Skin Care Emulsion Market Size 2024-2028

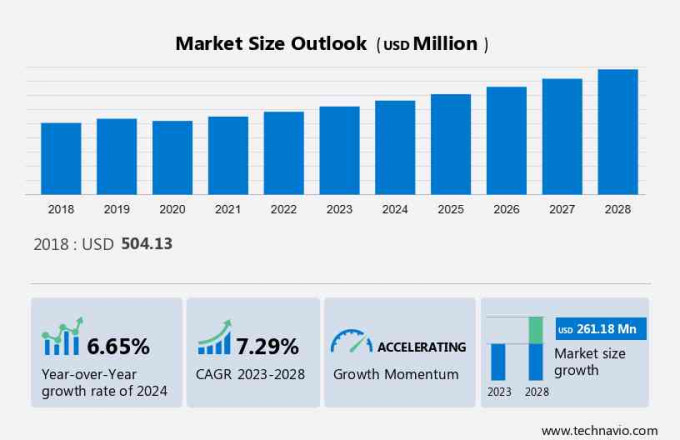

The skin care emulsion market size is estimated to grow at a CAGR of 7.29% between 2023 and 2028. The market size is forecast to increase by USD 261.18 million. Several factors play a crucial role in the market's growth, such as increasing online availability of skin care emulsions, rising beauty consciousness among people modern-day lifestyle changes and growing facial skin-related issues.

The report offers extensive research analysis on the skin care emulsion market, with a categorization based on Distribution Channel, including offline and online. It further segments the market by Product Type, encompassing lotion and skin cream. Additionally, the report provides Geographical segmentation, covering APAC, Europe, North America, Middle East and Africa, and South America. Market size, historical data (2018-2022), and future projections are presented in terms of value (in USD million) for all the mentioned segments.

What will be the size of the Skin Care Emulsion Market During the Forecast Period?

For More Highlights About this Report, Download Free Sample in a Minute

Skin Care Emulsion Market: Key Drivers, Trends and Challenges

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Skin Care Emulsion Market Driver

Increasing online availability of skin care emulsions is notably driving the market growth. Increasing internet penetration is leading to a rise in awareness about the online purchasing of skin care products such as skin care cosmetic emulsions. Sales through online channels are gradually penetrating, as products such as skin care emulsions are sold online to meet the increasing needs of consumers. Skincare emulsion product companies are increasingly adopting online platforms for selling their products in different regions. Such platforms also help customers save time, as they reduce the need to visit a retail store while enabling companies to connect directly with customers.

Moreover, increasing the online presence of skin care emulsions is further leading to more companies selling their products online. Thus, the increase in the number of digital portals offering skin care emulsion helps consumers around the world to purchase products with ease after comparing prices and product features. This, in turn, is expected to drive the growth of the skincare emulsion market during the forecast period.

Key Skin Care Emulsion Market Trends

Increasing focus on premiumization of skin care emulsion products is an emerging trend shaping the market growth. In recent times, the popularity and presence of premium skin care brands have led to market growth. Affluent consumers always look to update and advance their knowledge about skin care and are receptive to learning and engaging with luxury and premium brands online. These affluent consumers are, in turn, influencing premium skin care brands to build up their digital appeal and credibility to boost their market share. Premium brands are expanding their consumer base through product innovations, such as serums and retinol creams, not only to capture market share but also to address the skin problems of consumers effectively.

For instance, L'Oreal's premiumization and innovation division is pursuing its premiumization strategy, making high-end products affordable in a supply-driven market such as China. The brands continue to democratize high-value-added innovations. Thus, companies are focusing on new premium skin care products, including premium skin care emulsion products. Also, the demand for premium products is particularly high in North America and Western Europe. Such factors are expected to drive the growth of the market during the forecast period.

Major Skin Care Emulsion Market Challenge

Growing preferences for do-it-yourself (DIY) natural skincare products at home is a significant challenge hindering the market growth. DIY natural skincare products at home are trending among consumers, especially in North American and European countries. Social media and blogging about making natural skincare products at home allow people to access several recipes for preparing glycolic acid ,natural care products. Consumers perceive that the natural and organic skincare products available in the market contain certain amounts of oleochemicals and chemicals, which is encouraging such consumers to shift to DIY natural skincare products at home.

