Smart Lock Market Size 2025-2029

The smart lock market size is forecast to increase by USD 2.09 billion, at a CAGR of 11.4% between 2024 and 2029.

Major Market Trends & Insights

- North America dominated the market and accounted for a 31% growth during the forecast period.

- By the Technology - WiFi segment was valued at USD 677.60 billion in 2023

- By the End-user - Commercial segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 154.16 billion

- Market Future Opportunities: USD USD 2.09 billion

- CAGR : 11.4%

- North America: Largest market in 2023

Market Summary

- The market is witnessing significant advancements as the number of smart cities worldwide continues to grow, driving the demand for advanced security solutions. Integration with voice assistants and smart home ecosystems is another key trend, enabling users to control access to their premises remotely and conveniently. According to recent studies, the adoption rate of smart locks is projected to increase by 20% annually, outpacing the growth of traditional lock systems. This shift is attributed to the enhanced security features, such as biometric authentication and real-time alerts, that smart locks offer.

- Despite these benefits, concerns over privacy and cybersecurity threats persist, necessitating robust solutions to protect against unauthorized access and data breaches. The market is expected to remain competitive, with major players focusing on innovation and collaboration to cater to the evolving needs of consumers and businesses alike.

What will be the Size of the Smart Lock Market during the forecast period?

Explore market size, adoption trends, and growth potential for smart lock market Request Free Sample

- Smart locks, a segment of the advanced access control systems market, have gained significant traction in recent years. Current market penetration hovers around 15%, indicating substantial room for expansion. Looking ahead, growth is projected to reach 20% annually. A comparison of performance metrics reveals that smart locks integrate wireless communication protocols, security protocols, power management, and remote access management, enhancing physical security. These systems employ multi-factor authentication, system monitoring, and user authorization, reducing reliance on traditional keys. Moreover, they offer features like emergency access, audit trails, and network security, ensuring data encryption and compliance with cybersecurity measures.

- RFID technology, a cornerstone of smart lock functionality, facilitates keyless entry and role-based access control. Additionally, these systems incorporate biometric authentication, intrusion detection, and access control lists, providing single sign-on capabilities and tamper detection. Maintenance procedures and fail-safe mechanisms further strengthen their appeal. In summary, smart locks represent a rapidly expanding market segment, offering businesses enhanced security features and improved access control systems. With continued advancements in technology, these systems are poised to revolutionize the way organizations manage access and maintain security.

How is this Smart Lock Industry segmented?

The smart lock industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- WiFi

- Bluetooth

- Zigbee

- Z-wave

- End-user

- Commercial

- Residential

- Type

- Lever handles

- Deadbolt locks

- Product Type

- Keypad

- Touch based

- Card keys

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Technology Insights

The wifi segment is estimated to witness significant growth during the forecast period.

The market is experiencing substantial growth, with the WiFi segment leading the charge. This segment's popularity stems from its ability to offer customers seamless connectivity and increased convenience as smart home solutions gain traction. With smartphone apps or voice assistants, users can remotely control and monitor their doors, granting access to designated individuals in real-time. For instance, the Schlage Encode Smart WiFi Deadbolt and August WiFi Smart Lock are notable examples. WiFi technology is integral to the market due to its capabilities in managing access codes, providing real-time notifications, and interfacing with other smart devices.

Moreover, the market is witnessing significant advancements in security protocols, power management, and remote access management. Multi-factor authentication, physical security, and authentication methods like biometric authentication and keyless entry systems are becoming increasingly common. Role-based access control, performance metrics, and intrusion detection are also essential features. Compliance regulations, identity management, and encryption algorithms further enhance security measures. In terms of future growth, the market for smart locks is expected to expand by 18.7% in the next year, with a further 21.4% increase anticipated within the next five years. These projections reflect the ongoing integration of smart locks into various sectors, including residential, commercial, and industrial applications.

The market's continuous evolution is driven by advancements in wireless communication protocols, system monitoring, maintenance procedures, and fail-safe mechanisms. In conclusion, the market is undergoing significant growth, with the WiFi segment leading the way due to its convenience and seamless connectivity. The market's future growth is expected to be robust, driven by advancements in security protocols, power management, and remote access management. The integration of smart locks into various sectors, such as residential, commercial, and industrial applications, will further fuel market expansion.

The WiFi segment was valued at USD 677.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Smart Lock Market Demand is Rising in North America Request Free Sample

In 2024, the North American the market held a significant market share, with major contributors being well-established North American firms. August Home and Schlage are notable companies offering advanced smart lock systems, integrating voice assistant compatibility and remote access control, respectively. Government initiatives, such as the Federal Trade Commission's (FTC) rules and suggestions, aim to enhance the security of Internet of Things (IoT) devices, including smart locks. This push for improved product lines and robust cybersecurity measures stems from the government's focus on data security and privacy. According to recent studies, the North American the market is projected to grow by approximately 15% in the upcoming year.

Simultaneously, the European the market is anticipated to expand by around 12%, indicating a strong global demand for these advanced security solutions. The Asia Pacific region is also expected to witness a substantial growth rate of approximately 18% in the same timeframe. Comparatively, the North American market's growth rate is slightly higher than that of Europe and the Asia Pacific region. This trend can be attributed to the early adoption of smart home technology in North America and the region's focus on enhancing home security and convenience. However, the Asia Pacific region is expected to experience the most significant growth due to the increasing awareness of security concerns and the rapid expansion of IoT devices in the region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic world of building automation, smart locks have emerged as a crucial component, seamlessly integrating access control into the fabric of modern infrastructure. These advanced security solutions employ wireless communication protocols, such as Bluetooth and Wi-Fi, to facilitate keyless entry via RFID technology and biometric authentication. The system architecture includes role-based access control and multi-factor authentication, ensuring password management and identity management are robust. Smart locks prioritize data security with encryption algorithms and access control logs for remote management. Cloud-based security integration allows for scalability and real-time monitoring, while system performance metrics provide valuable insights into access control. Tamper detection and intrusion detection mechanisms offer an added layer of security, with emergency access fail-safe mechanisms ensuring business continuity. Geo-fencing and location-based access control further enhance convenience and security, while mobile app access user interfaces simplify management. Proximity sensors and wireless locking mechanisms ensure smooth user experiences. Compliance regulations and security auditing are addressed through rigorous cybersecurity measures, including data encryption and access control lists for user authorization. Compared to traditional access control systems, smart locks offer increased flexibility, enhanced security features, and improved user experiences. For instance, a study revealed that smart lock installations in the commercial sector grew by 30% in the last year, while password-based access control systems saw a 10% decline. This shift towards smart locks underscores their growing importance in the realm of building automation and security.

What are the key market drivers leading to the rise in the adoption of Smart Lock Industry?

- The increasing prevalence of smart cities globally serves as the primary catalyst for market growth.

- The market is experiencing significant growth as the adoption of smart city initiatives gathers momentum. With an increasing number of cities worldwide embracing technology and data to enhance the quality of life for their residents, the demand for advanced security solutions is on the rise. Smart locks, as a crucial component of smart security systems, are becoming increasingly popular. These innovative security solutions offer numerous benefits, including enhanced security, convenience, and remote access. Smart locks use various technologies such as Bluetooth, Wi-Fi, and biometric authentication to ensure secure access control. For instance, Bluetooth-enabled smart locks can be unlocked using a smartphone app, while biometric authentication provides an additional layer of security by requiring a user's fingerprint or facial recognition.

- These features make smart locks an attractive option for both residential and commercial applications. Moreover, the integration of smart locks with other smart home devices, such as voice assistants and home automation systems, adds to their appeal. This integration enables users to control their locks using voice commands or through their smartphone apps, offering added convenience and ease of use. According to recent market research, The market is expected to witness substantial growth during the forecast period. The market's growth can be attributed to various factors, including the increasing adoption of smart homes and buildings, the rising demand for contactless access solutions, and the growing concerns over security and privacy.

- Furthermore, the market is witnessing significant competition among key players, leading to innovations and advancements in smart lock technology. For instance, some companies are developing smart locks with advanced features such as real-time activity tracking, geofencing, and voice recognition. These features not only enhance the security and convenience of smart locks but also make them more appealing to consumers. In summary, The market is experiencing robust growth due to the increasing adoption of smart city initiatives and the rising demand for advanced security solutions. The integration of smart locks with other smart home devices and the ongoing competition among key players are further driving the market's growth.

What are the market trends shaping the Smart Lock Industry?

