Smart TV Sticks Market Size 2025-2029

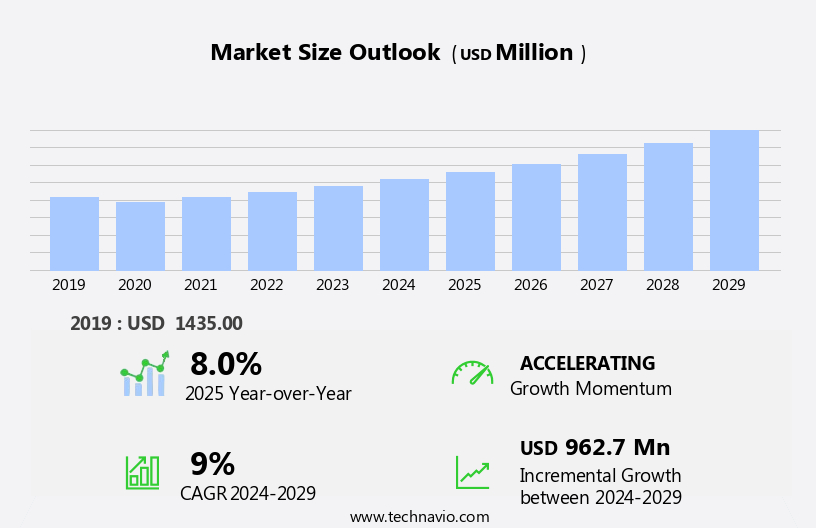

The smart tv sticks market size is forecast to increase by USD 962.7 million at a CAGR of 9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the expanding smart home ecosystem and the increasing penetration of smart TVs worldwide. With the rise of IoT technology and the integration of voice assistants into daily life, the demand for convenient and affordable streaming solutions has d. The market is further fueled by the increasing use of mobile electronic devices, enabling seamless content streaming between devices. However, challenges such as privacy concerns, intense competition, and the need for continuous innovation to keep up with consumer demands persist.

- Companies seeking to capitalize on this market opportunity must focus on developing user-friendly interfaces, ensuring compatibility with various devices and platforms, and addressing privacy concerns through security measures. By staying abreast of market trends and consumer preferences, players can effectively navigate challenges and establish a strong market presence.

What will be the Size of the Smart TV Sticks Market during the forecast period?

- The smart TV stick market in the US is experiencing significant growth as consumers seek cost-effective solutions to access online content on their standard televisions. These compact devices enable users to transform their regular TVs into smart televisions, granting access to multiple apps, online streaming channels, and web information. The market's expansion is driven by increasing consumer preferences for seamless streaming of media content, including live sporting events and voice control capabilities.

- As leading brands continue to innovate and improve the user experience, the smart TV stick market is poised for continued growth in the US, offering viewers an affordable and convenient alternative to traditional smart TVs.

How is this Smart TV Sticks Industry segmented?

The smart tv sticks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Non-4K

- 4K and above

- 1080p and below

- 4K

- 8K

- HDR Support

- Distribution Channel

- Offline

- Online

- Direct-to-Consumer

- Subscription Bundles

- Connectivity

- Wi-Fi

- Bluetooth

- OS

- Android TV OS

- Roku OS

- Amazon fire TV OS

- Linux-based OS

- Google TV

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- UAE

- North America

By Type Insights

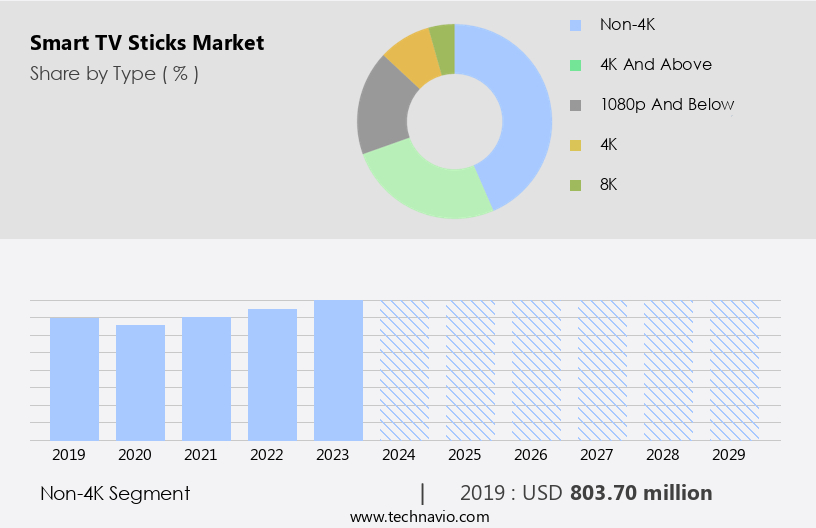

The non-4k segment is estimated to witness significant growth during the forecast period.