In addition, every ingredient in the DIY natural skincare product offers some beneficial properties to the user. These DIY natural skincare products can be stored at room temperature and last long without any deterioration in the quality of the ingredients. Therefore, the growing preference among consumers for DIY natural skincare products at home and the availability of DIY natural skincare product recipes on the Internet are expected to hinder the growth of the skincare emulsion market during the forecast period.

Skin Care Emulsion Market Customer Landscape

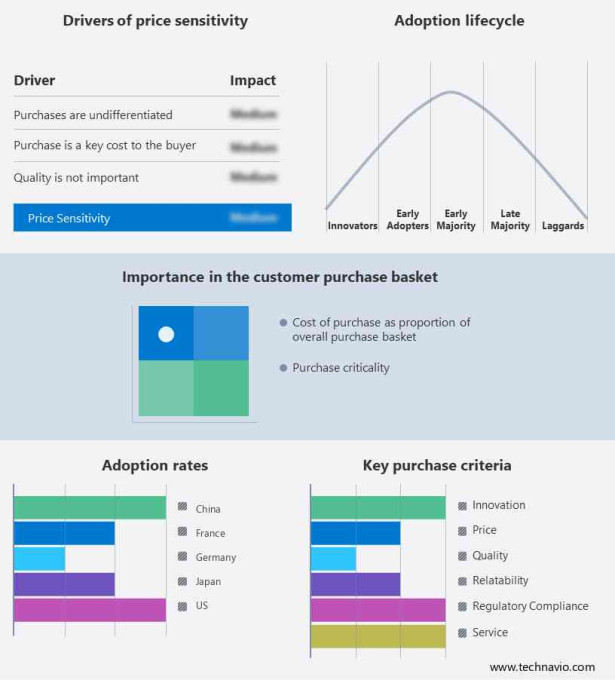

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Skin Care Emulsion Market Customer Landscape

Who are the Major Skin Care Emulsion Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AMOREPACIFIC Group Inc. - The company offers skin care emulsions such as Time response skin reserve fluid, this concentrated fluid contains first-harvest Green Tea ingredients that nourish and hydrate skin, improving visible signs of ageing.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- Aloisia Beauty

- Ayouthveda

- Beiersdorf AG

- Canadian Glacial Clay Cosmetics Corp.

- Clarins USA Inc.

- Daily life Forever52

- Galderma SA

- Johnson and Johnson

- Kao Corp.

- KOSE Corp.

- LOreal SA

- Natura and Co Holding SA

- Nutricare Holding Pty Ltd

- Pechoin Inc.

- Shiseido Co. Ltd.

- Skeyndor S.L.U

- The Estee Lauder Companies

- The Procter and Gamble Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

What are the Largest-Growing Segments in the Skin Care Emulsion Market?

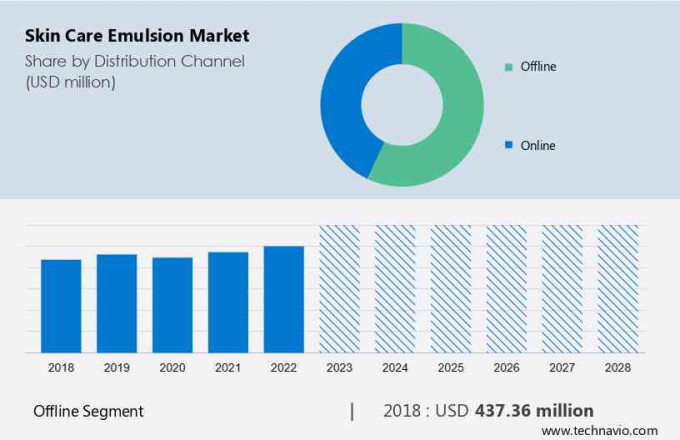

The offline segment is estimated to witness significant growth during the forecast period. The offline distribution channel accounted for the highest share of the global skincare emulsion market in 2023. The offline distribution segment is considered the most effective and influential mode of distribution as it offers a touch-and-feel experience to consumers.

