Unmanned Underwater Vehicles Market Size 2024-2028

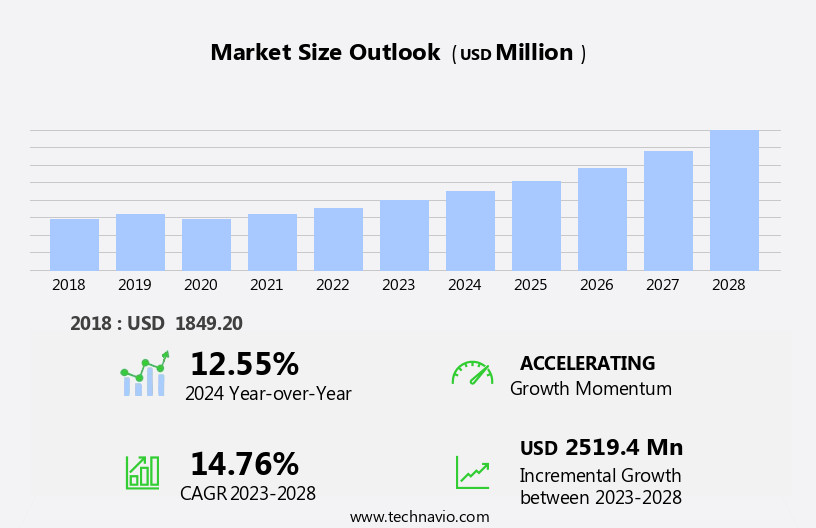

The unmanned underwater vehicles market size is forecast to increase by USD 2.52 billion at a CAGR of 14.76% between 2023 and 2028.

- Unmanned Underwater Vehicles (UUVs) have gained significant traction in recent years due to the increasing demand for stealth platforms and growing investments in undersea warfare capabilities. The market is witnessing several trends, including advancements in battery technology, increasing use of autonomous navigation systems, and the integration of advanced sensors for enhanced data collection.

- However, design and operational challenges persist, such as the need for reliable communication systems, complex underwater environments, and the high cost of development and maintenance. These factors present both opportunities and challenges for market growth. UUVs offer significant advantages, including extended operational endurance, improved mission flexibility, and increased safety for personnel.

- As the market continues to evolve, addressing these challenges will be crucial for market expansion.

What will be the Size of the Unmanned Underwater Vehicles Market During the Forecast Period?

- The unmanned underwater vehicle (UUV) market encompasses a range of applications, including maritime security, subsea exploration, environmental monitoring, naval defense, marine research, and surveillance. These vehicles are essential for reconnaissance, mine countermeasures, anti-submarine warfare, and ISR (Intelligence, Surveillance, and Reconnaissance) operations. UUVs are increasingly utilized for oceanographic data collection, enabling advancements in climate change research, deep sea mining, and marine biodiversity studies.

- Autonomous underwater vehicles (AUVs) and hybrid underwater vehicles (HUVs) are key market drivers, offering extended endurance for long-duration missions. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) enhances UUV capabilities, enabling more efficient data processing and analysis.

- UUVs play a crucial role in defense surveillance, addressing threats such as maritime terrorism, drug smuggling, and other security concerns. Navigation and hardware systems are critical components of UUVs, ensuring reliable and effective underwater exploration and monitoring.

How is this Unmanned Underwater Vehicles Industry segmented and which is the largest segment?

The unmanned underwater vehicles industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Remotely operated

