Syphilis Testing Market Size 2025-2029

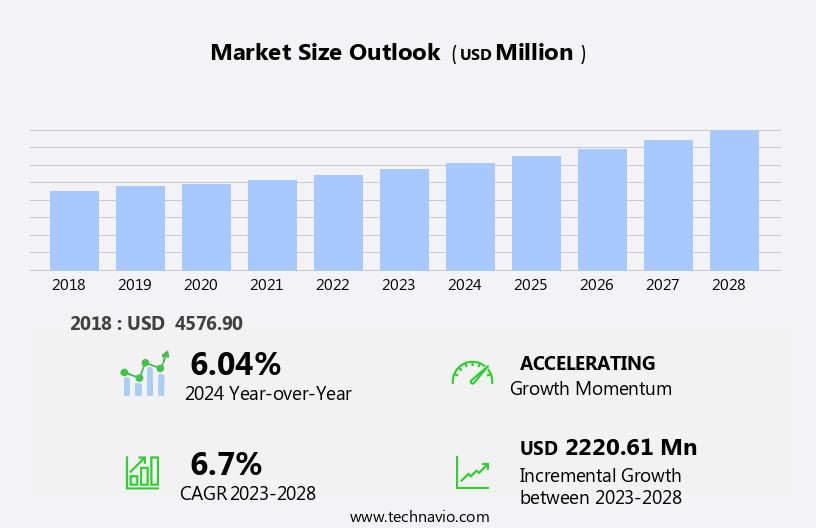

The syphilis testing market size is forecast to increase by USD 2.41 billion, at a CAGR of 6.8% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing prevalence of syphilis, particularly among key risk populations such as men who have sex with women of childbearing age. This trend is driving demand for accurate and reliable diagnostic tests to identify and treat the disease in its early stages. The market is expected to grow steadily, with advancements in testing technologies, such as point-of-care tests and molecular diagnostic tests, offering improved accuracy and convenience. However, high costs associated with syphilis diagnostic tests remain a significant challenge for the market.

- The cost of these tests can be prohibitive for individuals without adequate health insurance coverage or financial resources, leading to underdiagnosis and delayed treatment. This issue is particularly relevant in low- and middle-income countries, where the burden of syphilis is highest. Moreover, the emergence of antimicrobial resistance and the need for alternative diagnostic approaches, such as molecular tests, are adding complexity to the market landscape. Companies specializing in syphilis testing, such as Bio-Rad Laboratories, Roche Diagnostics, and Grifols, must navigate these challenges while continuing to innovate and improve their offerings to meet the evolving needs of healthcare providers and patients.

What will be the Size of the Syphilis Testing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in test performance and diagnostic technologies. Treponema pallidum, the bacterium responsible for syphilis, poses significant challenges for accurate and reliable testing. Diagnostic laboratories and testing centers employ various methods, including ELISA tests, molecular testing, and serological testing, to detect syphilis antibodies. Medical device companies innovate with home testing kits and point-of-care testing solutions, enhancing accessibility and convenience. Healthcare professionals and public health surveillance agencies rely on these tests for infectious disease management and regulatory compliance. The ongoing unfolding of market activities includes epidemiological studies, data analysis, and international standards organization collaborations, ensuring diagnostic accuracy and addressing concerns such as false negatives and false positives.

Sexually transmitted infections, including syphilis, necessitate ongoing research and innovation in laboratory analysis and sample preparation. Regulatory bodies, such as the FDA, play a crucial role in approving new testing methods and ensuring quality assurance. Safe sex practices, including condom use and treatment guidelines, remain essential components of syphilis prevention strategies. The dynamic nature of the market continues to unfold, with ongoing research in biotechnology companies and research laboratories addressing challenges like antibiotic resistance and improving test performance. Public health officials and healthcare policy makers collaborate to implement effective screening programs and promote sexual health awareness. The market's continuous evolution underscores the importance of ongoing research, innovation, and regulatory compliance in addressing the complexities of syphilis diagnosis and management.

How is this Syphilis Testing Industry segmented?

The syphilis testing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Primary and secondary

- Latent and tertiary

- Technology

- Laboratory and conventional testing

- POC testing

- End-user

- Diagnostic laboratories

- Hospitals

- Clinics

- Public health agencies

- Home care settings

- Product Type

- Automated syphilis testing systems

- Manual syphilis testing kits

- POC devices

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

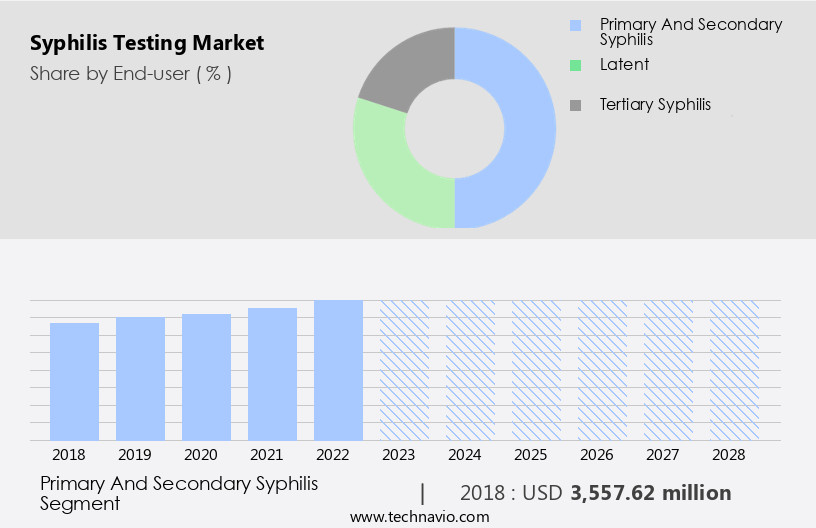

. By Application Insights

The primary and secondary segment is estimated to witness significant growth during the forecast period. The market encompasses various diagnostic techniques used to identify syphilis during its primary and secondary stages. In the primary stage, syphilis manifests as a painless sore, or chancre, which may appear on the genitals, rectum, or mouth. This stage necessitates prompt diagnosis and treatment to prevent disease progression and potential complications. ELISA tests and molecular testing, such as PCR, are commonly used for primary syphilis diagnosis. These tests detect syphilis antibodies or the presence of Treponema pallidum, the causative bacterium. Clinical trials and epidemiological studies contribute significantly to the advancement of diagnostic tests for syphilis. The International Organization for Standardization (ISO) and the Food and Drug Administration (FDA) establish regulatory compliance for diagnostic tests, ensuring diagnostic accuracy and quality assurance.

Diagnostic laboratories and testing centers employ various analytical techniques, including serological testing and laboratory analysis, to interpret test results. False negatives and false positives are potential issues in syphilis testing, necessitating rigorous quality control and sample preparation. Medical device companies develop test kits and point-of-care testing solutions to enhance accessibility and convenience. Rapid plasma reagin (RPR) tests and syphilis testing kits are popular POC diagnostic tools. Healthcare professionals play a crucial role in patient education, promoting safe sex practices and early testing to mitigate the spread of sexually transmitted infections (STIs). Public health surveillance and healthcare policy initiatives prioritize the importance of syphilis testing and treatment guidelines. Infectious disease management and antibiotic resistance are ongoing concerns in syphilis diagnosis and treatment.

Rapid diagnostic tests and research laboratories contribute to the development of innovative testing solutions, including urine collection and home testing, to improve diagnostic accuracy and accessibility. Public health officials and health ministries collaborate to implement statistical analysis and data analysis to monitor syphilis prevalence and trends. The market is characterized by ongoing innovation and regulatory compliance, with a focus on diagnostic accuracy, patient education, and public health surveillance. This includes the development of new testing technologies, such as molecular testing and point-of-care testing, and the implementation of quality control measures to ensure diagnostic accuracy and reduce false negatives and false positives.

Additionally, there is a growing emphasis on patient education and safe sex practices to prevent the spread of syphilis and other STIs. The market is also influenced by regulatory bodies, such as the FDA and ISO, which establish standards for diagnostic tests and ensure their accuracy and safety. Overall, the market is a critical component of infectious disease management and public health policy, with ongoing efforts to improve diagnostic accuracy and accessibility to enhance patient outcomes and prevent the spread of syphilis and other STIs.

The Primary and secondary segment was valued at USD 3.74 billion in 2019 and showed a gradual increase during the forecast period.

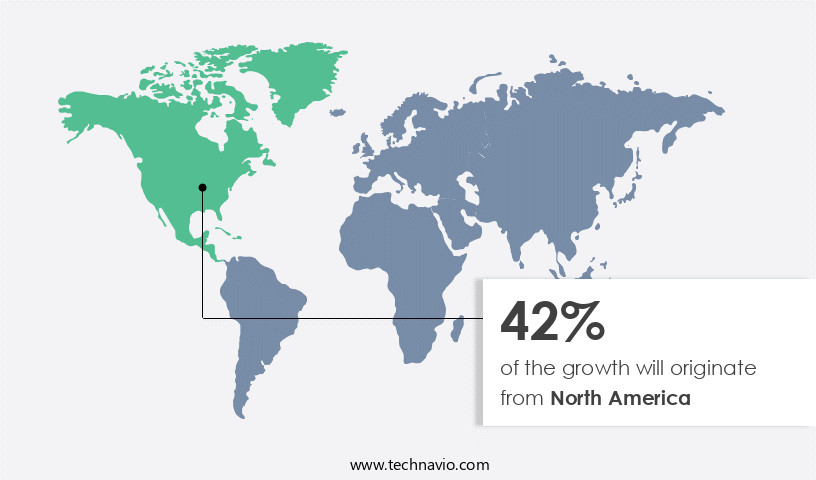

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America, primarily driven by the US, is witnessing significant growth due to the increasing prevalence of sexually transmitted diseases (STDs) and the availability of syphilis testing to prevent its spread. Major players in the region include Johnson and Johnson Pvt. Ltd. (J and J), Pfizer Inc (Pfizer), AbbVie Inc (AbbVie), and Abbott Laboratories (Abbott). The region's increase in regular health check-ups, led by both governmental and non-governmental organizations, is fueling the demand for syphilis testing. The Minority HIV/AIDS Fund, administered by the U.S. Department of Health and Human Services, plays a crucial role in funding STD prevention and testing initiatives.

Clinical trials and epidemiological studies are ongoing to improve diagnostic accuracy through advanced testing methods like ELISA tests, molecular testing, and PCR testing. Healthcare professionals are emphasizing the importance of patient education regarding safe sex practices and early detection to combat syphilis and other sexually transmitted infections (STIs). Regulatory compliance and quality assurance are critical factors in ensuring diagnostic accuracy and reducing false positives and false negatives. Medical device companies are investing in research laboratories and biotechnology companies to develop rapid diagnostic tests and home testing kits. Public health officials and healthcare policy makers are collaborating to establish international standards and treatment guidelines for syphilis management. Syphilis antibodies and serological testing are essential components of infectious disease management. The potential threat of antibiotic resistance underscores the importance of accurate and timely diagnosis and treatment. Laboratory services, statistical analysis, and quality control are essential elements of the market, ensuring efficient and reliable diagnostic results for patients.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Syphilis Testing Industry?

- The prevalence of syphilis represents a significant market driver, given its rising incidence. Syphilis, a sexually transmitted bacterial infection caused by Treponema pallidum, can lead to severe health complications if left untreated. The disease initially presents with mild symptoms, such as painless sores or no symptoms at all, which makes it challenging to diagnose. However, timely and accurate diagnosis is crucial to prevent the progression of the disease and its potentially devastating consequences, including blindness, organ damage, and death. Clinical trials and epidemiological studies play a significant role in the development of diagnostic tests for syphilis. In addition, advancements in syphilis testing technologies, such as rapid point-of-care tests, are making diagnosis more accessible and convenient for healthcare providers and patients alike. ELISA tests and molecular testing, including PCR testing, are commonly used for syphilis diagnosis.

- These tests offer high diagnostic accuracy, particularly in detecting early-stage infections. However, false negatives can occur, especially in the primary and secondary stages of the disease. Patient education and proper specimen collection are essential to ensure accurate test results. International standards organizations, such as the FDA, have set guidelines for the collection and handling of urine and blood specimens to minimize the risk of false negatives. The FDA has approved several syphilis diagnostic tests based on these guidelines. Maintaining diagnostic accuracy is crucial in preventing the spread of syphilis and reducing the risk of HIV infection.

- As the global focus on STD prevention and control continues to grow, the demand for accurate and reliable syphilis diagnostic tests is expected to increase.

What are the market trends shaping the Syphilis Testing Industry?

- The current market trend reflects the significance of advancements in syphilis testing technologies. These innovations are crucial for improving diagnostic accuracy and facilitating early detection of the disease. The market has witnessed significant advancements in technology, enhancing test performance and accuracy. Nucleic acid amplification tests (NAATs), a recent innovation, detect the bacterium Treponema pallidum's genetic material, improving early detection, especially in cases with negative serologic test results. This technology's introduction has revolutionized syphilis diagnosis, contributing to better infectious disease management and public health surveillance. Laboratories and testing centers have benefited from these advancements, ensuring regulatory compliance and delivering reliable results. Medical device companies continue to invest in research and development to provide healthcare professionals with safe and efficient testing solutions.

- Syphilis antibodies detection remains crucial for diagnosing syphilis, but NAATs offer a more definitive and timely diagnosis. Adherence to safe sex practices is essential to prevent syphilis transmission, making accurate and accessible testing essential.

What challenges does the Syphilis Testing Industry face during its growth?

- The escalating costs of syphilis diagnostic tests pose a significant challenge to the industry's growth trajectory. Syphilis testing is a crucial aspect of maintaining sexual health. In the realm of diagnostic tests, cost-effectiveness is a significant consideration. Newer syphilis diagnostic instruments, such as molecular tests and immunoassays, offer enhanced accuracy but come with a higher price tag. For instance, Alere's Impact Syphilis RPR Test Kit is priced at USD315.41. The high cost of upgrading to these advanced technologies is a substantial contributor to the overall expense of syphilis diagnostics. Frequent technological advancements and regulatory changes necessitate continuous equipment upgrades, imposing additional financial burdens on low- and average-income laboratories within the market. Serological testing, including rapid point-of-care tests, plays a vital role in syphilis diagnosis.

- These tests provide quick results, enabling early intervention and treatment. However, the potential for false positives and false negatives necessitates rigorous test results interpretation and quality assurance measures. Healthcare policies and health ministries worldwide prioritize the importance of accurate and reliable syphilis testing to mitigate the spread of the disease. To ensure test accuracy, laboratories rely on statistical analysis and data analysis techniques. These methods help identify trends and patterns in test results, providing valuable insights into disease prevalence and distribution. Additionally, collaboration between laboratories and diagnostic test manufacturers can facilitate the development of more efficient and cost-effective diagnostic solutions.

Exclusive Customer Landscape

The syphilis testing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the syphilis testing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, syphilis testing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company provides a syphilis testing solution utilizing the Bioline Syphilis 3.0 test, an immunochromatographic assay for qualitatively detecting antibodies against Treponema pallidum.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AdvaCare Pharma

- Beckman Coulter Inc.

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- Biolytical Laboratories Inc.

- Calibre Scientific Inc.

- Cepheid Inc.

- DiaSorin SpA

- Everlywell Inc.

- F. Hoffmann La Roche Ltd.

- Hologic Inc.

- LetsGetChecked

- Meril Life Sciences Pvt. Ltd.

- Omega Diagnostics Group Plc

- OriGene Technologies Inc.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Syphilis Testing Market

- In February 2023, Roche Diagnostics announced the launch of its new Syphilis Total package, which includes both rapid and lab-based tests for the detection of syphilis, aiming to streamline the testing process and improve diagnostic accuracy (Roche Press Release).

- In May 2024, Grifols and Quest Diagnostics entered into a strategic partnership to expand Grifols' syphilis testing services in the US market, leveraging Quest's extensive laboratory network and expertise in diagnostic testing (Quest Diagnostics Press Release).

- In August 2024, Hologic secured FDA approval for its Panther Fusion Syphilis Total assay, an automated, fully integrated, and fully automated platform for the detection of syphilis, enhancing laboratory efficiency and accuracy (Hologic Press Release).

- In January 2025, Bio-Rad Laboratories announced a significant investment of USD 50 million in its molecular diagnostics business, including the development of new syphilis testing solutions, to strengthen its position in the global infectious disease testing market (Bio-Rad Press Release).

Research Analyst Overview

- The global syphilis testing market is characterized by ongoing efforts to mitigate the disease's complications, particularly in relation to pregnancy and infant mortality. Tertiary syphilis, a severe form of the disease, can lead to neurological damage and cardiovascular disease, highlighting the importance of early diagnosis and effective treatment. Global health initiatives prioritize syphilis elimination programs, emphasizing partner notification, contact tracing, and public health campaigns. Despite these efforts, syphilis continues to pose a significant disease burden, with high incidence rates in certain populations and social disparities. Primary and secondary syphilis stages can lead to long-term health consequences, including reproductive health complications and health disparities.

- Access to healthcare remains a critical challenge, as does treatment adherence, which can impact the success of elimination programs. The World Health Organization (WHO) guidelines recommend the use of lateral flow assay tests for syphilis diagnosis, enabling quick and accurate results. However, the disease's social stigma and lack of awareness hinder early diagnosis and treatment, contributing to the persistence of syphilis complications. Congenital syphilis, a preventable condition, remains a concern, with potential for severe health consequences for infants. Syphilis prevalence varies by region, with some areas experiencing higher rates due to limited access to healthcare and socioeconomic factors.

- Syphilis elimination programs aim to reduce the disease's burden by improving access to healthcare, promoting treatment adherence, and implementing effective public health campaigns. Long-term outcomes depend on the success of these initiatives, as well as ongoing efforts to address the disease's stigma and social determinants of health.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Syphilis Testing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

241 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 2.41 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.3 |

|

Key countries |

US, Canada, China, Germany, France, UK, Mexico, Brazil, Italy, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Syphilis Testing Market Research and Growth Report?

- CAGR of the Syphilis Testing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the syphilis testing market growth of industry companies

We can help! Our analysts can customize this syphilis testing market research report to meet your requirements.