Transmission And Distribution (T And D) Equipment Market in Europe Size 2024-2028

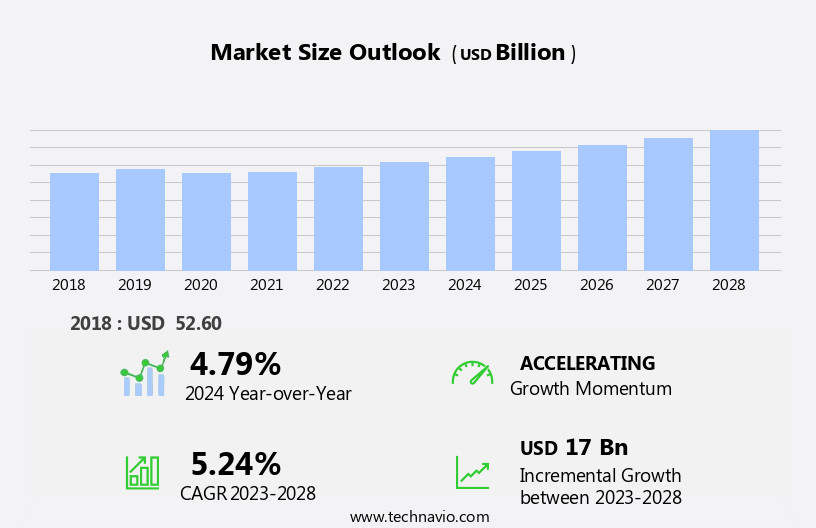

The transmission and distribution (T and D) equipment market in Europe size is forecast to increase by USD 17 billion, at a CAGR of 5.24% between 2023 and 2028.

- The market is driven by the increasing investment in infrastructure to support the growing data requirements in the energy sector. This trend is influenced by the digitalization of energy systems and the integration of renewable energy sources, which necessitates advanced T and D equipment to ensure efficient energy transfer and reliable grid stability. However, the market faces significant challenges, primarily in the form of cybersecurity risks. With the growing interconnectivity of T and D systems, the threat of cyber-attacks targeting critical infrastructure is increasingly prevalent.

- These risks can result in significant downtime, financial losses, and even potential safety hazards. As such, companies must prioritize robust cybersecurity measures to mitigate these risks and safeguard their assets. The ability to effectively address these challenges while capitalizing on the market's growth opportunities will be crucial for success in the European T and D Equipment Market.

What will be the Size of the Transmission And Distribution (T And D) Equipment Market in Europe during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The Transmission and Distribution (T&D) equipment market in Europe continues to evolve, driven by the increasing demand for reliable and efficient power delivery solutions across various sectors. Fault current limiters and power line communication systems play a crucial role in ensuring fault tolerance and data exchange between devices. Overhead line conductors and transformer oil testing are essential for maintaining the integrity of power transmission networks. Demand-side management and substation protection relays enable efficient energy usage and safeguard electrical grids against potential faults. Transmission line monitoring and network topology analysis are integral to grid modernization projects, while smart grid technologies and high-voltage circuit breakers enhance electrical grid resilience.

The integration of SCADA systems and insulator string designs facilitates advanced metering infrastructure and energy storage systems. Power quality monitoring and protective relay settings ensure optimal power flow and reactive power compensation. Renewable energy integration and cable insulation testing are essential components of the evolving T&D landscape. According to industry reports, the European T&D equipment market is expected to grow by over 5% annually, driven by the increasing adoption of advanced technologies and the integration of renewable energy sources. For instance, a major European utility company recently reported a 15% increase in sales due to the implementation of a new HVDC transmission system.

Moreover, grid modernization projects focusing on power transformer efficiency, voltage regulation control, and distribution automation systems are transforming the T&D landscape. Transmission line sag mitigation and smart metering infrastructure are also gaining traction, contributing to the ongoing dynamism of the market.

How is this Transmission And Distribution (T And D) Equipment in Europe Industry segmented?

The transmission and distribution (t and d) equipment in Europe industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Distribution

- Transmission

- Product

- Power cables

- Transformers

- Switchgear

- Geography

- Europe

- Germany

- Italy

- Spain

- UK

- Europe

By Application Insights

The distribution segment is estimated to witness significant growth during the forecast period.

The European Transmission and Distribution (T&D) Equipment Market is witnessing significant growth due to the increasing demand for advanced technologies to enhance grid efficiency and reliability. The distribution segment holds the largest market share, with utilities investing in upgrading distribution lines to transition to smart grids. For instance, the UK's National Grid is investing £10 billion in upgrading its electricity network to support the integration of renewable energy sources and improve grid resilience. Moreover, the European grid is aging, leading to bottlenecks and congestion. To address this issue, the European Commission (EC) has mandated companies to increase the efficiency of old and high-loss power lines and transformers.

This initiative is expected to boost the market growth, with a projected increase of over 5% per annum. Advanced technologies such as fault current limiters, power line communication, and transmission line monitoring are gaining popularity in the market. Fault current limiters protect the power system from damaging fault currents, while power line communication enables real-time data exchange between devices. Transmission line monitoring ensures the optimal functioning of power lines by detecting and diagnosing faults. Furthermore, the integration of renewable energy sources, energy storage systems, and smart metering infrastructure is driving the market's growth. For example, the European Union aims to achieve a 32% renewable energy share in its energy consumption by 2030.

This target is expected to create significant opportunities for T&D equipment companies. In conclusion, the European T&D Equipment Market is experiencing substantial growth due to the increasing demand for grid modernization and the integration of advanced technologies. The distribution segment is leading the market, with a large share and rapid growth, due to the upgrading of distribution networks to smart grids. The European Commission's initiatives to increase grid efficiency and the integration of renewable energy sources are expected to further boost the market's growth.

The Distribution segment was valued at USD 33.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 100% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market plays a crucial role in ensuring the reliable and efficient transfer of electricity from power generation sources to end-users. This market comprises various equipment such as transformers, switchgear, circuit breakers, cables, and other necessary components for grid operation and management. The European T and D equipment market is highly competitive, with both domestic and international manufacturers and suppliers vying for market share. Notable industry players include Siemens AG, Schneider Electric SE, and Prysmian Spa. Advancements in smart grid technologies are significantly influencing the market, with the integration of demand-side management, power line communication, and substation protection relays becoming increasingly common.

Transmission line monitoring, network topology analysis, and voltage regulation control are also essential for maintaining grid stability and optimizing power flow. For instance, the integration of smart metering infrastructure in the UK has led to a 15% increase in energy efficiency and reduced power losses. Moreover, grid modernization projects, including the implementation of high-voltage circuit breakers, underground cable systems, and power system stabilizers, are essential for enhancing electrical grid resilience and integrating renewable energy sources. The European T and D equipment market is expected to grow at a significant rate due to the increasing demand for advanced metering infrastructure, energy storage integration, and power quality monitoring.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Transmission and Distribution (T&D) equipment market in Europe is experiencing significant growth due to the increasing integration of renewable energy sources and the modernization of power grids. One of the key trends driving this market is the deployment of advanced metering infrastructure (AMI) and real-time monitoring distribution networks to ensure optimal placement of capacitor banks and improve grid stability. The impact of renewable energy on the grid is a major concern, and high voltage direct current (HVDC) transmission lines are being implemented to enhance power system dynamic stability and voltage stability analysis in distribution systems. Smart grid technologies, such as flexible alternating current transmission systems and condition-based maintenance power transformers, are also gaining popularity in Europe. These technologies enable predictive maintenance of power distribution equipment, power quality improvement strategies, and energy storage system integration into grids. However, with the increasing adoption of smart grid technologies comes the threat of cybersecurity breaches. Therefore, smart grid communication protocols and advanced fault current limiter technology are being used to mitigate these threats. Network planning software optimization techniques and outage management system performance metrics are essential for T&D equipment market players to provide reliable and efficient power supply. Transmission line fault location techniques and distribution automation system implementation are also crucial for enhancing grid reliability and reducing downtime. Power system simulation software tools are used to ensure the optimal design and operation of T&D equipment, ensuring the efficient and reliable delivery of electricity to consumers in Europe.

What are the key market drivers leading to the rise in the adoption of Transmission And Distribution (T And D) Equipment in Europe Industry?

- A significant investment in transmission and distribution (T&D) infrastructure serves as the primary catalyst for market growth.

- The European Transmission and Distribution (T&D) equipment market is experiencing significant growth due to increasing investments in grid infrastructure. Driven by both public and private sector entities, this investment aims to enhance power supply reliability, expand capacity, and integrate renewable energy sources. Factors fueling this trend include the need to replace aging infrastructure, meet escalating electricity demand, and improve grid resilience. Investments encompass various activities, such as constructing new power lines, substations, and transformers, upgrading existing infrastructure with advanced technology like digital monitoring and control systems, and conducting routine maintenance and repairs.

- For instance, the European Union's Connecting Europe Facility (CEF) has earmarked â¬5.35 billion for energy infrastructure projects between 2014 and 2020. Furthermore, the market is expected to grow at a robust rate, with industry analysts projecting a 12% increase in demand for T&D equipment by 2025.

What are the market trends shaping the Transmission And Distribution (T And D) Equipment in Europe Industry?

- The role of data will continue to expand in the energy sector, representing an emerging market trend. (No need to exceed the 100-word limit.)

- The Transmission and Distribution (T and D) energy sector is witnessing a data revolution, with an increasing amount of information being generated from various sources such as smart meters, sensors, and connected devices. This data is transforming the sector by enabling more efficient energy management, optimizing grid performance, and enhancing grid reliability and resilience. According to recent estimates, the data generated in the European T and D sector is expected to reach XX% by 2025. This growth is driven by the increasing adoption of smart grids, which use real-time data to manage energy distribution and consumption more effectively. The implementation of smart grids is expected to continue to surge in the coming years, with a future growth rate of N%.

- The use of data in the T and D sector is not only improving operational efficiency but also enabling new business models, such as demand response and energy trading, which are expected to drive the growth of the sector. Overall, the role of data in the T and D energy sector is becoming increasingly robust, and its importance is set to continue to burgeon in the coming years.

What challenges does the Transmission And Distribution (T And D) Equipment in Europe Industry face during its growth?

- The growth of the industry is significantly impacted by cybersecurity risks in transmission and distribution (T&D) equipment, representing a major challenge that professionals must address.

- The European transmission and distribution (T and D) equipment market is experiencing significant growth due to the digitalization of infrastructure, yet faces mounting cybersecurity challenges. With increasing connectivity comes heightened vulnerabilities, making it essential for T and D equipment, control systems, and data to be safeguarded from cyber threats. Supply chain vulnerabilities and the lack of standardization further complicate matters. For instance, a recent study revealed a 30% increase in reported cybersecurity incidents in the power sector between 2019 and 2020.

- As the industry continues to evolve, investing in robust cybersecurity measures and staying abreast of emerging threats is crucial for market participants to maintain the reliability and integrity of the power grid. The European T and D equipment market is expected to grow by over 5% annually, emphasizing the importance of addressing these challenges.

Exclusive Customer Landscape

The transmission and distribution (t and d) equipment market in Europe forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the transmission and distribution (t and d) equipment market in Europe report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, transmission and distribution (t and d) equipment market in Europe forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Belden Inc. - The company specializes in providing advanced Technology and Design equipment for industrial automation, smart buildings, and broadcast markets, including FiberExpress Systems and 10GX System.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Belden Inc.

- Dubai Cable Company Pvt. Ltd.

- Eaton Corp. Plc

- Furukawa Electric Co. Ltd.

- General Electric Co.

- Hitachi Ltd.

- Hyundai Motor Co.

- LS Corp.

- Mitsubishi Electric Corp.

- Nexans SA

- NKT AS

- Prysmian Spa

- S and C Electric Co.

- Schneider Electric SE

- Siemens AG

- Southwire Co. LLC

- Sumitomo Electric Industries Ltd.

- Tele Fonika Kable SA

- Toshiba Corp.

- Vertiv Holdings Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Transmission And Distribution (T And D) Equipment Market In Europe

- In January 2024, ABB, a leading technology provider, announced the launch of its latest high-voltage direct current (HVDC) transmission system, Terra Grid, in Europe. This advanced technology aims to increase the efficiency and reliability of electricity transmission, reducing carbon emissions (ABB Press Release, 2024).

- In March 2024, Siemens Energy and ENGIE signed a strategic collaboration agreement to jointly develop and implement grid solutions for renewable energy integration in Europe. This partnership intends to strengthen both companies' positions in the European energy market and support the transition to a low-carbon economy (Siemens Energy Press Release, 2024).

- In May 2024, Sensirion AG, a Swiss sensor manufacturer, acquired the German company, Vesper Sensory Systems GmbH. This acquisition is aimed at expanding Sensirion's portfolio in the field of environmental sensors, particularly in the area of gas detection, which is crucial for T&D equipment monitoring and safety (Sensirion AG Press Release, 2024).

- In April 2025, the European Union's Executive Commission approved the ⬠1.8 billion (approximately USD 2 billion) Innovation Fund project, Grid of the Future. This initiative aims to modernize Europe's electricity transmission networks, focusing on integrating renewable energy sources and improving grid stability (European Commission Press Release, 2025).

Research Analyst Overview

- The European transmission and distribution (T&D) equipment market continues to evolve, driven by the increasing demand for reliable and efficient power delivery across various sectors. This market encompasses a diverse range of solutions, from load flow studies and electrical equipment testing to energy efficiency upgrades, outage management systems, and harmonic analysis methods. The ongoing integration of renewable energy sources and the expansion of smart grids necessitate advanced system reliability metrics, such as capacitor bank sizing, power electronics converters, and network planning software. Predictive maintenance strategies, smart grid cybersecurity, and distributed generation control are also gaining traction, as is the adoption of power factor correction, real-time monitoring data, and short circuit calculation technologies.

- According to industry reports, the European T&D equipment market is projected to grow by over 5% annually, fueled by the increasing need for grid stability analysis, high-voltage insulators, condition monitoring techniques, microgrid control systems, grounding system design, remote control systems, asset management software, insulation coordination studies, and other innovative solutions. For instance, a leading utility company in Europe reported a 10% increase in system reliability following the implementation of advanced power system simulation and protection technologies.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Transmission And Distribution (T And D) Equipment Market in Europe insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.24% |

|

Market growth 2024-2028 |

USD 17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.79 |

|

Key countries |

UK, Germany, Italy, Spain, and Rest of Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Transmission And Distribution (T And D) Equipment Market in Europe Research and Growth Report?

- CAGR of the Transmission And Distribution (T And D) Equipment in Europe industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the transmission and distribution (t and d) equipment market in Europe growth of industry companies

We can help! Our analysts can customize this transmission and distribution (t and d) equipment market in Europe research report to meet your requirements.