Take Out Fried Chicken Market Size 2024-2028

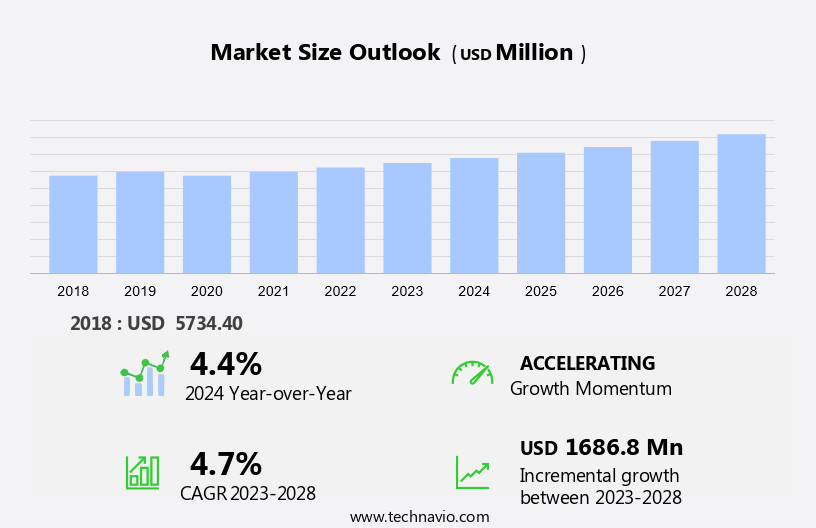

The take out fried chicken market size is forecast to increase by USD 1.69 billion at a CAGR of 4.7% between 2023 and 2028.

- The takeout fried chicken market is experiencing significant growth, driven by several key factors. The expansion of global fast-food chains and the increasing popularity of food delivery apps are major contributors to market growth. Consumers are increasingly aware of the health risks associated with frequent consumption of fast food, leading to a demand for healthier options. However, many people still enjoy fried chicken as a treat or convenience food. To address health concerns, the industry is focusing on innovations that improve the nutritional value of fried chicken. For instance, some restaurants are offering grilled or baked chicken alternatives, while others are experimenting with healthier batter recipes. Additionally, there is growing interest In the role of fried chicken in maintaining strong bones and muscles. Amino acids and bone mineral density are essential for muscle tissue growth and bone health. Regular consumption of fried chicken, particularly dark meat, can contribute to these nutrients.

- However, it is important to note that high intake can lead to weight management issues, heart health concerns, and elevated triglyceride levels and blood pressure. Therefore, moderation is key when incorporating fried chicken into a balanced diet. In summary, the market is experiencing growth due to the expansion of fast-food chains and food delivery apps, consumer awareness, and the nutritional benefits of fried chicken. However, it is crucial to consider the potential health risks and maintain moderation when consuming this food.

What will be the Size of the Take Out Fried Chicken Market During the Forecast Period?

- Take out chicken has gained immense popularity in the US market due to its unique preparation methods and diverse health benefits. This article explores the significance of take out chicken, focusing on its preparation methods, nutritional benefits, and consumer preferences. Take out fried chicken is prepared by coating chicken pieces, typically darker cuts such as thighs and drumsticks, in a seasoned batter and deep-frying them to achieve a crispy, golden exterior and juicy, tender interior. The cooking method retains the natural flavors of the chicken while enhancing its texture. Darker cuts of chicken, like thighs and drumsticks, contain more calories, saturated fat, and essential nutrients per serving compared to lighter cuts, such as breasts. These nutrients include protein, which plays a crucial role in building stronger bones and muscles, as well as amino acids that contribute to muscle tissue growth and bone mineral density. Consumption of take out fried chicken can help mitigate the risk of osteoporosis, aid in weight management, and support heart health. The high-quality proteins in take out fried chicken contribute to better mood regulation by increasing tryptophan levels, which in turn boosts serotonin production.

- Additionally, the chicken provides essential nutrients like vitamin B12, choline, zinc, iron, and copper. Regular consumption of take out chicken can help manage triglyceride levels, maintain healthy blood pressure, and reduce the risk of heart disease. Consumer Preferences: Despite the nutritional benefits, it is essential to consider the caloric content and saturated fat levels in take out chicken. Consumers can opt for leaner cuts, such as chicken breasts, or request that the chicken be grilled or baked instead of fried to reduce the caloric intake. By making informed choices, consumers can enjoy the taste and health benefits of take out chicken while maintaining a balanced diet. Take out chicken offers a unique culinary experience and various health benefits due to its preparation methods and nutritional content. By understanding the nutritional benefits and consumer preferences, individuals can make informed decisions when incorporating take out chicken into their diet.

How is this Take Out Fried Chicken Industry segmented and which is the largest segment?

The take out fried chicken industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Canada

- US

- APAC

- China

- Japan

- Europe

- UK

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

The offline distribution channel holds the largest market share In the industry In the United States. Consumers can order crispy, golden, and juicy chicken from fast-food outlets as takeaway through offline channels. Drive-thru services, a popular offline delivery option, enable customers to place orders from their vehicles. In 2020, due to pandemic-related restrictions, many governments imposed lockdowns and closed dine-in options in restaurants, including fast-food chains. As a result, the demand for take-out through offline channels has grown. Chicken, rich in iron and copper, offers various nutrients per serving. A typical serving contains approximately 350 calories, 20g of protein, and 20g of carbohydrates.

The crispy exterior and tender interior make a favorite comfort food for many. The offline distribution channel's convenience and accessibility, coupled with the deliciousness, are expected to drive market growth during the forecast period. In summary, the offline distribution channel's dominance in the market is due to its accessibility, convenience, and the popularity. The pandemic has further boosted demand for offline take-out and delivery services, making this trend a significant growth factor for the industry.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 3.99 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

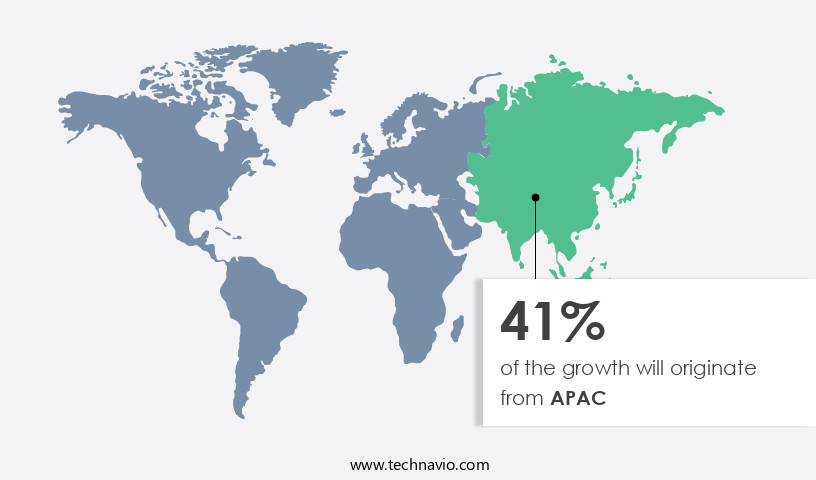

- APAC is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Another region that experiences growth in the market includes North America. The Scots crave for savory fried chicken, leading to a significant market for this dish in the United States and Canada. Numerous global and local fast-food chains cater to this demand, with key players such as Yum Brands Inc., McDonald Corporation, Wingstop Inc., Chick-fil-A Inc., Raising Canes Restaurants LLC, Shake Shack, and Bojangles dominating the market. Competition is fierce, with companies continually introducing unique offerings to distinguish themselves. Notable recent introductions include Bojangles' new Bo's Fried Chicken Sandwich, launched in August 2021. Seasoned and double-fried, take out fried chicken is available in various cuisines and styles, including pub-style and traditional. companies use a variety of seasonings and spices to enhance the flavor of their dishes, catering to diverse consumer preferences.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Take Out Fried Chicken Industry?

Growth of global multinational fast-food chains is the key driver of the market.

- The market is witnessing significant growth due to the expansion strategies of multinational fast-food chains. These companies have identified opportunities to broaden their reach in both domestic and international markets.

- Franchisees exhibit strong demand for these well-known brands, and the low entry barriers in developing nations make it an attractive proposition for these brands to increase their presence. By catering to local tastes through customized flavors, these multinational fast-food chains aim to penetrate untapped markets and expand their outlet numbers.

What are the market trends shaping the Take Out Fried Chicken Industry?

Increased usage of food delivery apps is the upcoming market trend.

- The takeout fried chicken market In the United States has experienced significant growth due to the increasing preference for convenient and easy-food delivery options. Consumers can now place orders for fried chicken through various online food delivery platforms, including the companies' own apps or third-party services. The trend towards online ordering has gained momentum in recent years, and the COVID-19 pandemic has further accelerated this trend due to social distancing measures and nationwide lockdowns. This shift to online ordering offers several benefits for consumers. Fried chicken is a rich source of essential nutrients, including amino acids, which contribute to stronger bones and muscle tissue.

- Regular consumption of chicken can help improve bone mineral density, reducing the risk of osteoporosis. Additionally, chicken can aid in weight management and support heart health by maintaining healthy triglyceride levels and blood pressure. companies In the US takeout chicken market have responded to this trend by expanding their online presence and improving their delivery services. This has led to an increase in sales through online distribution channels. As consumers continue to prioritize convenience and safety, the demand for takeout fried chicken through online ordering is expected to remain strong. Thus, the takeout chicken market In the US is experiencing growth due to consumers' increasing preference for convenient and safe food delivery options.

- The trend towards online ordering offers several benefits, including improved access to essential nutrients and reduced risk of osteoporosis, weight management, and heart health. companies are responding to this trend by expanding their online presence and improving their delivery services, leading to increased sales through online distribution channels.

What challenges does the Take Out Fried Chicken Industry face during its growth?

Consumer awareness regarding health risks associated with fast-food consumption is a key challenge affecting the industry growth.

- In the United States and Canada, the prevalence of chronic diseases is largely attributed to unhealthy lifestyle choices, particularly the consumption of fast food, such as take out chicken. Darker cuts like thigh and drumstick contain higher caloric content and saturated fat compared to lighter cuts like breast. This trend is of concern as excessive intake of fried food can lead to health issues such as obesity, heart disease, and diabetes. According to the American Heart Association, the risk of heart disease can increase by up to 68% due to the consumption of fried foods. With growing health consciousness, consumers are increasingly seeking healthier alternatives.

- Preparation methods for chicken, such as baking or grilling, can help reduce the caloric and saturated fat content. It is crucial for individuals to make informed choices and prioritize their health by limiting their intake of red meat and focusing on protein-rich alternatives.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, take out fried chicken market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bojangles Restaurants Inc.

- Cajun Operating Co.

- Charoen Pokphand Group Co. Ltd.

- Chicken Co.

- Chick fil A Inc.

- ColoradoFried Chicken Co.

- GENESIS BBQ

- Golden Franchising Corp.

- Guss Fried Chicken

- Honeybee Foods Corp.

- KRISPY KRUNCHY FOODS LLC

- KyoChon Chicken Rowland Heights

- McDonald Corp.

- Pacific Fried Chicken Co.

- Raising Canes Restaurants LLC

- Restaurant Brands International Inc.

- Shake Shack Inc.

- Wingstop Inc.

- YUM Brands Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Fried chicken, a beloved dish with distinct flavors and crispy textures, has captured the hearts and taste buds of consumers worldwide. The preparation methods for this delicacy typically involve marinating darker cuts like thighs and drumsticks in buttermilk or other seasonings before deep-frying them to a golden, juicy, and tender finish. The essence of chicken lies in its ability to provide a satisfying meal that caters to various health aspects. Darker cuts, such as thighs and drumsticks, offer a higher caloric content and more saturated fat than lighter cuts like breasts. However, they are also richer in nutrients like protein, which is essential for stronger bones and muscles, as well as essential amino acids that contribute to muscle tissue growth and bone mineral density. This can help combat conditions like osteoporosis and aid in weight management, heart health, and overall well-being. On the other hand, leaner cuts like breasts provide fewer calories and less saturated fat but still offer high-quality proteins, vitamin B12, choline, zinc, iron, copper, and other essential nutrients per serving.

Furthermore, the crispy exterior and juicy interior of chicken can provide a better mood boost due to the presence of tryptophan, an amino acid that contributes to the production of serotonin, a neurotransmitter associated with happiness and well-being. Despite the health benefits, there are common myths surrounding the negative aspects of chicken, particularly its high caloric and saturated fat content. However, the origins of this dish date back to ancient times, with various cuisines and styles incorporating their unique preparation methods and seasonings, such as the double-frying technique used in pub-style chicken or the use of specific spices in Scots fried chicken. Regardless of the preparation or style, chicken remains a beloved dish that offers a delightful combination of flavors and health benefits.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

131 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2024-2028 |

USD 1.69 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.4 |

|

Key countries |

US, China, Japan, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Take Out Fried Chicken Market Research and Growth Report?

- CAGR of the Take Out Fried Chicken industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the take out fried chicken market growth of industry companies

We can help! Our analysts can customize this take out fried chicken market research report to meet your requirements.