- Autonomous underwater

- Geography

- North America

- Canada

- US

- Europe

- Germany

- Norway

- APAC

- China

- South America

- Middle East and Africa

- North America

By Vehicle Type Insights

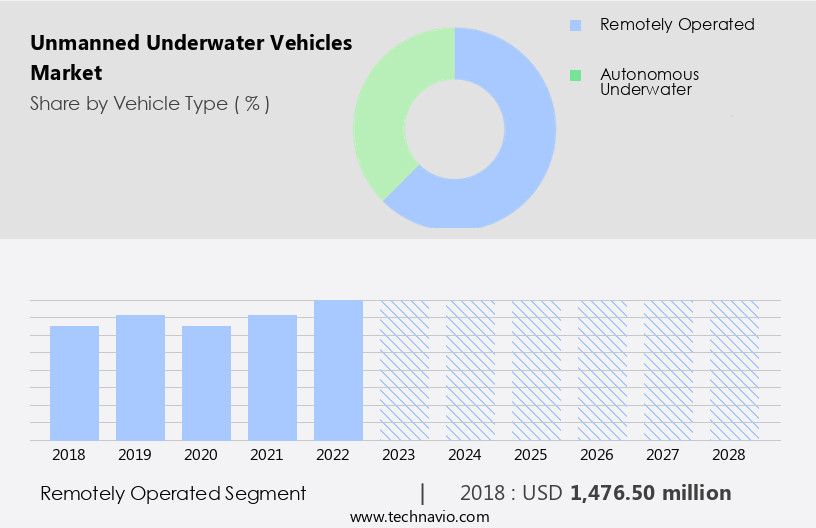

- The remotely operated segment is estimated to witness significant growth during the forecast period.

Unmanned Underwater Vehicles (UUVs) encompass a range of autonomous and remotely operated vehicles used for various applications in maritime security, subsea exploration, environmental monitoring, naval defense, marine research, and surveillance. These vehicles employ advanced sensors and payloads, including imaging technologies, sonar systems, high-resolution cameras, and acoustic and electromagnetic wave detection systems, for data collection and intelligence gathering. UUVs are integral to situational awareness, mine countermeasures, underwater research, and covert operations. They face challenges such as hardware and software failures, environmental disturbances, and operational limitations, including battery life and self-navigation capabilities. Energy solutions, including autonomous recharging and underwater wireless power, are being explored to enhance their capabilities. UUVs are utilized in deep water operations, offshore renewable energy, and scientific research, among other sectors. Their applications extend to defense, marine biodiversity, and underwater infrastructure maintenance.

Get a glance at the Unmanned Underwater Vehicles Industry report of share of various segments Request Free Sample

The Remotely operated segment was valued at USD 1.48 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

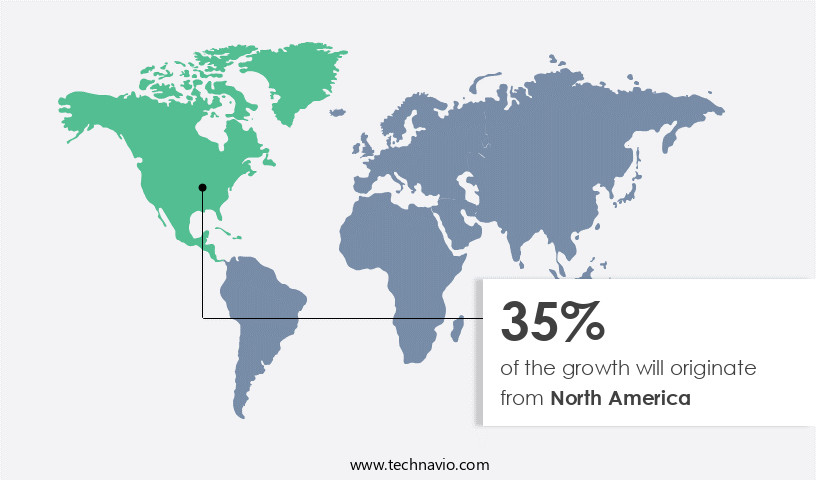

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market holds a prominent position In the global unmanned underwater vehicles (UUV) industry, with the US and Canada being the primary contributors. The region's growth is driven by escalating research and investments in UUV technology. Key players, such as Lockheed Martin Corp., General Dynamics Corp., L3Harris Technologies Inc., Teledyne Technologies Inc., and The Boeing Co., are significantly investing in research and development to innovate and upgrade their offerings. The US Department of Defense (DoD) is expected to increase procurement of advanced UUVs for the US Navy, as part of ongoing naval modernization efforts. Applications of UUVs span across various sectors, including maritime surveillance, subsea exploration, environmental monitoring, naval defense, marine research, surveillance, and reconnaissance, oceanographic data collection, mine countermeasures, underwater research, etc.

Challenges such as hardware failure, software failure, environmental failures, operational failures, battery life, self navigation capabilities, energy solutions, autonomous recharging, underwater wireless power, solar power, electromagnetic waves, acoustic waves, signal processing, and environmental disturbances are being addressed through technological advancements.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Unmanned Underwater Vehicles Industry?

Growing demand for stealth platform is the key driver of the market.

- Unmanned Underwater Vehicles (UUVs) have gained significant attention in various sectors, including maritime security, subsea exploration, environmental monitoring, and naval defense. These vehicles are equipped with sensors and payloads for oceanographic data collection, mine countermeasures, underwater research, and imaging technologies. UUVs play a crucial role in intelligence gathering, situational awareness, and covert operations. Advanced surveillance systems, such as sonar systems and high-resolution cameras, enable UUVs to provide real-time data and insights. However, challenges such as hardware failure, software failure, and environmental failures can impact the performance and reliability of UUVs. Operational failures, including battery life and self-navigation capabilities, also pose significant challenges.

- Energy solutions, such as autonomous recharging, underwater wireless power, solar power, and electromagnetic waves, are being explored to address these challenges. UUVs have numerous applications In the defense sector, including anti-submarine warfare, military intelligence gathering, and ISR operations. Artificial Intelligence and machine learning are being integrated into marine AI software to enhance the capabilities of UUVs. UUVs are also used for deep water operations, offshore renewable energy, and scientific research. Large, medium, and shallow vehicles cater to different applications, with large vehicles used for deep ocean exploration and deep sea mining, medium vehicles for underwater infrastructure maintenance, and shallow vehicles for oceanographic research and environmental monitoring.

- The high operating costs of UUVs necessitate the need for efficient communication and navigation systems, propulsion systems, and navigation systems. UUVs are essential for climate change research, marine biodiversity studies, and underwater resource exploration. Research institutions and defense organizations are investing in UUV technology to expand their capabilities and gain a competitive edge. Despite the challenges, the future of UUVs looks promising, with continued innovation and advancements in technology.

What are the market trends shaping the Unmanned Underwater Vehicles Industry?

Growing investments in undersea warfare capabilities is the upcoming market trend.

- Unmanned Underwater Vehicles (UUVs) play a pivotal role in maritime security and subsea exploration, with applications ranging from environmental monitoring and naval defense to marine research and surveillance. The global market for UUVs is experiencing significant growth due to the increasing demand for advanced surveillance, mine countermeasures, underwater research, and situational awareness. UUVs are equipped with sensors and payloads, including high-resolution cameras, sonar systems, and imaging technologies, enabling them to collect oceanographic data, map the seabed, and conduct covert operations. These vehicles offer self-navigation capabilities, energy solutions such as autonomous recharging and underwater wireless power, and can operate in deep water and offshore renewable energy environments.

- Military applications of UUVs include anti-submarine warfare, intelligence gathering, and ISR operations. The defense sector is also exploring the use of artificial intelligence, machine learning, and autonomous vehicles for advanced underwater capabilities. However, challenges such as hardware and software failures, environmental disturbances, and operational failures, including battery life, can impact the effectiveness of UUVs. The market for UUVs is diverse, with large vehicles designed for deep-sea operations, medium vehicles for shallow waters, and smaller vehicles for specific applications. The use of UUVs in scientific research, oceanographic research, and marine biodiversity studies is also increasing, with research institutions and underwater infrastructure maintenance companies investing In these vehicles for long-duration missions and climate change research.

- Despite the high operating costs, UUVs offer significant benefits, including increased efficiency, improved safety, and the ability to operate in hazardous environments. The future of UUVs lies In their ability to adapt to changing environmental conditions, integrate advanced technologies, and meet the evolving needs of various industries and defense applications.

What challenges does the Unmanned Underwater Vehicles Industry face during its growth?

Design and operational challenges is a key challenge affecting the industry growth.

- Unmanned underwater vehicles (UUVs) offer significant benefits to maritime security, subsea exploration, environmental monitoring, naval defense, marine research, and surveillance. However, they face unique challenges in terms of communication, navigation, and operational capabilities. These systems encounter difficulties in deep water operations due to environmental factors such as hardware and software failures, battery life, and self-navigation capabilities. Environmental disturbances, including signal processing and interference from electromagnetic and acoustic waves, hinder effective data collection. UUVs are employed for various applications, including oceanographic data collection, mine countermeasures, underwater research, and covert operations. They are integral to intelligence gathering, situational awareness, and imaging technologies, such as high-resolution cameras and sonar systems.

