Cosmetic Emulsifier Market Size 2025-2029

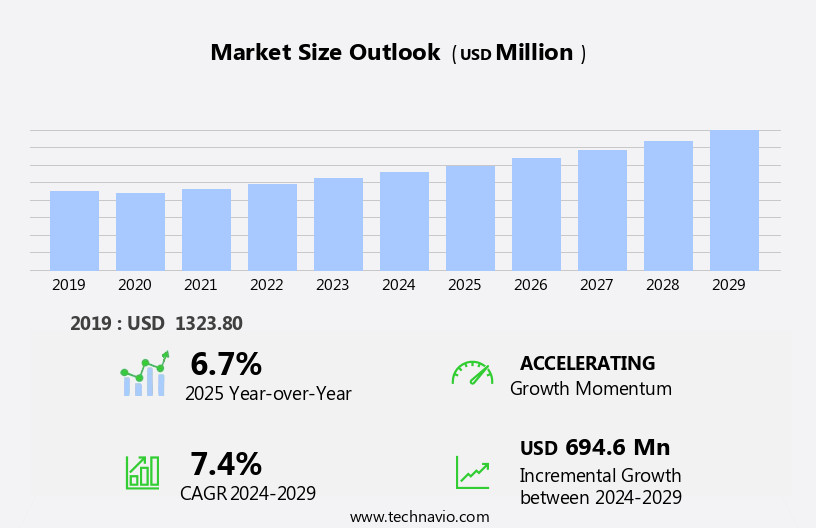

The cosmetic emulsifier market size is forecast to increase by USD 694.6 million, at a CAGR of 7.4% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for natural and organic cosmetic products. Consumers are increasingly seeking products that align with their health and wellness goals, leading to a surge in demand for emulsifiers derived from natural sources. Additionally, the market is witnessing a trend towards texture and sensory enhancements in cosmetic products, driving the need for advanced emulsification technologies. However, the market also faces challenges related to consumer sensitivity to certain ingredients in cosmetic emulsifiers. Allergic reactions and intolerances to common emulsifiers such as sodium lauryl sulfoacetate and polysorbate 80 are becoming more prevalent, necessitating the development of alternative, hypoallergenic emulsifiers.

- Companies seeking to capitalize on market opportunities should focus on innovation in natural and hypoallergenic emulsifiers, while also addressing the challenges posed by consumer sensitivity to certain ingredients. By staying abreast of market trends and consumer preferences, businesses can effectively navigate the dynamic the market.

What will be the Size of the Cosmetic Emulsifier Market during the forecast period?

- The market continues to evolve, driven by advancements in emulsion science and formulation development. Emulsifiers play a crucial role in skin hydration by improving emulsion rheology and stability, ensuring compatibility with various ingredients and maintaining biodegradability. Innovations in emulsifier technology have led to the development of eco-friendly and sustainable options, addressing regulatory compliance and consumer preferences. Emulsifier compatibility is essential for formulating effective serums and creams, with an impact on skin barrier function and irritation. Cost-effective emulsifiers have gained popularity in the personal care industry, while sun protection products require emulsifiers with enhanced stability improvement properties. Emulsion manufacturing processes have undergone significant advancements, with a focus on optimizing formulation development and ensuring emulsion texture and particle size.

- Colloid chemistry and interfacial tension play a pivotal role in emulsifier performance, influencing product differentiation and competitive advantage. Fragrance formulations and makeup products also benefit from emulsifier innovation, with a focus on improving emulsion stability testing and ensuring emulsifier safety. Anionic, cationic, and nonionic emulsifiers each offer unique advantages, with ongoing research into their phase behavior and performance in various applications. Emulsifier trends include a shift towards natural and vegetable-based options, addressing consumer demands for eco-friendly and allergy-tested ingredients. Sustainable sourcing and quality control are essential considerations for cosmetics manufacturing, with a growing emphasis on emulsifier technology and emulsion processing to enhance product innovation and meet evolving market demands.

How is this Cosmetic Emulsifier Industry segmented?

