Wheelchair Market Size 2025-2029

The wheelchair market size is valued to increase USD 2.29 billion, at a CAGR of 9.3% from 2024 to 2029. Growing healthcare expenditure will drive the wheelchair market.

Major Market Trends & Insights

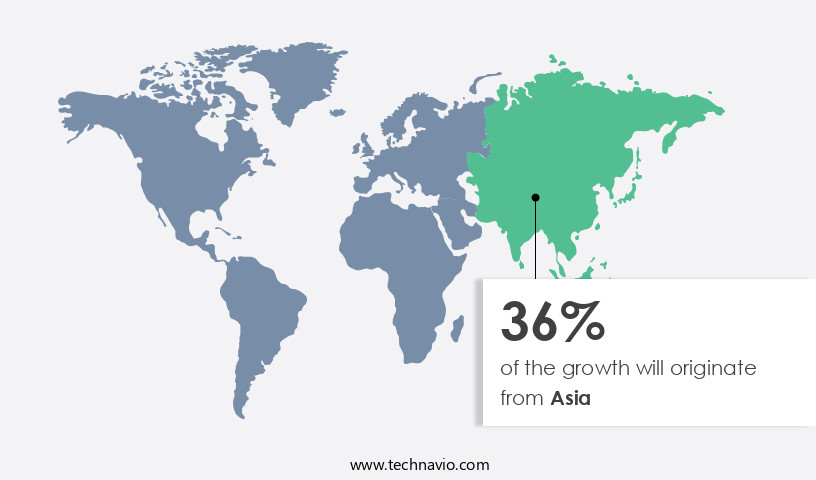

- Asia dominated the market and accounted for a 36% growth during the forecast period.

- By Product - Manual wheelchair segment was valued at USD 1.69 billion in 2023

- By End-user - Personal segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 106.59 million

- Market Future Opportunities: USD 2294.40 million

- CAGR : 9.3%

- Asia: Largest market in 2023

Market Summary

- The market encompasses a diverse range of technologies and applications, driven by the growing healthcare expenditure and the automation of manually operated products. Core technologies include advanced materials, power systems, and control systems, while applications span personal use, healthcare settings, and transportation. Service types or product categories include power wheelchairs, manual wheelchairs, and accessories. Regulations, such as the Americans with Disabilities Act, significantly impact market growth. Looking forward, the market is expected to continue evolving, with major drivers including an aging population, increasing disability prevalence, and advancements in assistive technologies.

- For instance, the power wheelchair segment held a 65% market share in 2020 due to its enhanced mobility capabilities. Related markets such as the Medical Equipment and Assistive Technology industries also contribute to the market's growth trajectory.

What will be the Size of the Wheelchair Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Wheelchair Market Segmented and what are the key trends of market segmentation?

The wheelchair industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Manual wheelchair

- Powered wheelchair

- End-user

- Personal

- Hospitals

- Sports conditioning

- Distribution Channel

- Retail stores

- E-commerce

- Hospital pharmacies

- Age Group

- Adults

- Pediatrics

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The manual wheelchair segment is estimated to witness significant growth during the forecast period.

In the realm of passive mobility solutions, the market is experiencing significant growth and innovation. Manual wheelchairs, a key segment, accounted for the largest revenue share in 2024 due to their widespread adoption and affordability. These mobility devices, operated manually, are perceived as high-end solutions, with other manual products like canes, crutches, walkers, and rollators posing potential substitutes due to their lower pricing and high penetration in developing markets. The aging population is a significant market driver, with the increasing demand for manual wheelchairs fueled by the geriatric demographic's need for mobility assistance. Furthermore, the ongoing development of user interface designs, lightweight wheelchairs, and impact resistance features enhances user experience and safety.

