Substation Automation Market Size 2024-2028

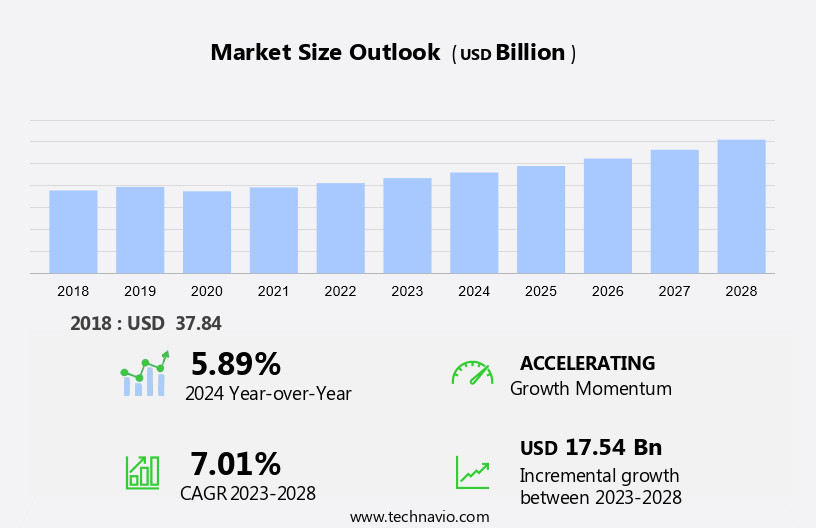

The substation automation market size is forecast to increase by USD 17.54 billion at a CAGR of 7.01% between 2023 and 2028.

- Substation automation is a critical aspect of the power transmission and distribution industry, with the market witnessing significant growth due to increasing demand for efficient power transmission and distribution. Technological advancements in substation automation, such as the integration of IoT and AI, are driving market growth. However, the high initial installation cost of Intelligent Electronic Devices (IEDs) in substations remains a challenge. The need for real-time monitoring and control of power grids to ensure reliability and minimize downtime is leading to increased adoption of substation automation systems. Additionally, the integration of renewable energy sources into the power grid is creating new opportunities for the market growth. Overall, the market is expected to experience steady growth In the coming years, driven by these trends and challenges.

What will be the Size of the Substation Automation Market During the Forecast Period?

- The market encompasses the adoption of digital technologies, such as automation, protection, control, communication, and monitoring systems, in electrical power transmission and distribution systems. This market is driven by the increasing demand for reliable and efficient power management in various sectors, including smart cities, data centers, and renewable energy projects. Substation automation systems enable real-time monitoring and remote control of substation equipment, enhancing the overall performance and resilience of the Smart grid and electrical grid. Digital technologies, such as smart electronic devices, sensors, communication networks, and remote terminal units, are integral to these systems. The integration of these advanced technologies facilitates improved power quality, energy consumption optimization, and fault detection and diagnosis.

How is this Substation Automation Industry segmented and which is the largest segment?

The substation automation industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Utilities

- Steel

- Mining

- Transportation

- Oil and gas

- Type

- Transmission

- Distribution

- Geography

- North America

- US

- APAC

- China

- India

- Europe

- Germany

- France

- South America

- Middle East and Africa

- North America

By End-user Insights

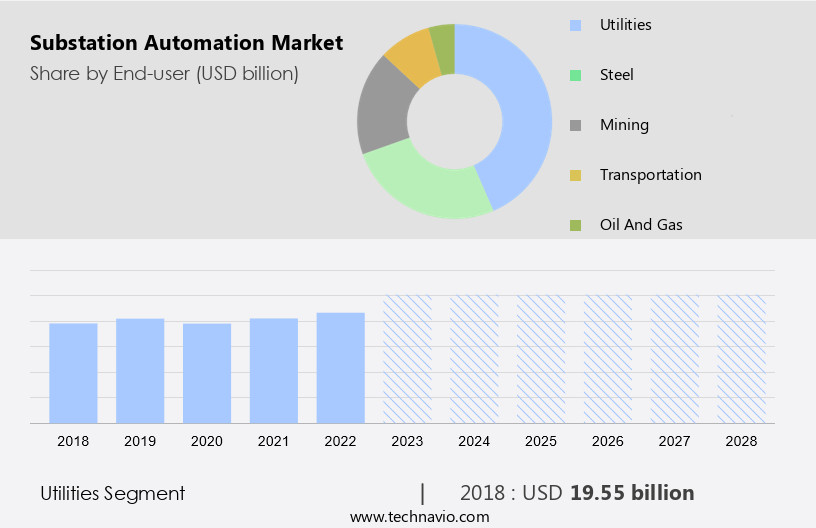

The utilities segment is estimated to witness significant growth during the forecast period. The utilities sector is experiencing a significant shift towards substation automation to enhance the efficiency and reliability of electrical power grids. With increasing electricity demand and the push towards carbon neutrality, utility companies are investing in advanced technologies such as digital systems, communication networks, and intelligent electronic devices to optimize their distribution systems. Substation automation solutions enable real-time monitoring and automatic rerouting, ensuring system performance and reliability. Intelligent grid technologies, including circuit breakers, load tap controllers, recloser controllers, and capacitor bank controllers, are integral to these systems. Utilities can diagnose issues, predict outages, and maintaIn their assets more effectively through digital technologies, ultimately improving safety, reliability, and worker safety. The adoption of smart grid programs and smart city infrastructure further enhances the benefits of substation automation.

Get a glance at the market report of various segments Request Free Sample

The Utilities segment was valued at USD 19.55 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American the market is experiencing growth due to the adoption of advanced technologies and the need to modernize aging electrical power grids. The US and Canada, with mature electrical infrastructure, are key markets for substation automation. Demand is primarily driven by the upgrading and digitization of conventional substations, as well as the development of smart electric substations. The transition to a low-carbon economy and the increasing adoption of renewable energy projects further boost the market. Advanced technologies, such as communication networks, control systems, and intelligent electronic devices, are integral to these upgrades. The smart grid program, including distribution automation, fault detection, monitoring, and predictive data, enhances system performance and reliability.

Utilities and industrial companies are investing In these solutions to improve power management, safety, and worker safety. The integration of communication capabilities, such as Ethernet and remote monitoring, enables real-time data exchange and enhances grid communication technology. The market is expected to continue growing as the energy transition progresses and the demand for electricity consumption and transmission increases.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.The market's growth is further fueled by the increasing focus on raw materials processing industries, which require substantial power supplies and demand robust power management solutions. The market is poised for significant expansion, as the global shift towards sustainable energy sources and the need for more efficient power distribution continue to gain momentum.

What are the key market drivers leading to the rise In the adoption of Substation Automation Industry?

- Increasing need for efficient power transmission and distribution is the key driver of the market.The market is experiencing notable growth due to advanced technologies addressing the challenges of aging energy infrastructure and increasing electricity demand. Efficient power transmission and distribution are crucial for maintaining grid reliability and integrating renewable energy sources. Reliable electricity supply is essential for various sectors, including residential, commercial, and industrial applications. Developing countries, such as India, China, Brazil, and South Africa, face significant demand growth, necessitating modernization and upgrading of conventional substations with digital technology. Advanced grid communication technology, including Ethernet, enables automatic rerouting, fault detection, and real-time monitoring. Digital systems, such as intelligent electronic devices, capacitor bank controllers, load tap controllers, recloser controllers, and switchgears, enhance system performance and reliability.

- Utilities and industrial companies are investing In these solutions to improve power management, safety, and maintenance, reducing potential issues and outages. Digital substation products, including smart electric substations and smart grid programs, enable predictive data analysis, grid communication, and worker safety. These solutions contribute to the development of intelligent grids, smart cities, and smart city infrastructure. Renewable energy projects and renewable power generation are also driving the demand for substation automation, as they require efficient power transmission and distribution to ensure grid stability and reliability. In conclusion, the market is experiencing growth due to the increasing need for efficient power transmission and distribution, driven by the integration of renewable energy sources and the growing demand for reliable electricity supply. Advanced technologies, such as digital systems, sensors, and communication networks, are essential for addressing the challenges of aging infrastructure and ensuring grid reliability and safety.

What are the market trends shaping the Substation Automation market?

- Technological advancements in substation automation is the upcoming market trend.Substation automation is undergoing significant transformation through the integration of advanced technologies. Traditional substations, which relied on manual monitoring and control, face challenges such as delayed fault detection and response times. However, the adoption of communication technologies like SCADA systems and Intelligent Electronic Devices (IEDs) enables real-time data collection and analysis, enhancing fault detection and response capabilities. This technological advancement in substation automation is essential for utilities to effectively manage electrical power grids, ensuring improved operational efficiency and reliability. The development of digital substation products and systems, such as digital technology, communication networks, control systems, circuit breakers, capacitor bank controllers, load tap controllers, recloser controllers, and switchgears, is crucial for the modernization of conventional substations.

- These digital systems facilitate automatic rerouting, fault diagnosis, and predictive data analysis, enhancing system performance and reducing potential issues. Moreover, the integration of advanced technologies like sensors, Ethernet, and smart electronic devices in substation automation is essential for the intelligent grid and smart city infrastructure. This transformation is vital for industries, including utilities, industrial companies, and the steel industry, to meet the increasing electricity demand and energy consumption while transitioning to low-carbon initiatives. Investment in upgrading and retrofitting existing substations and the development of new distribution substations is necessary to digitize the grid and ensure grid communication technology and power management.

What challenges does the Substation Automation Industry face during its growth?

- High initial installation cost of IEDs in substations is a key challenge affecting the industry growth.The market faces a significant challenge due to the high initial installation cost of Intelligent Electronic Devices (IEDs). IEDs are essential components of modern substations, as they enable advanced monitoring, control, and protection functions for electrical power transmission and distribution systems. These devices are crucial for enhancing grid reliability, improving system performance, and facilitating the integration of renewable energy sources. However, the complexity of integrating IEDs into aging energy infrastructure, which was not originally designed for such advanced technologies, contributes to the high installation cost. IEDs require communication capabilities, including Ethernet and other communication networks, as well as control systems and safety features.

- Furthermore, the adoption of digital technologies, such as digital substation products and smart grid programs, adds to the cost. Despite these challenges, the investment in upgrading and retrofitting conventional substations with digital systems is necessary to meet the increasing electricity demand, ensure grid communication technology, and promote carbon neutrality initiatives. The market for substation automation is expected to grow as industrial companies and utilities prioritize the digitization of the grid, modernization of distribution circuits and substations, and the implementation of smart city infrastructure.

Exclusive Customer Landscape

The substation automation market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the substation automation market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, substation automation market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - The company specializes in providing advanced substation automation offerings, including Smart Substation Control and Protection (SSC) systems, enhancing power grid efficiency and reliability. These solutions enable real-time monitoring, automated fault detection, and swift response to system anomalies

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Arteche Lantegi Elkartea SA

- Cisco Systems Inc.

- Eaton Corp. Plc

- Ependion AB

- General Electric Co.

- Hitachi Ltd.

- Mitsubishi Electric Corp.

- OHB SE

- Renewable Energy Systems Ltd.

- Schneider Electric SE

- Schweitzer Engineering Laboratories Inc.

- Shenzhen Nanwang Guorui Technology Co. Ltd.

- Siemens AG

- Texas Instruments Inc.

- The Weir Group Plc

- Toshiba Corp.

- TRC Companies Inc.

- Trilliant Holdings Inc.

- ZIV Automation

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global electrical power grid is undergoing a significant transformation as advanced technologies are being integrated to address the challenges posed by aging infrastructure and increasing electricity demand. The integration of digital systems and communication networks into electrical power transmission and distribution is a key aspect of this transition. The need for automation in substations arises from the complexity and size of electrical power grids, which require efficient and reliable power management. Conventional substations, which rely on manual inspection and maintenance, face potential issues in terms of reliability and safety. Substation automation, which involves the use of digital technologies and intelligent electronic devices, offers solutions to these challenges.

Digital substation products, such as control systems, capacitor bank controllers, recloser controllers, and load tap controllers, enable automatic rerouting and fault detection, ensuring system performance and reliability. Communication networks, including Ethernet and other grid communication technologies, facilitate real-time monitoring and remote control of substation equipment, such as circuit breakers and switchgears. The adoption of digital technologies In the power industry is driven by various factors, including the need for energy efficiency, carbon neutrality, and the integration of renewable energy projects. Industrial companies are investing in modernization and upgrading of existing substations, as well as In the development of new smart electric substations.

The integration of digital technologies into electrical power grids also offers benefits in terms of safety and security. Intelligent grid technologies, such as smart sensors and predictive data analysis, enable early fault detection and prevention of outages. Remote monitoring and control of substation equipment and distribution circuits also enhance worker safety and reduce the need for manual inspection. The use of digital technologies In the power industry is also contributing to the development of smart cities and smart city infrastructure. Smart grids, which incorporate digital technologies and communication networks, enable efficient power management and distribution, reducing electricity consumption and improving system reliability.

The transition to a digital power grid network also presents challenges, including the need for investment in new equipment and services, as well as the integration of digital technologies into existing infrastructure. The implementation of digital technologies In the power industry requires careful planning and coordination between utilities, industrial companies, and other stakeholders. In conclusion, the market is experiencing significant growth as digital technologies are being integrated into electrical power grids to address the challenges of aging infrastructure and increasing electricity demand. The adoption of digital technologies offers benefits in terms of reliability, safety, efficiency, and sustainability, but also presents challenges in terms of investment and integration. The power industry is undergoing a major transformation, and the successful implementation of digital technologies will be key to meeting the energy needs of the future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

188 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.01% |

|

Market growth 2024-2028 |

USD 17.54 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.89 |

|

Key countries |

US, China, Germany, France, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Substation Automation Market Research and Growth Report?

- CAGR of the Substation Automation industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the substation automation market growth of industry companies

We can help! Our analysts can customize this substation automation market research report to meet your requirements.