Sleepwear And Loungewear Market Size 2025-2029

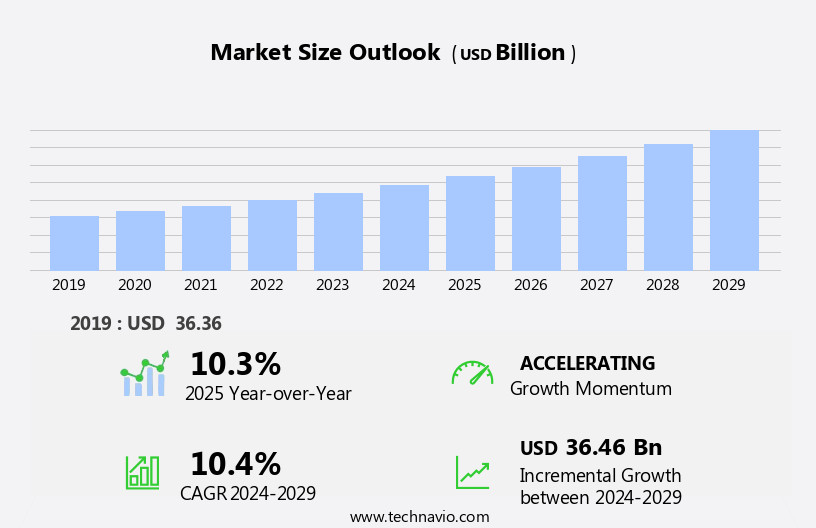

The sleepwear and loungewear market size is forecast to increase by USD 36.46 billion, at a CAGR of 10.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for designer and premium offerings. Consumers are prioritizing comfort and style in their at-home attire, leading to a surge in demand for high-quality sleepwear and loungewear. Also, the increasing focus on health and wellness has led to a rise in demand for high-quality, comfortable apparel for both sleep and relaxation. Cotton and silk are popular choices for their breathability and comfort, while some consumers prefer wool for its warmth and insulation. Additionally, the rise in adoption of sustainable manufacturing practices is becoming a key trend in the market, as consumers express a growing concern for the environment. However, the market faces challenges, including the prevalence of counterfeit products. These counterfeits not only undermine the reputation of legitimate brands but also pose a risk to consumers' safety.

- Companies seeking to capitalize on market opportunities must focus on offering unique designs, sustainable manufacturing, and ensuring product authenticity. Navigating these challenges requires a strategic approach, including robust brand protection measures and transparency in manufacturing processes.

What will be the Size of the Sleepwear And Loungewear Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic shifts in fabric weight and manufacturing processes shaping product offerings. Flannel pajamas, for instance, are popular for their warmth and softness, while modal and cotton pajamas provide breathability and comfort. Online reviews and influencer marketing have become crucial in shaping consumer preferences, influencing decisions on quality control and material choices. Sustainability is a growing concern, with an increasing demand for recycled materials, sustainable packaging, and ethical sourcing. Lace trim, fair trade, and product lifecycle management are also key considerations. Brands cater to various targets, from size ranges to demographics, offering a diverse range of sleep pants, night shirts, dressing gowns, and thermal underwear.

Manufacturing techniques, such as sewing and thread count, influence pricing strategies and retail channels. The market's continuous evolution is reflected in the emergence of new materials like Tencel and Lyocell pajamas, and the adoption of innovative marketing strategies on social media. Inventory and supply chain management remain essential components of this dynamic industry.

How is this Sleepwear And Loungewear Industry segmented?

The sleepwear and loungewear industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Sleepwear