The cosmetic emulsifier industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Skin care

- Hair care

- Make-up

- Others

- Type

- Synthetic emulsifier

- Natural emulsifier

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

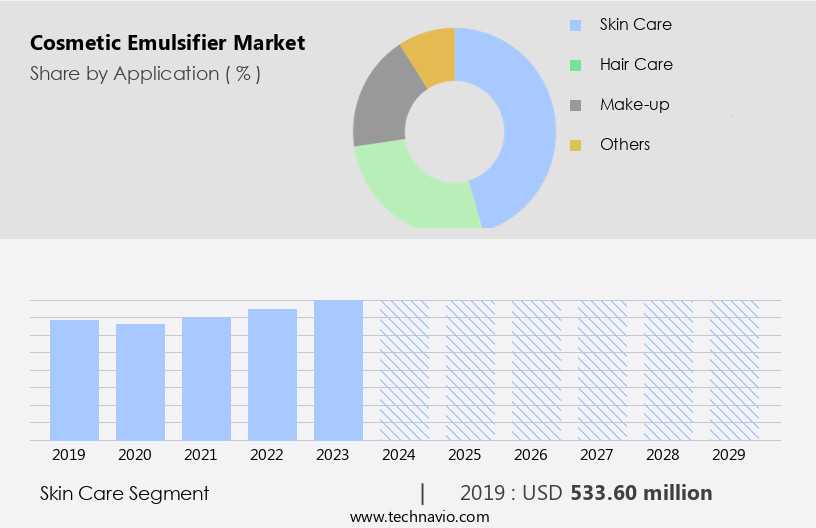

The skin care segment is estimated to witness significant growth during the forecast period.

Emulsifiers play a crucial role in the cosmetics industry, enabling the creation of various personal care products. In facial cleansers and make-up removers, they facilitate the removal of impurities by breaking down oil and dirt, ensuring easy rinsing without harsh scrubbing. Emulsifiers are also indispensable in moisturizing products like lotions and creams, allowing water and oil to mix, thereby providing the skin with both hydration and the nourishing benefits of the product's oils. These ingredients help lock in moisture and prevent skin dryness. In serums, emulsifiers enable the combination of water-soluble and oil-soluble active ingredients, ensuring their even distribution and optimal efficacy.

Emulsifier innovation continues to drive the cosmetics industry, with advancements in emulsion science leading to formulation optimization and development. Synthetic emulsifiers offer cost-effective solutions, while biodegradable options cater to growing consumer demand for eco-friendly products. Emulsifiers are also integral to sun protection products, improving their stability and enhancing their ability to provide broad-spectrum protection. Emulsion manufacturing processes have evolved, with a focus on emulsion rheology, stability, and regulatory compliance. Emulsifier compatibility is essential, ensuring the stability and performance of various formulations. Emulsifiers also impact the texture and appearance of personal care products, influencing consumer preferences. Emulsifiers are used in various applications, including hair care products, skincare formulations, and makeup products.

They contribute to skin barrier function, improving product efficacy and safety. Emulsifier technology continues to advance, with research focusing on sustainable sourcing, quality control, and eco-friendly alternatives. Emulsifiers are also essential in fragrance formulations, helping to ensure their even distribution and stability. Product differentiation is achieved through emulsifier selection, concentration, and particle size, contributing to competitive advantage in the market. Emulsifier safety is a critical consideration, with regulatory bodies setting strict guidelines to ensure consumer safety. Emulsion processing techniques have advanced, with a focus on surface chemistry and interfacial tension to optimize emulsifier performance. Colloid chemistry plays a significant role in understanding the behavior of emulsifiers in various applications.

Emulsifier research continues to uncover new applications and improve existing ones, contributing to the ongoing evolution of the personal care industry.

The Skin care segment was valued at USD 533.60 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