- However, the high operating costs and limitations in deep water operations, as well as the potential for hardware, software, and environmental failures, pose challenges. Energy solutions, such as autonomous recharging, underwater wireless power, solar power, and electromagnetic waves, are being explored to enhance UUV capabilities. Advancements in artificial intelligence, machine learning, and autonomous vehicles are also driving innovation In the field. UUVs play a crucial role in defense sector applications, including anti-submarine warfare, ISR operations, and military applications. They are used for scientific research, underwater infrastructure maintenance, and offshore renewable energy. Despite these advancements, UUVs face operational challenges, including communication and navigation, propulsion systems, and environmental research.

- Large, medium, and shallow vehicles are used for various applications, from scientific research to deep sea mining. UUVs are essential for climate change research, defense surveillance, and long-duration missions. However, they require robust design and maintenance to ensure effective and reliable operation.

Exclusive Customer Landscape

The unmanned underwater vehicles market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the unmanned underwater vehicles market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, unmanned underwater vehicles market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BAE Systems Plc

- BaltRobotics Sp.z.o.o.

- Cellula Robotics Ltd.

- Copenhagen Subsea AS

- Fugro NV

- GABRI S.R.L

- General Dynamics Corp.

- Graal Tech Srl

- Groupe Gorge SA

- Hydromea SA

- International Submarine Engineering Ltd.

- Kongsberg Gruppen ASA

- L3Harris Technologies Inc.

- Lockheed Martin Corp.

- RTSYS

- Subsea 7 SA

- TechnipFMC plc

- Teledyne Technologies Inc.

- The Boeing Co.

- thyssenkrupp AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Unmanned underwater vehicles (UUVs) have gained significant traction in various industries due to their ability to explore and collect data from underwater environments with minimal human intervention. These vehicles offer numerous advantages, including increased efficiency, reduced risks to human life, and the ability to operate in extreme conditions. UUVs are employed in a wide range of applications, including maritime security, subsea exploration, environmental monitoring, and naval defense. In the maritime security sector, UUVs are used for surveillance, reconnaissance, and intelligence gathering to enhance situational awareness and ensure security. In subsea exploration, UUVs are utilized for oceanographic data collection, seabed mapping, and resource discovery.

The naval defense industry leverages UUVs for advanced surveillance, anti-submarine warfare, and mine countermeasures. These vehicles provide operational advantages, such as extended mission durations, covert operations, and the ability to operate in deep waters. UUVs are also used in military applications for ISR (Intelligence, Surveillance, and Reconnaissance) operations, offering real-time data and imaging technologies to support strategic decision-making. UUVs are increasingly being integrated with advanced technologies, such as artificial intelligence (AI) and machine learning, to improve performance and capabilities. Autonomous vehicles can navigate complex environments, process data in real-time, and make decisions based on environmental factors. These advancements enable UUVs to conduct long-duration missions and adapt to changing conditions.

The defense sector is not the only industry benefiting from UUVs. Environmental research institutions use UUVs for climate change research, marine biodiversity studies, and underwater infrastructure maintenance. Offshore renewable energy companies employ UUVs for inspections, maintenance, and installation of underwater infrastructure. Despite the numerous advantages, UUVs face challenges, including hardware and software failures, environmental disturbances, and high operating costs. To address these challenges, innovations in energy solutions, such as autonomous recharging, underwater wireless power, solar power, and electromagnetic waves, are being explored. UUVs come in various sizes, including large, medium, and shallow water vehicles. Each type caters to specific applications and environments.

For instance, large vehicles are suitable for deep-water operations and resource exploration, while medium and shallow water vehicles are used for environmental research and infrastructure maintenance. In conclusion, the unmanned underwater vehicle market is a dynamic and growing industry, offering numerous opportunities for innovation and growth. UUVs are transforming various industries, from maritime security and naval defense to environmental research and offshore renewable energy. With continued advancements in technology and the integration of artificial intelligence and machine learning, UUVs are poised to revolutionize underwater exploration and data collection.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.76% |

|

Market growth 2024-2028 |

USD 2.52 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.55 |

|

Key countries |

US, China, Germany, Canada, and Norway |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Unmanned Underwater Vehicles Market Research and Growth Report?

- CAGR of the Unmanned Underwater Vehicles industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the unmanned underwater vehicles market growth of industry companies

We can help! Our analysts can customize this unmanned underwater vehicles market research report to meet your requirements.