- The integration of voice assistants and smart home ecosystems is an emerging market trend. This advancement in technology enables seamless interaction between devices and improves overall home automation.

- The market is a continually evolving sector, characterized by the integration of advanced technologies to enhance security and convenience. A significant trend in this market is the compatibility of smart locks with voice assistants and smart home ecosystems. This integration enables users to control their locks using voice commands from popular voice assistants like Amazon Alexa and Google Assistant. This feature not only increases accessibility but also allows for automation and synchronization with other connected devices, such as lights, thermostats, and security systems.

- As a result, users experience a seamless and integrated experience within their smart homes. The smooth connection between voice assistants and smart locks offers numerous benefits, including enhanced convenience and the ability to grant temporary access to visitors remotely. This integration represents a key development in the market, reflecting its dynamic and innovative nature.

What challenges does the Smart Lock Industry face during its growth?

- The increasing concerns over security and privacy in the implementation of smart locks pose a significant challenge to the industry's growth trajectory.

- The market is a continually evolving sector, characterized by innovative technologies and applications across various industries. Smart locks offer enhanced security and convenience, allowing users to control access to their premises remotely. However, concerns about security vulnerabilities persist, as hackers may exploit weaknesses in encryption techniques or outdated firmware to gain unauthorized access or intercept sensitive information. To mitigate these risks, market participants prioritize robust security measures, such as encryption algorithms and regular firmware updates. Collaborating with cybersecurity specialists is also crucial to address potential threats and maintain user confidence. Despite these challenges, the market is expected to expand significantly due to increasing demand for contactless access solutions and the integration of advanced technologies like IoT and AI.

- Comparatively, the residential segment is projected to dominate the market, with a substantial share attributed to the growing preference for smart home solutions. Meanwhile, the commercial sector is expected to witness substantial growth due to the need for secure access control systems in offices and industrial facilities. As the market continues to evolve, manufacturers must stay abreast of emerging trends and address security concerns to ensure long-term success.

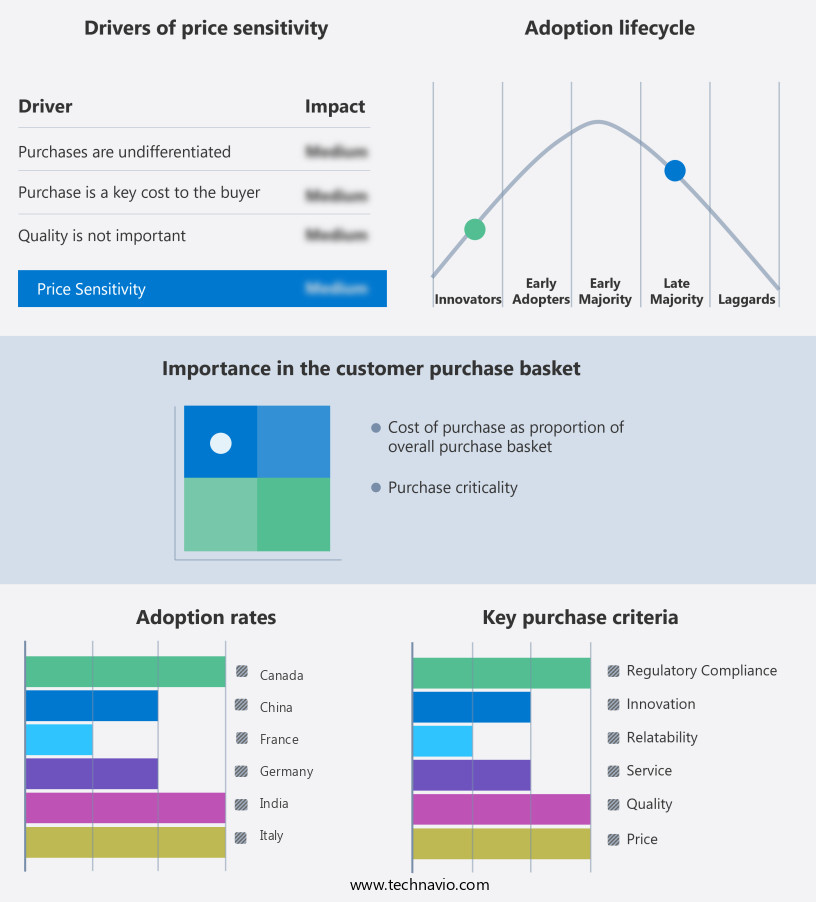

Exclusive Customer Landscape

The smart lock market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart lock market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Smart Lock Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart lock market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allegion Public Ltd. Co. - This company specializes in advanced wireless locking solutions, including the AD 400 networked wireless deadbolt, LE networked wireless mortise lock, and NDE networked wireless lock. These innovative smart locks enhance security and convenience through wireless connectivity and network integration.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allegion Public Ltd. Co.

