Unmanned Maritime Systems Market Size 2024-2028

The unmanned maritime systems market size is forecast to increase by USD 9.29 billion at a CAGR of 15.35% between 2023 and 2028. The UMS market is witnessing significant growth due to increasing demand from the defense sector for enhanced surveillance, mine countermeasures, and anti-submarine warfare applications. Technological advancements, such as autonomous navigation, advanced sensors, and communication systems, are driving market expansion. Unmanned maritime systems, including Unmanned Surface Vehicles (USVs), Unmanned Underwater Vehicles (UUVs), and Autonomous Underwater Vehicles (AUVs), are gaining significant traction in various industries, particularly in defense and security applications. The increasing threat of international terrorism and the need to secure Exclusive Economic Zones (EEZs) are driving the demand for these systems. Technological advancements, such as improved sensors, communication systems, and navigation capabilities, are enhancing the capabilities of unmanned maritime systems. However, regulatory hurdles, ethical concerns, and safety issues pose challenges to market growth. The use of unmanned maritime systems for surveillance, mine countermeasures, and underwater exploration offers significant benefits, including increased efficiency, cost savings, and reduced risk to human life. As the market continues to evolve, it is essential to stay informed of the latest trends and developments to capitalize on the opportunities and mitigate the risks.

What will be the Size of the Market During the Forecast Period?

The unmanned maritime systems, also known as unmanned marine systems, have gained significant attention in recent years due to their ability to enhance maritime security and surveillance. These systems, which include Unmanned Underwater Vehicles (UUVs), unmanned surface vehicles (USVs), and autonomous underwater vehicles (AUVs), play a crucial role in various applications such as maritime surveillance, naval forces, fisheries protection, and national security. A Primary Application Maritime surveillance and security are the primary applications for unmanned maritime systems. These systems enable agencies to monitor and secure exclusive economic zones (EEZs), ports, and international trade routes from threats such as illegal immigration, smuggling, piracy, international terrorism, and naval incursions.

Furthermore, manufacturing delays can impact the delivery of these systems to naval agencies and service providers, while the availability of payload suppliers can limit the capabilities of these systems. Market Drivers Defense budgets and autonomous technologies are the primary drivers of the market. Defense budgets provide the necessary funding for the development and deployment of these systems, while autonomous technologies enable them to operate more efficiently and effectively. A Potential Concern The increasing use of unmanned maritime systems raises concerns about the impact on surface warships. While these systems cannot replace surface warships entirely, they can supplement their capabilities and reduce the risk to human life in dangerous situations.

Market Segmentation

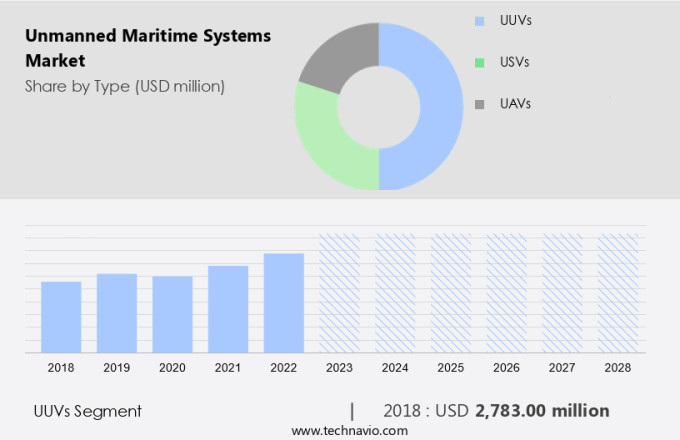

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- UUVs

- USVs

- UAVs

- Technology

- Remotely operated vehicle

- Autonomous vehicle

- Geography

- North America

- Canada

- US

- Europe

- UK

- France

- APAC

- China

- South America

- Middle East and Africa

- North America

By Type Insights

The UUVs segment is estimated to witness significant growth during the forecast period. Unmanned underwater vehicles (UUVs) are advanced technologies designed for underwater exploration and operation without human intervention. These autonomous vehicles employ onboard sensors and software for navigation and mission completion, making them indispensable for various applications such as seafloor mapping, pipeline inspection, environmental monitoring, and military operations. The demand for UUVs is on the rise due to the growing need for advanced underwater technology solutions and escalating investments in underwater research and defense. UUVs offer significant advantages to naval agencies in a network-centric environment. Their discrete operational capabilities, extended operational reach, and minimal exposure to manned assets make them valuable assets in military applications.

Moreover, UUVs' remote recharge capabilities enable prolonged underwater missions, enhancing their utility. Unmanned Surface Vehicles (USVs) are similarly designed for autonomous operations on the water surface. They are increasingly being used for applications such as border patrol, oceanographic research, and cargo transportation. USVs' autonomous capabilities and stealth platforms make them ideal for covert military operations. The market for unmanned maritime systems, including UUVs and USVs, is expected to witness significant growth due to the increasing demand for advanced maritime technology solutions and the expanding applications of these systems across various industries. Underwater wireless charging technology is a promising development in the field, offering the potential for even longer operational durations for UUVs.

Furthermore, in conclusion, unmanned maritime systems, including UUVs and USVs, are transforming the way we explore and utilize the world's waterways. Their autonomous capabilities, extended operational reach, and discrete operational advantages make them essential tools for various applications, from scientific research to military operations. The market for these systems is poised for significant growth, driven by increasing demand and technological advancements.

Get a glance at the market share of various segments Request Free Sample

The UUVs segment was valued at USD 2.78 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The United States and Canada dominate the North American market for unmanned maritime systems, contributing substantially to its revenue growth. The region's market expansion is fueled by escalating investments and research in this technology. Notable players in North America, such as Lockheed Martin, General Dynamics, Teledyne Technologies Incorporated, Lockheed Martin Corporation, and L3Harris Technologies Inc., are leading the way with their continuous product innovation and upgrades in unmanned maritime systems. Autonomous technologies have revolutionized maritime industries, enabling the deployment of unmanned vehicles for various applications, including surveillance in remote areas and ocean cleaning. The defense industry is a significant consumer of unmanned maritime systems due to their combat techniques and capabilities. Furthermore, these systems offer enhanced surveillance capacity, making them indispensable for securing borders and monitoring territorial waters. Investments in unmanned maritime systems are not limited to the defense sector alone. They are also being explored for commercial applications, such as distribution networks, where they can transport goods across vast bodies of water autonomously, thereby reducing operational costs and increasing efficiency.

Additionally, the region's market growth is driven by increasing investments and research in this technology. Autonomous technologies have transformed the maritime industry, enabling the deployment of unmanned vehicles for various applications. These systems offer enhanced surveillance capacity, making them crucial for securing borders and monitoring territorial waters in defense applications. Commercial applications, such as distribution networks, also benefit from unmanned maritime systems, which can transport goods across vast bodies of water autonomously, reducing operational costs and increasing efficiency.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rising demand for unmanned maritime systems from the defense sector is the key driver of the market. Unmanned maritime systems have gained significant attention in the defense sector for their capabilities to perform high-risk tasks in maritime environments without endangering personnel. These systems offer advanced surveillance and reconnaissance functions, making them valuable assets for naval platforms. Unmanned maritime systems, also known as Unmanned Sea Systems, are gaining significant attention in the defense sector for their capability to execute hazardous tasks in maritime environments without endangering human lives.

In addition, the US military is actively exploring the potential of unmanned maritime systems, with the US Navy's 5th Fleet launching Task Force 59 in 2021 to integrate unmanned systems and artificial intelligence. The Saildrone initiative under this program focuses on testing and deploying autonomous surface vehicles equipped with sophisticated sensor payloads for deep-water ocean mapping and maritime defense and security missions. In March 2024, Saildrone unveiled a new generation of Surveyor-class unmanned surface vehicles (USVs) for autonomous deep-water ocean mapping and maritime security applications. With their communication capabilities, these systems enable effective international trade monitoring and ports protection.

Market Trends

Technological advancements in unmanned maritime systems is the upcoming trend in the market. Unmanned maritime systems (UMS) have witnessed significant advancements in technology, leading to enhanced functions and capabilities. Key areas of improvement include data processing, communication signals, autonomy, navigation, and sensor integration. These innovations enable UMS to execute various tasks, such as mine countermeasures, oceanographic research, underwater mapping, infrastructure inspection, and communication.

Moreover, the evolution of UMS is characterized by progress in data processing capabilities and communication systems. This technological leap allows real-time data gathering, transmission, and analysis, resulting in informed decision-making and effective mission planning. For example, Saab AB delivers cutting-edge, technologically advanced, and cost-effective unmanned maritime solutions, empowering institutions, nations, and individuals to ensure security and defense in intricate scenarios.

Market Challenge

Regulatory hurdles in global market is a key challenge affecting market growth. Unmanned maritime systems, including Unmanned Underwater Vehicles (UUVs), Unmanned Surface Vehicles (USVs), and Autonomous Underwater Vehicles (AUVs), are gaining traction in various industries due to their ability to perform tasks in hazardous or hard-to-reach environments. However, the market for these systems is subject to numerous regulations, particularly in relation to international terrorism and Exclusive Economic Zones (EEZs). Regulatory bodies impose stringent safety and liability requirements on the operation of unmanned maritime systems, which can involve substantial investments in safety measures and risk mitigation strategies. Compliance with these regulations can be complex, as they vary significantly by region. For instance, UMS operations may be restricted in sensitive marine environments due to environmental regulations.

Furthermore, this can limit operational scope and market opportunities. Moreover, ethical concerns surrounding the use of unmanned maritime systems, particularly in military applications, can pose challenges for companies. As the market evolves, it is essential for companies to stay informed of regulatory developments and adapt their strategies accordingly to ensure compliance and maintain a strong market position. In conclusion, the market presents significant opportunities for growth, but companies must navigate complex regulatory frameworks and ethical considerations to succeed. By investing in safety measures and risk mitigation strategies, staying informed of regulatory developments, and addressing ethical concerns, companies can position themselves for long-term success in this dynamic market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BAE Systems Plc - The company offers unmanned maritime systems, such as advanced unmanned surface vessel which helps in vital tasks such as reconnaissance, surveys, and maritime security.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ECA Group

- Elbit Systems Ltd.

- General Dynamics Corp.

- Hanwha Systems Co.

- Huntington Ingalls Industries Inc.

- L3Harris Technologies Inc.

- Liquid Robotics Inc.

- Lockheed Martin Corp.

- Maritime Robotics

- Northrop Grumman Corp.

- Rafael Advanced Defense Systems Ltd.

- Saab AB

- SeaRobotics Corp.

- Teledyne Technologies Inc.

- Textron Systems

- The Boeing Co.

- Thales Group

- thyssenkrupp AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Unmanned maritime systems, also known as unmanned marine systems, are gaining significant attention from various industries and defense agencies due to their capabilities in maritime surveillance, naval forces enhancement, and environmental protection. These systems, which include unmanned surface vehicles (USVs) and unmanned underwater vehicles (UUVs), offer autonomous features, remote recharge capabilities, and advanced sensors such as Acoustic Sensors, imaging sensors, and communication capabilities. The demand for unmanned maritime systems is driven by the need for Maritime Intelligence, surveillance, and reconnaissance in areas of national security, illegal immigration, smuggling, fisheries protection, piracy, and international terrorism. These systems are also used for scientific research, defense spending, and combat techniques.

In addition, military applications of unmanned maritime systems include stealth platforms for naval agencies, underwater wireless charging for UUVs, and autonomous capabilities for USVs. The defense industry relies on service providers and payload suppliers for manufacturing and supplying these systems, with ethical concerns surrounding communication signals and potential manufacturing delays. Unmanned maritime systems have a wide range of applications, from surveillance missions in remote areas to ports protection and international trade. They offer significant advantages in terms of cost savings, increased efficiency, and enhanced capabilities compared to manned vessels. Additionally, these systems are being explored for ocean cleaning and distribution network applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.35% |

|

Market growth 2024-2028 |

USD 9.29 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.56 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 33% |

|

Key countries |

US, Canada, China, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

BAE Systems Plc, ECA Group, Elbit Systems Ltd., General Dynamics Corp., Hanwha Systems Co., Huntington Ingalls Industries Inc., L3Harris Technologies Inc., Liquid Robotics Inc., Lockheed Martin Corp., Maritime Robotics, Northrop Grumman Corp., Rafael Advanced Defense Systems Ltd., Saab AB, SeaRobotics Corp., Teledyne Technologies Inc., Textron Systems, The Boeing Co., Thales Group, and thyssenkrupp AG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch