Structural Steel Market Size 2024-2028

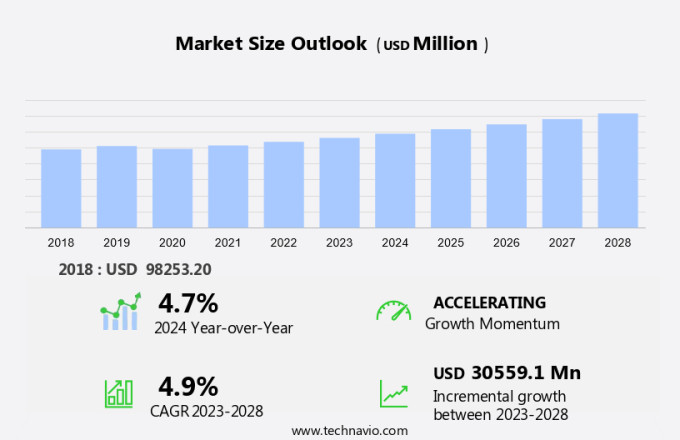

The structural steel market size is forecast to increase by USD 30.56 billion at a CAGR of 4.9% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for housing and the construction of green buildings in various regions. Structural steel, as a sustainable and eco-friendly construction material, is gaining popularity in the development of LEED-certified buildings and high-rise structures. The market is driven by the rising production of steel in developing countries and the inorganic growth strategies adopted by key players. However, stringent regulations regarding the use of structural steel in construction projects pose a challenge to market growth. The trend toward green building construction and the increasing number of high-rise buildings are expected to fuel the demand for structural steel in the coming years. As a result, the market is anticipated to witness steady growth, providing opportunities for companies to expand their customer base and increase their market share. Key players in the market are focusing on strategic collaborations and product innovations to meet the evolving needs of their customers and stay competitive.

What will be the Size of the Market During the Forecast Period?

-

The market is experiencing significant growth due to various factors, with a focus on energy conservation, waste reduction, and sustainable practices becoming increasingly prominent. These trends are driven by the need to minimize carbon emissions, reduce deforestation, and promote eco-friendly products in both residential and non-residential applications. In the residential sector, the demand for green building construction is on the rise. Structural steel's high strength-to-weight ratio makes it an ideal choice for constructing energy-efficient and eco-friendly houses. Additionally, the use of steel in modular construction reduces the amount of raw materials required and minimizes waste. Stainless steel, a type of structural steel, is gaining popularity due to its durability and recyclability. It is widely used in high-rise buildings and industrial applications, where strength and longevity are essential. The non-residential sector, particularly in the construction of LEED-certified buildings, is a significant consumer of structural steel. Eco-friendly steel, produced using computer-aided design (CAD), is becoming increasingly popular due to its reduced carbon footprint. This steel is manufactured using recycled raw materials, such as scrap metal, and produces fewer emissions during production compared to traditional steel.

-

Furthermore, the use of structural steel in green buildings not only helps in energy conservation but also contributes to improved housing conditions. Green buildings, which are designed to minimize the overall impact on the environment, are becoming a preferred choice for both residential and non-residential applications. The structural steel market is also witnessing a shift towards the use of lighter sectional steel, such as steel angles, in place of heavier alternatives. This trend is driven by the need to reduce the overall weight of structures, which in turn leads to lower transportation costs and reduced carbon emissions. In conclusion, the structural steel market is witnessing a significant shift towards eco-friendly and sustainable practices. The use of structural steel in energy-efficient and green buildings, along with the production of eco-friendly steel, is expected to drive the market's growth in the coming years. The demand for structural steel in both residential and non-residential applications, particularly in the industrial sector, is expected to remain strong due to its strength, durability, and recyclability

