.

- Furthermore, the integration of advanced technologies like SSDs, HDDs, 3D NAND, relational analytics, smart SSDs, optical transceivers, and connectivity ICs in SFF boards enhances their functionality and efficiency. The market is also driven by the growing demand for energy efficiency, thermal management techniques, alternative materials, and networking standards in data center applications. Additionally, the integration of machine learning, artificial intelligence (AI), deep learning, and hyperscale data centers is expected to further fuel market growth. The operational range of SFF boards, from shoeboxes and cubes to book-sized PCs, makes them suitable for various applications, including IoT devices and data center infrastructure.

What challenges does the Small Form Factor (SFF) Board Industry face during its growth?

Increasing technological complexity of SFF boards is a key challenge affecting the industry growth.

- The market is experiencing significant growth due to the increasing demand for compact, efficient electronics. SFF boards are integral to various applications, including Machine Learning (ML), Artificial Intelligence (AI), and Deep Learning in sectors such as Data centers, Internet of Things (IoT), Mobile phones, Tablets, and Industrial automation. M2M communication and LTE cellular networks are driving the adoption of SFF boards in transportation, healthcare, and industrial applications. The integration of SSDs and HDDs, along with 3D NAND and Relational analytics, is enabling the development of Smart SSDs and IoT devices. Semiconductor manufacturers are focusing on circuit designs, thermal management techniques, and alternative materials to address the challenges of power consumption and energy efficiency.

- The emergence of 5G networks and the increasing data traffic from connected devices necessitate advanced connectivity ICs and networking standards. Silicon photonics and optical transceivers are essential for high-speed data transfer in data center applications. The adoption of 5G networks and cloud-based services is expected to increase, leading to the development of hyperscale data centers. Manufacturers must navigate the complexities of network design and thermal management while ensuring operational range compatibility with single mode fibers. The integration of ML, AI, and Deep Learning in SFF boards is enabling the development of advanced electronics products.

Exclusive Customer Landscape

The small form factor (SFF) board market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the small form factor (sff) board market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, small form factor (sff) board market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ADLINK Technology Inc. - The company offers SFF board such as Little Board 735 which is extreme rugged EBX single board.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AAEON Technology Inc.

- Advantech Co. Ltd.

- American Portwell Technology Inc.

- AMETEK Inc.

- congatec GmbH

- Emerson Electric Co.

- EUROTECH Spa

- Intel Corp.

- Kontron AG

- Mercury Systems Inc.

- NVIDIA Corp.

- NXP Semiconductors NV

- Qualcomm Inc.

- Super Micro Computer Inc.

- Texas Instruments Inc.

- Toradex AG

- WINSYSTEMS Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing demand for compact, efficient technology solutions across various industries. SFF boards, also referred to as M2M communication boards or IoT devices, are integral components In the development of connected devices and systems. These boards enable seamless communication between different devices and networks, driving advancements in sectors such as data centers, transportation, healthcare, industrial automation, and more. The proliferation of IoT devices and the resulting increase in data traffic have necessitated the need for more efficient and energy-efficient solutions. SFF boards play a crucial role in this regard, as they help minimize power consumption and optimize thermal management techniques.

In addition, silicon photonics and alternative materials are some of the emerging technologies being explored to address the energy efficiency challenges in SFF boards. In the data center sector, SFF boards are increasingly being adopted for their ability to reduce infrastructure complexity and improve networking standards. The growing popularity of cloud-based services and the increasing adoption of 5G networks have further fueled the demand for these boards. With the operational range of SFF boards extending to single mode fibers, they are becoming an essential component in data center applications. The industrial automation industry is another significant market for SFF boards.

Furthermore, these boards enable the integration of advanced technologies such as machine learning, artificial intelligence (AI), deep learning, and relational analytics into industrial processes. Smart SSds and HDDs, equipped with 3D Nand technology, are being used to enhance the performance and capacity of industrial applications. The market dynamics of the SFF board market are shaped by several factors, including the increasing demand for connectivity in various industries, the need for energy efficiency, and the ongoing development of networking standards and circuit designs. The adoption of 5G networks and the growing popularity of hyperscale data centers are expected to drive the growth of the SFF board market In the coming years.

Moreover, the SFF board market is not limited to traditional computing applications such as desktop computers and laptops. These boards are also being used in mobile phones, tablets, and other IoT devices, expanding their reach and versatility. The integration of optical transceivers and smart devices into SFF boards is further enhancing their functionality and applicability. The market is expected to continue growing, fueled by the adoption of advanced technologies, the need for energy efficiency, and the ongoing development of networking standards and circuit designs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 30.1% |

|

Market growth 2025-2029 |

USD 16.66 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

22.8 |

|

Key countries |

China, Japan, India, US, South Korea, Australia, Germany, Canada, UK, and France |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Small Form Factor (SFF) Board Market Research and Growth Report?

- CAGR of the Small Form Factor (SFF) Board industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the small form factor (sff) board market growth of industry companies

We can help! Our analysts can customize this small form factor (sff) board market research report to meet your requirements.