Titanium Mill Products Market Size 2025-2029

The titanium mill products market size is forecast to increase by USD 636.4 million, at a CAGR of 3.4% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing applications of titanium in various industries, particularly in aerospace and automotive sectors. The material's high strength-to-weight ratio, corrosion resistance, and excellent mechanical properties make it an ideal choice for manufacturing lightweight and durable components. Advancements in manufacturing technologies, such as additive manufacturing and forging, are driving the production of high-quality and cost-effective titanium mill products. However, the market faces challenges due to the high cost of titanium mill products. The complex and energy-intensive production process, coupled with the scarcity of titanium ore, contributes to the elevated prices. Advancements in manufacturing technologies, such as additive manufacturing and powder metallurgy, aim to reduce production costs and improve efficiency. Nevertheless, these innovations may not fully mitigate the high cost barrier, necessitating ongoing research and development efforts to optimize production processes and explore alternative sources of titanium.

- Companies seeking to capitalize on the market's growth potential must navigate these challenges by focusing on cost reduction strategies, exploring new applications, and collaborating with technology partners to stay competitive in the evolving landscape.

What will be the Size of the Titanium Mill Products Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Titanium mill products continue to gain momentum in various industries due to their unique properties, including high strength-to-weight ratio and excellent corrosion resistance. This continuous evolution of market dynamics is driven by ongoing research and development efforts in marine engineering, environmental impact, regulatory compliance, and sustainability initiatives. In marine engineering, titanium's lightweight and robustness make it an ideal choice for constructing ships and offshore platforms. However, its use comes with environmental concerns, necessitating stringent regulatory compliance. To mitigate this, sustainability initiatives are being explored, such as the recycling of titanium scrap and the development of closed-loop production systems.

Titanium alloys, surface treatment, and heat treatment are essential processes in enhancing the material's properties for diverse applications. For instance, in the defense industries, titanium's high yield strength and creep resistance make it an essential component in manufacturing aircraft and military vehicles. In the consumer electronics sector, titanium's fatigue strength and lifecycle assessment make it a preferred material for manufacturing batteries and other high-performance components. The evolving patterns in the market also extend to the manufacturing processes themselves. Technological advancements in additive manufacturing, 3D printing, and powder metallurgy are transforming the way titanium products are produced, offering improved product development and quality control.

Moreover, the market is subject to industry regulations and safety standards, which impact pricing strategies and supply chain management. For example, in the oil and gas industry, titanium tubes are used extensively due to their excellent resistance to harsh environments. However, the industry's regulatory landscape and safety standards necessitate stringent quality control measures and rigorous testing procedures. In conclusion, the market is a dynamic and evolving landscape, shaped by ongoing research and development efforts, regulatory compliance, sustainability initiatives, and technological advancements. From marine engineering and environmental impact to consumer electronics and defense industries, titanium's unique properties continue to make it a sought-after material across various sectors.

How is this Titanium Mill Products Industry segmented?

The titanium mill products industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Industrial

- Commercial aerospace

- Defense

- Product

- Sheets and plates

- Billets and bars

- Others

- Grade Type

- Titanium alloys

- Commercially pure titanium (grades 1-4)

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

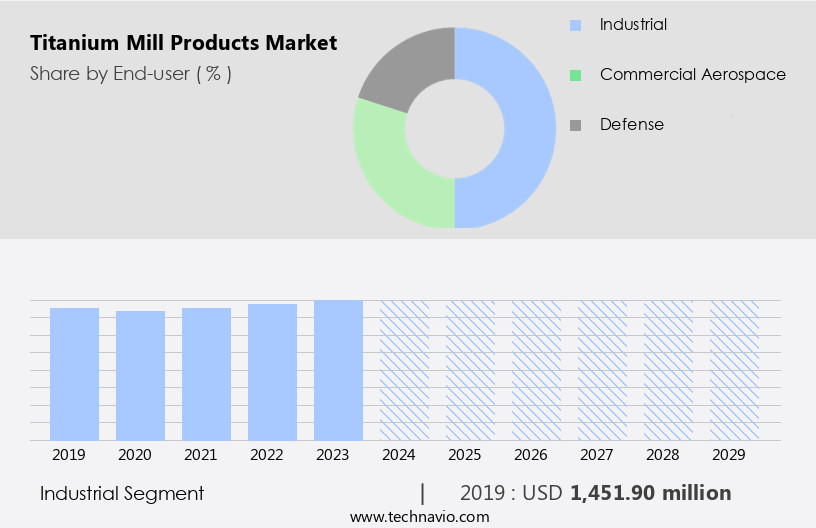

The industrial segment is estimated to witness significant growth during the forecast period.

Titanium, known for its high-strength-to-weight ratio, is a versatile metal with various applications in numerous industries. Established uses include power generation, healthcare, chemical processing, and desalination plants. The expansion of Southeast Asia and China's markets for titanium-intensive industrial equipment has fueled significant growth. Emerging applications encompass energy sectors like oil and gas, architecture, and transportation. Despite its premium price compared to steel and aluminum, titanium's superior properties, such as longevity, durability, and environmental sustainability, make it a preferred choice over the long term. Aerospace, sporting goods, medical implants, and consumer electronics are other sectors benefiting from titanium's unique characteristics. Advanced manufacturing techniques, including forging, casting, 3D printing, and powder metallurgy, contribute to the material's diverse product offerings.

Titanium's high tensile strength, fatigue resistance, and corrosion resistance make it an essential component in defense industries and marine engineering. The industry adheres to stringent regulatory compliance and sustainability initiatives to minimize environmental impact. Titanium alloys, surface treatments, and heat treatments further enhance its properties for specific applications. Titanium's yield strength, creep resistance, and lifecycle assessment ensure quality control and cost-effectiveness. Titanium scrap recycling and supply chain management are crucial aspects of the industry's circular economy. The market's evolution involves addressing challenges such as raw material sourcing, pricing strategies, and safety standards while catering to evolving customer needs.

The Industrial segment was valued at USD 1451.90 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

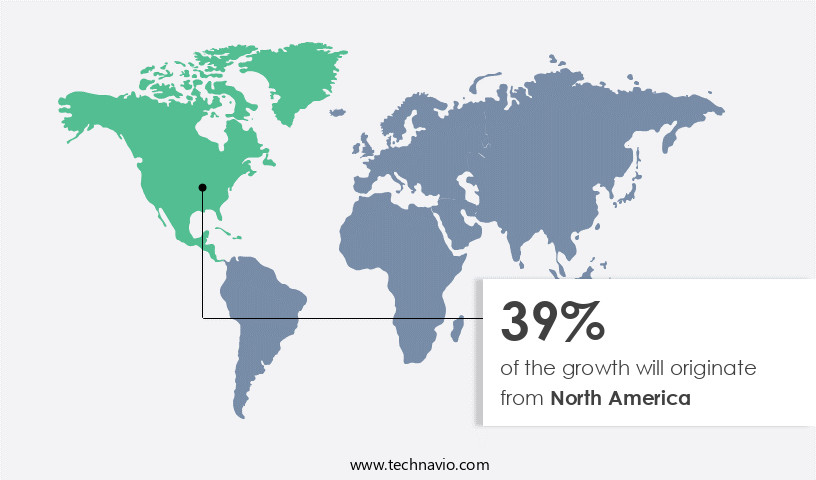

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market for titanium mill products experiences significant activity due to its prominent role as a producer and consumer in the global industry. The region's thriving aerospace, defense, medical, and industrial sectors fuel the demand for these products. In the aerospace industry, the high tensile strength, yield strength, creep resistance, and corrosion resistance of titanium make it an indispensable material for manufacturing critical components such as engine parts, landing gears, and structural elements. Major aerospace manufacturers, including Boeing and Airbus, based in North America, heavily rely on titanium mill products for their production processes. Additionally, the region's automotive, marine engineering, consumer electronics, and defense industries also contribute to the market's growth.

Raw material sourcing, chemical processing, and 3D printing are essential techniques used in the production of titanium mill products. Sustainability initiatives and regulatory compliance are crucial factors influencing the market, with an increasing focus on the environmental impact of production processes and the implementation of safety standards. Titanium mill products find extensive applications in various industries, including sporting goods, medical implants, and oil and gas. Product development, titanium extrusion, titanium forging, titanium casting, and surface treatment are some of the key manufacturing processes employed in the industry. The market's dynamics are further influenced by pricing strategies, supply chain management, and the availability of titanium scrap.

Titanium alloys, such as titanium-aluminum and titanium-molybdenum, are increasingly used due to their superior properties. The market's future trends include the adoption of advanced manufacturing techniques, such as additive manufacturing and powder metallurgy, and the development of new applications in emerging industries.

Market Dynamics

The global titanium mill products market is experiencing robust growth, driven by increasing demand across high-performance industries. The expanding global titanium mill products market size and dynamic titanium mill products market trends are fueled by strong titanium mill products market growth drivers. Key products include titanium sheets, titanium plates, titanium bars, titanium tubes, and titanium pipes, often composed of specialized titanium alloys. These forms are critical in Aerospace & Defense for lightweight aircraft components, and for Medical implants due to titanium's biocompatibility. The Chemical processing industry also heavily utilizes titanium for its superior corrosion resistance, as does the Marine industry. Advancements in manufacturing processes like titanium melting, hot rolling (titanium), cold rolling (titanium), forging (titanium), and casting (titanium) are enhancing product quality and efficiency. Furthermore, additive manufacturing (titanium 3D printing) is revolutionizing the production of complex titanium parts.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Titanium Mill Products Industry?

- The significant expansion of applications for titanium is the primary catalyst fueling market growth.

- Titanium mill products have gained significant attention in various industries due to their high-strength-to-weight ratio and exceptional resistance to corrosion. Beyond aerospace, chemical processing, power, and healthcare, titanium is increasingly used in marine, food, flue gas desulphurization, downhole oil and gas, petroleum processing, chlor-alkali processing, offshore oil and gas, and pulp and paper. The demand for titanium-based products stems from their resistance to solutions of hypochlorite, chlorate, perchlorate, chlorite, and chlorine dioxide. For instance, in the paper and pulp industry, titanium-based equipment has proven effective in handling these chemicals without corrosion. Titanium mill products come in various forms, including titanium forging, casting, bars, plates, ingots, sheets, and 3D printing.

- These products undergo chemical processing using titanium chloride to produce the final forms. The versatility of titanium mill products allows them to cater to diverse industries, making them an indispensable material in numerous applications. The increasing demand for lightweight, strong, and corrosion-resistant materials further propels the growth of the market.

What are the market trends shaping the Titanium Mill Products Industry?

- The current market trend reflects a significant advancement in manufacturing technologies. This progression is characterized by the adoption of innovative techniques and automation processes to enhance productivity and efficiency.

- The market has experienced notable progress due to technological advancements, particularly in manufacturing processes. One significant development is the integration of additive manufacturing, or 3D printing, which enables the creation of intricate designs and complex geometries, previously challenging with traditional methods. Additive manufacturing reduces material waste and offers greater design flexibility. Another key area of growth is in the aerospace industry, where the high fatigue strength and lightweight properties of titanium make it an ideal material for aircraft components. In the sporting goods sector, titanium's durability and resistance to corrosion have led to its increased use in golf clubs and other equipment.

- Product development in titanium extrusion, powder metallurgy, and chemical milling continues to expand the applications of titanium mill products in industries such as medical implants and industrial machinery. Effective supply chain management is essential to maintain the demand for titanium mill products, ensuring a steady flow of raw materials and finished goods to meet market needs.

What challenges does the Titanium Mill Products Industry face during its growth?

- The escalating costs of titanium mill products pose a significant challenge and hinder the growth of the industry.

- Titanium mill products are sought after for their superior properties, including high strength-to-weight ratio, corrosion resistance, and heat resistance. However, the high cost of producing these metals is a significant challenge in the global market. The extraction process for titanium ore, such as rutile or ilmenite, is complex and costly due to the low concentration of the ore in the earth's crust. The process involves multiple stages, including crushing, grinding, magnetic separation, and chemical treatments, which add to the overall cost. Moreover, regulatory compliance and environmental impact are critical factors influencing the market. Sustainability initiatives and the need for regulatory compliance are driving the demand for surface treatment and heat treatment processes to minimize the environmental footprint of titanium mill products.

- The marine engineering industry, consumer electronics, and defense industries are significant consumers of titanium alloys, which require high yield strength and durability. Titanium dioxide, a common pigment, is another major application for titanium mill products. Despite the challenges, the market for titanium mill products continues to grow due to the increasing demand for lightweight and durable materials in various industries.

Exclusive Customer Landscape

The titanium mill products market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the titanium mill products market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, titanium mill products market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acerinox SA

- Allegheny Technologies Inc.

- Auremo GmbH

- BAOTI Group Co. Ltd.

- Eastern Alloys Inc.

- Kobe Steel Ltd.

- Nippon Steel Corp.

- Norsk Titanium AS

- OSAKA Titanium Technologies Co. Ltd.

- Precision Castparts Corp.

- Reliance Inc.

- Rostec

- Smiths Metal Centres Ltd.

- Supra Alloys

- Titan Engineering Pte Ltd.

- Titanium Industries Inc.

- Toho Titanium Co. Ltd.

- Tricor Metals Inc.

- United Titanium Inc.

- Western Superconducting Technologies Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Titanium Mill Products Market

- In January 2024, Titanium Metals Corporation, a leading titanium mill products manufacturer, announced the launch of its new Ti-6Al-4V anode product line for the aluminum industry (Titanium Metals Corporation press release). This new product line is expected to enhance the company's market presence and cater to the increasing demand for high-performance anodes in the aluminum industry.

- In March 2024, titanium mill products manufacturer, Aerospace Titanium, entered into a strategic partnership with Boeing to supply advanced titanium alloys for various aerospace applications (Boeing press release). This collaboration is expected to strengthen Aerospace Titanium's position in the aerospace sector and contribute significantly to its revenue growth.

- In May 2025, titanium mill products manufacturer, Titanium Industries, completed the acquisition of its major competitor, Millennium Alloys, for approximately USD300 million (Titanium Industries SEC filing). This acquisition is expected to expand Titanium Industries' product portfolio, increase its market share, and improve its operational efficiency.

- In the same month, the European Union passed the new REACH regulation, which includes titanium dioxide on the candidate list for potential restriction (European Chemicals Agency press release). This regulatory development may lead to increased demand for alternative titanium mill products, such as titanium sponge and titanium pigments, as companies seek to comply with the new regulations.

Research Analyst Overview

- In the dynamic market, various processing techniques and testing methods play crucial roles in shaping the industry's landscape. Grade 2 titanium undergoes hot rolling and plasma arc welding for manufacturing large components, while precision casting and investment casting are preferred for intricate parts. Radiographic testing, ultrasonic testing, and non-destructive testing (NDT) ensure product quality and reliability. Resistance welding and laser cutting are essential for joining and shaping titanium alloys, such as grade 5 titanium, while microstructural analysis and corrosion testing help optimize their properties.

- Titanium nitride and titanium carbide coatings enhance surface durability and biocompatibility. Powder injection molding and die casting offer flexibility in producing complex geometries, while CNC machining and forging dies cater to mass production requirements. Fatigue testing and biocompatibility testing are essential for assessing the performance and safety of titanium components in diverse applications.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Titanium Mill Products Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.4% |

|

Market growth 2025-2029 |

USD 636.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, China, Canada, Japan, Germany, India, UK, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Titanium Mill Products Market Research and Growth Report?

- CAGR of the Titanium Mill Products industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the titanium mill products market growth of industry companies

We can help! Our analysts can customize this titanium mill products market research report to meet your requirements.