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

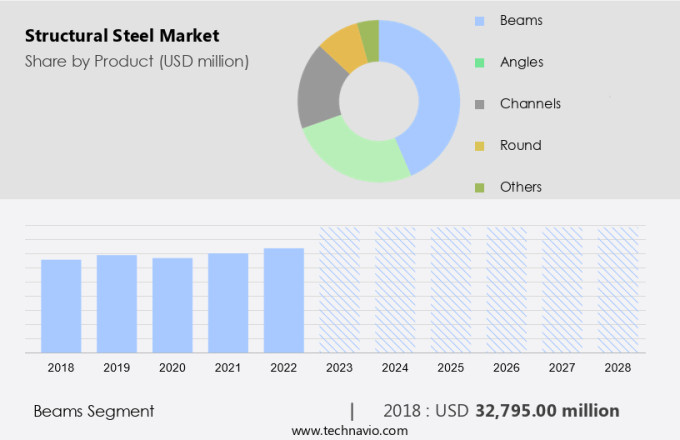

- Product

- Beams

- Angles

- Channels

- Round

- Others

- End-user

- Non-residential

- Residential

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- North America

- US

- Middle East and Africa

- South America

- Brazil

- APAC

By Product Insights

- The beams segment is estimated to witness significant growth during the forecast period.

The market holds significance in the construction sector due to its superior strength-to-weight ratio, making it an ideal choice for various infrastructure projects. A notable development occurred in the new terminal, encompassing 1.0 million square feet, which is being constructed in two phases. The first phase, which involves the building of the arrivals and departures hall, along with five gates, is slated for completion in 2026. The subsequent phase, which includes the remaining gates, is anticipated to be finished by 2028.

Furthermore, designed to augment passenger services, this terminal boasts increased gate and taxiway capacity, advanced security features, and improved roadway access. Raw materials, such as steel angles, are essential components of this project, contributing to the construction of industrial buildings and residential applications alike. The Terminal 6 project underscores the versatility of structural steel, which is not only suitable for large-scale projects like this one but also for various other applications. The use of steel in construction offers numerous benefits, including durability, strength, and cost-effectiveness. As the demand for modern infrastructure continues to grow, the market is poised for expansion.

Get a glance at the market report of share of various segments Request Free Sample

The beams segment was valued at USD 32.79 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

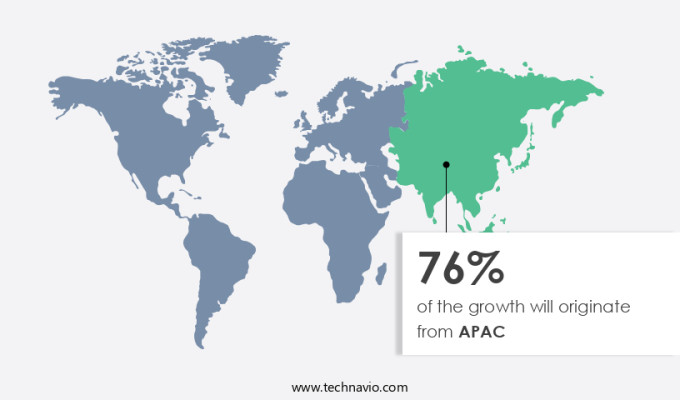

- APAC is estimated to contribute 76% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is experiencing continuous growth due to the region's industrial expansion and infrastructure development. In particular, India is a significant contributor to this trend, with numerous commercial and residential projects underway. In the 2023/24 financial year, India exhibited increased activity in the structural steel sector, importing 8.5 million metric tons of finished steel, marking a 38% increase from the previous year. This significant increase in imports underscores the strong demand for structural steel in the country, driven by extensive infrastructure projects and industrial growth. Sustainable practices, such as energy conservation and waste reduction, are becoming increasingly important in the structural steel industry. These practices not only help reduce carbon emissions but also contribute to the prevention of deforestation. As a result, the market in India is expected to continue growing, fueled by ongoing and new infrastructure developments, urbanization, and industrial expansion.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Structural Steel Market?

Increasing steel production in developing countries is the key driver of the market.

- The market in the global arena is witnessing a notable expansion, primarily due to the escalating steel production in developing countries. This expansion can be attributed to strategic government initiatives, which are aimed at increasing steel consumption and investment, particularly in underdeveloped regions. In the fiscal year 2023-24, India's crude steel production reached an impressive 144 million tons, marking a considerable increase from the 109 million tons produced in 2019-20. This significant rise underscores the success of policies designed to augment the steel sector's capacity and output. The Indian government's emphasis on infrastructure development, as demonstrated by the Gati-Shakti Master Plan, plays a crucial role in this expansion.

- This comprehensive plan aims to establish a unified multi-modal connectivity infrastructure, thereby fueling the demand for steel in various construction and infrastructure projects. Moreover, the adoption of eco-friendly products, such as stainless steel, is gaining traction in the residential construction sector and green building construction. Housing conditions continue to improve, leading to a rise in demand for heavy sectional steel in the construction industry. As a result, the market is poised for continued growth, driven by these trends and government initiatives.

What are the market trends shaping the Structural Steel Market?

Increasing inorganic growth by companies is the upcoming trend in the market.

- The market in the United States is experiencing notable growth trends, particularly through strategic mergers and acquisitions. For instance, in December 2023, NSC completed the acquisition of US Steel, bolstering its capabilities and expanding its geographical reach. This acquisition will allow NSC to increase its production capacity in the US, thereby diversifying its global footprint that already encompasses significant regions like Japan, ASEAN, and India. These strategic moves underscore the industry's trend of utilizing inorganic growth to expand market presence and strengthen competitive positions.

- Green construction materials, such as structural steel, are increasingly being adopted for the development of green buildings and LEED-certified structures, further fueling market growth. Structural steel's strength, durability, and sustainability make it an ideal choice for high-rise buildings and infrastructure projects, contributing to its growing demand.

What challenges does Structural Steel Market face during the growth?

Stringent regulations is a key challenge affecting the market growth.

- The market is experiencing challenges due to increasing regulatory requirements, with the Environmental Protection Agency (EPA) Clean Power Plan 2.0 being a notable concern. This regulation sets stricter greenhouse gas (GHG) emission standards for coal- and natural gas-fired power plants, aiming to minimize the environmental impact of these energy sources. Compliance with such regulations necessitates substantial investments in innovative technologies and procedures to decrease emissions, which can be costly and time-consuming for market participants. Light sectional steel, rebar products, and other structural steel solutions are extensively utilized in the construction of commercial buildings, industrial facilities, and institutional structures.

- However, the stringent regulatory landscape, including the Clean Power Plan 2.0, poses challenges for market growth. The American Iron and Steel Institute (AISI) has voiced industry concerns regarding the financial and logistical implications of these regulations. In the US context, the market must adapt to these regulatory changes to remain competitive and sustainable.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ArcelorMittal

- Baogang (Shandong) Iron and Steel Co.,Ltd.

- Deepak Steel India

- Gerdau Special Steel

- Harwal Group

- Hyundai Steel Co.

- JSW Steel

- Kamdhenu Ltd.

- Kobe Steel Ltd.

- Mahavir Steel Industries Ltd.

- MSP Steel and Power Ltd.

- MVC Corp

- Nucor Corp.

- Primegold International Ltd.

- Qingdao Wuxiao Group Co. Ltd.

- Shyam Metalics

- Tata Steel Ltd.

- YENA Engineering

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Structural steel is a vital component in the construction industry, renowned for its strength, durability, and versatility. Its extensive usage spans across various sectors, including residential and non-residential, commercial buildings, industrial facilities, and institutional structures. The increasing focus on energy conservation, waste reduction, and carbon emissions reduction has driven the demand for eco-friendly practices in the market. Eco-friendly products, such as stainless steel and recycled steel, are gaining popularity due to their reduced carbon footprint.

Furthermore, in residential applications, structural steel is used in green building construction to meet housing needs while adhering to sustainable practices. In the non-residential sector, heavy and light sectional steel, steel angles, and rebar products are integral to the development of LEED-certified buildings, smart cities, and high-rise structures. The raw materials for structural steel production include iron ore and scrap metal. The industry is embracing computer-aided design (CAD) and advanced technologies to optimize the strength-to-weight ratio, ensuring efficient construction projects. Structural steel's resilience against seismic events and its adaptability to modular construction further bolster its appeal in the construction materials market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.9% |

|

Market growth 2024-2028 |

USD 30.56 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.7 |

|

Key countries |

China, India, Japan, South Korea, US, Germany, Turkey, UK, Brazil, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch