What is the Sheet Mica Market Size?

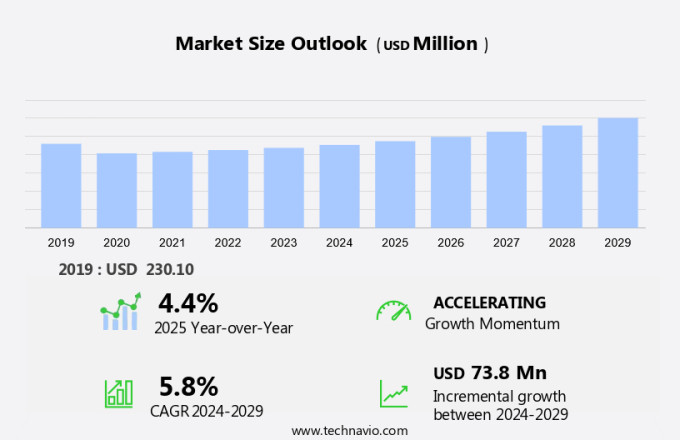

The sheet mica market size is forecast to increase by USD 73.8 million, at a CAGR of 5.8% between 2024 and 2029. The market is experiencing significant growth due to the increasing demand for high-performance insulation materials. This trend is being driven by the adoption of mica in various industries, including construction and renewable energy. In the construction sector, mica is used as a reinforcing filler in cement and asphalt, while in the renewable energy sector, it is utilized in the production of solar panels and thermal insulation. However, the market faces challenges from substitute materials such as glass fibers and ceramic fibers. These alternatives offer similar insulation properties and are often more cost-effective. To remain competitive, market players are focusing on product innovation and cost reduction strategies. The market analysis report provides an in-depth assessment of these trends and challenges, offering valuable insights for stakeholders.

What will be the size of the Market during the forecast period?

Request Free Sheet Mica Market Sample

Market Segmentation

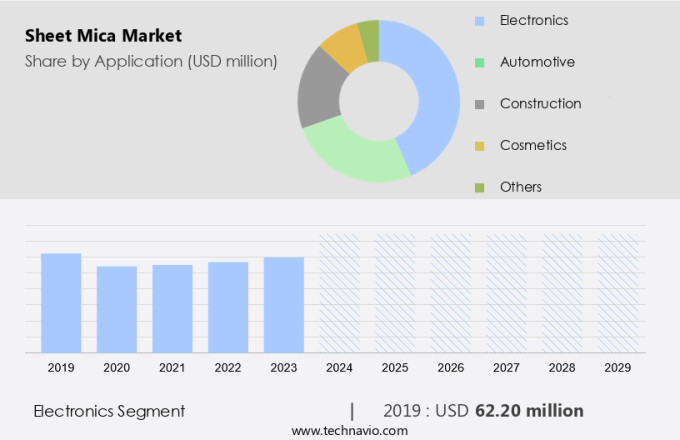

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019 - 2023 for the following segments.

- Application

- Electronics

- Automotive

- Construction

- Cosmetics

- Others

- Type

- Natural

- Synthetic

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

Which is the largest segment driving market growth?

The electronics segment is estimated to witness significant growth during the forecast period. The market is driven by its essential role in the electronics industry, particularly in applications where its superior electrical insulation properties are indispensable.

Get a glance at the market share of various regions. Download the PDF Sample

The electronics segment was valued at USD 62.20 million in 2019. Mica's high dielectric strength, capable of withstanding up to 2000 kV/mm, makes it an ideal material for insulating electrical components across various voltage levels. Its high permittivity enhances its functionality as a dielectric in capacitors, while its durability is further enhanced when combined with materials like glass or ceramic. In power electronics, mica is extensively utilized in resistors and capacitors to enhance the stability and performance of high-precision circuits. Sustainable mining practices and advanced processing technologies ensure a consistent supply of high-quality sheet mica, contributing to the market's revenue growth.

Which region is leading the market?

For more insights on the market share of various regions, Request Free Sample

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Asia-Pacific (APAC) region is a significant contributor to the market, primarily due to its thriving industrial and economic activities. China, India, and Japan are key players in this market, with substantial usage in their automotive and electronics sectors. China, home to the world's largest automotive sector, is projected to produce over 30 million units annually by 2025. This vast production scale generates considerable demand for mica, which is employed for electrical insulation and heat shielding in automotive components. China's automotive industry's reliance on mica highlights its importance in enhancing vehicle efficiency and safety. In the APAC region, the demand for sheet mica is stable and consistent, driven by the region's industrial growth and the increasing use of mica in various applications, including insulation, smoke detectors, and toasters.

How do company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Asheville Mica Co. - The company offers sheet mica for various applications, including decorative mica products, stove mica, and muscovite mica blocks.

Technavio provides the ranking index for the top 18 companies along with insights on the market positioning of:

- Axim Mica Inc.

- C. L. Roongta

- Cleveland MICA Co.

- Datamica Material and Technology

- Elmelin Ltd.

- Hangzhou Weshare Import and Export Co. Ltd.

- Highmica

- Imerys S.A.

- Langtec Ltd.

- Nippon Rika Industries Corp.

- Pamica Group Ltd.

- RUBY MICA CO. LTD.

- Sakti Mica Manufacturing Co.

- Shenzhen Shenglong Electric Heating Technology Co. Ltd.

- Sigma Sealing and Insulations Pvt. Ltd.

- The Premier Mica Co.

- Zennov Industry Sdn Bhd

Explore our company rankings and market positioning. Request Free Sample

How can Technavio assist you in making critical decisions?

What is the market structure and year-over-year growth of the Market?

|

Market structure |

Fragmented |

|

YoY growth 2024-2025 |

4.4 |

Market Dynamics

The market encompasses a diverse range of applications, from cosmetics and paints to electronics and construction. This versatile mineral, known for its unique properties such as heat resistance, durability, and electrical insulation, is in high demand across various industries. Mica's role in cosmetics is significant, with its shimmering and reflective qualities making it a popular ingredient in makeup and skincare products. In the electronics sector, mica's excellent insulating properties make it an essential component in the production of capacitors and other electronic devices. The construction industry also relies heavily on mica, particularly for thermal insulation and as a reinforcing agent in concrete. Mica's usage in the automotive and aerospace industries is growing due to its lightweight and high-performance characteristics. Research and innovation continue to drive the mica market forward. New applications are being discovered, such as in the pharmaceutical industry for its potential medicinal properties, and in agriculture for its use as a soil conditioner. Sustainability is a key focus in the mica industry, with initiatives being taken to ensure responsible sourcing and ethical mining practices. Companies are also exploring alternatives to mica, such as synthetic materials, to reduce the environmental impact of its extraction.

Despite the challenges, the future of the mica market looks bright, with continued growth expected due to its wide range of applications and unique properties. The demand for mica is expected to remain strong, making it an attractive investment opportunity for businesses and individuals alike. In conclusion, the mica market is a dynamic and diverse industry, with applications spanning from cosmetics and paints to electronics and construction. Its unique properties, including heat resistance, durability, and electrical insulation, make it an essential component in various industries. The focus on sustainability and innovation is driving the market forward, ensuring its continued growth and relevance. Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the primary factors driving the market growth?

Increasing demand for high-performance insulation materials is notably driving the market growth. The market is witnessing notable expansion due to the escalating demand for insulation materials with superior thermal and electrical properties. Mica's unique crystal structure, composed of layers of silica tetrahedra, aluminum, potassium, magnesium, and iron, grants it exceptional thermal adaptability. These layers can slide over each other, adapting to temperature shifts through weak ionic bonds. Mica's high heat resistance and durability make it indispensable in industries such as construction, electronics, and transportation. In the electronics sector, mica's insulating properties are crucial for components like capacitors and resistors. In construction, mica is used as a joint filler and insulator in various applications, including thermal insulation for buildings and kiln linings.

Additionally, mica's shimmer and texture add value in cosmetics and consumer goods. Sustainable mining practices and responsible sourcing are increasingly important in the mica supply chain, ensuring transparency and ethical production. Processing technologies continue to evolve, enabling the production of synthetic mica and the recycling of mica scrap. Market revenue is expected to grow steadily as technology adoption increases in industries that require high-performance insulation materials. Applications for mica-based products span from heat resistance in toasters and smoke detectors to tough materials for aircraft and acoustic guitars. Thus, such factors are driving the growth of the market during the forecast period.

What are the significant trends being witnessed in the market?

The adoption of mica in the renewable energy sector is an emerging trend shaping the market growth. The market encompasses the production and utilization of mica, a mineral known for its unique properties, primarily in the construction and electronics industries. Mica's attributes, such as heat resistance, chemical stability, mechanical strength, and electrical insulation, make it an indispensable component in various applications. In the construction sector, mica's insulation properties contribute to thermal insulation in various goods, including toasters and smoke detectors. Its flexibility and toughness make it an excellent joint filler and ground mica for paints and coatings. Furthermore, its shimmer and texture add aesthetic value to consumer goods, such as cosmetics and acoustic guitars. The electronics industry benefits significantly from mica's electrical insulation properties. It is used extensively in the production of electronic components, including capacitors, resistors, and transformers. Mica's stability and resistance to high temperatures make it suitable for use in high-performance applications, such as in aircraft and aerospace components.

Moreover, the renewable energy sector is increasingly adopting mica due to its insulation and heat resistance properties. Mica is used in wind and solar energy systems to insulate motor coils and cables, ensuring efficient and safe operation. In wind turbine blades, mica sheets provide durability and performance by protecting them from extreme temperatures and electrical stresses. The market revenue for mica is expected to grow due to the increasing demand for mica-based products and the adoption of advanced processing technologies. Sustainable mining practices and responsible sourcing are essential to maintaining a stable supply chain and ensuring market growth. Overall, the market is poised for continued growth, driven by the diverse applications and unique properties of this versatile mineral. Thus, such market trends will shape the growth of the market during the forecast period.

What are the major market challenges?

Competition from substitute materials is a significant challenge hindering the market growth. The market encompasses the production and distribution of natural and synthetic mica products for various industries, including construction, electronics, and cosmetics. With a focus on responsible sourcing and sustainable mining practices, mica infrastructure ensures a steady supply of high-quality mica. Mica's unique properties, such as shimmer, texture, thermal insulation, and heat resistance, make it an essential component in numerous applications. However, the market faces competition from alternative materials like clay, plastics, glass, paper, Teflon, and PFA. Clay, particularly ceramic and porcelain, offers heat resistance and durability, making it a viable substitute in applications requiring high thermal stability. Plastics, such as PVC, are preferred for their versatility, ease of processing, and cost-effectiveness. In the electronics sector, mica's excellent insulating properties make it indispensable in various components, including capacitors, resistors, and transformers.

In construction, mica is used as joint filler and insulation in buildings and infrastructure. The cosmetics industry utilizes mica-based products for their shimmering and textured effects. Mica's production capacity is influenced by technology adoption and processing techniques, ensuring the market's stability. Market revenue is driven by the increasing demand for mica in various industries, including consumer goods, aircraft, and appliances. Despite competition from substitute materials, mica's unique properties and wide range of applications ensure its continued relevance in numerous industries. Hence, the above factors will impede the growth of the market during the forecast period.

