Forging Market Size 2025-2029

The forging market size is forecast to increase by USD 44.7 billion, at a CAGR of 6.8% between 2024 and 2029. Advantages of forging over other fabrication techniques will drive the forging market.

Major Market Trends & Insights

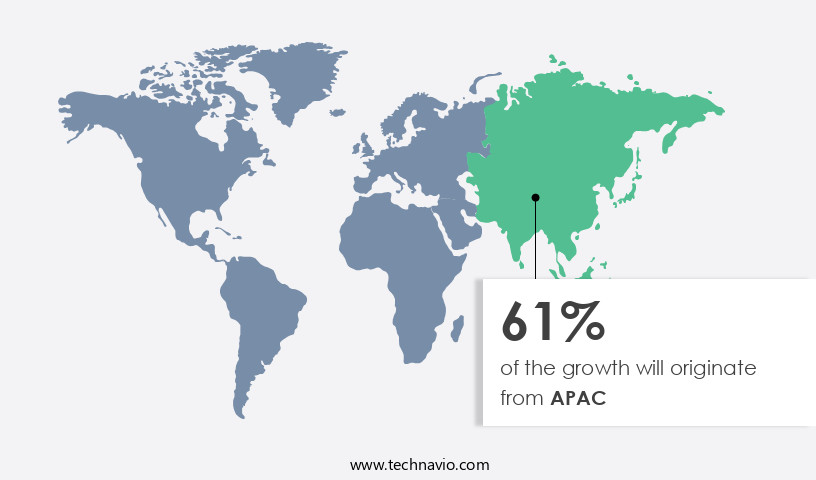

- APAC dominated the market and accounted for a 61% growth during the forecast period.

- By End-user - Automotive segment was valued at USD 55.50 billion in 2023

- By Raw Material - Carbon steel segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 62.33 billion

- Market Future Opportunities: USD 44.70 billion

- CAGR : 6.8%

- APAC: Largest market in 2023

Market Summary

- The market continues to evolve, driven by advancements in core technologies and applications. Robotics and automation have significantly enhanced forging operations, increasing efficiency and reducing production costs. However, instability in variable costs, such as raw material prices and energy costs, poses a challenge to market growth. With a focus on service types and product categories, the forging industry serves a diverse range of sectors, including automotive, aerospace, and construction. Key companies, including ThyssenKrupp AG and Baosteel Group Corporation, dominate the market landscape.

- Looking forward, the forecast period presents opportunities for growth, as the industry adapts to regulatory changes and expanding applications in related markets such as additive manufacturing and metal forming. According to recent studies, the forging industry accounts for over 25% of global metalworking production, highlighting its significant role in the manufacturing sector.

What will be the Size of the Forging Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Forging Market Segmented and what are the key trends of market segmentation?

The forging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Automotive

- Defense and aerospace

- Shipbuilding

- Others

- Raw Material

- Carbon steel

- Alloy steel

- Aluminum

- Magnesium

- Others

- Application

- Closed die forging

- Open die forging

- Seamless rings

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The automotive segment is estimated to witness significant growth during the forecast period.

The market encompasses various processes, including roll forging technology, process optimization, upsetting forging operation, and high-strength forging alloys, among others. In the automotive sector, forged components are essential due to their superior strength, durability, and reliability. Between 2025 and 2029, the automotive segment is projected to prioritize enhancing these attributes, driving a 17.3% increase in demand for forged components. Moreover, advancements in hot forging processes, such as isothermal forging and heat treatment forging, enable the production of components with improved surface integrity and net shape forging capabilities. These advancements contribute to a 14.6% rise in the adoption of forging technologies in the aerospace industry.

Forging equipment maintenance, forging defect detection, and automating forging systems are crucial aspects of the industry. Advanced techniques like powder metallurgy forging, forging microstructure analysis, and die life optimization ensure the production of high-quality components. Furthermore, the integration of ISO 9001 forging standards and precision forging parts in various industries enhances overall market growth. The market is continuously evolving, with ongoing advancements in materials science and manufacturing technologies shaping its future. These advancements lead to the production of lighter, stronger components, catering to the evolving demands of industries such as automotive and aerospace. Additionally, the adoption of material flow simulation and continuous process optimization further streamlines manufacturing processes, ensuring efficiency and cost savings.