Non-4K smart TV sticks remain popular choices for American homes due to their cost-effectiveness and wide content reach. These devices offer high dynamic range (HDR) content, which enhances the viewing experience. The lower cost of non-4K TV sticks compared to their 4K counterparts drives demand. CloudWalker's HALFTICKET TV Smart Stick, for instance, offers 8GB internal storage, expandable up to 32GB, enabling users to search for online content on their TVs. Voice control is another attractive feature, allowing users to access online content hands-free. Improved performance, powerful speakers, and bundling options further add value. With the rise of connected homes, live streaming services, and high-definition content, smart TV sticks have become essential streaming gadgets for internet users.

Consumers prefer these CTV-focused devices for their versatility, seamless streaming, and user-friendly interfaces. Strategic alliances with leading brands, improved performance, and advanced features cater to consumer preferences. E-commerce platforms offer various bundle packages, making it convenient for users to purchase these devices. The entertainment industry's technological developments cater to the fast-paced lifestyle, providing viewers with enhanced viewing experiences and entertainment options on official websites, mobile devices, and even offline.

Get a glance at the market report of share of various segments Request Free Sample

The Non-4K segment was valued at USD 803.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

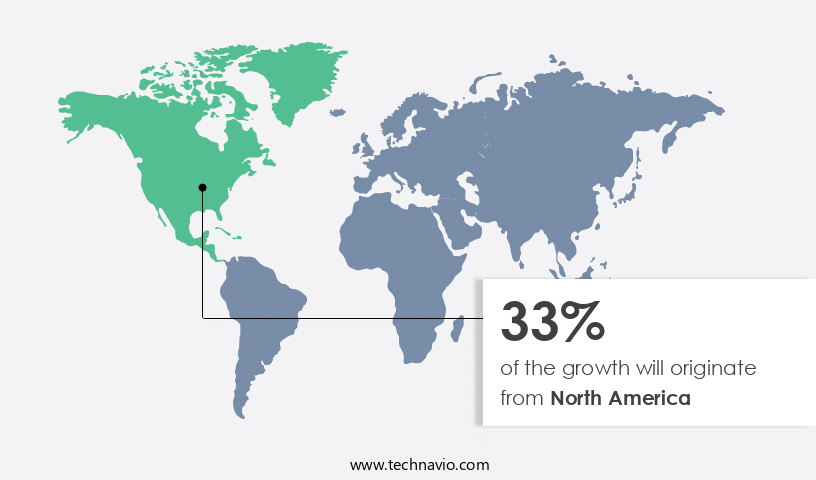

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market for smart TV sticks is experiencing significant growth due to the region's high online content consumption and technologically advanced entertainment sector. With popular web series, movies, and animated shows readily accessible through digital content providers, the demand for these streaming gadgets is increasing. Furthermore, strategic alliances and improved performance features, such as voice control and powerful speakers, are key factors driving the market. Consumers in American homes are increasingly seeking cost-effective solutions for accessing their favorite content, including music, TV shows, and movies, on their big displays. Smart TV sticks offer versatility, seamless integration with multiple apps, and compatibility with various channels, making them a popular choice for internet users.

Additionally, the e-commerce ecosystem and online retailers are offering bundling options and post-purchase support experiences to enhance the consumer experience. The market is expected to continue growing as technological developments cater to the fast-paced lifestyle of consumers, providing enhanced viewing experiences and entertainment options on both standard TVs and connected homes.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Smart TV Sticks Industry?

- Growing smart home ecosystem is the key driver of the market.

- Smart TV sticks have emerged as integral components of modern smart home ecosystems, enabling users to manage their TV and streaming experiences through voice commands and automation routines. The integration of these devices with other smart home technologies, such as smart speakers, displays, and other connected devices, fosters seamless interoperability and enhances the overall user experience. This interconnectivity allows users to control their smart TV sticks alongside other smart home devices via unified control interfaces offered by virtual assistants like Amazon Alexa, Google Assistant, and Apple Siri.

- As a result, users can effortlessly adjust lighting, temperature, and other home settings while watching TV, thereby enhancing convenience and accessibility.

What are the market trends shaping the Smart TV Sticks Industry?

- Increasing penetration of smart TVs worldwide is the upcoming market trend.

- The expanding adoption of smart TVs is projected to negatively impact the demand for smart TV sticks. Smart TVs, equipped with built-in capabilities to stream applications like Netflix and Amazon Prime, render smart TV sticks obsolete as they only stream content from local networks or the internet to the TV. The proliferation of smart technologies globally fuels the growth of the smart TV market.

- With advanced consumer electronics and the increasing popularity of smart TVs, the need for separate devices like smart TV sticks may diminish during the forecast period.

