Underground Mining Equipment Market Size 2024-2028

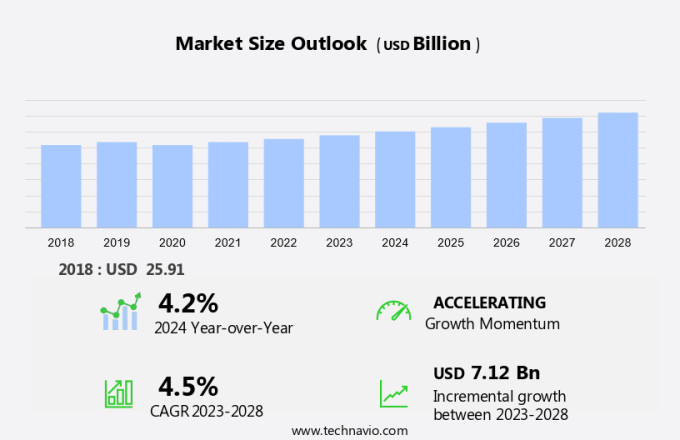

The underground mining equipment market size is forecast to increase by USD 7.12 billion, at a CAGR of 4.5% between 2023 and 2028.

- The market is driven by the availability of efficient and safe mining equipment, which is essential for optimizing mining operations and enhancing productivity in harsh underground conditions. Technological advances continue to shape the market, with innovations in automation, remote operation, and real-time monitoring systems transforming the underground mining landscape. However, the high cost of underground mining equipment poses a significant challenge for market growth. Mining companies must navigate this obstacle by exploring financing options, implementing cost-saving measures, and focusing on the long-term benefits of investing in advanced equipment.

- To capitalize on market opportunities, companies should prioritize research and development efforts, collaborate with technology providers, and maintain a strong focus on safety and efficiency. By addressing these challenges and embracing technological advancements, market players can effectively navigate the complexities of the market and position themselves for long-term success.

What will be the Size of the Underground Mining Equipment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution and dynamic nature, with ongoing advancements and applications across various sectors. Water management solutions are increasingly crucial for efficient mine operations, while service contracts ensure uninterrupted equipment functionality. Geotechnical engineering plays a pivotal role in mine development, ensuring stability and safety. Load haul dumpers and mining excavators are essential components of the mining process, with a focus on operational efficiency and energy consumption. Safety equipment, including personal protective equipment and mine safety regulations, are paramount to prevent accidents and ensure a healthy work environment. Mine planning and mine development involve the use of mining software and automation systems to optimize mine design and blast design.

Mine hoists and conveyor systems facilitate efficient material transport, while tunnel boring and ore sorting technologies enhance productivity and resource estimation. Remote control systems and autonomous vehicles are transforming the mining industry, enabling real-time monitoring and optimization of mining processes. Drilling machines and rock mechanics are integral to mine exploration and development, with a focus on reducing noise levels and improving fuel consumption. Mine reclamation and environmental remediation are becoming increasingly important, with a focus on minimizing the environmental impact of mining activities. Mine rescue and emergency response teams are essential for ensuring the safety of mining personnel, while spare parts and maintenance services ensure the longevity of mining equipment.

In the ever-changing landscape of the mining industry, these entities continue to unfold and evolve, shaping the market dynamics and driving innovation.

How is this Underground Mining Equipment Industry segmented?

The underground mining equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Room and pillar mining

- Longwall mining

- Borehole mining

- Others

- Geography

- North America

- US

- Europe

- Russia

- APAC

- Australia

- China

- India

- Rest of World (ROW)

- North America

.

By Application Insights

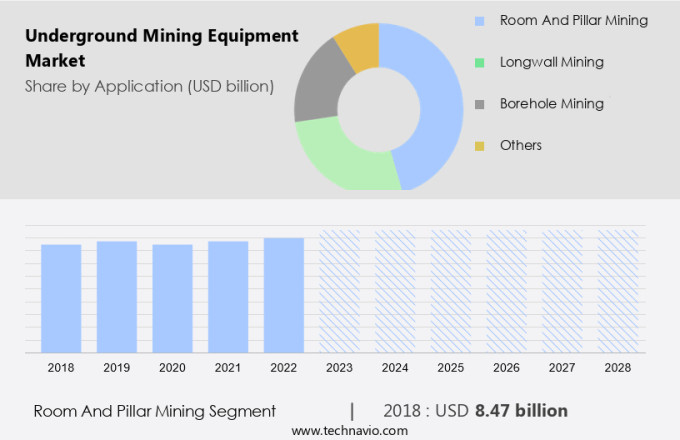

The room and pillar mining segment is estimated to witness significant growth during the forecast period.

In the realm of underground mining, room and pillar mining plays a significant role in extracting relatively flat-lying deposits of iron, coal, and base metal ores. This method involves mining a material across a horizontal plane, creating rooms and pillars. In the first phase, pillars are left intact to support the roof overburden, while the remaining areas are extracted. In the second phase, the pillars are partially extracted. Mining equipment essential for room and pillar mining includes haulage machines, mining drills, continuous miners, roof bolters, and scoops. Waste management is crucial in this process, with conveyor systems and trucks utilized for transporting extracted materials.