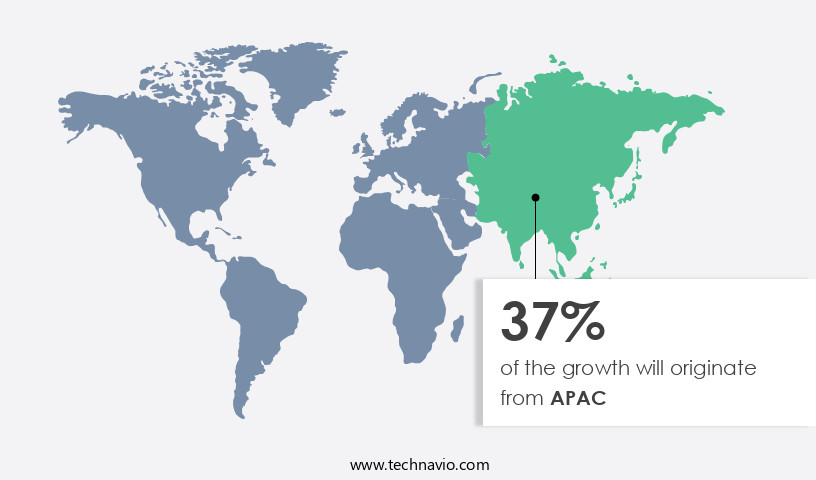

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is experiencing notable growth due to the region's consumer preference for high-performing, specifically formulated beauty products. With a growing awareness and education about skin care, European consumers are increasingly seeking cosmetics that cater to their unique needs. This demand drives the market for emulsifiers, which play a crucial role in enhancing product performance. Europe's leadership in the clean and natural beauty trend is further fueling market growth, as consumers seek cosmetics with fewer synthetic ingredients. Natural emulsifiers are gaining popularity, leading to the development of eco-friendly and sustainable formulations. The expanding middle class in Europe, with increased disposable income, is driving demand for a diverse range of cosmetics, including sun protection products, hair care, and skincare formulations.

Emulsifiers are essential in the manufacturing of these products, ensuring optimal viscosity, stability, and compatibility. Regulatory compliance and safety are also key considerations, with a focus on biodegradable and sustainable sourcing. Innovation in emulsifier technology continues to improve emulsion stability, texture, and rheology, providing a competitive advantage for manufacturers. Emulsifiers are also integral to fragrance formulations, product differentiation, and the development of anti-aging and personal care products. Emulsion science, colloid chemistry, and surface chemistry play significant roles in formulation optimization and manufacturing processes. Emulsifier research and testing are ongoing to ensure product safety, efficacy, and compatibility, with a focus on skin irritation and allergy testing.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Cosmetic Emulsifier Industry?

- The increasing preference for natural and organic cosmetic products, driven by growing consumer awareness and demand for healthier alternatives, is the primary market trend.

- The cosmetic industry is witnessing a significant shift towards natural and organic products, driving the demand for emulsifiers derived from sustainable sources. Emulsifiers, which play a crucial role in maintaining the texture and stability of personal care formulations, are increasingly being sourced from botanical extracts, natural oils, and organic materials. This trend aligns with the clean beauty movement, which emphasizes transparency in ingredient sourcing and avoids potentially harmful substances. Emulsifier performance in cosmetics manufacturing is influenced by various factors, including surface chemistry and phase behavior. Cationic emulsifiers, for instance, are commonly used in anti-aging products due to their ability to provide a stable emulsion and enhance the efficacy of active ingredients.

- Sustainable sourcing of these emulsifiers is essential to meet consumer demands for eco-friendly personal care products. Quality control is another critical factor in the production of cosmetic emulsifiers. Manufacturers must ensure that their products meet the required standards for safety, efficacy, and consistency. Emulsifier research and development are ongoing to improve their performance, stability, and compatibility with various ingredients and formulations. In conclusion, the market is dynamic, with a focus on developing sustainable, natural, and organic emulsifiers that meet the evolving needs of consumers. The emphasis on clean beauty and eco-friendly products is driving innovation in emulsifier research and development, ensuring that the cosmetics industry remains responsive to consumer preferences.

What are the market trends shaping the Cosmetic Emulsifier Industry?

- The focus on enhancing texture and sensory experiences is a significant market trend emerging in the industry. This emphasis on tactile and sensory elements is set to become increasingly important.

- Cosmetic emulsifiers play a crucial role in the development of textured and sensory-enhanced cosmetic and personal care products. Formulators and manufacturers prioritize emulsifier selection based on their ability to create desirable textures and improve skin feel. In the cosmetic industry, innovation is key, and emulsifier manufacturers respond by introducing new products that cater to diverse formulation needs. These include lightweight serums, rich creams, and unique textures such as gels, mousses, and whipped formulations. Emulsifiers contribute significantly to the overall experience of cosmetic products by ensuring a smooth, silky, and luxurious feel on the skin. The emphasis on texture and sensory enhancements has led to advancements in emulsion science, focusing on formulation optimization and emulsion stability.

- Cost-effective emulsifiers are also in demand, as they enable manufacturers to create high-quality products without compromising on performance or consumer satisfaction. In summary, cosmetic emulsifiers are essential ingredients in the creation of textured and sensory-rich cosmetic and personal care products, driving innovation and advancements in emulsion science.

What challenges does the Cosmetic Emulsifier Industry face during its growth?

- The cosmetics industry faces significant growth challenges due to increasing consumer sensitivity to certain emulsifier ingredients. This sensitivity, a growing concern, necessitates rigorous research and development efforts to formulate effective, alternative solutions.

- In the cosmetic industry, regulatory compliance and consumer safety are paramount. Emulsifiers, a crucial ingredient in cosmetic formulations, play a significant role in ensuring product stability, compatibility, and rheology. With the increasing demand for biodegradable and eco-friendly ingredients, manufacturers are focusing on emulsifiers that meet these requirements. Emulsion stability improvement is a critical concern for cosmetic formulators, and emulsifier concentration and compatibility are essential factors. Sun protection products, a significant market segment, require emulsifiers that provide excellent stability and compatibility with other ingredients, such as UV filters. Emulsion manufacturing requires a deep understanding of colloid chemistry and emulsifier safety.

- Fragrance formulations, a key differentiator for cosmetic brands, necessitate emulsifiers that do not interfere with the fragrance's scent profile. Emulsion stability testing is a critical aspect of product innovation, ensuring the product's long-term performance and consumer satisfaction. As the market competition intensifies, formulators seek emulsifiers that provide a competitive advantage through improved stability, compatibility, and safety.

Exclusive Customer Landscape

The cosmetic emulsifier market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cosmetic emulsifier market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cosmetic emulsifier market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Air Liquide SA - The company's subsidiary, SEPPIC, provides a range of high-performing cosmetic emulsifiers. Notable options include MONTANOV 202, MONTANOX 20 DF, and SIMULSOL 165. These innovative emulsifiers deliver optimal texture and stability to cosmetic formulations, enhancing their overall quality. By leveraging SEPPIC's expertise in specialty ingredients, the company caters to the evolving needs of the global cosmetics industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Liquide SA

- BASF SE

- Clariant International Ltd

- Corbion nv

- Elementis Plc

- Evonik Industries AG

- Givaudan SA

- Hallstar Innovations Corp.

- Koninklijke DSM NV

- Lonza Group Ltd.

- Musashino Chemical Laboratory Ltd.

- Nouryon Chemicals Holding B.V.

- Sensient Technologies Corp.

- Spartan Chemical Co.

- Stepan Co.

- Stephenson Group Ltd.

- Symrise Group

- Takasago International Corp.

- The Dow Chemical Co.

- The Lubrizol Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cosmetic Emulsifier Market

- In February 2023, BASF Corporation announced the expansion of its production capacity for its Neossance Renewable Polyglycerides portfolio, a key emulsifier for cosmetics, at its site in Ludwigshafen, Germany. This expansion will enable BASF to meet the growing demand for sustainable cosmetic ingredients (BASF press release, 2023).

- In May 2024, DSM and Croda International formed a strategic partnership to co-develop and commercialize innovative emulsifier systems for the personal care industry. This collaboration aims to offer customers improved performance, sustainability, and consumer safety (DSM press release, 2024).

- In September 2024, Clariant announced the acquisition of the specialty chemicals business of Huntsman Corporation, including its emulsifier product line. This acquisition strengthened Clariant's position in the cosmetic ingredients market and expanded its product portfolio (Clariant press release, 2024).

- In January 2025, Ashland Global Holdings Inc. Launched its new emulsifier, Natrosol 100 HS, which offers high stability and improved sensory properties for water-in-oil emulsions. This innovation addresses the growing demand for high-performance, natural-based cosmetic ingredients (Ashland press release, 2025).

Research Analyst Overview

The market is characterized by continuous innovation and advancements in technology, driven by consumer demand for effective, safe, and sustainable personal care products. Skin permeation and clinical trials play a significant role in the development of new emulsifiers, enabling improved delivery of active ingredients. Shelf life and temperature stability are crucial factors in emulsifier selection, with polyethylene glycol (PEG) and polyglyceryl esters being popular choices due to their HLB value and emulsifier synergy. Sensory evaluation, antioxidant additives, and preservative systems ensure product quality and consumer satisfaction. Hydrophilic-lipophilic balance, emulsion stability enhancers, and packaging compatibility are essential considerations for formulators.

Transdermal delivery systems, such as those using glyceryl stearate and cetearyl alcohol, are gaining popularity for their efficacy. Environmental impact, including ecotoxicity testing and bioaccumulation potential, is a growing concern, driving the development of eco-friendly emulsifiers like xanthan gum. Emulsifier blends and temperature stability enhancers are also key trends, addressing the need for multifunctional ingredients and improved product performance.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cosmetic Emulsifier Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 694.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.7 |

|

Key countries |

US, Germany, Canada, France, China, Japan, UK, Italy, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cosmetic Emulsifier Market Research and Growth Report?

- CAGR of the Cosmetic Emulsifier industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cosmetic emulsifier market growth of industry companies

We can help! Our analysts can customize this cosmetic emulsifier market research report to meet your requirements.