Tissue Paper Market Size 2025-2029

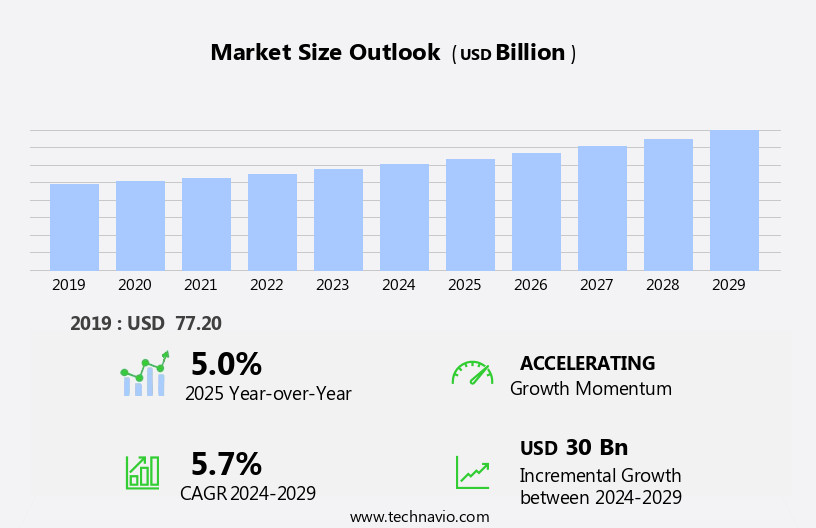

The tissue paper market size is forecast to increase by USD 30 billion, at a CAGR of 5.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by increasing concerns about health and hygiene in developing economies. This trend is particularly evident in regions with rising disposable income and urbanization, as consumers prioritize personal cleanliness and sanitation. Another key driver is the increasing adoption of e-commerce, enabling greater access to tissue paper products for consumers in remote areas or those with limited physical retail options. However, the market faces challenges as well. The threat of prominent substitutes, such as reusable cloth or homemade alternatives, persists, particularly in price-sensitive markets.

- Companies must differentiate themselves through product innovation, branding, and value-added services to maintain market share. Effective strategic planning, operational efficiency, and a deep understanding of consumer preferences will be essential for businesses looking to capitalize on the market's growth potential and navigate these challenges effectively.

What will be the Size of the Tissue Paper Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by various factors shaping its dynamics. Product development remains a key focus, with innovations in bulk packaging and sheet size catering to diverse consumer needs. Ply count and product differentiation are crucial elements, as manufacturers strive for cost optimization while maintaining high-quality standards. Hygiene products, including paper towels and bathroom tissue, dominate the market. The food service sector also utilizes tissue paper extensively, necessitating supply chain efficiency and consistency. Consumer perception plays a significant role, with brand loyalty and personal care driving demand for superior quality and eco-friendly options. Environmental impact is a growing concern, leading to increased use of recycled pulp and alternative fibers like bamboo and cotton.

Manufacturing processes are under scrutiny, with a focus on safety standards and production capacity. Pricing strategies and retail channels also influence market trends, as price sensitivity and competition among brands shape consumer behavior. Wood fiber remains a primary raw material, but its sustainability is under scrutiny. Pulp production and manufacturing processes are evolving to address these concerns, ensuring a continuous supply while minimizing environmental impact. The market's future trends include further product innovation, increased focus on sustainability, and expanding applications across various consumer goods sectors.

How is this Tissue Paper Industry segmented?

The tissue paper industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Commercial

- Residential

- Distribution Channel

- Hypermarkets and supermarkets

- Convenience stores

- Online retail

- Drug and pharmacy stores

- Product

- Toilet paper

- Facial tissue

- Paper towel

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

.

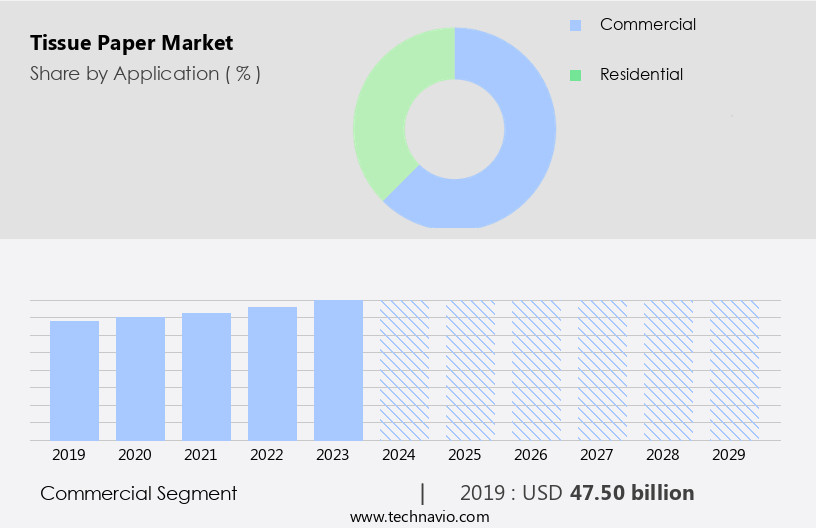

By Application Insights

The commercial segment is estimated to witness significant growth during the forecast period.

The market encompasses a broad range of applications, with significant demand originating from commercial and non-residential sectors. In this segment, tissue paper is utilized in workplaces, hotels, hospitals, restaurants, spas, beauty parlors, fashion studios, and aircraft. Factors driving this growth include the increasing number of people traveling and the subsequent demand for disposable products, as well as the advocacy of hygiene practices in healthcare settings. Product development in the tissue paper industry focuses on bulk packaging, product differentiation, and cost optimization. Paper towels and hygiene products are key categories, with manufacturers prioritizing quality control and safety standards. Consumer perception plays a crucial role, with brand loyalty and price sensitivity influencing purchasing decisions.

Pulp production is a significant aspect of the market, with manufacturers utilizing wood fiber, recycled pulp, bamboo fiber, and virgin pulp in their manufacturing processes. Environmental impact is a growing concern, with recycling rates and supply chain efficiency becoming increasingly important. Roll length, sheet size, and production capacity are essential factors in the manufacturing of various tissue products, including bathroom tissue, facial tissue, and paper towels. Pricing strategies and retail channels are also key considerations for market players. Competitor analysis and cost optimization are essential for maintaining a competitive edge in the market. Product differentiation through innovation and sustainability initiatives can help companies distinguish themselves from competitors.

In conclusion, the market is characterized by continuous innovation, a focus on sustainability, and the growing importance of consumer perception and hygiene practices. The market's evolution is driven by trends such as increasing demand for disposable products, a shift towards eco-friendly manufacturing processes, and the growing influence of consumer preferences.

The Commercial segment was valued at USD 47.50 billion in 2019 and showed a gradual increase during the forecast period.

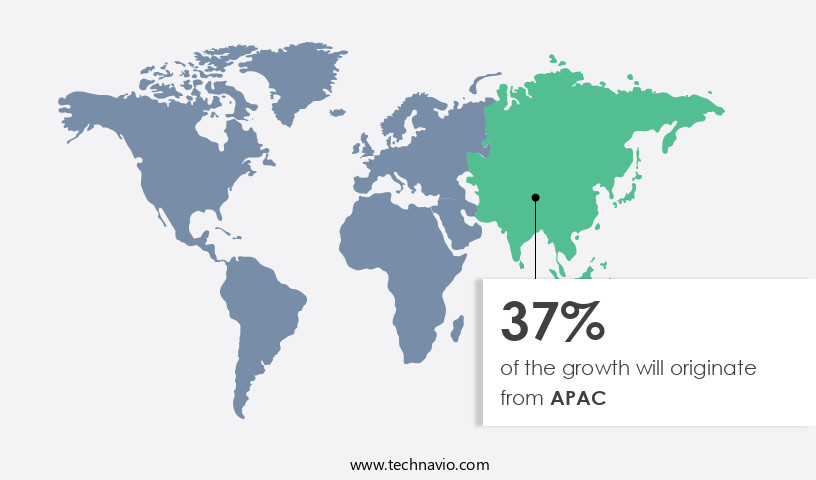

Regional Analysis

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing significant growth due to several factors. The region's population growth, particularly among the elderly, and rising incomes have increased the demand for hygiene products, including tissue paper. Additionally, consumers in APAC are prioritizing health and wellness, leading to an increase in demand for tissue paper in spas and other health-focused establishments. With over 50,000 spas currently operating in the region, the potential for tissue paper sales is substantial. The market is also witnessing advancements in product development, such as bulk packaging, cost optimization, and product differentiation, to cater to the varying needs of consumers and industries, including food service and personal care.

Pulp production and manufacturing processes are also evolving to improve quality control and meet safety standards. The use of alternative fibers like bamboo and recycled pulp is increasing due to environmental concerns and cost efficiency. The market's growth potential is further boosted by the increasing retail channels and pricing strategies, making tissue paper accessible to a wider consumer base. The market in APAC is expected to continue its robust expansion during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Tissue Paper Industry?

- In developing economies, heightened concerns regarding health and hygiene are primary catalysts fueling market growth.

- The market in developing countries exhibits significant growth potential due to rising disposable incomes, urbanization, and changing consumer preferences. In recent years, emerging economies, particularly in the Asia Pacific region, have witnessed a shift in consumer behavior and habits. This trend is driven by increasing disposable income, as well as the convenience and availability of a wide range of products through online portals. The demand for tissue paper is particularly strong in sectors such as food service and hygiene products. In the food service industry, bulk packaging of paper towels is increasingly popular due to their cost-effectiveness and ease of use.

- In the hygiene sector, tissue paper is a staple item due to its association with cleanliness and health. To meet the growing demand, manufacturers are focusing on product development and quality control. Pulp production is a key area of investment, as it directly impacts the cost and quality of the final product. Competitor analysis is also crucial to remain competitive in the market. Consumer perception plays a significant role in market dynamics, and companies must ensure their products meet the highest standards of quality and hygiene. In conclusion, the market in developing countries is poised for growth due to changing consumer preferences, increasing disposable income, and the convenience of packaged food products and organized retailing.

- Manufacturers must focus on product development, quality control, and competitor analysis to meet the evolving demands of consumers and maintain market share.

What are the market trends shaping the Tissue Paper Industry?

- The e-commerce market is experiencing significant growth, with an increasing number of consumers preferring to shop online. This trend is expected to continue, making e-commerce a mandatory focus for businesses aiming to remain competitive.

- The market is experiencing significant growth due to various factors. Product differentiation through ply count and manufacturing processes is a key driver, as companies cater to diverse consumer preferences. Cost optimization is another crucial factor, with companies focusing on supply chain efficiency and the use of raw materials like wood fiber. In the personal care and household goods sectors, brand loyalty plays a significant role, with consumers seeking reliable and eco-friendly options. Environmental impact is increasingly important, and companies are responding by adopting sustainable manufacturing practices. Online sales channels are gaining traction, with companies offering discounts to encourage purchases and expand their reach.

- As internet penetration rises, consumers are becoming more aware of the convenience and wide product offerings available online. This shift towards e-commerce is expected to continue, further fueling market growth. In conclusion, the market is witnessing dynamic changes, with a focus on product differentiation, cost optimization, and sustainability. The increasing importance of online sales channels, driven by rising internet penetration and consumer preferences, is a significant trend shaping the market's future.

What challenges does the Tissue Paper Industry face during its growth?

- The presence of formidable alternatives poses a significant challenge to the expansion of the industry.

- The market encompasses various sheet sizes used in bathroom tissue, retail packaging, and consumer goods. The production capacity for tissue paper is substantial, with key drivers being consumer preferences and recycling rates. However, the growth potential of the market may be impacted by the increasing popularity of alternative materials, such as recycled pulp, bamboo fiber, and hand dryers. While these alternatives offer sustainability benefits, they may also pose a threat to traditional tissue paper sales, particularly in the paper towel segment.

- Hand dryers, gaining prominence in commercial settings like hotels, restaurants, and workplaces, offer convenience and minimal paper wastage. Yet, their high initial investment and maintenance costs hinder widespread adoption. Overall, the market dynamics necessitate a balanced approach to growth, incorporating both traditional and innovative solutions.

Exclusive Customer Landscape

The tissue paper market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tissue paper market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, tissue paper market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Asia Pulp and Paper APP Sinar Mas - The company specializes in the production and distribution of a range of tissue products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asia Pulp and Paper APP Sinar Mas

- Kimberly Clark Corp.

- CMPC SA

- Svenska Cellulosa AB (SCA)

- The Procter and Gamble Co.

- Hengan International Group Co. Ltd.

- Cascades Inc.

- Unicharm Corp.

- Georgia-Pacific LLC

- Carmen Tissues SAE

- Clearwater Paper Corp.

- Koch Industries Inc.

- Kruger Inc.

- Sofidel Group

- The SCA Group LLC

- Unicharm Corp.

- Unilever PLC

- Irving Tissue

- Asia Symbol (Guangdong) Paper Co., Ltd.

- Stora Enso Oyj

- Metsa Tissue Corporation

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Tissue Paper Market

- In March 2024, Procter & Gamble (P&G), a leading consumer goods company, introduced a new line of eco-friendly tissue paper products under its brand, Bounty, in the US market. This expansion aimed to cater to the growing demand for sustainable tissue paper options (P&G Press Release, 2024).

- In July 2024, Kimberly-Clark and Sofidel, two major tissue paper manufacturers, announced a strategic partnership to co-develop and manufacture innovative tissue products. This collaboration was expected to strengthen both companies' market positions and enhance their product offerings (Kimberly-Clark Press Release, 2024).

- In November 2024, Hengan International Group, a leading Chinese tissue paper manufacturer, completed the acquisition of a tissue paper mill in Indonesia from APP, Asia Pulp & Paper. This acquisition marked Hengan's entry into the Indonesian market and expanded its production capacity significantly (Hengan International Press Release, 2024).

- In January 2025, the European Union (EU) passed new regulations on single-use plastics, including plastic-coated tissue paper. This policy change put pressure on tissue paper manufacturers to develop and promote eco-friendly alternatives, creating a significant opportunity for companies offering sustainable tissue paper solutions (European Parliament Press Release, 2025).

Research Analyst Overview

- The market exhibits dynamic consumer behavior, with purchase habits influenced by various factors such as embossed patterns, brand awareness, and antibacterial properties. Product innovation continues to drive market trends, with companies exploring carbon footprint reduction through forestry management and the use of renewable resources. Sustainable sourcing and biodegradable plastics are becoming increasingly important in the industry. Social media marketing and pay-per-click advertising are effective strategies for reaching target audiences. Product life cycle management is crucial for maintaining competitiveness, with companies focusing on content marketing, customer segmentation, and digital marketing to enhance brand awareness.

- Printing techniques, such as water footprint minimization and the use of coloring agents, are also key areas of innovation in the tissue paper industry. The innovation pipeline includes advancements in tissue paper grades and the integration of biodegradable plastics, further shaping market dynamics.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Tissue Paper Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2025-2029 |

USD 30 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, China, India, Germany, Japan, UK, Canada, France, Brazil, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Tissue Paper Market Research and Growth Report?

- CAGR of the Tissue Paper industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the tissue paper market growth of industry companies

We can help! Our analysts can customize this tissue paper market research report to meet your requirements.