Space Heaters Market Size 2025-2029

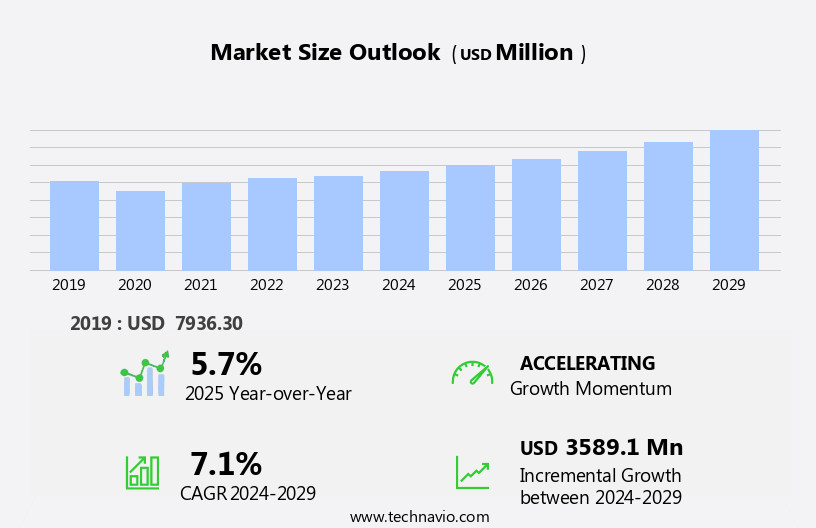

The space heaters market size is forecast to increase by USD 3.59 billion at a CAGR of 7.1% between 2024 and 2029.

- The global space heater market is experiencing significant growth due to the increasing demand for energy-efficient and safe heating solutions in both residential and commercial sectors. The market is driven by the rising awareness of energy savings and the need for comfort during colder weather conditions. Moreover, collaborations and new product launches among key players are further fueling market expansion. However, the market faces challenges such as high operational costs associated with space heaters, particularly those using fossil fuels. Additionally, regulatory hurdles impact adoption due to stringent energy efficiency regulations and safety standards. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on developing advanced technologies, such as electric and renewable energy-based space heaters, and optimizing their supply chains to mitigate operational costs.

- By addressing these challenges and meeting the evolving demands of consumers, market participants can position themselves for long-term success in the global space heater market.

What will be the Size of the Space Heaters Market during the forecast period?

- The space heater market is experiencing significant advancements, with a focus on digital thermostat control and heating optimization to enhance user experience and energy efficiency. Aesthetic appeal and stylish design are becoming essential factors, as portable heaters with compact sizes and ceramic heating elements gain popularity. Heating system upgrades incorporate renewable energy sources, carbon monoxide detectors, and frost protection for improved indoor air quality and safety. Heat circulation and adjustable heating settings ensure even distribution of warmth, while eco-friendly materials and energy consumption monitoring cater to sustainability-conscious consumers. Infrared technology and heat pump technology offer energy-efficient models, catering to seasonal heating needs and retrofit options.

- Smart home integration and remote control operation further enhance convenience, making space heaters a smart choice for businesses seeking sustainable heating solutions during winter. Safety certification and low-energy consumption are essential considerations, as businesses prioritize energy efficiency and safety in their operations. Portable, adjustable, and energy-efficient heaters are increasingly preferred, offering both heating comfort and cost savings. With advancements in heating technology, businesses can now choose from a range of innovative heating solutions, including flameless heating and sustainable heating options, to meet their specific needs.

How is this Space Heaters Industry segmented?