Mining software optimizes mine planning and resource estimation, ensuring operational efficiency. Noise reduction technology is integrated into mining equipment to minimize disturbances, while mine safety regulations govern the industry. Mine safety regulations necessitate the use of personal protective equipment and safety equipment. Mine rescue teams are on standby for emergency response situations. Mine development includes shaft sinking and mine hoists for vertical transportation. Blast design and energy efficiency are crucial factors in mine closure and environmental remediation. Mine reclamation and water management are integral parts of mine closure, ensuring minimal environmental impact. Service contracts for spare parts and maintenance are common in the mining industry.

Geotechnical engineering and rock mechanics are essential in mine planning and mine development. Automation systems and remote control technology increase operational efficiency and accident prevention. Fuel consumption is a concern in underground mining, with a growing emphasis on energy efficiency and autonomous vehicles. Dust control and health and safety are top priorities, with mine safety regulations mandating strict adherence to standards. Tunnel boring and ore sorting are advanced techniques used in modern mining operations. Ventilation systems ensure proper air circulation, while drilling machines are used for drilling and blasting operations. The mining industry continues to evolve, with a focus on innovation and sustainability.

The Room and pillar mining segment was valued at USD 8.47 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

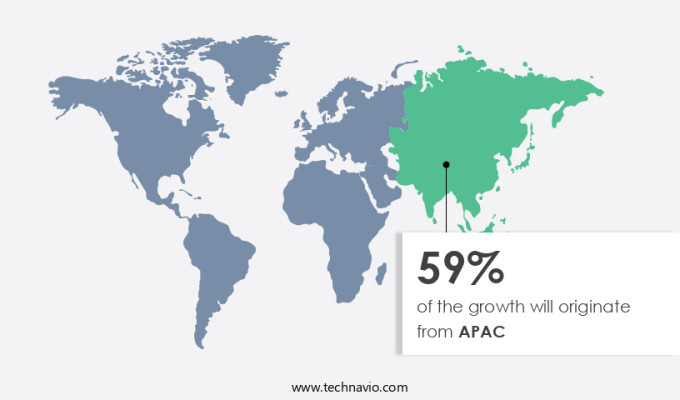

APAC is estimated to contribute 59% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to the increasing demand for metals and minerals, driven by the region's expanding population and urbanization. Coal, a primary energy source for APAC's thermal power plants, is a major contributor to this demand. As a result, coal mining activities are on the rise in countries like China and India, where population growth is rapid. Mine development, including shaft sinking and mine planning, is a crucial aspect of this industry. Mining software and automation systems are essential tools for optimizing operational efficiency and reducing noise and fuel consumption. Mine safety regulations mandate the use of personal protective equipment, emergency response systems, and safety equipment.

Mine reclamation and environmental remediation are also essential components of modern mining practices. Resource estimation and mineral processing are integral parts of the mining process, requiring geotechnical engineering expertise and advanced drilling machines. Mine hoists, conveyor systems, and load haul dumpers facilitate the transportation of raw materials. Mine closure is a critical consideration for mine operators, necessitating effective water management, dust control, and waste management strategies. Mine rescue, rock bolting, ventilation systems, and rock mechanics are essential for ensuring mine safety and productivity. Spare parts and service contracts are vital for maintaining mining equipment and minimizing downtime. The mining industry's ongoing shift towards energy efficiency, accident prevention, and autonomous vehicles is driving innovation in underground mining equipment technology.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Underground Mining Equipment Industry?

- The market's growth is primarily driven by the availability of advanced and safe underground mining equipment that enhances productivity and ensures the safety of workers.

- The global underground mining industry is experiencing a shift towards more health-conscious and efficient mining equipment. Operating in mining environments presents unique challenges, including high noise levels, vibrations, and dust, which can negatively impact the health and productivity of drilling operators. To address these concerns, innovative mining equipment solutions are being introduced. For example, Kennametal Inc. has developed a combination of a bit isolator and a chuck isolator to minimize the vibration transmitted to drill steel, thereby reducing noise and improving working conditions. Furthermore, the integration of automation systems, energy efficiency, and accident prevention technologies in underground mining equipment is gaining significant traction.

- Autonomous vehicles and advanced ventilation systems are also being employed to enhance safety and productivity in mining operations. Additionally, environmental remediation and mine rescue equipment are essential components of modern underground mining equipment, ensuring compliance with health and safety regulations and minimizing environmental impact. Overall, the focus on health and safety, fuel consumption, and automation systems is driving the growth of the market.

What are the market trends shaping the Underground Mining Equipment Industry?

- Underground mining equipment is currently experiencing significant technological advances, making it the prevailing market trend in the mining industry. Innovations in this sector are driving productivity, safety, and efficiency, shaping the future of mining operations.

- The market is undergoing significant advancements, driven by technological innovations such as the integration of the Internet of Things (IoT) with global positioning systems (GPS). This technology enables remote monitoring and operation of mining equipment, enhancing efficiency and productivity. Real-time data analysis on equipment performance, including distance traveled and fuel consumption, can be accessed by engineers from a central location. Furthermore, geotechnical engineering, water management, safety equipment, and advanced machinery like load haul dumpers, drilling machines, ore sorting systems, and tunnel boring equipment are essential components of the industry.

- Service contracts play a crucial role in ensuring the optimal performance of these complex systems. The mining industry's focus on safety and rock mechanics continues to be a primary concern, with remote control capabilities and advanced drilling techniques contributing to a more harmonious and efficient mining environment.

What challenges does the Underground Mining Equipment Industry face during its growth?

- The escalating costs of underground mining equipment pose a significant challenge to the industry's growth trajectory.

- Underground mining equipment rental is a significant trend in the global mining industry due to the high cost of purchasing new equipment. This trend allows mining companies to reduce their mining project expenses by renting equipment on a weekly or monthly basis. The high investment required for procuring new underground mining equipment can be allocated to other essential activities, thereby enabling companies to maintain their competitive edge. The market for underground mining equipment is witnessing high penetration in developed countries like North America and Europe. Meanwhile, developing countries such as India and China are experiencing rapid growth in the rental of underground mining equipment.

- The use of underground mining equipment rental is essential for mine development, including shaft sinking, mine planning, mine reclamation, and mineral processing. Additionally, it is crucial for waste management, mine safety, emergency response, and roof support systems. Mining software and noise reduction technologies are also integral components of modern underground mining equipment, enhancing operational efficiency and productivity.

Exclusive Customer Landscape

The underground mining equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the underground mining equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, underground mining equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - The company specializes in supplying advanced underground mining equipment, encompassing underground load haul dumpers, mine trucks, and electric underground trucks.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Atlas Copco AB

- Boart Longyear Ltd.

- Caterpillar Inc.

- CME Blasting and Mining Equipment Ltd

- CMM Cocental SAS

- FURUKAWA Co. Ltd.

- Guizhou Sinodrills Equipment Co. Ltd

- Hitachi Construction Machinery Co. Ltd.

- Kennametal Inc.

- Komatsu Ltd.

- Mindrill Systems and Solutions Pvt. Ltd.

- Resemin SA

- REVATHI EQUIPMENT Ltd

- ROCKMORE International Inc.

- Sandvik AB

- Schmidt Kranz and Co Gmbh

- Sulzer Ltd.

- TEI Rock Drills

- Yantai Jiaxiang Mining Machinery Co Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Underground Mining Equipment Market

- In February 2023, Caterpillar Inc. Unveiled its new autonomous mining vehicle, the MineStar Command for Underground, marking a significant technological advancement in the market (Caterpillar Press Release, 2023). This innovation is designed to increase productivity, improve safety, and reduce operational costs for mining companies.

- In June 2024, Sandvik and Glencore signed a strategic partnership to jointly develop and commercialize autonomous mining solutions, combining Sandvik's expertise in technology and Glencore's extensive mining operations experience (Sandvik Press Release, 2024). This collaboration is expected to accelerate the adoption of autonomous mining equipment and drive growth in the market.

- In November 2024, Komatsu announced a USD1.2 billion investment in its mining equipment business, focusing on research and development of electric and autonomous mining equipment (Komatsu Press Release, 2024). This substantial investment underscores the company's commitment to innovation and its confidence in the future growth of the market.

- In March 2025, the Australian government launched a new initiative to promote the adoption of electric and autonomous mining equipment, offering incentives for mining companies to invest in these technologies (Australian Government Media Release, 2025). This policy change is expected to boost the market for underground mining equipment in Australia and position the country as a leader in the global transition towards more sustainable and efficient mining operations.

Research Analyst Overview

- Underground mining operations continue to evolve, integrating advanced technologies to enhance safety, efficiency, and sustainability. Ground control measures, such as mine mapping and seismic monitoring, play a crucial role in mitigating risks. Remote operations and automation, including machine learning and artificial intelligence, optimize mine production and reduce human exposure to hazardous conditions. Safety management systems are essential in hard rock and coal mining, ensuring compliance with regulations and minimizing risks. Underground infrastructure, including shaft design and mine surveying, are critical components of mine development. Mine rehabilitation and circular economy practices are gaining importance in the industry.

- Soft rock mining, such as block caving and longwall mining, require specialized equipment and techniques for efficient and safe operations. Mine water drainage and rock dust control are essential for maintaining a safe and productive mining environment. Underground haulage systems and mine automation contribute to increased productivity and reduced costs. Mine closure planning is a growing concern, with innovations in mine ventilation and digital twin technology facilitating effective and sustainable mine decommissioning. Rockburst mitigation and safety measures, including safety management systems and environmental monitoring, are essential for minimizing risks in underground mining operations. Mining technology innovations, such as autonomous mining and shaft design, are transforming the industry, enabling safer and more efficient mining practices.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Underground Mining Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 7.12 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.2 |

|

Key countries |

China, US, Russia, India, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Underground Mining Equipment Market Research and Growth Report?

- CAGR of the Underground Mining Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the underground mining equipment market growth of industry companies

We can help! Our analysts can customize this underground mining equipment market research report to meet your requirements.