Get a glance at the market contribution of various segments Download the PDF Sample

The offline segment was the largest and was valued at USD 437.36 million in 2018. Speciality stores, hypermarkets and supermarkets, convenience stores, and drug stores are the major offline channels that will contribute significantly to the global skincare emulsion market. The preference of consumers for personal care products, including skincare products through drugstores, is increasing significantly. Salons and spas are also encouraging the sales of premium skincare products as per product specifications. Moreover, salons and spas are becoming vital marketing stations for new products launched by skincare brands in the market. Hence, the sales and consumption of skincare products, such as skin care emulsions through salons and spas, are expected to grow, which will drive the growth of the market in focus during the forecast period.

Which are the Key Regions for the Skin Care Emulsion Market?

For more insights on the market share of various regions Download PDF Sample now!

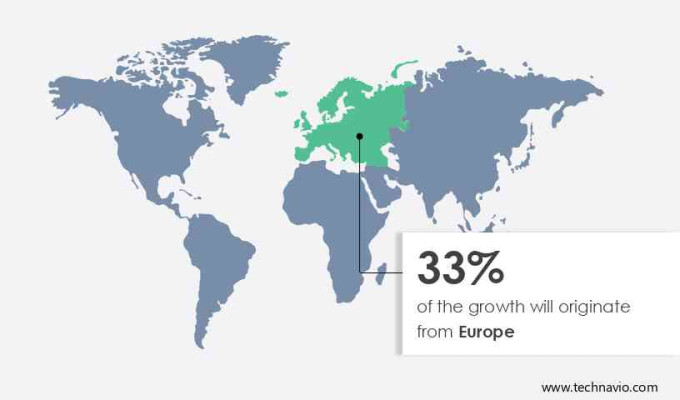

Europe is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The top three countries in Europe include Germany, the UK, and France. The skin care emulsion market in Europe was largely supported by the growing number of fashion-conscious consumers. Conglomerate companies like Unilever PLC, LOreal SA, and Beiersdorf offer skin care emulsion products in the region and are involved in R&D related to skincare and product innovation, thus aiding in the rapid growth of the market in focus.

In addition, with the presence of several companies offering a wide range of products and the extensive availability of resources, raw material suppliers, and manufacturing plants, the skin care emulsion market in Europe is expected to grow significantly during the forecast period.

The COVID-19 outbreak in 2020 had a significant negative impact on the expansion of the skin care emulsion market in Europe. However, in 2021, due to the initiation of large-scale COVID-19 vaccination drives led to the lifting of lockdown restrictions in a significant number of countries. Furthermore, retailers are focusing on marketing strategies, e-commerce supply-chain innovations, and increasing spending on skin care products. Thus, these factors are expected to increase the demand for skin care emulsion products,makeup base which, in turn, is expected to drive the growth of the regional skin care emulsion market during the forecast period.

Segment Overview

The skin care emulsion market report forecasts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2018 to 2028.

- Distribution Channel Outlook

- Offline

- Online

- Product Type Outlook

- Lotion

- Skin cream

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

|

Skin Care Emulsion Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.29% |

|

Market Growth 2024-2028 |

USD 261.18 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.65 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 33% |

|

Key countries |

US, China, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aloisia Beauty, AMOREPACIFIC Group Inc., Ayouthveda, Beiersdorf AG, Canadian Glacial Clay Cosmetics Corp., Clarins USA Inc., Daily life Forever52, Galderma SA, Johnson and Johnson, Kao Corp., KOSE Corp., LOreal SA, Natura and Co Holding SA, Nutricare Holding Pty Ltd, Pechoin Inc., Shiseido Co. Ltd., Skeyndor S.L.U, The Estee Lauder Companies, The Procter and Gamble Co., and Unilever PLC |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Skin Care Emulsion Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.