The space heaters industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Residential

- Commercial

- Industrial

- Product

- Fan heaters

- Convection heaters

- Radiant heaters

- Ceramic heaters

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Application Insights

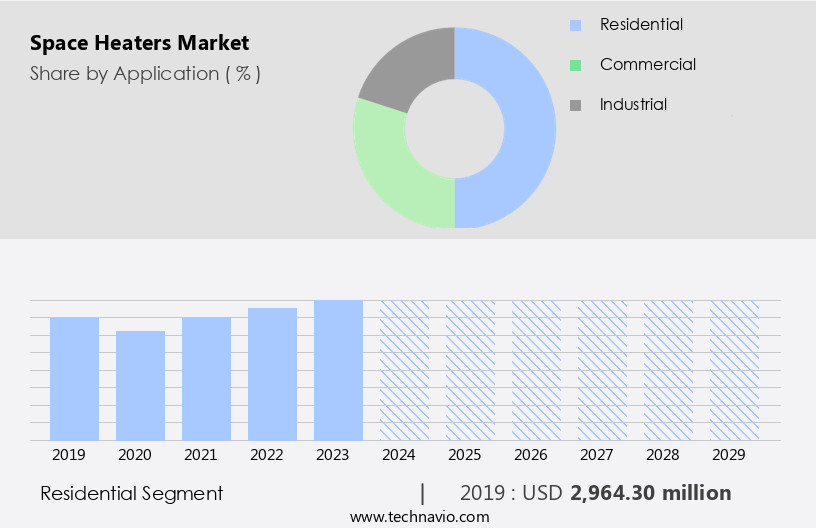

The residential segment is estimated to witness significant growth during the forecast period.

Space heaters cater to various heating needs in both residential and commercial settings, offering solutions for outdoor, office, workshop, and home use. Energy efficiency is a significant trend in the market, with consumers seeking cost-effective and eco-friendly options. Residential space heaters, in particular, have gained popularity due to their ability to heat specific areas without wasting energy, making them an attractive choice for budget-conscious and environmentally-conscious consumers. Portable and compact, residential space heaters come in various types, including electric, oil-filled, propane, and infrared heaters. Safety features such as tip-over switches, overheat protection, and flame-retardant materials ensure user safety.

Digital controls, app control, and timer settings add to the convenience. Energy-saving modes and fuel efficiency are essential considerations for consumers. Commercial applications include outdoor heating, such as patio heaters, and industrial use, with large-scale heating solutions like heat exchangers and convection heaters. Ul and CSA certifications ensure compliance with safety standards. Heating performance, temperature uniformity, and heating zones are crucial factors in commercial applications. Heating elements, blower motors, and heating coils are essential components, while heat pumps and radiant heaters offer alternative heating technologies. Maintenance needs vary depending on the type and usage. Voice control and remote control add to the user experience.

The market continues to evolve, with innovations in energy efficiency, heat distribution, and smart technology.

The Residential segment was valued at USD 2.96 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

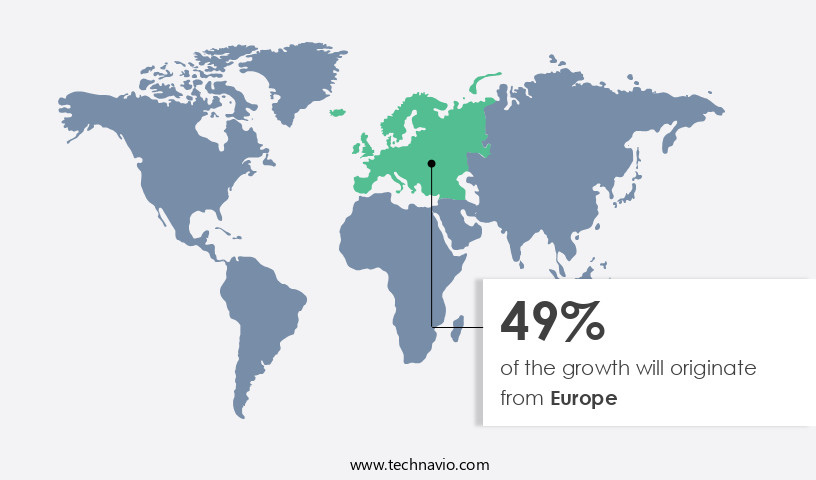

Europe is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European space heater market is experiencing growth as consumers seek cost-effective supplements to their central heating systems. Gas heaters have traditionally dominated the market, but there is a rising preference for electric alternatives due to energy efficiency. Popular space heater types include fan and convection models. Innovations like smart heaters, which offer digital controls, app integration, and energy-saving modes, are gaining traction among high-income consumers investing in home automation. Safety features, such as tip-over switches, overheat protection, and flame-retardant materials, are essential considerations. Heating elements, blower motors, and heat pumps are integral components, while heat distribution, temperature uniformity, and heating performance are key factors influencing consumer decisions.

Commercial use, industrial applications, and various heating zones, including offices, workshops, and residential spaces, also drive market expansion. Certifications, such as UL and CSA, ensure safety standards are met. Maintenance needs, including heating coils and filters, are essential considerations for consumers. Overall, the European space heater market is evolving with a focus on energy efficiency, comfort levels, and advanced technology.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Space Heaters market drivers leading to the rise in the adoption of Industry?

- The market is driven primarily by the rising demand for energy-efficient, safe, and cost-effective domestic heating appliances, which are increasingly preferred for their ability to reduce energy consumption and enhance overall safety.

- The market is witnessing significant growth due to the increasing demand for energy-efficient and safe heating solutions, particularly in urban areas. The market is driven by the desire for comfort and luxury, leading to increased investment in advanced heating technologies. Ul and CSA certifications ensure safety and efficiency in various heating appliances, including ceramic heaters, heat exchangers, convection heaters, and gas heaters. Innovations such as wi-fi connectivity, voice control, remote control, timer settings, and infrared heating further enhance the market's appeal.

- Industrial use of heating appliances also contributes to the market's expansion. Maintenance needs, including heating coils, are addressed through ongoing research and development efforts. The market's growth is further fueled by advancements in heating technologies, ensuring a continuous supply of energy-efficient and cost-effective heating solutions.

What are the Space Heaters market trends shaping the Industry?

- The trend in the market is leaning towards increased collaboration and a higher number of product launches. A professional and knowledgeable approach involves staying informed of this developing industry pattern.

- The market is witnessing an increase in product innovation and collaboration among manufacturers to meet evolving consumer demands and stay competitive. One recent example is Lasko's September 2023 launch of four new heater models, including a smart oscillating tower and compact variants. These new heaters offer contemporary designs for efficient heat dispersion, smart control via the Lasko app and voice commands, and ClimaSense Technology for enhanced functionality. Such launches contribute to market growth by introducing safety features, energy efficiency improvements, and sustainability initiatives. The global space heater market encompasses various types, such as oil-filled heaters, heat pumps, propane heaters, and natural gas heaters.

- Safety features, including tip-over switches and blower motor protection, are essential for all types. Heating elements and heat output vary depending on the specific model and application, such as office heating or workshop heating. Compliance with safety standards is crucial for manufacturers to ensure customer safety and regulatory compliance.

How does Space Heaters market faces challenges face during its growth?

- The escalating operational costs associated with space heaters pose a significant challenge to the industry's growth trajectory.

- Electric space heaters are a common solution for supplemental home heating, particularly in areas not served by central heating systems. However, their operational costs can be a significant deterrent for consumers, averaging around USD 800- USD 850 per year. This is higher than the operational costs of alternative heating solutions such as gas room heaters and reverse cycle ACs. Despite the initial affordability of electric space heaters, their high energy consumption can outweigh the savings from low upfront costs. To address this challenge, manufacturers are focusing on developing energy-efficient technologies. Radiant heaters, digital controls, mica heaters, fan speed, and oscillating function are some features that can contribute to energy savings.

- For instance, radiant heaters directly heat objects and people, reducing the need for continuous heating of the surrounding air. Digital controls enable users to set desired temperatures and adjust settings remotely through apps, ensuring optimal energy usage. Mica heaters, known for their durability and heat retention properties, can also contribute to energy savings. Moreover, eco-friendly heating solutions are gaining popularity. Companies are focusing on designing space heaters with overheat protection and energy recovery systems to minimize energy waste. These features not only contribute to cost savings but also enhance consumer comfort levels. For specific applications, such as garage heating, space heaters with these advanced features can prove to be a cost-effective and energy-efficient alternative to traditional heating solutions.

Exclusive Customer Landscape

The space heaters market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the space heaters market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, space heaters market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bromic Group Pty Ltd. - This company specializes in providing efficient and stylish heating solutions for outdoor spaces through offerings such as Bromic Platinum Smart-Heat Electric Heaters..

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bromic Group Pty Ltd.

- Crane USA

- Daikin Industries Ltd.

- De Longhi S.p.A

- Dr. Infrared Heater

- Duraflame Inc.

- Dyson Group Co.

- Energy Wise Solutions

- Honeywell International Inc.

- Lasko Products LLC

- Midea Group Co. Ltd.

- Mill International AS

- Newegg Commerce Inc.

- Newell Brands Inc.

- Rinnai Corp.

- Solar Panels Plus LLC

- Stadler Form Aktiengesellschaft

- SUNHEAT International

- Sunpentown International Inc.

- Vornado Air LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Space Heaters Market

- In January 2024, leading space heater manufacturer, Honeywell, introduced its new line of high-efficiency, smart space heaters, integrating Wi-Fi connectivity and voice control capabilities (Honeywell Press Release, 2024). This innovation marks a significant shift towards smart heating solutions in the space heater market.

- In March 2025, LG and Samsung, two major players in the electronics industry, announced a strategic partnership to co-develop space heating technologies, aiming to combine their expertise in consumer electronics and home appliances (Samsung Newsroom, 2025). This collaboration is expected to result in advanced, energy-efficient space heating solutions.

- In July 2024, Carrier Global Corporation, a leading HVAC solutions provider, completed the acquisition of Utility Partners of America, a prominent provider of energy services and solutions, including space heating systems (Carrier Press Release, 2024). This acquisition will enable Carrier to expand its offerings in the energy services sector and strengthen its position in the space heater market.

- In October 2025, the European Union passed new regulations mandating higher energy efficiency standards for space heaters, effective from 2027 (EU Press Release, 2025). This policy change is expected to drive innovation and investment in energy-efficient space heating technologies.

Research Analyst Overview

The space heater market continues to evolve, with various types of heaters catering to diverse applications across sectors. Smart heaters, with their digital controls and app integration, offer enhanced comfort levels and energy efficiency. Outdoor heating solutions, such as propane heaters and patio heaters, provide warmth in open spaces, while oil-filled heaters offer consistent heat output for office and home environments. Heat pumps and heat exchangers are gaining popularity for their energy-saving capabilities, while safety features like tip-over switches, overheat protection, and flame-retardant materials ensure user safety. Natural gas heaters and industrial heaters, with their high heat output and commercial use applications, require safety standards compliance, such as CSA and UL certifications.

Workshop heating solutions, including ceramic heaters and convection heaters, cater to industrial use, while radiant heaters offer uniform temperature distribution for residential and commercial spaces. The market also features a range of heating elements, fan speeds, oscillating functions, and eco-friendly heating options. Electric heaters, such as mica heaters and infrared heaters, offer energy efficiency and low maintenance needs, while gas heaters, like kerosene heaters and heating coils, provide heat distribution and heating zones. With ongoing advancements in technology, heating performance and temperature uniformity continue to improve, making space heaters an essential solution for various applications.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Space Heaters Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 3589.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.7 |

|

Key countries |

US, Germany, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Space Heaters Market Research and Growth Report?

- CAGR of the Space Heaters industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the space heaters market growth of industry companies

We can help! Our analysts can customize this space heaters market research report to meet your requirements.