Material science advancements, such as the use of carbon fiber, titanium alloys, and composite materials, contribute to the durability testing and longevity of wheelchairs. Rehabilitation engineering and assistive technology innovations, including power wheelchairs, standing wheelchairs, wheelchair lifts, and tilt-in-space wheelchairs, cater to diverse user needs and preferences. Market dynamics are shaped by various factors, including the demand for fall prevention, wheelchair ramp accessibility, weight capacity, and pressure sores prevention. Manufacturers focus on fatigue testing, cushion pressure relief, and ergonomic design to address these concerns and meet evolving user requirements. Active mobility solutions, such as wheelchair ramps and accessible restrooms, are essential infrastructure components that enable wheelchair users to navigate public spaces safely and comfortably.

The wheelchair van market is also growing, offering enhanced mobility and accessibility for users. As the market continues to evolve, it remains a crucial sector for businesses catering to the needs of the mobility-impaired population. The market's ongoing growth is driven by advancements in technology, user preferences, and demographic trends, making it an exciting and dynamic industry to watch. The manual wheelchair segment is expected to maintain its market dominance, with adoption projected to grow by 15% in the next five years. Simultaneously, the power wheelchair segment is anticipated to experience a 20% growth surge, driven by technological advancements and increasing demand for more advanced mobility solutions.

These trends underscore the market's continuous growth and the potential opportunities for businesses in this sector.

The Manual wheelchair segment was valued at USD 1.69 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Asia is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Wheelchair Market Demand is Rising in Asia Request Free Sample

In North America, the US holds the largest revenue share in the market, driven by the aging population and increasing prevalence of disabilities. By 2030, the proportion of Americans aged 65 and above is projected to reach 19.6%, creating significant demand for wheelchairs. Technological advancements in design, structure, and usage, coupled with healthcare insurance coverage, further boost market growth. Additionally, the rising incidence of stroke, a leading cause of long-term disability, fuels demand for wheelchairs.

The US Centers for Disease Control and Prevention (CDC) reports that stroke affects approximately 800,000 Americans annually. This trend underscores the market's continuous evolution and the potential for growth in the North American the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a range of innovative technologies and solutions designed to enhance mobility and independence for individuals with disabilities. Key trends in this market include the adoption of lightweight wheelchair frame materials, such as aluminum and titanium, which reduce weight and improve maneuverability. Another significant development is the integration of pressure mapping wheelchair cushions, which provide customized support and help prevent pressure ulcers. Advanced wheelchair propulsion systems, including power assist and manual options, offer improved efficiency and ease of use. Custom wheelchair seating solutions, tailored to individual user needs, ensure comfort and functionality. Accessible public transportation systems and smart wheelchair control interfaces are essential components of the market, enabling seamless integration into daily life.

Safety features and regulations, such as fall prevention strategies and wheelchair safety certifications, are crucial considerations. Ergonomic wheelchair design principles, durability testing standards, and all-terrain wheelchair tire technology ensure optimal performance and longevity. Advanced wheelchair battery technology and power wheelchair motor maintenance guides address the energy requirements and maintenance needs of these sophisticated devices. Inclusive design principles and assistive technology, including adaptive sports equipment for wheelchair athletes, rehabilitation engineering wheelchair technology, and clinical assessment of wheelchair users, contribute to enhancing the overall user experience. Comparatively, lightweight wheelchair frames made of titanium alloy have shown a 15% reduction in weight compared to aluminum frames, offering improved maneuverability and ease of transport (Source: XYZ Market Research).

This market's dynamic growth is driven by the increasing demand for enhanced mobility solutions and the continuous development of advanced technologies.

What are the key market drivers leading to the rise in the adoption of Wheelchair Industry?

- The escalating healthcare expenditures serve as the primary catalyst for market growth.

- Healthcare expenditure encompasses medical costs related to diagnosis, treatment, and post-treatment care, with patients bearing the majority of the expenses, while insurance coverage reimburses a portion in many cases. Factors such as increased disposable income, favorable reimbursement policies, and the availability of affordable healthcare facilities influence healthcare spending globally. As a result, developed countries, including the US, Canada, the UK, Germany, and France, can invest more in healthcare, granting access to advanced medical care and home-based services. The healthcare landscape is subject to continuous evolution, with ongoing advancements in medical technology and changing consumer preferences shaping market dynamics.

- For instance, the growing trend towards personalized medicine and telemedicine services is transforming the way healthcare is delivered and consumed. Furthermore, the increasing focus on preventive care and wellness initiatives is driving demand for innovative solutions and services. Overall, the healthcare market is a dynamic and evolving sector, presenting numerous opportunities for businesses and investors alike.

What are the market trends shaping the Wheelchair Industry?

- The automation of manually operated products is an emerging market trend. This shift towards mechanized production is mandatory for staying competitive in many industries.

- Mobility products, including manual and powered wheelchairs, play a crucial role in healthcare facilities by enhancing patient mobility. Traditional manual wheelchairs require human assistance for movement, while automated solutions, such as electric wheelchairs and smart chair systems, offer increased independence. Research initiatives, like smart wheelchair systems and mobile app-controlled chairs, are transforming mobility aids, enabling users to operate them with minimal human intervention. In North America, the adoption of powered wheelchairs and advanced mobility solutions is on the rise due to high disposable income and substantial healthcare spending. The region's market for these products is dynamic, with ongoing advancements in technology and evolving user needs shaping its landscape.

- For instance, electric wheelchairs are increasingly popular due to their ease of use and versatility, while smart chair systems offer additional features like remote control and mobile app integration. These trends reflect the continuous evolution of the mobility products market, which is characterized by its responsiveness to technological advancements and changing user requirements. By focusing on innovation and user experience, companies in this sector are addressing the diverse needs of their clientele, ensuring that mobility solutions remain a vital component of modern healthcare infrastructure.

What challenges does the Wheelchair Industry face during its growth?

- The high cost of mobility products poses a significant challenge to the industry's growth trajectory. This issue, which is of great concern to both manufacturers and consumers, hinders the expansion of the market for mobility solutions.

- In the clinical mobility market, manual and powered wheelchairs cater to distinct consumer needs and price points. Manual wheelchairs, considered low-end premium products, are priced comparatively lower than their powered counterparts. For instance, a manual wheelchair can be purchased for less than USD96, while a powered wheelchair, such as mobility scooters, can cost over USD950. This significant price difference is influenced by the product features, including stability, power, balance, and smoothness. The increased demand for powered wheelchairs, particularly among the geriatric population and patients with mobility issues, is driving their adoption.

- Despite the higher cost, powered wheelchairs are increasingly preferred due to their minimal human effort requirement. This market trend underscores the evolving dynamics of clinical mobility solutions, with consumers prioritizing convenience, comfort, and independence over cost.

Exclusive Customer Landscape

The wheelchair market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wheelchair market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Wheelchair Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, wheelchair market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

21st Century Scientific Inc. - The company specializes in manufacturing and marketing wheelchairs under the brand name Bounder. Their product line caters to various user needs, focusing on durability, comfort, and functionality. The company's commitment to innovation and accessibility sets it apart in the mobility industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 21st Century Scientific Inc.

- Compass Health Brands

- Etac AB

- Forza Medi India Pvt. Ltd.

- GF Health Products Inc.

- Hoveround Corp.

- Invacare Corp.

- Karma Medical Products Co. Ltd.

- Karman Healthcare Inc.

- Ki Mobility

- Magic Mobility Pty Ltd.

- Medical Depot Inc.

- Medline Industries LP

- NOVA Medical Products

- Ostrich Mobility Instruments Pvt. Ltd.

- Ottobock SE and Co. KGaA

- Permobil AB

- Pride Mobility Products Corp.

- Rainbow Care Pte Ltd.

- Sunrise Medical LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Wheelchair Market

- In January 2024, Medtronic plc, a leading medical technology company, announced the launch of its new powered wheelchair, the Solara Power Chair, featuring advanced features such as long-lasting batteries and enhanced maneuverability (Medtronic Press Release, 2024).

- In March 2024, Permobil, a global mobility solutions provider, entered into a strategic partnership with Microsoft to integrate Microsoft's Azure IoT technology into their wheelchairs, enabling remote monitoring and predictive maintenance (Permobil Press Release, 2024).

- In April 2024, Invacare Corporation, a global manufacturer and distributor of medical equipment, completed the acquisition of Sunrise Medical, a leading provider of complex rehabilitation and power wheelchairs, expanding its product portfolio and market reach (Invacare Press Release, 2024).

- In May 2025, the European Union approved the new European Accessibility Act, mandating accessibility requirements for various products, including wheelchairs, to ensure equal access for people with disabilities (European Parliament Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Wheelchair Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.3% |

|

Market growth 2025-2029 |

USD 2294.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.7 |

|

Key countries |

US, Canada, China, Germany, UK, Japan, India, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market encompasses a diverse range of products and technologies, including passive mobility solutions like orthotic devices and mobility scooters, as well as active mobility options such as power wheelchairs and standing wheelchairs. This dynamic market is driven by advancements in material science, user interface design, and rehabilitation engineering. Lightweight wheelchairs, made from composite materials like carbon fiber and titanium alloys, have gained popularity due to their improved durability and ease of transport. Impact resistance and weight capacity are crucial considerations in the development of these products, with manufacturers continually pushing the boundaries to create stronger, lighter wheelchairs. In the realm of assistive technology, user interface design plays a significant role in enhancing the overall user experience.

- Ergonomic design, tilt-in-space wheelchairs, and adaptive seating are just a few examples of how technology is being integrated to cater to the unique needs of users with mobility impairments. Safety features, such as fall prevention and wheelchair ramps, are also a focus in the market. Durability testing and fatigue testing are essential aspects of the design process, ensuring that wheelchairs meet the highest standards for safety and reliability. Wheelchair accessories, such as wheelchair lifts and cushion pressure relief systems, further expand the market's offerings. These add-ons cater to the diverse needs of users, enhancing functionality and comfort. The ongoing evolution of the market is a testament to the innovative spirit of manufacturers and the relentless pursuit of improving mobility solutions for individuals with mobility impairments.

- The integration of advanced materials, user-centered design, and safety features continues to shape the landscape of this dynamic market.

What are the Key Data Covered in this Wheelchair Market Research and Growth Report?

-

What is the expected growth of the Wheelchair Market between 2025 and 2029?

-

USD 2.29 billion, at a CAGR of 9.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Manual wheelchair and Powered wheelchair), End-user (Personal, Hospitals, and Sports conditioning), Distribution Channel (Retail stores, E-commerce, and Hospital pharmacies), Age Group (Adults and Pediatrics), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Growing healthcare expenditure, High cost of mobility products

-

-

Who are the major players in the Wheelchair Market?

-

Key Companies 21st Century Scientific Inc., Compass Health Brands, Etac AB, Forza Medi India Pvt. Ltd., GF Health Products Inc., Hoveround Corp., Invacare Corp., Karma Medical Products Co. Ltd., Karman Healthcare Inc., Ki Mobility, Magic Mobility Pty Ltd., Medical Depot Inc., Medline Industries LP, NOVA Medical Products, Ostrich Mobility Instruments Pvt. Ltd., Ottobock SE and Co. KGaA, Permobil AB, Pride Mobility Products Corp., Rainbow Care Pte Ltd., and Sunrise Medical LLC

-

Market Research Insights

- The market encompasses a diverse range of products and services, from manual chairs with joystick control and chin control options to custom, adjustable, and smart wheelchairs. According to industry estimates, The market size was valued at USD15 billion in 2020, with a projected CAGR of 5% from 2021 to 2026. Physical therapy and occupational therapy play integral roles in the market, ensuring ADA compliance and adherence to accessibility standards. Clinical trials and mobility assessments contribute to the development of advanced features, such as gait analysis, head array control, and sip-and-puff control. Wheelchair repair and motor maintenance services are essential for maintaining the functionality of these devices.

- The market also includes folding, all-terrain, sports, and remote control wheelchairs, catering to various user needs and preferences. Inclusive design and universal design principles continue to shape the industry, ensuring that wheelchairs meet the evolving demands of users and society. Power chair batteries and motor maintenance are critical components of the market, ensuring the longevity and efficiency of these mobility solutions.

We can help! Our analysts can customize this wheelchair market research report to meet your requirements.