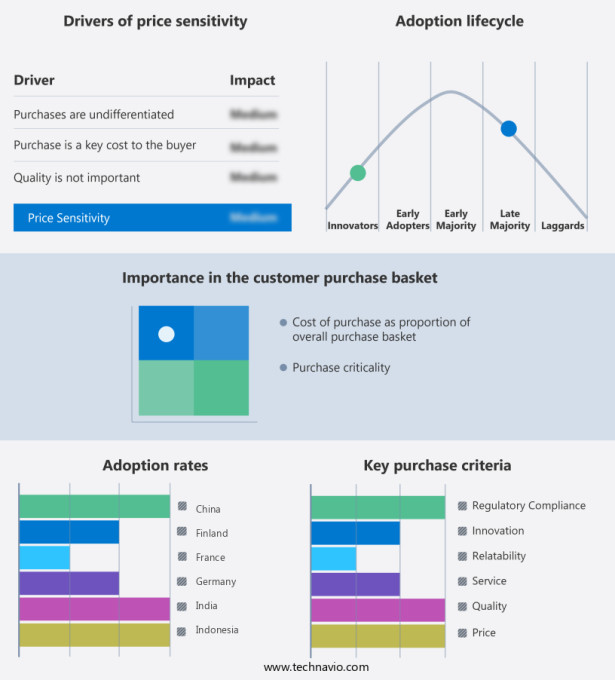

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

The market encompasses a diverse range of applications, spanning from construction to electronics, cosmetics, and various consumer goods. This market, driven by the unique properties of mica, continues to evolve, fueled by research and development efforts and the adoption of advanced processing technologies. Mica's inherent qualities, such as its shimmer, texture, heat resistance, and durability, make it an indispensable component in numerous industries. In construction, mica is used as a thermal insulator and joint filler due to its excellent insulating properties and stability. In the electronics sector, it plays a crucial role in various components, including capacitors and connectors, due to its high dielectric strength and stability. Responsible sourcing and sustainable mining practices have become increasingly important in the mica industry. Producers and consumers alike are focusing on supply chain transparency to ensure ethical and environmentally responsible production. Mica's historical use in various applications, from smoke detectors to aircraft, attests to its versatility and enduring value.

In addition, mica production capacity has grown significantly over the years, with various countries, including India and China, leading the way. Processing technologies have also advanced, enabling the production of synthetic mica and the recycling of mica scrap. These developments have expanded the market's reach and increased the availability of mica-based products. The cosmetics industry is another significant consumer of mica, utilizing its unique shimmer and texture properties. Mica's flexibility and resistance to cracks make it an ideal ingredient in various cosmetic products. In the electronics sector, mica's heat resistance and toughness contribute to the production of high-performance components, such as those used in toasters and appliances. The market is experiencing significant growth due to its diverse mica applications across various industries.

Further, mica in electronics is particularly crucial, with its mica insulation and mica heat resistance properties making it essential for electrical components. In the cosmetic industry, mica cosmetics and mica shimmer are widely used for their aesthetic properties. The demand for mica coatings and mica paints is increasing due to their unique texture and durability. Mica in construction and mica in glass are gaining importance for their insulation and strength qualities. The market is also benefiting from innovations in mica technology and mica research, leading to more sustainable practices and improved mica sustainability initiatives. The mica mining process and mica extraction techniques are advancing, promoting better sourcing and mica sustainability. Furthermore, mica substitutes and mica alternatives are being explored as more eco-friendly options for various industries, including mica in pharmaceuticals and mica in aerospace.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019 - 2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market Growth 2025-2029 |

USD 73.8 million |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 42% |

|

Key countries |

US, China, India, South Korea, Russia, Japan, Finland, Germany, France, and Indonesia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Asheville Mica Co., Axim Mica Inc., C. L. Roongta, Cleveland MICA Co., Datamica Material and Technology, Elmelin Ltd., Hangzhou Weshare Import and Export Co. Ltd., Highmica, Imerys S.A., Langtec Ltd., Nippon Rika Industries Corp., Pamica Group Ltd., RUBY MICA CO. LTD., Sakti Mica Manufacturing Co., Shenzhen Shenglong Electric Heating Technology Co. Ltd., Sigma Sealing and Insulations Pvt. Ltd., The Premier Mica Co., and Zennov Industry Sdn Bhd |

|

Market Segmentation |

Application (Electronics, Automotive, Construction, Cosmetics, and Others), Type (Natural and Synthetic), and Geography (APAC, Europe, North America, South America, and Middle East and Africa) |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the market forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies