Telehandler Market Size 2025-2029

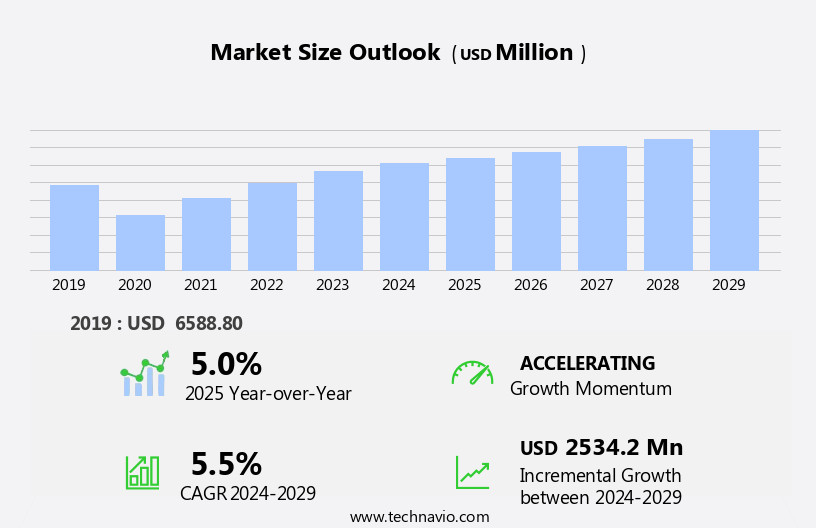

The telehandler market size is forecast to increase by USD 2.53 billion at a CAGR of 5.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by increased investments in infrastructure projects, the emergence of electric telehandlers, and advancements in precision farming technologies. These trends are transforming the construction, agriculture, and material handling industries, offering new opportunities for market participants. The integration of telehandlers into modern farm equipment, particularly within precision agriculture systems, is expanding their utility beyond traditional construction sites, improving efficiency and productivity in farming operations. However, the market also faces challenges that necessitate strategic planning and effective management.

- Regulatory hurdles impact adoption, as stringent safety and emissions regulations require telehandlers to meet specific standards, thereby increasing production costs. Additionally, supply chain inconsistencies temper growth potential, as demand for telehandlers and farm equipment can fluctuate based on project schedules, seasonal cycles, and broader economic conditions. Despite these challenges, the market's future looks promising, with the growing popularity of electric telehandlers addressing environmental concerns and offering operational cost savings. Companies seeking to capitalize on these opportunities should focus on innovation, regulatory compliance, and supply chain agility to stay competitive and meet the evolving needs of their customers.

What will be the Size of the Telehandler Market during the forecast period?

- The market is characterized by continuous innovation in safety features, compact size, and telescopic boom design. Manufacturers prioritize parts availability and emission reduction technologies to cater to the evolving needs of logistics optimization and construction site safety. High-capacity lifting and operator comfort are essential considerations for businesses seeking to maximize productivity. Rental fleet management and operator proficiency are key trends, with telematics integration and remote control functionality enabling real-time monitoring and optimization. Rough terrain capability, attachment versatility, and hydraulic pump system efficiency are crucial for handling various applications.

- Boom stability, hybrid power systems, autonomous operation, load moment indicator, electric powertrain, and telescopic handler safety are emerging priorities in the market. Construction sites and agricultural applications benefit from the versatility and efficiency of telehandlers, making them an indispensable tool for US businesses.

How is this Telehandler Industry segmented?

The telehandler industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Construction

- Agriculture

- Industrial

- Others

- Type

- Compact telehandlers

- High reach telehandlers

- Heavy lift telehandlers

- Capacity

- Below 3 tons

- 3-6 tons

- Above 6 tons

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

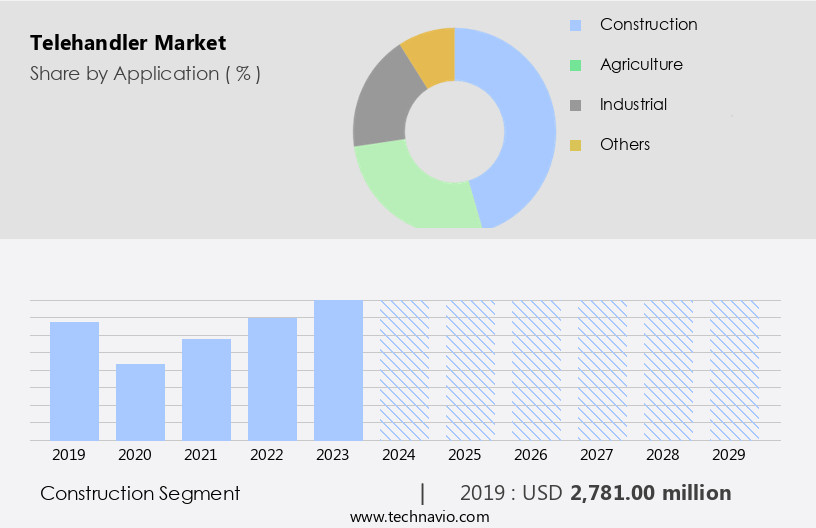

The construction segment is estimated to witness significant growth during the forecast period. In the construction industry, telehandlers have become an essential tool for material handling and transportation. These versatile machines offer numerous advantages over traditional cranes, enabling quicker material handling and reducing the need for extensive installation preparations. Telehandlers are widely used in residential and industrial construction projects with structures up to 80 feet in height. Manufacturers continue to innovate by increasing the load capacity and boom length of telehandlers, making them suitable for a broader range of applications. Two common types of telehandlers are diesel and electric models, each catering to specific operational requirements. Diesel telehandlers provide greater power and flexibility for heavy-duty tasks, while electric telehandlers offer lower emissions and higher fuel efficiency.

Load sensing technology and high-capacity telehandlers are other trends gaining traction in the market. Safety features, such as operator cabs with improved visibility and ergonomics, are essential for ensuring operator comfort and productivity. Additionally, the rental market plays a significant role in the telehandler industry, providing flexibility for businesses to access various telehandler models for their material handling needs. Telescopic handlers, also known as telescopic boom lifts or telescopic handlers, offer a hydraulic system for lifting heavy loads and reaching great heights. Articulated booms and rotating booms extend the reach and maneuverability of telehandlers, making them ideal for construction sites with challenging terrain and tight spaces.

Emissions regulations continue to shape the market, with hybrid telehandlers and other eco-friendly alternatives gaining popularity. Safety features, such as load stability systems, are becoming increasingly important to prevent accidents and ensure operator safety. Telehandlers are also used in agriculture for various applications, including loading and unloading materials, transporting equipment, and performing maintenance tasks. With their versatility and adaptability, telehandlers have become indispensable tools for material handling and construction equipment applications.

The Construction segment was valued at USD 2.78 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

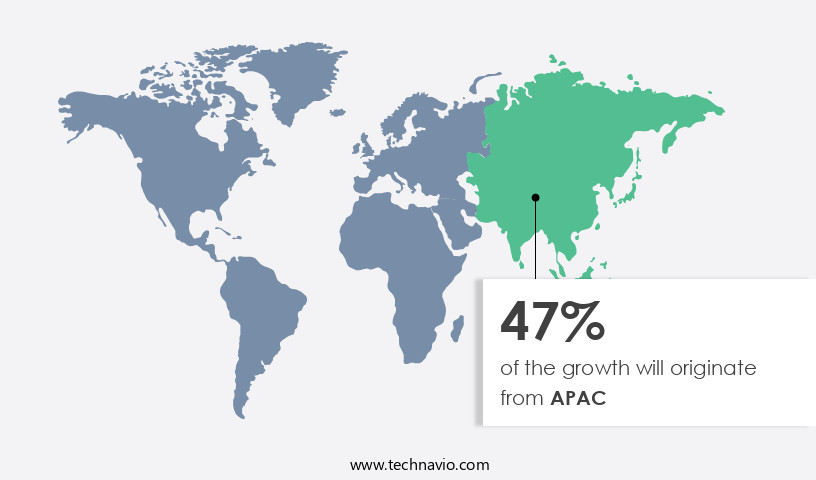

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, driven by the expanding construction sector in emerging economies. Increased government investments in infrastructure development are fueling the demand for new residential and commercial projects, leading to increased demand for material handling equipment like telehandlers. For instance, in the Asia Pacific region, projects like the Oxirich Chintamani residential complex and Oberoi Forestville are underway, requiring heavy-duty telehandlers for lifting materials and ensuring load stability. The market offers various types of telehandlers, including diesel and electric models, compact and high-capacity, and those with rotating booms and remote control capabilities. Safety features, such as operator cabs and hydraulic systems, are also crucial considerations in the market.

Additionally, the rental market is gaining traction, providing flexibility to customers and contributing to the market's growth. Emissions regulations are also influencing the market, with hybrid and electric telehandlers gaining popularity due to their fuel efficiency. Construction equipment manufacturers are focusing on developing telescopic handlers with advanced load sensing technology and heavy lifting capabilities to cater to the evolving market demands. The market also includes telescopic booms and articulated booms, offering varying reach heights and terrain handling capabilities. Overall, the market is expected to continue its growth trajectory, driven by the construction sector's expansion and the increasing demand for efficient and versatile material handling equipment.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Telehandler market drivers leading to the rise in the adoption of Industry?

- A significant increase in infrastructure investments serves as the primary catalyst for market growth. The market is experiencing growth due to the increasing investments in infrastructure projects worldwide. For instance, China's investment of approximately USD 13.1 billion in the development and construction of the Beijing International Airport is a notable example. This airport is designed to accommodate around 72 million passengers annually by 2025. Similarly, governments across the globe are investing substantially in the development of sports infrastructure and facilities. The 2022 FIFA World Cup in Qatar led to increased construction spending in the Middle East, with local organizations planning to build nine new stadiums and renovate three existing ones for the event.

- These capital-intensive projects and infrastructure developments are anticipated to witness significant growth in the coming decade, thereby driving the expansion of the market. Telehandlers, also known as telescopic handlers or reach forks, are versatile machines used for lifting and transporting heavy loads. They offer advantages such as increased load stability, operator cabs for enhanced comfort, and various boom lengths to cater to diverse applications. Telehandlers are used extensively in various industries, including construction, agriculture, and logistics. In the agricultural sector, they are used for loading and unloading materials such as bales, pallets, and fertilizers. Telehandlers are available in different types, such as diesel and electric, and some models come with advanced features like load sensing for improved efficiency and safety.

- High-capacity telehandlers are also available for handling heavier loads. The market for telehandlers is expected to grow significantly due to the increasing demand for these machines in various industries and the ongoing infrastructure development projects.

What are the Telehandler market trends shaping the Industry?

- The emergence of electric telehandlers represents a significant market trend in the material handling industry. These innovative machines offer numerous advantages, including reduced emissions, increased efficiency, and improved maneuverability compared to their diesel counterparts. Compact telehandlers are essential for material handling in confined indoor spaces such as warehouses and buildings under maintenance. Due to limited ventilation, diesel-powered telehandlers are not ideal as their exhaust emissions can pose health risks to workers. Instead, compact telehandlers with electric engines or lower engine power are preferred in such settings. The load handling requirements in indoor environments typically range from a few hundred to 10,000 lbs. Thus, the engine power of compact telehandlers does not need to be as robust as that of construction equipment like earthmovers and graders.

- Moreover, electric telehandlers can offer a reasonable runtime on a single charge, making them a practical choice for indoor applications. Additionally, charging infrastructure for electric telehandlers is feasible in indoor environments. The rental market for compact telehandlers is growing due to their versatility and fuel efficiency. Operator training is crucial for ensuring safe and efficient use of these machines.

How does Telehandler market faces challenges face during its growth?

- The escalating costs of telehandlers represent a significant challenge to the growth of the industry, necessitating ongoing efforts to increase efficiency and affordability in their acquisition and operation. Telehandlers, a type of material-handling equipment, offer impressive reach heights and lifting capacities for various industries. The cost of telehandlers is a critical consideration for potential buyers, as prices can vary significantly based on factors such as brand, model, and features. Basic telehandlers with a lifting capacity of 2-3 tons can range from USD 30,000 to USD 60,000. More advanced models, featuring higher lifting capacities of 5-6 tons, can cost between USD 80,000 and USD 150,000. Telehandlers with specialized hydraulic systems, quick couplers, or high-lift capabilities can cost upwards of USD 200,000. Emissions regulations also impact the cost of telehandlers, as manufacturers incorporate advanced technologies to meet these standards.

- Safety features are another essential consideration, as telehandlers must adhere to stringent safety regulations. These features include remote control operation, articulated booms, and robust hydraulic systems. Despite the high cost, telehandlers remain a valuable investment for construction and other industries due to their versatility and ability to increase productivity.

Exclusive Customer Landscape

The telehandler market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the telehandler market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, telehandler market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - The company offers telehandler such as RT-706J, RT-708J, VR-518, VR-1056C, and others under the brand name Ingersoll Rand.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Caterpillar Inc.

- CNH Industrial N.V.

- Dieci Srl

- Doosan Bobcat Inc.

- Faresin Industries Spa

- Groupe Mecalac SAS

- Haulotte Group

- Hunan Sinoboom Intelligent Equipment Co. Ltd.

- J C Bamford Excavators Ltd.

- Komatsu Ltd.

- Liebherr International AG

- Linamar Corp.

- MACO Corp. India Pvt. Ltd.

- Manitou BF SA

- Merlo Spa

- Oshkosh Corp.

- Pettibone Traverse Lift LLC

- Terex Corp.

- Wacker Neuson SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Telehandler Market

- In January 2024, JLG, a leading telehandler manufacturer, introduced its new electric telehandler model, the JLG 5208S, marking a significant advancement in the telehandler industry with its zero-emission capabilities (JLG press release). This innovation aligns with the growing global trend towards sustainable construction equipment.

- In March 2025, Volvo Construction Equipment and Terex Corporation announced a strategic partnership to jointly develop and produce telehandlers under the Volvo brand (Volvo Construction Equipment press release). This collaboration aims to strengthen Volvo's product portfolio and expand its market presence in the telehandler segment.

- In July 2024, KION Group, a leading industrial truck manufacturer, acquired the telehandler business of Linde Material Handling from KION's sister company Linde AG (KION Group press release). This acquisition strengthened KION's position as a major player in the market, providing the company with a broader product range and increased market reach.

- In October 2025, the European Union introduced new regulations for the telehandler industry, mandating the implementation of advanced safety features such as load stabilization systems and improved operator protection (European Parliament press release). These regulations aim to enhance safety standards and reduce workplace accidents in the telehandler sector.

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and the diverse needs of various industries. Telehandlers, also known as telescopic handlers or telescopic boom lifts, are versatile machines used for material handling and lifting applications. They are available in different configurations, including diesel and electric models, compact designs, and high-capacity variants with extended boom lengths. The agricultural sector is a significant market for telehandlers, with their ability to handle heavy loads and reach great heights essential for farming operations. In the construction industry, telehandlers are indispensable for handling building materials and working in rough terrain.

The rental market plays a crucial role in the telehandler industry, offering flexibility and affordability to businesses. Load handling is a critical aspect of telehandler applications, and advancements in load sensing technology enable precise load distribution and improved stability. Operator training is essential to ensure safe and efficient use of telehandlers, with training programs focusing on safe lifting techniques, machine operation, and safety features. Fuel efficiency is another important consideration, with hybrid telehandlers and electric models gaining popularity due to their reduced environmental impact and cost savings. Emissions regulations continue to shape the market, driving innovation in engine technology and alternative fuel solutions.

Telehandlers come in various configurations, including articulated booms, rotating booms, and remote-controlled models, each designed for specific applications. Safety features, such as load stability sensors and hydraulic systems, are continually improving to enhance operator safety and productivity. The market is characterized by its continuous dynamism, with ongoing innovations in engine power, boom length, lifting capacity, and reach height. The versatility and adaptability of telehandlers make them an indispensable tool for material handling and lifting applications across various industries.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Telehandler Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 2.53 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, China, Japan, India, Canada, UK, South Korea, Germany, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Telehandler Market Research and Growth Report?

- CAGR of the Telehandler industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the telehandler market growth and forecasting

We can help! Our analysts can customize this telehandler market research report to meet your requirements.