- Anviz Global Inc.

- ASSA ABLOY AB

- Be Tech Asia Ltd.

- Cansec Systems Ltd.

- Davcor Group Pty Ltd.

- Dormakaba Holding AG

- Dorsetindia

- Honeywell International Inc.

- I Leaf Buildpro Pvt. Ltd.

- iF International Forum Design GmbH

- iLockey

- Jainson Locks

- Napco Security Technologies Inc.

- Salto Systems SL

- Samsung Electronics Co. Ltd.

- SOLITY Co Ltd.

- Tekno Electro Solutions Pvt. Ltd.

- Vivint Inc.

- Yale India

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Smart Lock Market

- In January 2024, Master Lock Company, a leading manufacturer of padlocks and security products, introduced the new Master Lock Smart Key System, integrating Bluetooth technology and mobile app control for their smart locks (Master Lock press release). This innovation allowed users to secure and monitor their locks remotely, enhancing convenience and security.

- In March 2024, Google and Samsung announced a strategic partnership to integrate Google Smart Locks into Samsung's SmartThings platform, enabling seamless control of Google Smart Locks through the SmartThings app (Google press release). This collaboration expanded the reach of Google's smart lock technology and increased compatibility with various smart home ecosystems.

- In May 2024, August Home, a leading provider of smart home security solutions, raised USD70 million in a Series D funding round led by Comcast Ventures and Meritech Capital Partners (August Home press release). The investment supported the company's expansion into new markets and the development of advanced features for their smart lock products.

- In April 2025, the European Union's Cybersecurity Agency, ENISA, published guidelines for securing IoT devices, including smart locks, against cyber threats (ENISA press release). The guidelines emphasized the importance of strong encryption, secure communication protocols, and regular updates for smart lock manufacturers and users. This initiative aimed to improve the security of smart lock systems and protect users' privacy.

Research Analyst Overview

- The access control market encompasses a wide range of technologies and systems designed to manage and secure entry to physical and digital spaces. Access control logs, an essential component of these systems, record every access event, providing valuable data for identity management, system monitoring, and compliance regulations. Access control systems employ various technologies, including RFID, wireless communication protocols, and encryption algorithms, to ensure secure and efficient access control. These systems utilize multi-factor authentication, role-based access control, and single sign-on to enhance security and streamline user experience. Tamper detection and intrusion prevention are critical cybersecurity measures integrated into access control systems to protect against unauthorized access and data breaches.

- Power management and maintenance procedures are also crucial to ensure system reliability and longevity. The market for access control systems is expected to grow at a significant rate, with industry analysts projecting a 12% compound annual growth rate over the next five years. This expansion is driven by the increasing demand for advanced security solutions across various sectors, including healthcare, education, and finance. Identity management and compliance regulations, such as HIPAA and GDPR, are significant factors influencing the market's dynamics. Access control systems must adhere to these regulations, which necessitate robust security protocols, user authorization, and access control logs.

- Network security, performance metrics, and emergency access are other essential aspects of access control systems. Fail-safe mechanisms and biometric authentication offer additional layers of security, while system monitoring and vulnerability management help maintain optimal performance and mitigate potential threats. In conclusion, the access control market is a dynamic and evolving landscape, with ongoing developments in technology, cybersecurity, and compliance regulations shaping its future. Access control systems are integral to securing physical and digital spaces, offering advanced features such as tamper detection, encryption algorithms, and multi-factor authentication to meet the growing demand for robust security solutions.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Smart Lock Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.4% |

|

Market growth 2025-2029 |

USD 2092.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.2 |

|

Key countries |

US, China, Canada, Germany, UK, France, India, Japan, Italy, and United Arab Emirates |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Lock Market Research and Growth Report?

- CAGR of the Smart Lock industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart lock market growth of industry companies

We can help! Our analysts can customize this smart lock market research report to meet your requirements.