System-On-Chip (SOC) Test Equipment Market Size 2025-2029

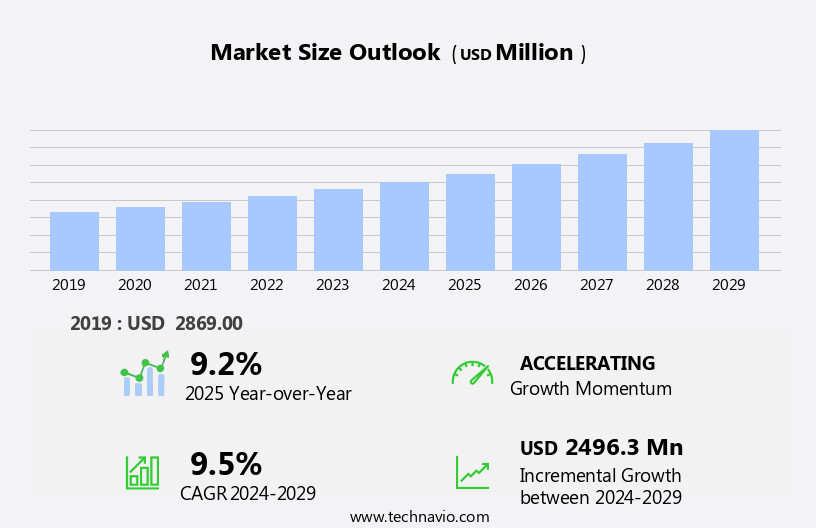

The system-on-chip (SOC) test equipment market size is forecast to increase by USD 2.5 billion at a CAGR of 9.5% between 2024 and 2029.

- The market experiences robust growth, driven by the escalating demand for SOCs due to their benefits, including power efficiency, reduced form factor, and enhanced performance. This trend is further fueled by the adoption of Field-Programmable Gate Array (FPGA) and embedded testing technologies, enabling real-time testing and debugging of complex SOC designs. However, regulatory hurdles impact adoption, with stringent regulations governing the production and testing of SOCs in various industries. Additionally, supply chain inconsistencies temper growth potential, as the globalized supply chain for SOC components and test equipment presents challenges in terms of quality, reliability, and delivery. A significant challenge emerging in the market is the growing risk of cybersecurity threats from foreign electronic Original Equipment Manufacturers (OEMs), necessitating robust security measures to protect intellectual property and maintain data confidentiality. Key trends include the integration of advanced processor technologies to reduce energy waste, the rise of 5G technology and the Internet of Things (IoT) driving increased investments, and the reliance of SOC companies on IP core providers.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively must focus on innovation, regulatory compliance, and supply chain resilience. Power consumption and efficiency remain critical concerns, with the need for continuous innovation to meet the demands of AI and computing activities.

What will be the Size of the System-On-Chip (SOC) Test Equipment Market during the forecast period?

- The SOC test equipment market is experiencing significant activity and trends, driven by the increasing complexity of integrated circuits and the need for efficient and accurate testing. Test cost optimization is a key focus, with test environment and design-for-testability (DFT) playing crucial roles in reducing testing costs. Functional verification, test analysis, and system integration require advanced test software and reporting tools to ensure thorough testing and quick identification of issues. Thermal verification and test process improvement are essential for ensuring reliable operation in extreme temperatures and reducing testing time. Test data generation, test automation tools, and test infrastructure are vital components of the test process, enabling efficient and effective testing of performance verification, power verification, and test optimization. Multi-chip systems, and Power management systems. SOCs are utilized in various applications such as IT, telecommunication, laptops, Macs, iPads, database management, fraud detection systems, cybersecurity, and more

- Firmware development and security verification require specialized tools and techniques, including fault coverage analysis, test case management, test scripting, and fault simulation. Test hardware and test development are integral to design validation, with built-in self-test (BIST) and reliability verification ensuring the integrity of the silicon. Power verification and performance optimization are critical for meeting the demands of modern applications, while test metrics and test results databases enable data-driven test strategy decisions and continuous improvement. In the realm of software development, test automation tools and test scripting are essential for efficient and effective testing of embedded software.

- Overall, the SOC test equipment market is dynamic and evolving, with a focus on improving testing efficiency, accuracy, and cost-effectiveness while addressing the challenges of increasing design complexity and the need for advanced verification capabilities.

How is this System-On-Chip (SOC) Test Equipment Industry segmented?

The system-on-chip (SOC) test equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Consumer electronics

- IT and telecommunication

- Automotive

- Others

- End-user

- Integrated device manufacturer

- Foundry

- Design house

- Deployment

- On-premises

- Cloud-based

- Hybrid

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

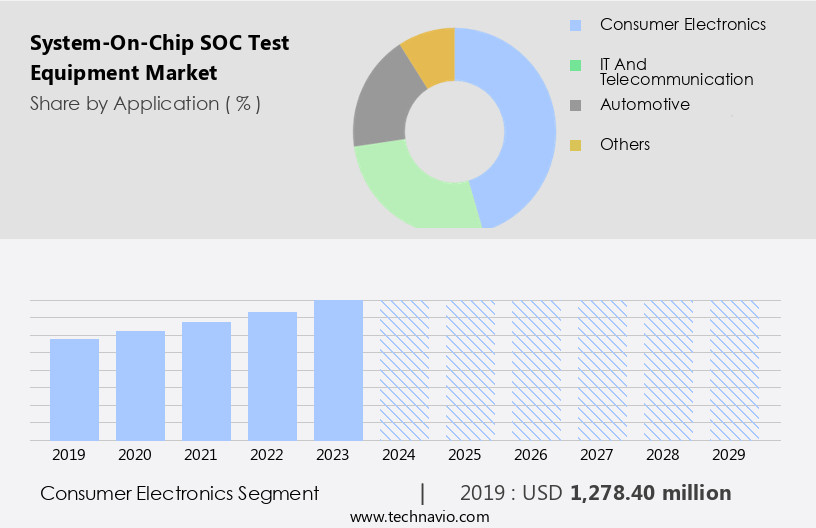

The consumer electronics segment is estimated to witness significant growth during the forecast period. The SOC test equipment market encompasses various applications, including test results analysis, design verification, and system validation for consumer electronics, automotive electronics, industrial automation, and high-performance computing. Consumer electronics, which include smartphones, smartwatches, tablets, and smart home appliances, dominate the market due to their mass production. SOC devices, integrated into these products, reduce power consumption and increase run time on single charges, making them indispensable. Moreover, SOC technology enables miniaturization, contributing to the market's growth. Test coverage and test data management are crucial elements in post-silicon validation, ensuring the functionality and reliability of SOC devices. Furthermore, with the advent of 5G technology and the Internet of Things (IoT), the SOC market is witnessing significant growth.

Serial and memory interfaces, parallel and bus interfaces, and digital-to-analog and analog-to-digital converters are essential for memory testing and functional test. Functional safety, test standards, and defect analysis are integral parts of the design verification process. Test automation, test time reduction, and test efficiency are key drivers in the market, with test bench development and test reporting streamlining the testing process. Pre-silicon validation and power analysis are essential for optimizing design performance and reducing test costs. Protocol analysis and boundary scan help identify and resolve design issues, while test patterns and test vectors ensure comprehensive testing.

The Consumer electronics segment was valued at USD 1.28 billion in 2019 and showed a gradual increase during the forecast period. The emergence of 5G technology, edge computing, and cloud computing is driving the adoption of SOC testing in various industries, including automotive electronics, industrial automation, and data centers. Machine learning and artificial intelligence are also transforming the testing landscape, enabling predictive maintenance and real-time fault detection. In-circuit testing and test fixtures are essential for ensuring the quality and reliability of electronic manufacturing. RF testing and power analysis are crucial for evaluating the performance of wireless communication systems and power management circuits. Overall, the SOC test equipment market is witnessing significant growth due to the increasing demand for advanced and reliable electronic systems across various industries.

Regional Analysis

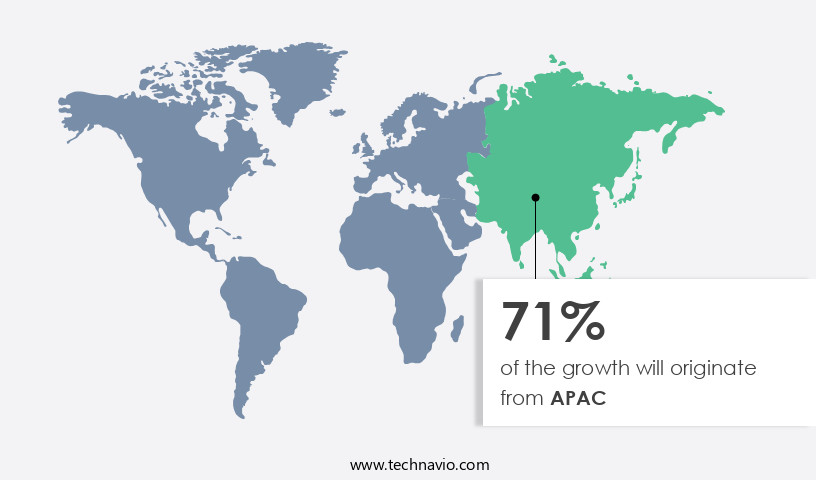

APAC is estimated to contribute 71% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The SOC test equipment market in the Asia-Pacific (APAC) region is experiencing significant growth due to increasing investments in telecommunication network infrastructure and the rising demand for advanced electronics in consumer electronics and the automotive industries. Telecommunication network equipment providers, including Huawei Technologies, Nokia, ZTE Corp., China Telecom Global Ltd., China Mobile Ltd., China Unicom (Hong Kong) Ltd., and SK Telecom Co. Ltd., are aggressively investing in the development of 4G and 5G networks in the region, driving the demand for advanced test equipment. Consumer electronics companies, such as Samsung and Xiaomi, are also contributing to the market growth by releasing new mobile devices with advanced features, requiring rigorous testing.

Functional safety and test standards are becoming increasingly important in the automotive industry, leading to an increase in demand for test equipment for automotive electronics. Design verification, test cost reduction, yield enhancement, and test time reduction are key challenges driving the development of innovative test solutions. Test data management, test coverage analysis, debug and trace, performance test, defect analysis, and test reporting are essential components of the SOC testing process. Advanced test equipment is also required for testing complex interfaces, such as serial, memory, bus, parallel, and RF interfaces, as well as digital-to-analog and analog-to-digital converters.

Test automation, machine learning, artificial intelligence, high-performance computing, and cloud computing are also playing an increasingly important role in the SOC testing process. The industrial automation sector is also a significant contributor to the market growth, with the need for reliable and efficient testing solutions for various applications, including power analysis, test efficiency, and boundary scan testing. Test fixtures and test benches are essential components of the test equipment landscape, enabling efficient and accurate testing of SOCs. In summary, the SOC test equipment market in the APAC region is experiencing robust growth due to the increasing demand for advanced electronics in consumer electronics, automotive, and industrial automation industries, as well as the deployment of 5G networks.

Companies are investing in innovative test solutions to address challenges such as test cost reduction, yield enhancement, and test time reduction, while also ensuring functional safety and test coverage.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the System-On-Chip (SOC) Test Equipment market drivers leading to the rise in the adoption of Industry?

- The escalating market demand for System-on-Chips (SOCs) is primarily driven by their numerous benefits, including enhanced performance, power efficiency, and integrated functionality. The market has gained significant traction due to the increasing adoption of SOCs in various electronic applications. SOCs offer advantages such as power savings and miniaturization, making them a preferred choice for consumer electronics like laptops, desktops, tablets, and smartphones. The integration of various components on a single chip enables high-speed data transmission and processing. However, the tight integration also poses challenges in testing and validation. Post-silicon validation is crucial to ensure test coverage and accurate test results analysis. Test data management is another critical aspect, as the volume and complexity of test data increase with the integration of more functionalities on a single chip.

- Serial and memory interfaces require specialized test equipment to validate their functionality. Functional safety is another concern, especially in safety-critical applications such as automotive electronics, where test standards and test vectors play a vital role. Memory testing is essential to ensure data integrity and reliability. The SOC test equipment market is driven by the increasing demand for electronic products that use SOCs and the need for comprehensive testing to ensure their functionality and reliability. Test equipment providers must focus on developing advanced testing solutions to address the challenges of testing complex SOC designs.

What are the System-On-Chip (SOC) Test Equipment market trends shaping the Industry?

- The adoption of Field-Programmable Gate Array (FPGA) and embedded testing technologies is an emerging trend in the industry. These advanced technologies enable efficient hardware development and testing, ensuring high product quality and reduced time-to-market. The SOC test equipment market experienced substantial growth in 2024, fueled by the increasing complexity of System-on-Chips (SOCs) and the adoption of advanced testing technologies. SOCs, which integrate processors, memory, I/O interfaces, and specialized accelerators, necessitate advanced, flexible, and high-speed testing solutions. Embedded FPGAs (eFPGAs) have gained popularity due to their ability to integrate programmable logic directly into SOCs, enabling post-production hardware reconfiguration, design flexibility, and accelerated time-to-market. This is particularly beneficial in industries like automotive, industrial automation, and telecommunications, where evolving standards and AI-driven applications necessitate adaptable hardware. Meanwhile, the broader FPGA market is expanding, driven by innovations in real-time processing, edge AI, and low-latency data handling.

- These capabilities make FPGAs ideal for embedded test systems. In the realm of design verification, test cost reduction, yield enhancement, and test time reduction are critical concerns. This situation could lead to declining consumption of electronic equipment in the US, affecting various sectors, including the demand for cable testers. Boundary scan, test benches, protocol analysis, and pre-silicon validation are essential techniques used to address these challenges. Furthermore, the emergence of 5G technology and the increasing use of digital-to-analog converters (DACs) in RF testing and electronics manufacturing necessitate specialized testing solutions. Overall, the SOC test equipment market is poised for continued growth as technology advances and industries seek to optimize their testing processes.

How does System-On-Chip (SOC) Test Equipment market faces challenges during its growth?

- The increasing risk posed by foreign electronic Original Equipment Manufacturers (OEMs) to cyber security is a significant challenge that could hinder industry growth. It is essential for businesses to implement robust cybersecurity measures to mitigate potential threats and safeguard sensitive information from unauthorized access. This issue assumes greater importance in today's interconnected world, where the dependence on technology is at an all-time high. Companies must remain vigilant and collaborate with industry experts to stay informed about emerging threats and best practices for cybersecurity.

- The SOC test equipment market experiences significant growth due to the increasing demand for advanced electronic devices and the need for thorough testing to ensure power efficiency, test coverage analysis, and performance. Power analysis is crucial in the design and manufacturing process of System-on-Chips (SOCs) to optimize energy consumption and reduce heat dissipation. Test efficiency is another critical factor driving the market, as manufacturers seek to minimize testing time and costs while maintaining high test coverage. Debug and trace tools are essential for identifying and resolving defects in SOCs, and parallel interface testing and in-circuit testing (ICT) are common methods used for this purpose.

Exclusive Customer Landscape

The system-on-chip (SOC) test equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the system-on-chip (SOC) test equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, system-on-chip (SOC) test equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Micro Devices Inc. - The company provides advanced SOC Test Systems, including the Versal Premium VP1902 adaptive SOC, which boasts a 2X capacity increase compared to previous generations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Micro Devices Inc.

- Advantest Corp.

- Aeris Communications Inc.

- Arrow Electronics Inc.

- Astronics Corp.

- Broadcom Inc.

- Chroma ATE Inc.

- Cohu Inc.

- Intel Corp.

- Marvin Test Solutions Inc.

- Microchip Technology Inc.

- Qualcomm Inc.

- Samsung Electronics Co. Ltd.

- STMicroelectronics NV

- Tektronix Inc.

- Telefonaktiebolaget LM Ericsson

- Teradyne Inc.

- Texas Instruments Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in System-On-Chip (SOC) Test Equipment Market

- In February 2024, Synopsys, a leading provider of semiconductor design software, announced the launch of its new SOClever FPGA-based prototyping platform for advanced SOC design verification (Synopsys Press Release, 2024). This innovative solution allows designers to test and validate complex SOC designs more efficiently, addressing the increasing complexity of modern chips.

- In May 2025, Teradyne and Advantest, two major players in the test equipment market, announced a strategic partnership to develop next-generation semiconductor test solutions (Teradyne Press Release, 2025). By combining their expertise and resources, they aim to address the growing demand for advanced test solutions for emerging technologies, such as AI and 5G.

- In August 2024, Cadence Design Systems, a leading EDA (Electronic Design Automation) company, raised USD 1.5 billion in a secondary offering to fund the expansion of its test and measurement business (Cadence Design Systems SEC Filing, 2024). This significant investment will enable the company to accelerate the development and deployment of advanced test solutions for the rapidly growing SOC market.

Research Analyst Overview

The market continues to evolve, driven by the dynamic needs of various sectors. Design verification and test cost reduction are key priorities, leading to the adoption of advanced test techniques such as boundary scan, test benches, and test time reduction. The integration of 5G technology and digital-to-analog converters (DACs) in SOCs necessitates the development of specialized test solutions. Industrial automation and electronics manufacturing sectors require robust test equipment for RF testing and yield enhancement. Test data management and test coverage analysis are crucial for ensuring functional safety and test efficiency. Pre-silicon validation and power analysis are essential components of the SOC testing process. This increase in complexity is especially notable in Mixed Signal SOCs. As a result, old SOC test equipment becomes obsolete for cost-effective testing of these advanced SOCs. Consequently, the demand for Automated Test Equipment that can handle complex SOCs cost-effectively is rising among SOC manufacturers.

The ongoing development of high-performance computing (HPC), artificial intelligence (AI), machine learning, and edge computing necessitates the continuous evolution of test equipment to support these technologies. Test automation, test reporting, and test pattern generation are becoming increasingly important. The market for SOC test equipment is characterized by its ability to adapt to the ever-changing landscape of technology and applications. Testing for parallel interfaces, memory interfaces, bus interfaces, and serial interfaces requires specialized test solutions. Protocol analysis and performance testing are also critical components of the SOC testing process. In the automotive electronics sector, functional safety and test standards are paramount.

Testing for functional safety, test coverage, and defect analysis are essential to ensure the reliability and safety of SOCs in this sector. The SOC test equipment market is a vibrant and evolving space, with ongoing innovation and development in test solutions for various applications and sectors. The integration of advanced technologies such as AI, machine learning, and cloud computing is transforming the way SOCs are tested and validated. The market is expected to continue to grow and adapt to the changing needs of the technology landscape.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled System-On-Chip (SOC) Test Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.5% |

|

Market growth 2025-2029 |

USD 2.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.2 |

|

Key countries |

China, US, Japan, Germany, France, Canada, India, South Korea, Australia, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this System-On-Chip (SOC) Test Equipment Market Research and Growth Report?

- CAGR of the System-On-Chip (SOC) Test Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the system-on-chip (SOC) test equipment market growth of industry companies

We can help! Our analysts can customize this system-on-chip (SOC) test equipment market research report to meet your requirements.