Specialty Medical Chairs Market Size 2024-2028

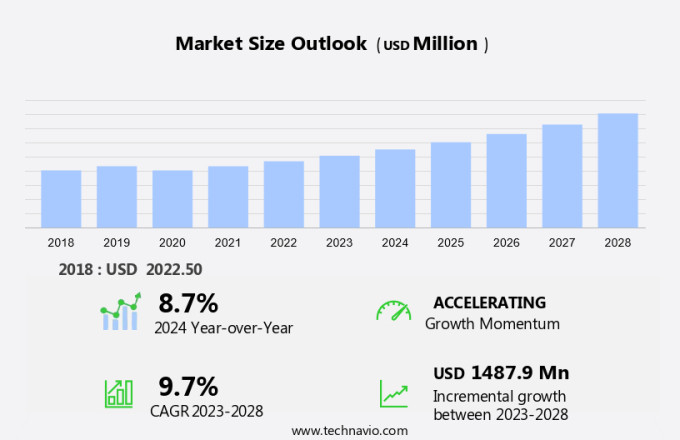

The specialty medical chairs market size is forecast to increase by USD 1.49 billion, at a CAGR of 9.7% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing number of dentists and dental practices. This trend is particularly noticeable in the segment catering to individuals who use wheelchairs, as there is a growing demand for specialized dental chairs that can accommodate their unique needs. However, the market faces challenges from stringent regulatory standards. Compliance with these regulations adds to the manufacturing costs and can limit the market's growth potential. Companies must navigate these challenges by investing in research and development to create innovative solutions that meet both regulatory requirements and the evolving needs of their customers.

- By focusing on these key drivers and challenges, market players can capitalize on the opportunities in this dynamic market and effectively plan their strategic business decisions.

What will be the Size of the Specialty Medical Chairs Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. These chairs are engineered to cater to diverse patient needs, integrating advanced features such as weight capacity limits, adjustable height mechanisms, easy clean upholstery, and lumbar support mechanisms. Adjustable armrests, anti-microbial surface treatment, tilt-in-space functionality, wheelchair compatibility, and electrical components are seamlessly integrated into ergonomic seating designs. Mobility assistance features, such as seat width adjustment, integrated safety features, and cushion density, are essential for patient comfort and transfer systems. Ergonomic seating designs prioritize backrest angle adjustments, chair frame construction, and durability testing protocols to ensure optimal patient support.

Integrated controls, footrest adjustments, and headrest adjustability enhance the user experience, while bariatric chair specifications cater to larger patients. Healthcare chair materials, hydraulic lift systems, and upholstery durability ratings are crucial factors in the selection process. Lateral support features, postural support systems, seat depth adjustment, comfort rating scales, and power lift recliners further expand the market's offerings. The continuous evolution of specialty medical chairs is driven by advancements in technology, changing patient needs, and regulatory requirements. These chairs are more than just medical devices; they are essential tools that contribute significantly to patient care and overall healthcare delivery.

How is this Specialty Medical Chairs Industry segmented?

The specialty medical chairs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Rehabilitation

- Examination

- Treatment

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Product Insights

The rehabilitation segment is estimated to witness significant growth during the forecast period.

Rehabilitation medical chairs are essential tools in healthcare settings, enabling patients to assume proper postures for their recovery and mobility enhancement. These chairs offer various features, including adjustable footrests, height, headrest, backrest, and armrests, as well as safety belts. Mechanically or electrically adjustable, these chairs cater to diverse patient needs. The market's growth is driven by the increasing number of patients requiring rehabilitation and the growing geriatric population worldwide. Additionally, these chairs prioritize user comfort and safety with ergonomic designs, integrated safety features, and adjustable backrest angles. Durability is a crucial factor, with chairs undergoing rigorous testing protocols and constructed from robust healthcare chair materials.

Hydraulic lift systems and gas spring mechanisms facilitate seamless adjustments, while tilt-in-space functionality and wheelchair compatibility cater to diverse patient needs. Moreover, chairs may incorporate anti-microbial surface treatments, pressure relief cushions, and lateral support features to enhance patient comfort and overall well-being. Integrated controls, remote operation, and chair stability testing ensure optimal functionality and safety. Cushion density, seat width adjustment, and seat depth adjustment further customize the user experience. Comfort rating scales provide valuable insights into the chairs' effectiveness. Overall, the market is witnessing significant growth, catering to the evolving needs of patients in various healthcare settings.

The Rehabilitation segment was valued at USD 839.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Specialty medical chairs have gained significant traction in North America due to the increasing number of accidents leading to increased demand for recovery and rehabilitation solutions. These chairs offer numerous benefits, including adjustable height mechanisms, easy-to-clean upholstery, lumbar support, adjustable armrests, and anti-microbial surface treatment. The market's growth in the region is fueled by healthcare investments, advanced healthcare facilities, and services such as intensive care, acute care, critical care, and long-term care. Key features like tilt-in-space functionality, wheelchair compatibility, electrical components, seat width adjustment, integrated safety features, and durability testing protocols are essential for these chairs.

Additionally, ergonomic seating design, mobility assistance features, backrest angle adjustments, chair frame construction, and hydraulic lift systems contribute to the market's growth. Comfort rating scales, power lift recliners, and pressure relief cushions further enhance the user experience. The region's healthcare spending and the setting up of advanced healthcare facilities have created a favorable environment for the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market caters to the unique seating requirements of various patient populations, offering advanced postural support features to ensure optimal comfort and safety. Adjustable height medical chairs allow users to find the perfect seat position, while pressure relief cushions alleviate discomfort and prevent the development of pressure ulcers. Bariatric patient chairs are designed with specifications to accommodate larger patients, featuring heavy-duty frames, wider seats, and stronger mechanisms. Power lift recliner chairs offer convenience and ease of use, with mechanisms that allow caregivers to lift patients with minimal effort. Ergonomic design healthcare seating prioritizes lateral support features, ensuring proper spinal alignment and reducing the risk of injury. Upholstery durability medical chairs are built to withstand frequent use, utilizing high-quality materials that resist wear and tear. Healthcare chair materials specifications include antimicrobial properties, easy-to-clean surfaces, and resistance to fluids and stains. Adjustable armrest chair mechanisms enable users to find a comfortable position, while lumbar support systems provide targeted support for the lower back. Remote controlled medical chair systems offer added convenience, allowing users to adjust settings with the touch of a button. Electrical components medical chairs feature advanced technology, including hydraulic lift system chair components and gas spring medical chair mechanisms, which provide smooth and efficient movement. Seat depth adjustment medical chairs enable users to find the ideal position, while backrest angle adjustment mechanisms offer flexibility for various postures. Chair stability testing protocols ensure safety and reliability, while comfort rating scales provide objective measures of seat comfort. Integrated safety medical chair features, such as anti-tipping mechanisms and seatbelts, further enhance the safety and functionality of these specialized chairs.

What are the key market drivers leading to the rise in the adoption of Specialty Medical Chairs Industry?

- The expansion of the dental workforce, specifically the increase in the number of dentists and dental practices, serves as the primary catalyst for market growth.

- Dental chairs have become essential equipment in dental care establishments, with hospitals and clinics investing in advanced models to enhance the efficiency and safety of dental procedures. The global dental chairs market is experiencing growth due to several factors, including technological advancements, rising healthcare expenditure in developing countries, and an increasing prevalence of dental diseases. The industry's expansion is driven by the growing number of dentists and dental practices worldwide. For instance, as of 2019, there were approximately 200,400 dentists practicing in the US. Similarly, countries such as Australia, Armenia, Austria, France, Germany, and India have seen a surge in the number of dentists.

- Advanced features in dental chairs, such as upholstery durability ratings, lateral support features, postural support systems, seat depth adjustment, comfort rating scales, and power lift recliners, are attracting dental professionals. Additionally, pressure relief cushions provide added comfort to patients during lengthy procedures. These features contribute to the immersive and harmonious dental experience, emphasizing patient satisfaction and safety. In conclusion, the dental chairs market is witnessing growth due to the increasing number of dentists and dental practices, rising healthcare expenditure, and technological advancements. Advanced features, such as upholstery durability ratings, lateral support, and postural support systems, are essential factors driving the market's growth.

- The adoption of these advanced chairs is essential for dental care establishments to provide a comfortable, safe, and efficient dental experience for their patients.

What are the market trends shaping the Specialty Medical Chairs Industry?

- The focus on dental chairs specifically designed for wheelchair users is an emerging market trend. In the dental industry, there is a growing recognition for the importance of accommodating individuals with mobility challenges.

- The market has witnessed significant growth due to the increasing focus on providing dental care to individuals using wheelchairs. These chairs are designed to accommodate wheelchair users, enabling them to receive dental treatment in their own chairs. One such example is the Diaco dental chair, manufactured by Diaco Ltd. This fully mobile dental platform is recognized in over 100 NHS hospitals in the UK and across 14 countries in North America, Europe, and Asia. The chair's features include weight capacity limits, adjustable height mechanism, easy clean upholstery, lumbar support mechanism, adjustable armrests, and anti-microbial surface treatment.