- Loungewear

- Material Type

- Cotton

- Wool

- Silk

- Others

- End-User

- Female

- Male

- Kids

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

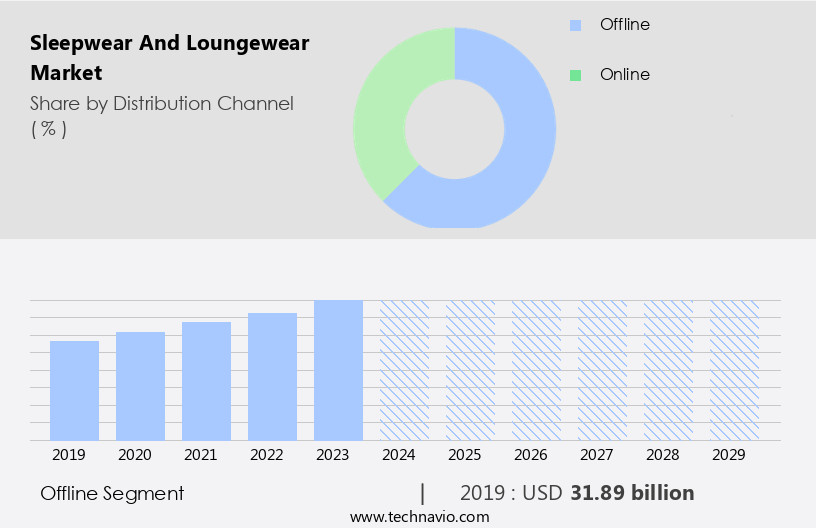

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses various fabric weights, manufacturing processes, and product offerings, including silk pajamas, cotton pajamas, modal pajamas, flannel pajamas, tencel pajamas, bamboo pajamas, and lyocell pajamas. Companies employ various sewing techniques and size ranges to cater to diverse customer segments. Recycled materials and sustainable packaging are gaining popularity, as is ethical sourcing and fair trade. Product lifecycle management is crucial for maintaining quality control. Target demographics span from children to adults, with night shirts, sleep pants, sleep shorts, and dressing gowns among the popular product categories. Manufacturing processes range from traditional to modern, with an increasing focus on automation and technology.

Online reviews and influencer marketing are significant marketing strategies, influencing customer decisions. Inventory management and supply chain management are essential for ensuring timely delivery and maintaining customer satisfaction. Retail channels include both offline and online, with the latter experiencing significant growth due to its convenience and accessibility. Thread count and fiber content are essential considerations for product differentiation. Pricing strategies vary, with some companies focusing on affordability, while others prioritize premium pricing for luxury offerings. Social media marketing is a key promotional tool, reaching a broad audience and facilitating engagement.

The Offline segment was valued at USD 31.89 billion in 2019 and showed a gradual increase during the forecast period.

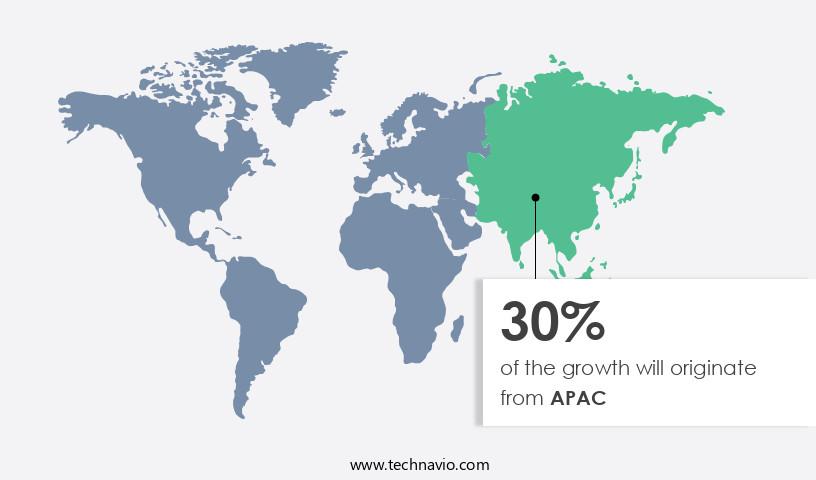

Regional Analysis

APAC is estimated to contribute 30% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing significant growth, surpassing other regions. This expansion can be largely attributed to the influx of global brands and the rising preference for premium sleepwear and loungewear in APAC. China, India, and Japan are the primary contributors to this market, with China leading as the major manufacturing hub. Consumers in China are increasingly spending on apparel, particularly in the premium category, fueling the demand for sleepwear and loungewear. Recycled materials, such as modal and tencel, are gaining popularity in the market for their sustainability. Manufacturing processes include various sewing techniques, from hand-sewn to industrial, and product lifecycle management is crucial for maintaining quality.

Size ranges cater to diverse customer segments, including children and adults. Brand licensing and ethical sourcing add value to the market. Cotton, flannel, silk, and bamboo are common fiber contents. Marketing strategies encompass social media, retail channels, and influencer collaborations. Pricing strategies vary, with sustainable packaging and fair trade practices appealing to eco-conscious consumers. Inventory and supply chain management are essential for meeting demand and maintaining customer satisfaction. Sleepwear offerings include pajamas, night shirts, sleep shorts, and dressing gowns, available in various thread counts and fiber blends. Thermal underwear and lace trims add functionality and aesthetics.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the thriving market, consumers seek comfort and style for their at-home moments. Quality fabrics, such as cotton, silk, and fleece, dominate the scene, ensuring a cozy and breathable experience. Designs range from classic pajamas to trendy loungewear sets, including robes, leggings, and sweatpants. Sustainability is a growing concern, with eco-friendly materials and ethical production methods gaining popularity. Technology integration, like temperature-regulating and moisture-wicking features, enhances the sleepwear experience. Comfortable fits, soft textures, and versatile designs cater to various body types and preferences. The market continues to evolve, reflecting consumers' increasing demand for comfort and self-care in their daily lives.

