Automated Test Equipment (ATE) Market Size 2025-2029

The automated test equipment (ate) market size is valued to increase USD 2.59 billion, at a CAGR of 5.7% from 2024 to 2029. Augmented production of electronic goods will drive the automated test equipment (ate) market.

Major Market Trends & Insights

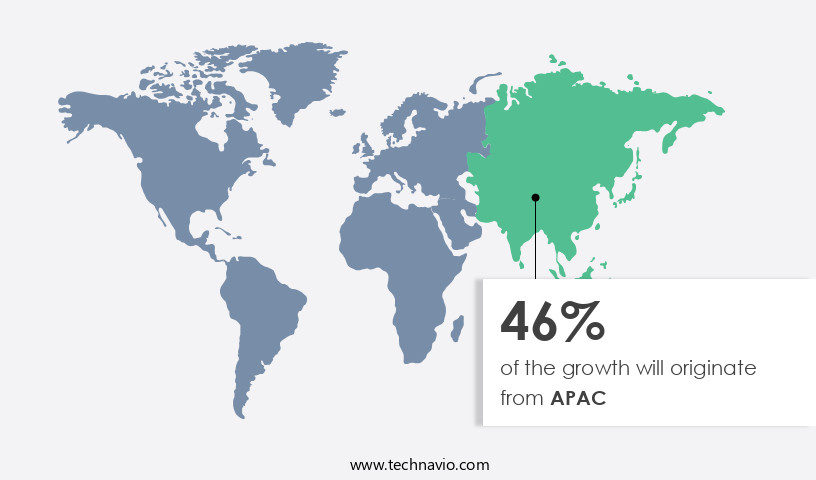

- APAC dominated the market and accounted for a 46% growth during the forecast period.

- By End-user - Consumer electronics segment was valued at USD 1.86 billion in 2023

- By Product - Non-memory ATE segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 59.42 million

- Market Future Opportunities: USD 2592.10 million

- CAGR from 2024 to 2029 : 5.7%

Market Summary

- The market plays a pivotal role in the production process of electronics, particularly in industries such as telecommunications and automotive, where wireless technologies are increasingly prevalent. According to recent market research, the global ATE market is projected to reach a value of USD23.5 billion by 2026, driven by the growing demand for advanced testing solutions to ensure the quality and reliability of complex electronic systems. ATE systems are essential for manufacturing high-volume, high-mix electronic products, as they enable rapid and accurate testing, reducing the risk of defects and improving overall production efficiency. However, the high cost of these systems remains a significant challenge for many businesses, necessitating the development of cost-effective solutions and the integration of advanced technologies such as artificial intelligence and machine learning to optimize testing processes.

- Moreover, the trend towards miniaturization and the increasing complexity of electronic components require ATE systems to be adaptable and versatile, capable of testing a wide range of products and configurations. As such, the market is witnessing significant innovation, with companies focusing on developing modular and configurable solutions that can be easily integrated into production lines. In conclusion, the ATE market is experiencing steady growth, driven by the increasing demand for advanced testing solutions in a rapidly evolving electronic landscape. Despite the challenges posed by high costs and the need for flexibility, the market is expected to continue its expansion, offering significant opportunities for businesses seeking to improve their production processes and ensure the quality of their electronic products.

What will be the Size of the Automated Test Equipment (ATE) Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Automated Test Equipment (ATE) Market Segmented ?

The automated test equipment (ate) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Consumer electronics

- Telecommunications

- Aerospace and defense

- Others

- Product

- Non-memory ATE

- Memory

- Discrete

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- Australia

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The consumer electronics segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, particularly in the consumer electronics sector, driven by the increasing global population of high-net-worth individuals (HNWI). According to the Capgemini Research Institutes World Wealth Report 2024, the HNWI population grew by 5.1% in 2023, reaching 22.8 million, with a combined wealth of USD86.8 trillion. This economic trend signifies the growing capability of individuals to purchase various consumer electronics, such as mobile devices like smartphones and tablets. These devices predominantly use mixed-signal integrated circuits (ICs) due to their cost-effectiveness, low power consumption, and superior performance. Consequently, the consumer electronics segment of the global ATE market is witnessing a rising year-over-year growth rate.

This trend is primarily due to the high demand for mobile devices, which offer mobility and multi-functionality advantages, necessitating rigorous testing using advanced techniques such as system level testing, boundary scan testing, dc parametric testing, software-defined testing, and high-speed digital testing. Additionally, other testing methods like thermal testing, environmental testing, power integrity testing, and reliability testing are crucial to ensure the functionality and longevity of these devices. Overall, the ATE market is continuously evolving to meet the demands of various industries, including automotive, telecommunications, military, and aerospace, through the development of innovative testing solutions for functional testing, defect classification, test time reduction, test data management, test equipment calibration, and test handler interface, among others.

The Consumer electronics segment was valued at USD 1.86 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automated Test Equipment (ATE) Market Demand is Rising in APAC Request Free Sample

In the dynamic landscape of the market, Asia Pacific (APAC) holds a significant position due to its status as the manufacturing hub for numerous durable consumer products, electronics, and IT devices. Major players in this region, including China, Japan, and South Korea, offer competitive pricing, making them key contributors to the market's growth. The region's electronics sector is home to some of the world's largest companies and foundries, driving demand for ATE. Asia's consumer electronics market is experiencing a surge due to technological advancements, price deflations, and increasing per capita incomes.

For example, India's GDP per capita was reported to be USD2,480 in 2024. This economic growth, coupled with the region's robust manufacturing sector, ensures a continuous demand for ATE in APAC.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a range of advanced solutions designed to streamline and optimize the testing process for electronic devices and systems. High-speed digital test system integration plays a crucial role in accommodating the increasing complexity of modern semiconductors, enabling efficient test program development methodology. Mixed-signal test challenges are addressed through innovative solutions, ensuring accurate RF microwave test equipment calibration procedures and effective failure analysis techniques for semiconductor devices. Improving ATE throughput is a significant focus, achieved through efficient test program design and the implementation of advanced signal integrity testing methods. Test data management for large-scale production testing is essential for maintaining quality and reducing test time. Effective strategies for reducing test time in ATE include implementing robust statistical process control and designing efficient and reliable test fixtures. Utilizing advanced probe card technology for high-density testing and implementing boundary-scan testing for improved fault detection are critical components of modern ATE systems. Advanced techniques for defect classification in semiconductor manufacturing ensure accurate identification and resolution of issues. Hardware-in-the-loop testing of complex electronic systems and software-defined testing capabilities provide increased flexibility and precision. Comprehensive reliability testing of electronic systems is essential to ensure product quality and customer satisfaction. Component-level testing for enhanced yield and system-level testing for complex integrated systems are integral parts of the ATE market. By staying at the forefront of technology and innovation, ATE market participants continue to meet the evolving demands of the electronics industry.

What are the key market drivers leading to the rise in the adoption of Automated Test Equipment (ATE) Industry?

- The augmented production of electronic goods serves as the primary catalyst for market growth.

- The electronics industry is experiencing significant expansion during the forecast period, with notable increases in electronic goods exports from China, Japan, and Singapore. The majority of these exports consist of moderately priced and low-cost equipment, primarily driven by the robust growth in the semiconductor and electronics industry within the Asia Pacific (APAC) region. Despite a plateau in smartphone sales, the shipment volume continues to rise, fueling the demand for test and measurement equipment.

- This trend is primarily observed in APAC, where market fragmentation and lower average selling prices in North America, Western Europe, and China are influencing growth dynamics. The electronics industry's continuous evolution and its applications across various sectors underscore its importance and potential for future innovation.

What are the market trends shaping the Automated Test Equipment (ATE) Industry?

- Automotive wireless technologies are becoming the market trend. This emerging technology sector is poised for significant growth.

- The automotive sector is experiencing a significant shift from manufacturing conventional vehicles to cars integrated with advanced electronic devices, catering to both performance enhancement and entertainment needs. Future vehicles are anticipated to incorporate numerous devices, facilitated by wireless technologies like Wi-Fi and Bluetooth. Europe has been at the forefront of this transformation, with several manufacturers integrating cellular technologies that automatically alert emergency centers following serious accidents. This integration of technology in the automotive industry is a continuous process, with new innovations and applications emerging regularly.

- For instance, electric and autonomous vehicles are gaining popularity, while connected cars are becoming increasingly common. The sector's evolution is driven by consumer preferences for enhanced safety, comfort, and convenience features. The European automotive market is expected to remain at the forefront of these advancements, as manufacturers strive to meet the evolving needs and expectations of their customers.

What challenges does the Automated Test Equipment (ATE) Industry face during its growth?

- The escalating cost of Automated Test Equipment (ATE) poses a significant challenge to the industry's growth trajectory. This issue, which is of great concern to professionals in the field, necessitates continuous exploration for cost-effective solutions to mitigate its impact.

- In the dynamic and evolving ATE market, competition is intense as manufacturers continually invest in research and development, driven by technological innovations. However, rising raw material costs and increasing import duties have significantly impacted production expenses, escalating the overall cost of test equipment. This cost pressure is particularly felt by price-sensitive end-users. For instance, digital ultrasonic flaw detectors from local Chinese companies are offered at a USD1,000 lower price point than those from leading suppliers. Despite these challenges, the market remains robust, with numerous applications across various sectors, including automotive, electronics, and semiconductor industries.

- The ATE landscape is characterized by ongoing advancements, with a focus on miniaturization, automation, and integration of advanced technologies like AI and IoT. This data-driven narrative underscores the continuous evolution of the ATE market and its diverse applications.

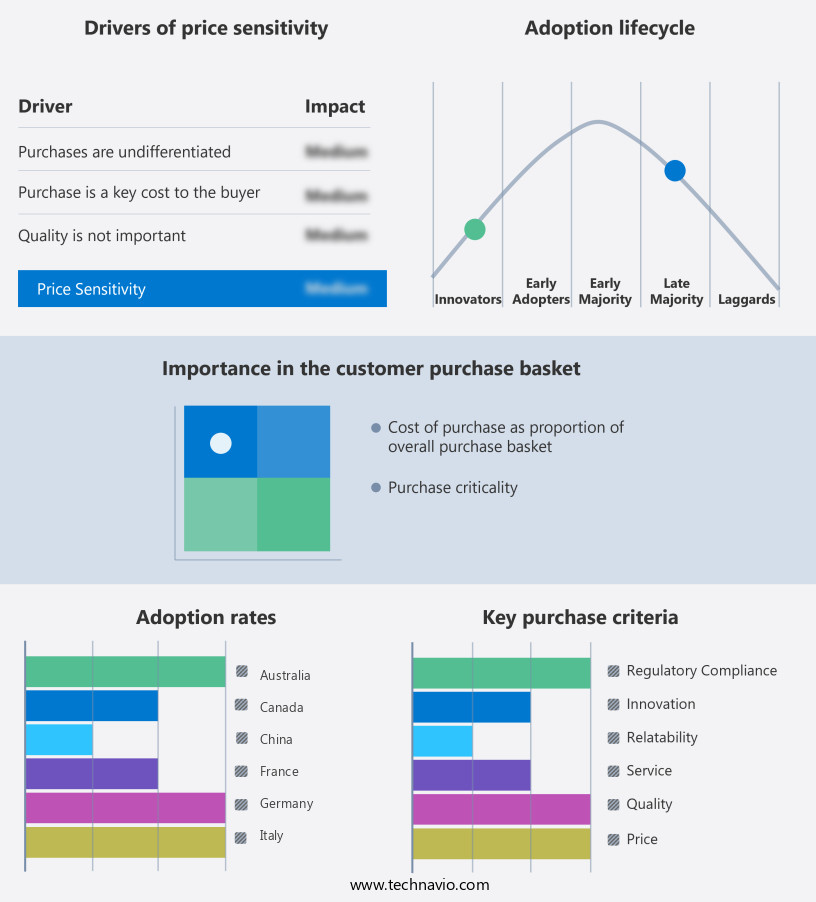

Exclusive Technavio Analysis on Customer Landscape

The automated test equipment (ate) market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automated test equipment (ate) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Automated Test Equipment (ATE) Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, automated test equipment (ate) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advantest Corp. - The company specializes in providing automated test equipment solutions, including the V93000, T2000, and T6391 models, enhancing efficiency and accuracy in various industries. These advanced tools streamline testing processes and ensure consistent product quality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advantest Corp.

- ADVINT LLC

- Aemulus Holdings Bhd

- Aimil Ltd.

- Anritsu Corp.

- Astronics Corp.

- Averna Technologies Inc.

- BAE Systems Plc

- Chroma ATE Inc.

- Cobham Ltd.

- Cohu Inc.

- INNOTECH Corp.

- Keysight Technologies Inc.

- National Instruments Corp.

- Rohde and Schwarz GmbH and Co. KG

- ROOS INSTRUMENTS Inc.

- SPEA Spa

- Teradyne Inc.

- TESEC Inc.

- The Marvin Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automated Test Equipment (ATE) Market

- In January 2024, Teradyne Inc., a leading provider of Automated Test Equipment (ATE), announced the launch of their new J750 Automated Test System, which supports advanced packaging technologies and high-speed serial interfaces (Teradyne Press Release). This expansion into advanced packaging and high-speed interfaces underscores Teradyne's commitment to addressing the evolving needs of the semiconductor industry.

- In March 2024, Advantest Corporation and National Instruments entered into a strategic partnership to integrate Advantest's ATE solutions with National Instruments' software platforms, enabling seamless data exchange and analysis between the two systems (National Instruments Press Release). This collaboration aims to streamline the testing process for customers in the automotive, industrial, and communications markets.

- In May 2024, TE Connectivity, a global industrial technology leader, acquired ATE specialist, Asset Intertech, to expand its test and measurement solutions portfolio. The acquisition strengthened TE Connectivity's position in the ATE market and provided it with Asset Intertech's advanced test solutions for high-reliability applications (TE Connectivity Press Release).

- In April 2025, the European Union introduced the European Chip Act, a €43 billion investment initiative to boost Europe's semiconductor manufacturing capabilities and reduce reliance on imports. The Act includes funding for research, development, and production of advanced semiconductors, as well as initiatives to boost the European ATE market (European Commission Press Release). This policy change is expected to drive significant growth in the European ATE market over the coming years.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automated Test Equipment (ATE) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2025-2029 |

USD 2592.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

US, China, Japan, Germany, South Korea, UK, France, Canada, Italy, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by the ever-increasing complexity of electronic devices and systems. This dynamic market encompasses various testing techniques, including system level testing, thermal testing, boundary scan testing, DC parametric testing, mixed-signal test, defect classification, AC parametric testing, software-defined testing, high-speed digital testing, functional testing, environmental testing, software test automation, RF microwave testing, power integrity testing, production test systems, test coverage analysis, test fixture design, in-circuit testing, test program development, throughput optimization, pin electronics, test socket design, yield enhancement, analog circuit testing, test time reduction, error rate measurement, ATE hardware, signal integrity testing, failure analysis techniques, reliability testing, automated test program development, test data management, test equipment calibration, test handler interface, hardware-in-the-loop testing, component level testing, and more.

- For instance, in the semiconductor industry, high-speed digital testing plays a crucial role in ensuring the functionality and reliability of advanced chips. According to industry reports, the global high-speed digital testing market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years. In a recent case, a leading semiconductor manufacturer achieved a 20% reduction in test time by implementing an advanced software-defined testing solution for their high-speed digital ICs. This innovation not only improved their production efficiency but also enhanced their test coverage and yield.

What are the Key Data Covered in this Automated Test Equipment (ATE) Market Research and Growth Report?

-

What is the expected growth of the Automated Test Equipment (ATE) Market between 2025 and 2029?

-

USD 2.59 billion, at a CAGR of 5.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Consumer electronics, Telecommunications, Aerospace and defense, and Others), Product (Non-memory ATE, Memory, and Discrete), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Augmented production of electronic goods, High cost of automated test equipment (ATE)

-

-

Who are the major players in the Automated Test Equipment (ATE) Market?

-

Advantest Corp., ADVINT LLC, Aemulus Holdings Bhd, Aimil Ltd., Anritsu Corp., Astronics Corp., Averna Technologies Inc., BAE Systems Plc, Chroma ATE Inc., Cobham Ltd., Cohu Inc., INNOTECH Corp., Keysight Technologies Inc., National Instruments Corp., Rohde and Schwarz GmbH and Co. KG, ROOS INSTRUMENTS Inc., SPEA Spa, Teradyne Inc., TESEC Inc., and The Marvin Group

-

Market Research Insights

- The market for Automated Test Equipment (ATE) is a dynamic and ever-evolving industry, continually adapting to the demands of technology advancements. Two significant data points illustrate this trend. First, the number of test patterns generated annually has seen a steady increase, reaching over 10 billion in the latest estimates. Second, industry analysts project a growth rate of approximately 5% year-over-year in the coming years. In the realm of ATE, various techniques are employed to ensure product quality and performance. These include noise floor measurement, signal path analysis, quality control metrics, test pattern generation, compliance testing, data acquisition systems, diagnostic testing, fault simulation, test cell design, test program debugging, thermal management techniques, accelerated life testing, contact resistance measurement, fixture verification, test sequence generation, timing analysis, test cell automation, probe card technology, jitter analysis, manufacturing test flow, test result reporting, stress testing, test resource management, burn-in testing, statistical process control, and power consumption measurement.

- An example of the impact of ATE on market dynamics can be observed in the semiconductor industry. By implementing advanced test solutions, companies have achieved a sales increase of up to 20% in their production lines. This enhancement in testing efficiency has led to shorter time-to-market for new products and improved overall competitiveness.

We can help! Our analysts can customize this automated test equipment (ate) market research report to meet your requirements.