Surgical Clips Market Size 2024-2028

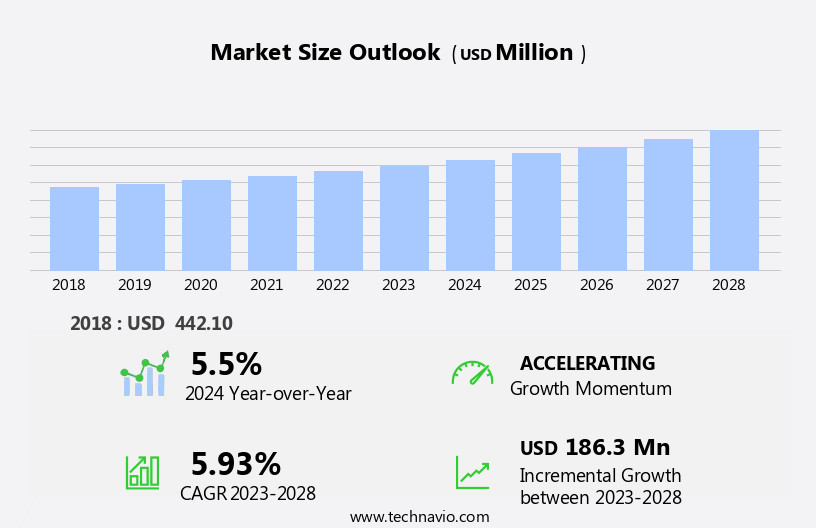

The surgical clips market size is forecast to increase by USD 186.3 million at a CAGR of 5.93% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing number of surgical procedures worldwide. The market is anticipated to expand at a steady pace, driven by the rising demand for minimally invasive surgeries and the growing preference for using advanced surgical instruments. A notable trend in the market is the focus on developing dissolvable clips using magnesium alloy. These clips offer several advantages, including reduced post-surgical complications and the elimination of the need for secondary procedures to remove the clips. However, the market faces challenges, primarily the risks and complications associated with surgical clips.

- These risks include infection, hemorrhage, and allergic reactions to the clip materials. To mitigate these challenges, companies must prioritize research and development efforts to create safer and more effective surgical clips. Additionally, regulatory compliance and stringent quality control measures are essential to ensure patient safety and market acceptance. Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay abreast of technological advancements and regulatory requirements while maintaining a strong focus on product safety and quality.

What will be the Size of the Surgical Clips Market during the forecast period?

- The market showcases a dynamic and evolving landscape, driven by continuous advancements in various sectors. Urological surgery and cardiothoracic procedures are prominent arenas, with biocompatible clips playing a crucial role in tissue approximation and hemostasis control. Clip technology's ongoing innovation is evident in the development of minimally invasive surgical instruments, including those used in bariatric, gynecological, and general surgery. Biomedical engineering and surgical supplies companies are at the forefront of creating clip solutions, addressing the need for clip certification, safety, and efficacy. Clip design, placement, and deployment techniques are under constant refinement, with a focus on clip strength, size, and closure mechanisms.

- Vascular clips and hemostatic clips are essential in controlling bleeding during surgical procedures, while absorbable and titanium clips cater to different application requirements. The market's competitive landscape is shaped by ongoing regulatory efforts, cost considerations, and the pursuit of clip standardization. Clip innovation continues to unfold, with advancements in clip technology, clip applicators, and clip removal tools. Despite challenges such as clip migration, surgical complications, and clip failure, the market remains vibrant, driven by the relentless pursuit of improved patient outcomes and surgical efficiency.

How is this Surgical Clips Industry segmented?

The surgical clips industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals and clinics

- Ambulatory surgery centers

- Geography

- North America

- US

- Canada

- Europe

- Germany

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

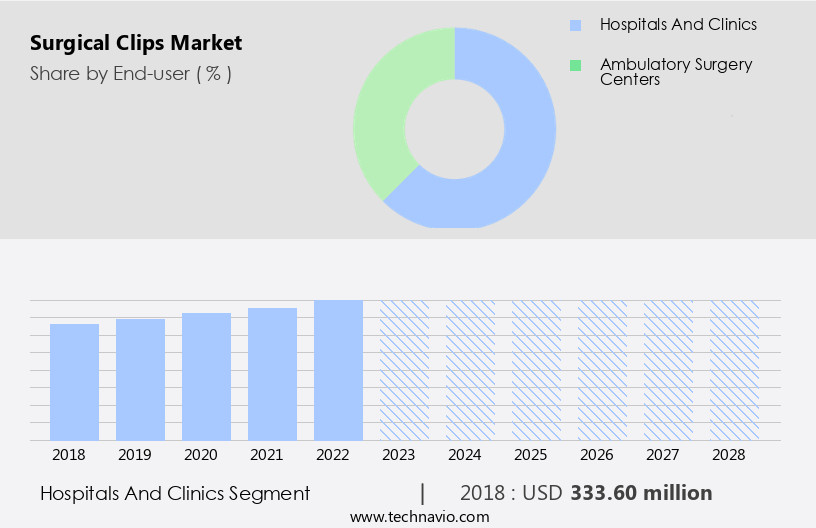

The hospitals and clinics segment is estimated to witness significant growth during the forecast period.

In the healthcare industry, surgical clips play a crucial role in various surgical procedures, including urological, cardiothoracic, bariatric, gynecological, and general surgeries. These clips, made from biocompatible materials like titanium or absorbable substances, are integral to tissue approximation, hemostasis control, and wound closure during minimally invasive surgeries. Clip technology continues to evolve, with innovations in clip design, placement, size, and closure ensuring greater efficacy, safety, and patient satisfaction. Surgical clips are used extensively in various surgical procedures, from cardiothoracic and neurological surgeries to laparoscopic and orthopedic procedures. Their application extends to vascular surgeries, tissue approximation, and hemostasis control, making them indispensable surgical instruments.

Clips are also used in wound closure, with clip applicators and removers facilitating their deployment and removal. Biomedical engineering has played a significant role in the advancement of clip technology, leading to clip certification and standardization. Despite their importance, clips face challenges such as clip failure, migration, and complications related to clip material. These challenges necessitate ongoing research and innovation to improve clip safety, strength, and cost-effectiveness. Medical devices like surgical staplers and hemostatic clips serve as alternatives to surgical clips, but their use depends on the specific surgical procedure and the surgeon's preference. Regulation of surgical clips is crucial to ensure their safety and efficacy, with regulatory bodies overseeing clip design, manufacturing, and deployment.

Surgical clips continue to be an essential component of surgical procedures, with their use spanning various surgical specialties and evolving to meet the demands of minimally invasive surgeries. The ongoing research and innovation in clip technology aim to address challenges related to clip safety, efficacy, and cost, ensuring that surgical clips remain a valuable tool in the healthcare industry.

The Hospitals and clinics segment was valued at USD 333.60 million in 2018 and showed a gradual increase during the forecast period.

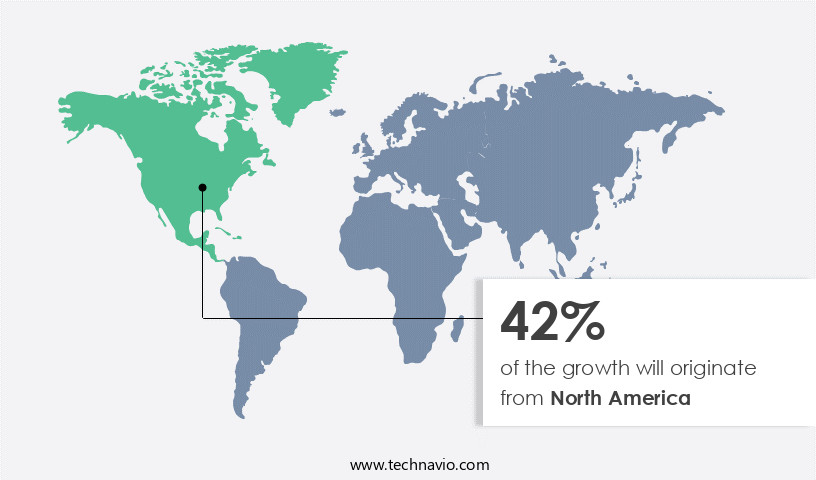

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market encompasses various applications in urological surgery, cardiothoracic surgery, bariatric surgery, tissue approximation, and wound closure, among others. Biocompatible clips, a key market trend, are integral to hemostasis control during surgical procedures. Minimally invasive surgeries, such as laparoscopic and orthopedic procedures, utilize clip technology for tissue approximation and hemostasis. The market comprises vascular clips, ligating clips, hemostatic clips, and absorbable and titanium clips, among others. Surgical instruments, including clip applicators and removers, facilitate clip deployment and removal. Innovation in clip design and placement techniques, along with regulatory compliance and certification, ensure clip efficacy, safety, and standardization.

The market's growth is driven by the increasing number of surgical procedures, particularly in North America, where chronic conditions, government and private insurance coverage, and healthcare infrastructure improvements fuel demand. The region's growing number of specialty hospitals, ASCs, and partnerships between hospitals and ASCs further contribute to market expansion. Major players in the market focus on research and development to introduce new clip technologies, improve clip strength, and address surgical complications related to clip material and clip failure. Biomedical engineering plays a crucial role in clip innovation and production. The market's future direction lies in the continued development of advanced clip technologies, ensuring optimal patient outcomes and minimizing surgical risks.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Surgical Clips Industry?

- The significant rise in the volume of surgical procedures is the primary factor fueling market growth.

- Surgical clips are essential medical devices used to secure tissues during various surgical procedures. The growing prevalence of chronic conditions, such as cancer and cardiovascular diseases, necessitates an increase in surgical interventions. As a result, the demand for surgical clips is on the rise. These clips are preferred over staples due to their ability to avoid entering the blood vessels, making them suitable for neurological, general, and orthopedic surgeries. The US market for surgical clips is expected to grow significantly due to the increasing number of surgical cases, including lumpectomies, orthopedic procedures for muscle and bone repair, and general surgical cases like appendectomies.

- Surgical clip applicators and removers, along with advanced biomedical engineering, are enhancing the efficiency and precision of surgical procedures. Titanium and absorbable clips are the most commonly used types in the market. The strength and reliability of titanium clips make them ideal for various surgical applications, while absorbable clips offer the advantage of dissolving naturally within the body, reducing the need for additional surgical interventions. The increasing incidence of chronic conditions and the subsequent rise in surgical procedures are driving the demand for surgical clips in the US market. The advancements in surgical clip technology, such as clip applicators and biocompatible materials, are further boosting market growth.

What are the market trends shaping the Surgical Clips Industry?

- The use of magnesium alloy in creating dissolvable clips is gaining increasing attention in the medical market. This emerging trend in medical technology emphasizes the development of biodegradable clips for enhanced patient recovery and reduced post-surgical complications.

- Surgical clips, essential medical devices used for hemostasis during surgical procedures, have seen increased utilization due to the rising number of surgeries. These clips, available in ligating and hemostatic varieties, are typically made from materials like polymer, titanium, or stainless steel. While they effectively stop bleeding, complications such as clip migration and nerve pain can arise. Clips may remain inside the body until the surgical incision heals, increasing the risk of infection. The migration of clips can lead to complications, including the formation of scar tissue and potential re-bleeding.

- Despite these challenges, surgical clips remain a crucial component in surgical procedures, with clip deployment and removal playing a significant role in the overall success of the surgery. Regulation of clip materials and manufacturing processes is essential to minimize complications and ensure patient safety.

What challenges does the Surgical Clips Industry face during its growth?

- The surgical clips' risks and complications pose a significant challenge to the industry's growth, requiring continuous research and innovation to mitigate their impact and ensure patient safety.

- Surgical clips are essential surgical supplies used extensively in various surgical procedures, including urological, cardiothoracic, bariatric, gynecological, and minimally invasive surgeries, for tissue approximation and hemostasis control. Clip technology plays a crucial role in surgical instruments, enabling surgeons to securely close wounds and control bleeding. However, despite their benefits, surgical clips carry potential risks, such as migration of clips to unintended sites, which can lead to complications like inflammation and infection. For instance, during hepatic resection, surgical clips used for vessel ligation can migrate to the anterior abdominal wall, causing a foreign body reaction and resulting in granuloma and abscess formation.

- It is imperative for healthcare professionals to be aware of these risks and take necessary precautions to minimize complications. Biocompatible clips are increasingly preferred due to their reduced risk of adverse reactions. Surgical clips continue to be an essential component of surgical supplies, offering significant advantages in wound closure and hemostasis control. However, the potential risks associated with their use necessitate careful consideration and appropriate application to ensure optimal patient outcomes.

Exclusive Customer Landscape

The surgical clips market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the surgical clips market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, surgical clips market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ackermann Instrumente GmbH - The company specializes in providing a range of advanced surgical clips for medical professionals.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ackermann Instrumente GmbH

- Amsel Medical Corp.

- B.Braun SE

- Boston Scientific Corp.

- Changzhou Lookmed Medical Instrument Co. Ltd.

- Edwards Lifesciences Corp.

- Gebruder Martin GmbH and Co. KG

- Grena Ltd.

- Hangzhou Kangji Medical Instruments Co. Ltd.

- Johnson and Johnson Services Inc.

- LeMaitre Vascular Inc.

- Medtronic Plc

- Mizuho Medical Co. Ltd.

- Novo Surgical Inc.

- Peters Surgical

- Qingdao DMD Medical Technology Co. Ltd.

- Scanlan International

- Sklar Surgical Instruments

- STERIS plc

- Teleflex Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Surgical Clips Market

- In February 2024, Ethicon, a Johnson & Johnson company, announced the launch of its new line of surgical clips, the ECHELON Flex Clip System. This innovative product features a unique design that allows for more precise placement and better grip, addressing the challenges of traditional clips during complex surgeries (Johnson & Johnson press release).

- In October 2024, Medtronic and Ethicon entered into a strategic collaboration to integrate Medtronic's surgical navigation system with Ethicon's ECHELON Flex Clip System. This partnership aims to enhance surgical efficiency and accuracy by providing real-time visualization and guidance during clipping procedures (Medtronic press release).

- In March 2025, Stryker completed the acquisition of EndoChoice, a leading provider of endoscopic and surgical devices. This acquisition expanded Stryker's portfolio in the market, giving them access to EndoChoice's advanced clip designs and technologies (Stryker press release).

- In July 2025, the US Food and Drug Administration (FDA) granted 510(k) clearance to Integra LifeSciences for its new line of absorbable surgical clips, TissuGlu Surgical Clips. These clips offer advantages such as reduced operative time, improved hemostasis, and reduced scarring, making them a significant addition to the market (Integra LifeSciences press release).

Research Analyst Overview

The market encompasses a diverse range of products utilized in various medical procedures. Market trends indicate a growing focus on biocompatibility and sterilization to ensure patient safety. Clip pricing remains a significant factor, with manufacturers continually seeking cost-effective solutions without compromising quality. Clip labeling and traceability are crucial for efficient inventory management and ensuring regulatory compliance. Clinical trials and validation are essential for new clip designs and materials, driving innovation trends in the industry. Corrosion and fatigue testing are essential components of clip manufacturing to ensure durability and longevity. Reimbursement policies and market share analysis are critical factors influencing market growth.

Competitive analysis reveals a focus on developing advanced clip delivery and deployment systems, enhancing clinical outcomes and reducing procedural complexity. Innovation trends include the integration of smart technologies and biodegradable materials. Clip testing, including biocompatibility and sterilization, is a key area of investment for manufacturers to meet regulatory requirements and maintain market competitiveness. The future of the clip market lies in continued advancements in material science, manufacturing processes, and clinical applications.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Surgical Clips Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.93% |

|

Market growth 2024-2028 |

USD 186.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.5 |

|

Key countries |

US, Canada, Germany, Japan, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Surgical Clips Market Research and Growth Report?

- CAGR of the Surgical Clips industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the surgical clips market growth of industry companies

We can help! Our analysts can customize this surgical clips market research report to meet your requirements.