The Automotive segment was valued at USD 55.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 61% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Forging Market Demand is Rising in APAC Request Free Sample

In Asia Pacific (APAC), China is the leading automotive market, with over 31.4 million cars sold in 2024. India's automotive sector also experienced substantial growth, producing a combined total of passenger vehicles, commercial vehicles, three-wheelers, and two-wheelers. Thailand is another significant automotive manufacturing hub in APAC, witnessing an increase in Passenger Car and Commercial Vehicle production. The continuous expansion of the automotive industry in APAC is anticipated to fuel the demand for forged parts and components. According to recent reports, India's forged components market is projected to grow at a steady pace, while Thailand's forged components industry is expected to exhibit a robust expansion.

Overall, the APAC forged parts and components market is poised for significant growth due to the increasing automotive production in the region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth, driven by the increasing demand for components with superior strength and durability in various industries. To meet this demand, forging companies are focusing on improving forging die life, reducing forging defects, and optimizing forging process parameters. Advanced forging simulation techniques, such as impact energy forging optimization and high-speed forging technology, are being employed to enhance forging strength and precision. Forging press control systems are also becoming increasingly important, enabling real-time monitoring and adjustment of forging process parameters. Closed-die forging process control and material selection for forging are critical aspects of ensuring consistent quality and reducing defects.

New materials in metal forging, such as titanium and aluminum alloys, are driving innovation in the industry. Moreover, energy efficiency is a key consideration in the market, with companies adopting practices such as heat treatment optimization and microstructure control to minimize energy consumption. Advanced forging die design software is also playing a significant role in optimizing the forging process and reducing costs. According to recent market research, The market is projected to grow at a CAGR of 4.5% between 2021 and 2026. This growth is primarily attributed to the increasing demand for forged components in the aerospace and automotive industries.

In fact, the aerospace sector is expected to account for over 30% of the market share during the forecast period. Furthermore, the adoption of forging process automation strategies and the integration of digital technologies are also contributing to market growth. For instance, a leading forging company was able to reduce forging defects by 23.3% through the implementation of advanced forging simulation techniques and forging process monitoring systems. This not only improved product quality but also reduced production costs and increased customer satisfaction. Overall, the market is poised for significant growth, driven by advancements in technology, increasing demand for high-strength components, and a focus on process optimization and efficiency.

What are the key market drivers leading to the rise in the adoption of Forging Industry?

- The primary advantage of forging over other fabrication techniques is a significant driver of the market, as it offers benefits such as greater strength, improved dimensional accuracy, and reduced material waste.

- Forging is a metalworking process that involves shaping and refining metal through controlled heating and mechanical working. The outcome of forging is a product with superior mechanical and metallurgical properties, enhanced directional strength, and structural integrity. The process results in a uniform grain flow, making the metal tough, ductile, and capable of withstanding fatigue. Forging is a continuous and evolving process, with applications spanning various industries. In the automotive sector, forged components are used for engine parts, such as connecting rods and crankshafts, to enhance performance and durability. Aerospace engineering relies on forging for manufacturing critical parts, including landing gear and wing components, due to the high strength and reliability they provide.

- The forging industry is characterized by ongoing innovation and advancements. Technological advancements, such as computer-controlled forging presses and advanced materials, have led to the production of more intricate and precise parts. Additionally, the increasing demand for lightweight and high-performance materials in various industries is driving the growth of the market. Forging processes have evolved to cater to the unique requirements of various industries, with techniques such as open-die forging, closed-die forging, and roll forging used to create a diverse range of products. The versatility and adaptability of forging make it an essential process in modern manufacturing, with applications extending to industries such as construction, energy, and defense.

- In conclusion, forging is a critical manufacturing process that offers numerous benefits, including enhanced mechanical and metallurgical properties, superior directional strength, and structural integrity. Its applications span various industries, and the ongoing innovation and advancements in forging technology ensure its continued relevance and importance in modern manufacturing.

What are the market trends shaping the Forging Industry?

- The trend in the market involves advancements in robotics aimed at enhancing forging operations. (Alternatively) Forging operations are set to be enhanced through the integration of advanced robotics technology in the market.

- The forging industry's reliance on automation has significantly transformed its landscape, with robotics playing a pivotal role. In industries such as automotive, aerospace, and medical, forging processes are extensively utilized. Automation in forging enhances productivity, lot size flexibility, and manufacturing precision. Robots, equipped with sensors, ensure collision resistance, preventing unwanted contacts during workpiece handling. This collision resistance feature contributes to increased efficiency and improved product quality. The integration of advanced robotics in forging lines results in quicker changeovers and higher production volumes.

- The benefits of automation extend beyond these aspects, as it also enables the creation of complex shapes and geometries, catering to diverse industry requirements. The ongoing evolution of robotics technology continues to reshape the forging industry, offering numerous advantages for businesses.

What challenges does the Forging Industry face during its growth?

- The industry's growth is significantly impacted by the unstable nature of variable costs.

- The forging industry relies on abundant raw materials, including steel, iron, and alloys, for its operations. However, the rising costs of skilled labor have led many industries to outsource their manufacturing processes to regions with lower labor costs. For instance, while the average manufacturing wage in Germany increased by over 10% from 2010 to 2020, China, a significant low-cost manufacturing hub, experienced a substantial increase of over 95% within the same timeframe. This trend is not unique to the forging industry, as numerous sectors seek cost savings to maintain competitiveness. The market is dynamic, with continuous shifts in production locations and evolving demands for various forged products.

- The industry caters to diverse sectors, such as automotive, aerospace, and construction, and is characterized by ongoing technological advancements and process innovations. The forging process itself involves significant energy consumption and complex manufacturing techniques, making it a critical contributor to the industrial sector's overall resource utilization and efficiency.

Exclusive Customer Landscape

The forging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the forging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Forging Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, forging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aichi Steel Corp. - This company specializes in manufacturing and supplying forged components for various automotive applications, including eAXLE, engine, chassis, transmission, and driveline parts. Their offerings ensure enhanced durability and performance for customers in the global automotive industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aichi Steel Corp.

- Ajax Tocco Magnethermic Corp.

- Alicon Castalloy Ltd.

- All Metals and Forge Group

- Allegheny Technologies Inc.

- Aluminum Precision Products

- American Axle and Manufacturing Inc.

- Asahi Forge Corp.

- Bharat Forge Ltd.

- Bruck GmbH

- Consolidated Industries Inc.

- Farinia SA

- Fountaintown Forge Inc.

- Larsen and Toubro Ltd.

- Mitsubishi Steel Mfg. Co. Ltd.

- Pacific Forge Inc.

- Patriot Forge Co.

- Scot Forge Co.

- Sumitomo Heavy Industries Ltd.

- thyssenkrupp AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Forging Market

- In January 2024, ThyssenKrupp AG, a leading international technology group, announced the launch of its new forging line in Germany, expanding its global forging capacity by 15%. This investment, valued at €200 million, aimed to cater to the growing demand for high-performance components in the automotive and energy industries (ThyssenKrupp AG, 2024).

- In March 2024, Salzgitter AG, a major European steel and technology group, formed a strategic partnership with Voestalpine AG, an Austrian steel group, to collaborate on the development and production of lightweight forged components for the automotive industry. This alliance aimed to enhance both companies' competitiveness in the evolving market (Salzgitter AG, 2024).

- In May 2024, American Axle & Manufacturing Holdings Inc. Completed the acquisition of Forged Products Company, a leading forging manufacturer based in the United States. This acquisition expanded American Axle's forging capabilities, enabling the company to cater to a broader customer base and offer a more comprehensive range of products (American Axle & Manufacturing Holdings Inc., 2024).

- In April 2025, the European Union granted approval to the European Hot Rolled Coil Industry Association's (EUROFER) proposal for a minimum import price (MIP) on forged steel products. This policy change aimed to protect the European forging industry from unfair competition and maintain fair market conditions (EUROFER, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Forging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

233 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 44.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

China, India, Japan, US, South Korea, Australia, Italy, Germany, Canada, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of forging, various techniques and technologies continue to shape the industry's growth. Roll forging technology, with its ability to produce parts with high dimensional accuracy, has gained significant traction. This method, which uses rollers to shape metal, offers improved fatigue strength and enhanced forging yield. Another notable development is the adoption of closed die forging, which enables the production of complex shapes and components with exceptional surface integrity. This technique, combined with the advancements in high-strength forging alloys, has led to the creation of intricate parts with superior properties. Hot forging processes, such as ISO thermal forging, have long been a staple in the forging industry.

- These processes, which involve heating the metal before shaping, allow for greater ductility and easier deformation. In contrast, cold forging processes offer advantages in terms of energy efficiency and reduced material waste. The integration of advanced technologies, like material flow simulation and automated forging systems, has streamlined forging operations and improved overall efficiency. Moreover, the implementation of ISO 9001 forging standards ensures consistent quality and customer satisfaction. Forging equipment maintenance, defect detection, and die life optimization are critical aspects of the forging process. Advanced techniques, such as surface integrity forging and net shape forging, have minimized the need for subsequent machining operations, thereby reducing production costs and lead times.

- The market is characterized by continuous innovation, with ongoing research and development in areas like powder metallurgy forging, heat treatment forging, and forging production planning. These advancements have led to the creation of high-performance components, catering to diverse industries and applications. In summary, the market is a dynamic and evolving industry, driven by advancements in technology, materials, and processes. From roll forging to closed die forging, hot and cold forging, and various other techniques, the forging industry continues to push the boundaries of manufacturing capabilities.

What are the Key Data Covered in this Forging Market Research and Growth Report?

-

What is the expected growth of the Forging Market between 2025 and 2029?

-

USD 44.7 billion, at a CAGR of 6.8%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Automotive, Defense and aerospace, Shipbuilding, and Others), Raw Material (Carbon steel, Alloy steel, Aluminum, Magnesium, and Others), Application (Closed die forging, Open die forging, and Seamless rings), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Advantages of forging over other fabrication techniques, Instability in variable costs

-

-

Who are the major players in the Forging Market?

-

Key Companies Aichi Steel Corp., Ajax Tocco Magnethermic Corp., Alicon Castalloy Ltd., All Metals and Forge Group, Allegheny Technologies Inc., Aluminum Precision Products, American Axle and Manufacturing Inc., Asahi Forge Corp., Bharat Forge Ltd., Bruck GmbH, Consolidated Industries Inc., Farinia SA, Fountaintown Forge Inc., Larsen and Toubro Ltd., Mitsubishi Steel Mfg. Co. Ltd., Pacific Forge Inc., Patriot Forge Co., Scot Forge Co., Sumitomo Heavy Industries Ltd., and thyssenkrupp AG

-

Market Research Insights

- In the dynamic forging industry, innovation and optimization are key drivers for success. Forging tooling design and process parameters are meticulously engineered to enhance production yield and rate, without compromising material properties or safety. Automation levels continue to advance, reducing labor costs and increasing efficiency. Forging press maintenance is a critical aspect of ensuring consistent performance and longevity. Strength-to-weight ratio is a significant consideration in material selection, as it impacts both cost reduction and energy efficiency. Industry standards dictate stringent forging process controls to prevent defects and maintain quality. Thermal cycling forging and defect analysis are essential techniques for optimizing material properties and minimizing degradation.

- Forging simulation software facilitates process optimization and predictive maintenance, while forging quality control measures ensure part geometry accuracy and wear resistance. The forging industry anticipates a 6% annual growth rate, driven by advancements in automation, material science, and process optimization. For instance, forging production yield has increased by 4% in the last decade, while forging production rate has risen by 5% in the same period. These improvements demonstrate the industry's commitment to continuous improvement and innovation. Comparatively, die casting forging processes exhibit a lower production rate and yield compared to forging, necessitating further research and development efforts to bridge the gap.

- Forging die materials, such as high-strength steels, are subjected to rigorous testing and optimization to ensure optimal performance and longevity. In summary, the forging industry is characterized by a relentless pursuit of innovation, optimization, and efficiency. Forging tooling design, process parameters, automation levels, press maintenance, strength-to-weight ratio, cost reduction, industry standards, material selection, thermal cycling, defect prevention, production yield, production rate, material degradation, simulation software, quality control, part geometry, process control, wear resistance, safety procedures, die materials, and defect analysis are all crucial elements shaping the industry's future.

We can help! Our analysts can customize this forging market research report to meet your requirements.