What are the key market drivers leading to the rise in the adoption of Sleepwear And Loungewear Industry?

- The significant rise in consumer preference for designer and premium sleepwear and loungewear serves as the primary market driver.

- The market is experiencing significant competition and innovation. Consumers' preferences and purchasing power are driving market growth, as they seek comfortable and durable products. companies are responding by focusing on advanced manufacturing processes, such as using high-quality fabrics with varying fabric weights, and employing sewing techniques that ensure longevity. Additionally, there is a growing trend towards using recycled materials in the production of sleepwear and loungewear. Brand licensing and expanding size ranges are also key strategies being employed to cater to diverse customer segments.

- Silk pajamas remain a popular choice due to their luxurious feel and breathability, but other materials like cotton, wool, and synthetic blends are also gaining traction. Distribution networks are being expanded to reach a wider customer base, both domestically and internationally. Overall, the market is dynamic and competitive, with companies continually researching and developing new products to meet evolving consumer demands.

What are the market trends shaping the Sleepwear And Loungewear Industry?

- The adoption of sustainable manufacturing is gaining significant traction in the current market, representing a noteworthy trend in the industry. This shift towards more eco-friendly and efficient production methods is increasingly becoming a priority for businesses seeking to reduce their environmental footprint and enhance their competitive edge.

- Sleepwear and loungewear are popular consumer goods manufactured using high-quality fabrics, including cotton, modal, and flannel. The production process involves the use of significant quantities of chemicals for color dyes and other processing agents, leading to substantial industrial waste. This waste, primarily from chemicals, contributes to environmental concerns, such as increased waste and deforestation due to the use of wood pulp. To mitigate these issues, companies are embracing sustainable manufacturing practices and collaborating with industry associations. They are focusing on product lifecycle management to minimize waste and improve quality control.

- Online reviews and influencer marketing play a crucial role in consumer decision-making, driving demand for eco-friendly and sustainable sleepwear and loungewear. Consumers increasingly prefer products with sustainable packaging, lace trims, and fair trade certifications. By adopting these practices, companies aim to reduce their environmental footprint and cater to the evolving needs and preferences of the modern consumer.

What challenges does the Sleepwear And Loungewear Industry face during its growth?

- The proliferation of counterfeit products poses a significant challenge to the industry's growth trajectory. It is essential for businesses to implement robust anti-counterfeiting measures to safeguard their brand reputation and consumer trust, thereby fostering sustainable industry expansion.

- The market experiences significant growth, driven by increasing consumer demand. However, this expansion also presents challenges, as the proliferation of counterfeit sleepwear and loungewear, particularly in developing regions, undermines market dynamics. These counterfeit products, often made from low-quality raw materials, compromise fiber content and durability. The rise of e-commerce contributes to the distribution and sales of counterfeit items, expanding their reach. Consumers may find it difficult to distinguish between genuine and counterfeit products due to their similar appearances. Government authorities worldwide have seized large quantities of counterfeit sleepwear and loungewear, highlighting the issue's severity.

- The affordability of counterfeit products can lead to increased demand, negatively impacting companies' sales strategies, market shares, and reputations. As a professional, it's crucial to emphasize the importance of ethical sourcing and product authenticity in this market.

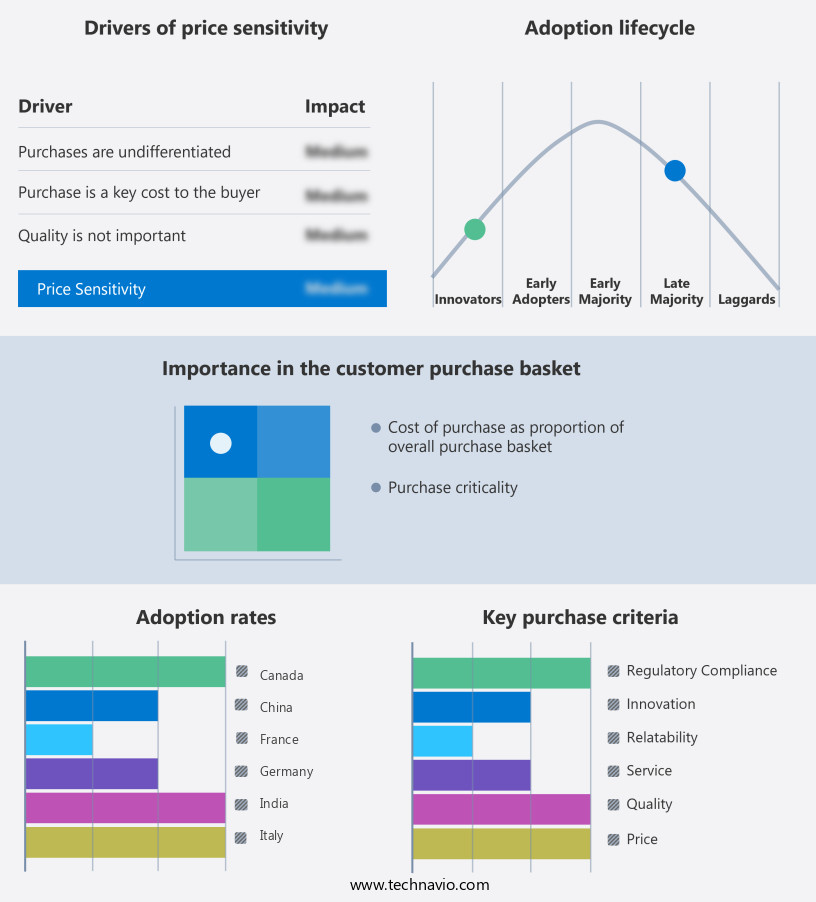

Exclusive Customer Landscape

The sleepwear and loungewear market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sleepwear and loungewear market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sleepwear and loungewear market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aimer online store - This company specializes in the design and production of high-quality sleepwear and loungewear.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aimer online store

- American Eagle Outfitters Inc.

- Authentic Brands Group LLC

- Chantelle SA

- Hanesbrands Inc.

- Hennes and Mauritz AB

- Jack and Jones

- Jockey International Inc.

- La Perla Global Management UK Ltd.

- Lise Charmel

- LUNYA

- MASH Holdings Co. Ltd.

- Parahsol Srl

- PVH Corp.

- Quiksilver Inc.

- Ralph Lauren Corp.

- Sleepy Jones LLC

- Triangl Group Ltd.

- Victorias Secret and Co.

- Wacoal Holdings Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sleepwear And Loungewear Market

- In January 2024, H&M Group, a leading global fashion retailer, announced the launch of its new sustainable sleepwear line, 'CONSCIOUS EXCLUSIVE,' made from recycled materials, further expanding its product offerings in the eco-friendly market segment (H&M Press Release, 2024).

- In March 2024, Nike, Inc. entered into a strategic partnership with the National Basketball Association (NBA) to create co-branded sleepwear and loungewear collections, combining Nike's athletic expertise with the NBA's brand recognition to cater to basketball fans worldwide (Nike Press Release, 2024).

- In April 2025, HanesBrands Inc., a leading marketer of basic apparel, announced the acquisition of DB Apparel, a leading player in the European sleepwear market, for approximately USD450 million. This acquisition strengthened HanesBrands' presence in Europe and expanded its product offerings (HanesBrands Press Release, 2025).

- In May 2025, the European Union (EU) approved new regulations on textile labeling, requiring sleepwear and loungewear manufacturers to provide clear information on the environmental impact of their products. This initiative aimed to promote transparency and sustainability within the market (European Commission Press Release, 2025).

Research Analyst Overview

- The market is witnessing significant trends and dynamics, shaped by various factors. Visual merchandising plays a crucial role in showcasing lounge sets and pajama sets, ensuring an inviting retail environment. Durability testing and quality assurance are essential for maintaining brand loyalty, as consumers seek reliable and long-lasting products. Size specification and fit testing are essential for catering to diverse customer needs, enhancing the shopping experience. Design trends lean towards technical textiles, performance fabrics, and smart fabrics, offering both comfort and functionality. Customer service and a comprehensive returns policy are vital in addressing consumer behavior and fostering loyalty. Data analytics and fashion forecasting help retailers stay informed about market intelligence and color palettes.

- E-commerce platforms and omnichannel retailing are transforming the industry, with mobile commerce and social commerce gaining popularity. Appliqués, slipper socks, and sleep masks add value to loungewear offerings, appealing to various consumer preferences. Brand loyalty is a significant competitive advantage, with companies investing in material testing, product testing, and retail display to differentiate themselves. Comfort testing and fiber analysis ensure that loungewear and sleepwear meet the highest standards, driving innovation and growth in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sleepwear And Loungewear Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.4% |

|

Market growth 2025-2029 |

USD 36.46 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.3 |

|

Key countries |

US, China, Germany, India, Canada, France, Mexico, UK, Italy, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sleepwear And Loungewear Market Research and Growth Report?

- CAGR of the Sleepwear And Loungewear industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sleepwear and loungewear market growth of industry companies

We can help! Our analysts can customize this sleepwear and loungewear market research report to meet your requirements.