Thermostatic Radiator Valve Market Size 2024-2028

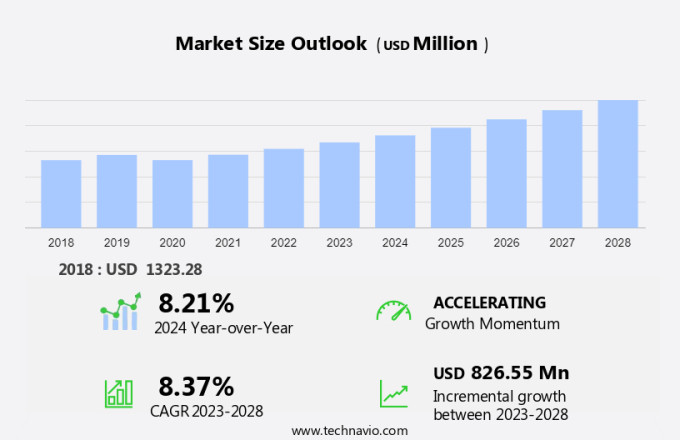

The thermostatic radiator valve market size is forecast to increase by USD 826.55 billion at a CAGR of 8.37% between 2023 and 2028.

- The thermostatic radiator valve (TRV) market is experiencing significant growth due to several key trends. One of the primary drivers is the increasing adoption of condensing boilers in heating systems, which has led to a higher demand for TRVs to optimize temperature control and energy efficiency. Additionally, the market is experiencing an increasing number of TRV launches, catering to diverse customer needs and preferences, particularly in the boiler and construction sectors, where energy efficiency and climate control are in high demand. However, intense pricing pressure due to the availability of local and low-priced TRVs poses a challenge to market growth. Despite this, the market is expected to continue expanding as consumers prioritize energy savings and comfort In their homes.

What will be the Size of the Thermostatic Radiator Valve Market During the Forecast Period?

- The thermostatic radiator valve (TRV) market is experiencing significant growth due to the increasing demand for advanced heating system solutions that offer improved room temperature control and energy efficiency. TRVs operate by regulating the flow of hot water to individual radiators based on the desired temperature setting, resulting in more consistent room temperatures and reduced energy waste. TRV designs come in various forms, including liquid and wax models, each with their unique advantages. Installation of TRVs is relatively straightforward, and while initial costs may be higher than manual radiator valves, the long-term energy savings and temperature control benefits make up for the investment.

- Maintenance requirements for TRVs are minimal, and heating zones can be easily managed with the use of temperature control systems and thermostats. Building regulations increasingly require the use of heating controls to ensure energy efficiency and reduce carbon emissions. Common problems with TRVs include draughts affecting temperature settings and furniture blocking valve mechanisms. Troubleshooting can be facilitated through a numbering system on the valves, allowing for easy identification and resolution of issues. TRVs are compatible with both boiler systems and room thermostats, making them a versatile solution for various heating applications. Heating efficiency is improved through precise temperature control, and cost considerations should factor In the long-term energy savings.

How is this Thermostatic Radiator Valve Industry segmented and which is the largest segment?

The thermostatic radiator valve industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Type

- Electronic TRV

- Self-operate TRV

- End-user

- Commercial

- Residential

- Geography

- Europe

- Germany

- UK

- APAC

- China

- Japan

- North America

- US

- Middle East and Africa

- South America

- Europe

By Product Type Insights

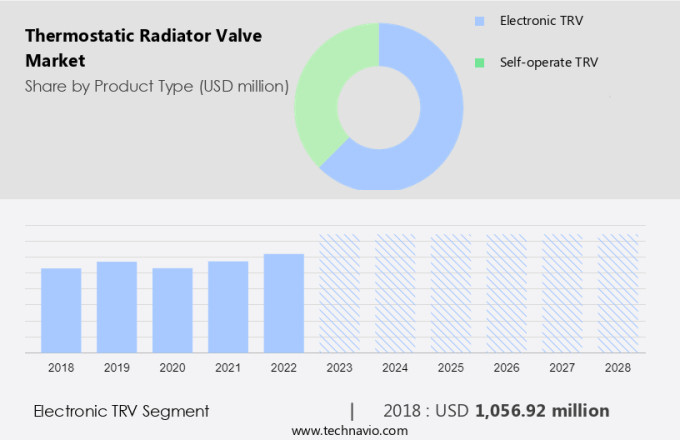

- The electronic TRV segment is estimated to witness significant growth during the forecast period.

The thermostatic radiator valve (TRV) market is driven by the increasing demand for cost savings, home comfort, and energy bill reduction. Electronic TRVs, which are the largest segment of this market, have gained popularity due to their advanced functionality. These smart TRVs enable room-by-room heating control through collaboration with a thermostat kit, creating a zonal heating system. Users can manage these eTRVs remotely via smartphone apps or voice assistants, making them an integral part of smart heating systems. By allowing precise temperature control, eTRVs contribute significantly to energy savings and improved home comfort.

Get a glance at the Thermostatic Radiator Valve Industry report of share of various segments Request Free Sample

The Electronic TRV segment was valued at USD 1.06 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market holds a significant share of the global thermostatic radiator valve (TRV) market, driven by the widespread adoption of heating systems due to extreme cold weather conditions. Major contributors to this market include Germany, the UK, and France. According to the European Building Automation Controls Association, approximately 95% of homes In the UK have central heating systems, with 86% utilizing gas central heating. Over 26 million households In the UK use wet central heating systems, making it one of the highest In the EU. TRVs are increasingly being installed to optimize energy usage and maintain room temperature control.

Their energy efficiency benefits are a significant factor In their growing popularity. While manual radiator valves are still in use, TRVs offer more precise temperature control and ease of installation. Regular maintenance is essential to ensure their longevity and optimal performance.

Market Dynamics

Our thermostatic radiator valve market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the Thermostatic Radiator Valve Industry?

Increasing adoption of condensing boilers in heating systems is the key driver of the market.

- Thermostatic Radiator Valves (TRVs) offer several advantages In the operation of heating systems, particularly in homes equipped with condensing boilers. These energy-efficient devices allow for room temperature control, enabling the heating system to maintain desired temperatures while minimizing energy consumption. TRVs work by regulating the flow of hot water to individual radiators based on the desired temperature setting. TRVs come in two main types: Liquid TRVs and Wax TRVs. Both types operate by sensing the room air temperature and adjusting the valve mechanism accordingly to maintain the desired temperature. Installation of TRVs is relatively straightforward and can be done by a professional or DIY enthusiast.

- Cost considerations vary depending on the type and number of valves required. Manual radiator valves, on the other hand, do not offer temperature control and rely on users to manually adjust the valve position. TRVs provide more precise temperature regulation and energy savings. However, regular maintenance is essential to ensure the valves function correctly. Common problems include draughts, furniture blockage, and temperature adjustment issues. TRVs are compatible with various heating systems, including boiler systems, and can be used in heating zones to optimize temperature control. Building Regulations require the use of TRVs in new buildings to improve energy efficiency and reduce heating costs.

What are the market trends shaping the Thermostatic Radiator Valve Industry?

An increasing number of TRV launches is the upcoming market trend.

- The Thermostatic Radiator Valve (TRV) market In the US is experiencing significant growth due to the increasing demand for room temperature control and energy efficiency in heating systems. TRVs offer advantages over manual radiator valves by automatically adjusting the temperature settings based on the ambient room temperature, ensuring optimal heating efficiency. This results in energy savings and reduced energy bills. The operation of TRVs is based on the principle of a bimetallic actuator, which responds to changes in temperature and adjusts the valve position accordingly. Two main types of TRVs are Liquid TRVs and Wax TRVs, each with its unique advantages and installation considerations.

- Liquid TRVs use a thermostatic liquid to expand and contract, while Wax TRVs use a wax capsule that expands and contracts with temperature changes. Both types offer temperature control and heating zone management, making it easier to maintain a comfortable home environment. Installation of TRVs requires minimal effort, as they can be retrofitted to existing heating systems. However, cost considerations must be taken into account, as TRVs may have a higher upfront cost compared to manual radiator valves. Maintenance of TRVs is relatively low, with occasional temperature adjustments and occasional cleaning required to remove limescale build-up. Common problems include draughts and furniture blockage, which can be troubleshot through simple troubleshooting steps.

What challenges does the Thermostatic Radiator Valve Industry face during its growth?

Intense pricing pressure due to the availability of local and low-priced TRVs is a key challenge affecting the industry growth.

- The Thermostatic Radiator Valve (TRV) market is experiencing significant growth due to the increasing demand for room temperature control and energy efficiency in heating systems. TRVs offer advantages such as automatic temperature adjustment and energy savings by regulating the flow of hot water to individual radiators based on the desired temperature setting. Operation of TRVs is straightforward, with some models featuring a wheelhead valve or lockshield valve for manual temperature adjustment. Installation of TRVs is relatively easy and can be done by a professional or DIY enthusiast. Cost considerations are a crucial factor In the market, with manual radiator valves serving as an affordable alternative for those seeking basic temperature control.

- However, TRVs offer greater energy savings and heating system efficiency, making them a worthwhile investment for homeowners. There are two main types of TRVs: Liquid TRVs and Wax TRVs. Liquid TRVs use a thermostatic liquid to expand and contract, while Wax TRVs use a wax element to expand and contract. Both types have their advantages and disadvantages, with Liquid TRVs offering faster response times and Wax TRVs providing better temperature stability. Maintenance of TRVs is minimal, with regular cleaning and occasional adjustments required. Heating zones can be created by installing TRVs in each room, allowing for individual temperature control and improved comfort.

Exclusive Customer Landscape

The thermostatic radiator valve market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the thermostatic radiator valve market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, thermostatic radiator valve market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aalberts NV

- American Steam Control

- Caleffi SpA

- CastIronRadiators4u.co.UK

- Danfoss AS

- Fratelli Pettinaroli SpA

- GIACOMINI Spa

- Herz Armaturen GmbH

- Honeywell International Inc.

- I.V.A.R. SpA

- IMI Hydronic Engineering International SA

- Oventrop GmbH and Co. KG

- Poul Due Jensens Fond

- Purmo Group Plc

- puteus GmbH

- Schneider Electric SE

- Siemens AG

- Vaillant GmbH

- Zhejiang Hualong Valves Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Thermostatic radiator valves (TRVs) have gained significant traction In the heating market due to their ability to provide room temperature control and energy efficiency. These valves allow for individualized temperature settings in different heating zones, enabling users to optimize their heating system and reduce energy consumption. The operation of thermostatic radiator valves is based on the principle of temperature regulation. The valve mechanism includes a thermostat that senses the room temperature and an actuator that adjusts the valve position accordingly. When the room temperature drops below the desired setting, the thermostat sends a signal to the actuator, which opens the valve to allow more hot water to flow into the radiator.

Conversely, when the room temperature reaches the desired setting, the thermostat signals the actuator to close the valve, reducing the flow of hot water. Advantages of thermostatic radiator valves include improved energy efficiency, as they allow for precise temperature control and prevent overheating. They also provide enhanced comfort by maintaining consistent room temperatures. Natural gas is not only more efficient but also has low operating costs than other fossil fuels. Additionally, they enable heating system balancing, which ensures that each room receives an equal amount of heat. Installation of thermostatic radiator valves is a straightforward process, typically involving connecting the valve to the radiator and the heating system. Cost considerations may vary depending on the number of valves required and the complexity of the installation.

Furthermore, maintenance of thermostatic radiator valves is minimal, with regular checks for draughts and furniture blockages necessary to ensure proper functioning. Common problems include valve mechanism malfunctions and temperature adjustment issues, which can be addressed through troubleshooting and repair. Two types of thermostatic radiator valves are commonly used: liquid TRVs and wax TRVs. Liquid TRVs utilize a thermostat filled with a temperature-sensitive liquid, while wax TRVs use a wax element that expands and contracts with temperature changes. Both types offer similar benefits, with liquid TRVs providing faster response times and wax TRVs offering a longer lifespan. Building regulations may require the installation of thermostatic radiator valves to ensure energy efficiency and safety.

|

Thermostatic Radiator Valve Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.37% |

|

Market Growth 2024-2028 |

USD 826.55 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.21 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Thermostatic Radiator Valve Market Research and Growth Report?

- CAGR of the Thermostatic Radiator Valve industry during the forecast period

- Detailed information on factors that will drive the Thermostatic Radiator Valve growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the thermostatic radiator valve market growth of industry companies

We can help! Our analysts can customize this thermostatic radiator valve market research report to meet your requirements.