What challenges does the Smart TV Sticks Industry face during its growth?

- Rising use of mobile electronic devices is a key challenge affecting the industry growth.

- The global market for smart TV sticks has been experiencing notable influences from the widespread adoption of portable electronic devices such as smartphones, tablets, and laptops. With increasing economic growth, rising literacy rates, and escalating purchasing power in developing regions like APAC, MEA, and South America, the demand for these multimedia devices has d. This trend is expected to impact the demand for traditional TVs negatively, potentially hindering the growth of the market.

- Despite this challenge, the market continues to exhibit significant potential due to the convenience and affordability of smart TV sticks as an alternative to purchasing a new smart TV.

Exclusive Customer Landscape

The smart tv sticks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart tv sticks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart tv sticks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Actions Microelectronics Co. Ltd. (Taiwan) - The company provides smart TV solutions through devices like the EZCast Dongle, compatible with Android, iOS, Windows, Mac, and Chrome OS systems. This innovative technology enables seamless streaming and mirroring of content from various devices to a larger screen, enhancing user experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Actions Microelectronics Co. Ltd. (Taiwan)

- Airtame (Denmark)

- Amazon.com Inc. (United States)

- Apple Inc. (United States)

- ASUSTeK Computer Inc. (Taiwan)

- Bharti Airtel Ltd. (India)

- CloudWalker Streaming Technologies Pvt. Ltd. (India)

- Dish TV India Ltd. (India)

- Geniatech Inc. (China)

- Google LLC (United States)

- Matricom (United States)

- MECOOL (China)

- NVIDIA Corp. (United States)

- Roku Inc. (United States)

- Shenzhen Rikomagic Tech Corp. Ltd. (China)

- Shenzhen Tomato Technology Co. Ltd. (China)

- Topleo Technology Ltd. (China)

- Xiaomi Inc. (China)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The smart TV stick market has witnessed significant growth in recent years, driven by the increasing demand for cost-effective solutions that enable users to access online content on their television screens. These devices, also known as streaming gadgets or CTV-focused devices, offer voice control functionality, allowing viewers to easily navigate and search for their favorite content. The user experience is a key factor in the adoption of smart TV sticks. High-definition content and improved performance are essential features that consumers look for in these devices. Powerful speakers and seamless integration with home entertainment systems are also important considerations.

Strategic alliances between streaming services and smart TV stick manufacturers have played a crucial role in the growth of this market. These partnerships provide users with access to a wide range of apps and channels, enhancing the overall entertainment experience. The proliferation of live streaming services and the availability of a vast amount of web information have led to a shift in consumer preferences towards OTT (over-the-top) viewing. Smart TV sticks offer a convenient and portable solution for consumers who want to access their favorite content on the go. The technological developments in the field of smart TV sticks have been rapid, with devices offering advanced features such as compatibility with multiple apps, user-friendly interfaces, and seamless integration with other smart home devices.

The entertainment industry has been significantly impacted by the rise of smart TV sticks. Consumers now have access to a vast array of entertainment options, including movies, TV shows, web series, and live sporting events, all at their fingertips. The convenience and versatility of smart TV sticks have made them a popular choice among internet users, particularly those who have broadband connections. These devices offer a post-purchase support experience that is unmatched by traditional cable services. The e-commerce ecosystem has also played a role in the growth of the smart TV stick market. Online retailers offer a wide range of devices at competitive prices, making it easy for consumers to purchase and have them delivered to their doorstep.

The compact designs of smart TV sticks make them an attractive option for consumers who want to upgrade their television viewing experience without having to invest in a new TV set. The absence of advertisement interruptions is another advantage that these devices offer over traditional TV. The entertainment experience offered by smart TV sticks is not limited to just streaming movies and TV shows. Many devices offer cloud gaming services, enabling users to play games on their big displays. The future of the smart TV stick market looks promising, with technological advancements such as 8k resolution and advanced voice assistants expected to drive growth.

Consumer preferences for enhanced viewing experiences and the fast-paced lifestyle of modern consumers are also expected to fuel demand for these devices. The smart TV stick market is a dynamic and rapidly growing industry that offers consumers a cost-effective and convenient solution for accessing online content on their television screens. The devices offer advanced features, seamless integration, and a user-friendly experience that is unmatched by traditional TV. The future of this market looks bright, with technological advancements and changing consumer preferences expected to drive growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

243 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 962.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, Canada, Germany, UK, China, France, India, Japan, Italy, South Korea, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart TV Sticks Market Research and Growth Report?

- CAGR of the Smart TV Sticks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart tv sticks market growth of industry companies

We can help! Our analysts can customize this smart tv sticks market research report to meet your requirements.