- Additionally, it offers tilt-in-space functionality and wheelchair compatibility. Electrical components ensure a smooth and efficient operation. These chairs are gaining popularity in countries like Canada, Qatar, and Singapore, making dental care more accessible to a wider population.

What challenges does the Specialty Medical Chairs Industry face during its growth?

- The strict regulatory standards pose a significant challenge to the expansion of the industry. Adhering to these stringent regulations adds complexity and cost to business operations, potentially hindering growth.

- Specialty medical chairs are subject to rigorous regulations, both domestically and internationally, which impact their manufacturing, distribution, marketing, and sales. The US Food and Drug Administration (FDA) sets the standards for medical devices in the US, including specialty medical chairs. companies must comply with the FDA's Quality System Regulation (QSR) Act to ensure product quality through periodic inspections. Additionally, chairs must adhere to the Americans with Disabilities Act (ADA) to accommodate people with disabilities. These chairs often feature seat width adjustments, integrated safety features, ergonomic seating design, backrest angle adjustments, and mobility assistance features.

- Cushion density and chair frame construction are essential considerations for durability and patient comfort. Manufacturers must prioritize these features while adhering to regulatory requirements to cater to the growing demand for specialized medical chairs.

Exclusive Customer Landscape

The specialty medical chairs market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the specialty medical chairs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, specialty medical chairs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A dec Inc. - This company specializes in providing a diverse selection of medical chairs, including the A-dec 500, A-dec 400, and A-dec 300 models, catering to various healthcare applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A dec Inc.

- Altimate Medical Inc.

- AMETEK Inc.

- ATMOS MedizinTechnik GmbH and Co. KG

- BMB Medical LLC

- Cefla SC

- Danaher Corp.

- DentalEZ Inc.

- Dentsply Sirona Inc.

- Fresenius Medical Care AG and Co. KGaA

- Greiner AG

- Hill Laboratories Co.

- Invacare Corp.

- J. Morita Corp.

- medifa GmbH

- Midmark Corp.

- Planmeca Oy

- Stryker Corp.

- Topcon Corp.

- Winco Mfg. LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Specialty Medical Chairs Market

- In January 2024, Medtronic plc, a global healthcare solutions company, announced the launch of its new line of specialty surgical chairs, the Mazor X StealthStation, integrated with robotics and imaging technology for enhanced spinal procedures (Medtronic Press Release, 2024).

- In March 2024, Invacare Corporation, a leading manufacturer and distributor of medical equipment, entered into a strategic partnership with ErgoSphere, a provider of ergonomic seating solutions, to expand its product offerings in the market (Invacare Press Release, 2024).

- In May 2024, Ethicon, a part of Johnson & Johnson, received FDA approval for its new specialty surgical chair, the SurgiChair, designed for bariatric patients undergoing weight loss surgery (Johnson & Johnson Press Release, 2024).

- In February 2025, Stryker Corporation, a medical technology company, completed the acquisition of Wright Medical Group N.V., significantly expanding its portfolio of specialty medical chairs and orthopedic implants (Stryker Press Release, 2025).

Research Analyst Overview

- The market encompasses a range of advanced seating solutions designed to cater to diverse patient needs. Key features include wheel lock mechanisms for enhanced mobility, therapeutic seating options for improved patient comfort, and infection control measures to ensure hygiene. Comfort features comparison, chair base construction, and integrated heating systems are essential considerations for buyers. Electrical safety standards, body positioning adjustments, and accessible chair designs are integral to user experience. Maintenance requirements, warranty specifications, cleaning instructions, and pressure mapping technology are crucial factors in chair selection. Material flammability ratings, skin integrity assessment, mobility device integration, and leg rest adjustments are also vital for healthcare providers.

- Hygienic surface treatments, adjustable back height, vibration therapy features, safety harness systems, user weight limits, fall prevention mechanisms, posture correction features, and customizable seating options are additional features shaping market trends. Market dynamics are influenced by advancements in technology, increasing demand for patient-centric care, and regulatory compliance. Incorporating transfer assist features, weight bearing capacity, and safety harness systems enhances patient safety and mobility. Adherence to electrical safety standards and pressure mapping technology ensures optimal patient comfort and improved clinical outcomes. The integration of infection control measures and accessible chair designs addresses the needs of diverse patient populations. Overall, the market is evolving to meet the demands of healthcare providers for advanced, customizable, and safe seating solutions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Specialty Medical Chairs Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.7% |

|

Market growth 2024-2028 |

USD 1487.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.7 |

|

Key countries |

US, UK, China, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Specialty Medical Chairs Market Research and Growth Report?

- CAGR of the Specialty Medical Chairs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the specialty medical chairs market growth of industry companies

We can help! Our analysts can customize this specialty medical chairs market research report to meet your requirements.