Titanates Market Size 2024-2028

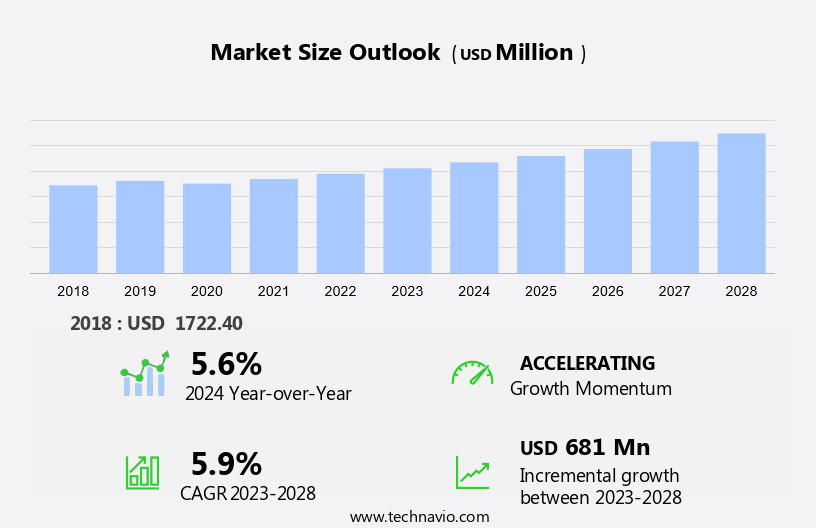

The titanates market size is forecast to increase by USD 681 million at a CAGR of 5.9% between 2023 and 2028.

- The market is experiencing significant growth due to the expansion of the automotive sector, which is driving the demand for advanced materials. Another trend influencing market growth is the emergence of nanostructured titanates, offering enhanced properties and applications. However, high production costs associated with titanates remain a challenge for market growth. Producers must find ways to reduce costs while maintaining product quality to remain competitive. Titanates, a class of complex titanium oxides, are gaining popularity due to their unique properties, including high dielectric constant, high piezoelectricity, and excellent thermal stability. These properties make titanates suitable for various applications, including capacitors, piezoelectric sensors, and ceramic capacitors. Despite the challenges, the market is expected to grow steadily, driven by the increasing demand for advanced materials in various industries.

What will be the Size of the Titanates Market During the Forecast Period?

- The market encompasses a range of titanate-based products, including foundry processes, automotive components, capacitors, energy storage systems, battery technology, optical instruments, and various industrial applications. Lithium titanate, barium titanate, and aluminum titanate are key types of titanates, each with distinct properties. Lithium titanate is known for its electrochemical stability and high energy density, making it a popular choice for batteries. Barium titanate functions as a dielectric material in capacitors, while piezoelectric titanates find use in sensors, microphones, and piezoelectric devices.

- Moreover, the market's growth is driven by the increasing demand for energy storage solutions, advanced electronics, and high-performance ceramics. Titanates' recharge lifecycles, energy density, and electrochemical stability make them valuable components in various industries, including refractories, catalysts, and jewelry. The market is expected to continue expanding, fueled by ongoing research and development efforts in energy storage, electronics, and advanced materials.

How is this Titanates Industry segmented and which is the largest segment?

The titanates industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Barium titanate

- Aluminum titanate

- Lithium titanate

- Strontium titanate

- Others

- Application

- Ceramics

- Automotive components

- Energy storage and batteries

- Optical instruments

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- South America

- Brazil

- Middle East and Africa

- APAC

By Type Insights

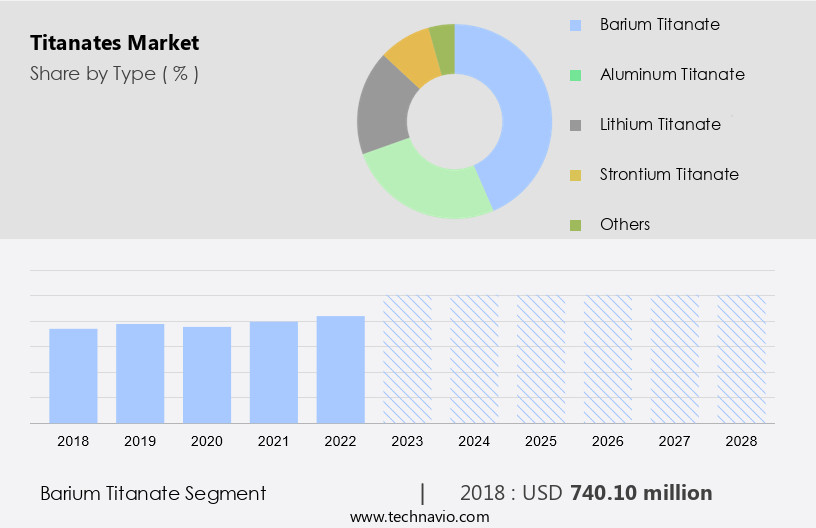

- The barium titanate segment is estimated to witness significant growth during the forecast period.

Barium titanate, a ferroelectric ceramic material, plays a pivotal role in various advanced industries due to its exceptional dielectric constant and piezoelectric properties. In the electronics sector, it is essential for manufacturing multilayer ceramic capacitors (MLCCs), which are integral to energy storage and signal filtering in electronic circuits. The high dielectric constant of barium titanate enables miniaturization while maintaining high capacitance, making it indispensable for modern electronics and telecommunications. MLCCs find applications in consumer electronics, automotive electronics, and telecommunications infrastructure, underscoring the importance of barium titanate In the electronics industry. The increasing demand for these capacitors highlights the necessity of barium titanate in developing efficient and advanced electronic devices.

Get a glance at the Titanates Industry report of share of various segments Request Free Sample

The barium titanate segment was valued at USD 740.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

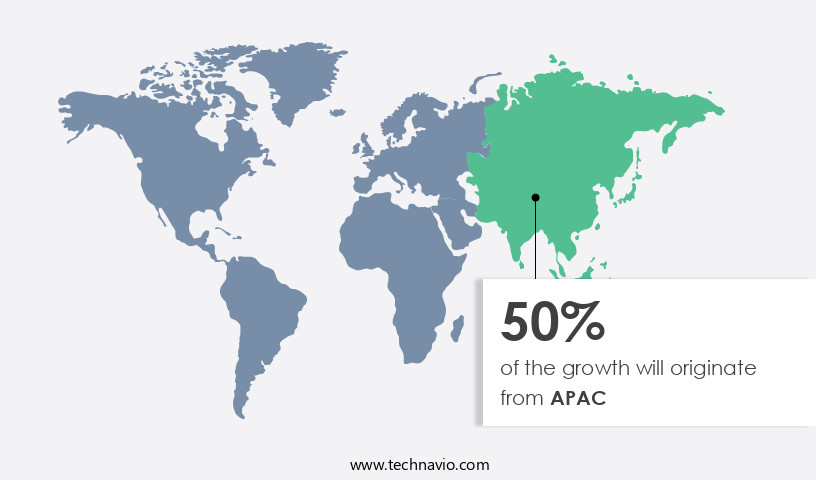

- APAC is estimated to contribute 50% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market experiences substantial growth, particularly In the Asia Pacific region, due to expanding automotive sales and renewable energy initiatives. In India, passenger vehicle sales rose by 3.2% year-over-year in December 2023, reaching approximately 242,920 units, with overall vehicle sales increasing by 7.4% to around 1,247,614 units. This growth is driven by the demand for components that improve vehicle performance, fuel efficiency, and safety, including those utilizing titanate materials. China, the world's largest automobile market, also contributes significantly to the market's growth. Titanates, such as Aluminum Titanate, Barium Titanate, and Lithium Titanate, are utilized in various industries, including electronics, energy storage, ceramics, refractories, catalysts, sensors, and piezoelectric devices.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Titanates Industry?

Growth in automotive sector is the key driver of the market.

- The market experiences significant growth, driven primarily by the automotive industry's adoption of advanced materials. Particularly In their nanostructured forms and as perovskite-based materials, titanates play a pivotal role in enhancing mechanical strength, reducing vehicle weight, and improving fuel efficiency. These benefits align with industry trends focusing on sustainable and high-performance vehicles. Nanostructured titanates find extensive use In the production of lightweight composites, which are integrated into various automotive components. These composites offer weight reduction without compromising strength or durability. Additionally, titanates contribute to various applications in electronics, energy storage systems, and other industries. In energy storage systems, lithium titanate is a critical material due to its electrochemical stability and high energy density.

- In addition, it offers superior recharge lifecycles and is a preferred choice for battery technology. Barium titanate, as a dielectric material, is widely used in capacitors, while its piezoelectric properties make it essential for microphones, transducers, and sensors. Titanates also find applications in renewable energy integration, such as in piezoelectric devices, thermistors, and pyroelectric properties for pulsed power systems (PPS). The market for titanates extends to various industries, including ceramics, refractories, catalysts, and sensors, further fueling its growth.

What are the market trends shaping the Titanates Industry?

Emergence of nanostructured titanates is the upcoming market trend.

- The market is witnessing significant advancements, primarily due to the emergence and utilization of nanostructured titanates. Nanostructured forms, including nanosheets, nanotubes, nanowires, and nanorods, offer enhanced properties for various industrial applications, particularly In the fields of catalysis and energy storage. The unique nanoscale structure of these materials facilitates improved ion diffusion, higher surface area, and superior interaction with other substances. A notable development in nanostructured titanates is the integration of platinum into titanate perovskites. This results In the formation of stable platinum nanoparticles upon heating to 700 degrees Celsius, leading to materials with significantly increased catalytic activity.

- Furthermore, in energy storage systems, titanates play a crucial role in battery technology through the use of lithium titanate. The electrochemical stability and energy density of lithium titanate make it an ideal choice for rechargeable lithium-ion batteries, contributing to the growth of the electric vehicle market. Barium titanate, another type of titanate, is widely used as a dielectric material and piezoelectric material in various industries, including optical instruments, microphones, transducers, and sensors. The lightweight nature of titanates, coupled with their high thermal stability, makes them suitable for applications in fuel efficiency, photovoltaic modules, and thermal shock resistance. Titanates also find applications in wastewater treatment, pulsed power systems, and ceramics.

What challenges does the Titanates Industry face during its growth?

High production costs associated with titanates is a key challenge affecting the industry growth.

- Titanates, a family of complex titanium oxides, are integral to various industries, including foundry processes, automotive components, energy storage systems, battery technology, optical instruments, and electronics. The production of titanates, primarily from titanium dioxide, involves energy-intensive and costly processes, such as mining, crushing, chemical separation, and the acquisition of additional raw materials like alkali metal hydroxides and acids. These factors contribute to the steep cost of titanates, with prices ranging from USD200 to USD2,000 per ton based on quality. Manufacturing titanates, particularly nanostructured varieties, necessitates advanced equipment, stringent control over reaction conditions, and sophisticated purification techniques, leading to substantial capital investment and operational expenses.

- Moreover, in the energy storage sector, titanates like lithium titanate and barium titanate are employed as dielectric and piezoelectric materials in capacitors, thermistors, pyroelectric properties, and ferroelectric properties. In the field of renewable energy integration, titanates play a crucial role in pulsed power systems (PPS), batteries, and photovoltaic modules, enhancing energy density, recharge lifecycles, and thermal shock resistance while minimizing thermal runaway risks. Titanates' unique properties make them indispensable in various applications, from automotive components and optical instruments to sensors, catalysts, and piezoelectric devices. Their role in improving battery performance and energy storage systems, as well as their applications in wastewater treatment and jewelry, further underscores their market significance.

Exclusive Customer Landscape

The titanates market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the titanates market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, titanates market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Enterprises

- Akaiyo Chem Tech

- Chem Pharma

- Dorf Ketal Chemicals I Pvt. Ltd.

- Huangshan KBR New Material Technology Co., Ltd.

- Kamman Group

- Kenrich Petrochemicals, Inc.

- Mitsubishi Gas Chemical Co. Inc.

- Nippon Chemical Industrial Co. Ltd.

- Otto Chemie Pvt. Ltd.

- Polygel Industries Pvt. Ltd.

- Roopal Products Inc.

- Sakai Chemical Industry Co. Ltd.

- Sigma Aldrich Chemicals Pvt Ltd

- Synthochem Pvt Ltd.

- TAM Ceramics Group of New York, LLC

- Thermograde Process Technology

- Titanates Ltd.

- Toho Titanium Co. Ltd.

- TPL,Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Titanates are a class of complex oxide materials, primarily composed of titanium and oxygen, with various other elements such as lithium, barium, aluminum, and strontium. These materials exhibit unique properties that make them valuable in various industries, including electronics, energy storage, foundry processes, and advanced materials. Titanates have gained significant attention In the energy storage sector due to their high electrochemical stability and excellent energy density. Lithium titanate, in particular, is a popular choice for cathode materials in lithium-ion batteries. The high electrochemical stability of lithium titanate enables it to operate at high temperatures and cycling rates, making it suitable for applications in electric vehicles and pulsed power systems.

Moreover, in the field of capacitors, titanates have been widely used due to their excellent dielectric and piezoelectric properties. Ceramic capacitors, which are made from barium titanate, are commonly used in electronic circuits due to their high capacitance, low equivalent series resistance, and high voltage rating. Barium titanate is also used in piezoelectric materials, which convert mechanical energy into electrical energy, and vice versa. These materials find applications in microphones, transducers, and sensors. The automotive industry is another significant consumer of titanates. Titanates are used as refractories in foundry processes due to their high melting points and excellent thermal shock resistance.

Furthermore, they are also used as catalysts In the production of automotive components, such as catalytic converters, due to their ability to promote chemical reactions at high temperatures. Titanates have also found applications In the renewable energy sector. In photovoltaic modules, titanates are used as electrodes due to their excellent electrical conductivity and stability. In wastewater treatment, titanates are used as adsorbents due to their high surface area and ability to adsorb pollutants. The market for titanates is driven by the increasing demand for lightweight materials, fuel efficiency, and energy storage solutions. The growing trend towards electric vehicles and renewable energy integration is expected to drive the demand for titanates In the energy storage sector.

In addition, the increasing use of titanates in foundry processes and advanced materials is also expected to contribute to the growth of the market. Despite the numerous benefits of titanates, there are challenges associated with their use. Thermal shock and thermal runaway are significant concerns In the energy storage sector, as high temperatures can lead to degradation of the material and safety issues. Therefore, research and development efforts are focused on improving the thermal stability of titanates and developing new applications that can mitigate these challenges. The growing demand for lightweight materials, fuel efficiency, and energy storage solutions is expected to drive the growth of the market. However, challenges associated with thermal stability and safety remain, and ongoing research and development efforts are necessary to address these challenges and expand the applications of titanates.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2024-2028 |

USD 681 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.6 |

|

Key countries |

China, US, Japan, Germany, South Korea, India, France, Canada, Brazil, and UK |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Titanates Market Research and Growth Report?

- CAGR of the Titanates industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the titanates market growth of industry companies

We can help! Our analysts can customize this titanates market research report to meet your requirements.