Uranium Mining Market Size 2023-2027

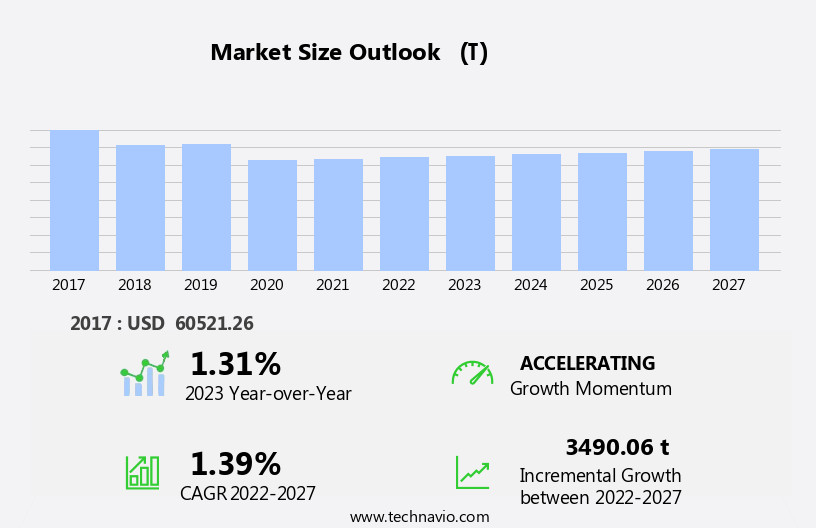

The uranium mining market size is forecast to increase by 3490.06 t at a CAGR of 1.39% between 2022 and 2027.

- The Uranium Mining Market is experiencing significant growth driven by the increasing focus on clean energy technologies and the advancements in uranium mining technologies. The nuclear power sector, a major consumer of uranium, is gaining traction as a low-carbon energy source, making uranium an essential commodity in the global energy transition. However, the market is not without challenges. Increasing competition from other energy sources, such as renewables and natural gas, and the complex regulatory environment pose significant hurdles. Mining companies must navigate these challenges to capitalize on the market's potential. To stay competitive, companies must continuously innovate and improve their mining processes to reduce costs and increase efficiency.

- Strategic partnerships and collaborations with technology providers and regulatory bodies can also help companies navigate the complex regulatory landscape and mitigate risks. Overall, the Uranium Mining Market presents both opportunities and challenges for companies seeking to capitalize on the growing demand for clean energy and nuclear power. Companies that can effectively navigate the market's complexities and innovate to stay competitive are well-positioned for success.

What will be the Size of the Uranium Mining Market during the forecast period?

- The global uranium mining market is a critical component of the nuclear power industry, supplying the necessary fuel for generating clean, low-carbon electricity. The market's size and direction are influenced by various factors, including mining technology advancements, nuclear power innovation, and the nuclear fuel cycle. Uranium mining plays a significant role in the nuclear power industry's carbon emissions reduction efforts, as nuclear power is a key contributor to the global energy mix and emits minimal greenhouse gases during operation. Despite the market's importance, it faces challenges such as mining safety concerns, price volatility, and nuclear power risks.

- Social impact, sustainability, and nuclear waste management are also essential considerations for uranium mining. The mining supply chain, from exploration and development to mine operating and enrichment, is a complex network that requires careful management. Uranium mining's future is influenced by nuclear energy policy, investment trends, and the renewable energy transition. Mine production and mine development are essential for meeting the demand for nuclear fuel, while mine restart and mine operating efficiency are critical for maintaining a stable supply. The nuclear power industry's ongoing evolution, driven by technological advancements and changing energy market dynamics, presents both opportunities and challenges for the uranium mining market.

How is this Uranium Mining Industry segmented?

The uranium mining industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD t" for the period 2023-2027, as well as historical data from 2017-2021 for the following segments.

- Method

- ISL

- Underground and open pit

- Technique

- Dynamic leaching

- Heap leaching

- Deposit Type

- Sandstone Deposits

- Quartz-Pebble Conglomerate Deposits

- Vein Deposits

- Breccia Complex Deposits

- Others

- Product

- Uranium Ore

- Yellowcake (U308)

- End-Use

- Nuclear Power Generation

- Military and Defense

- Medical

- Research and Development

- Others

- Geography

- APAC

- Australia

- Middle East and Africa

- North America

- Canada

- Europe

- South America

- Brazil

- APAC

By Method Insights

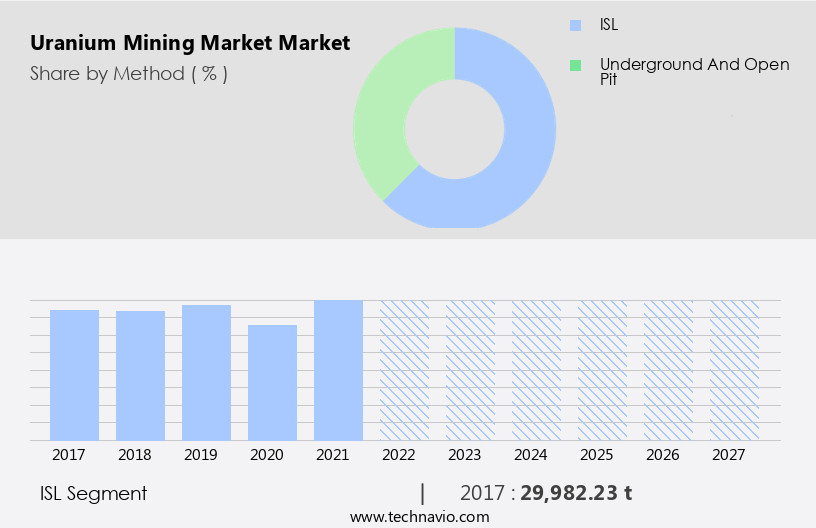

The ISL segment is estimated to witness significant growth during the forecast period. Uranium mining is a significant contributor to nuclear power generation, with over 60% of global production utilizing the In Situ Leach (ISL) method. Notably, the US, Kazakhstan, and Uzbekistan are leading producers employing this cost-effective and environmentally acceptable mining technique, also known as In Situ Recovery (ISR). Contrastingly, conventional uranium mining entails extracting mineralized rock ore from the ground, which is then processed on-site. ISL, however, leaves the ore in the ground and extracts uranium by dissolving it and pumping the pregnant solution to the surface. Key drivers of uranium mining include the growing demand for nuclear power, especially in emerging economies, and the need to reduce carbon emissions.

Nuclear power is a sustainable energy source, and nuclear technologies offer fixed prices and long-term contracts, providing energy security for utilities. Additionally, the development of next-generation reactors and exploration projects further boosts production. Environmental goals and subsidies also influence the market, as governments and utilities seek to reduce their carbon footprint and promote sustainable energy. Despite these advantages, challenges remain, including the environmental impact of mining and the dependence on imported uranium. Operating mines must balance production with these concerns while maintaining the highest safety and sustainability standards.

Get a glance at the market report of share of various segments Request Free Sample

The ISL segment was valued at 29982.23 t in 2017 and showed a gradual increase during the forecast period.

Regional Analysis

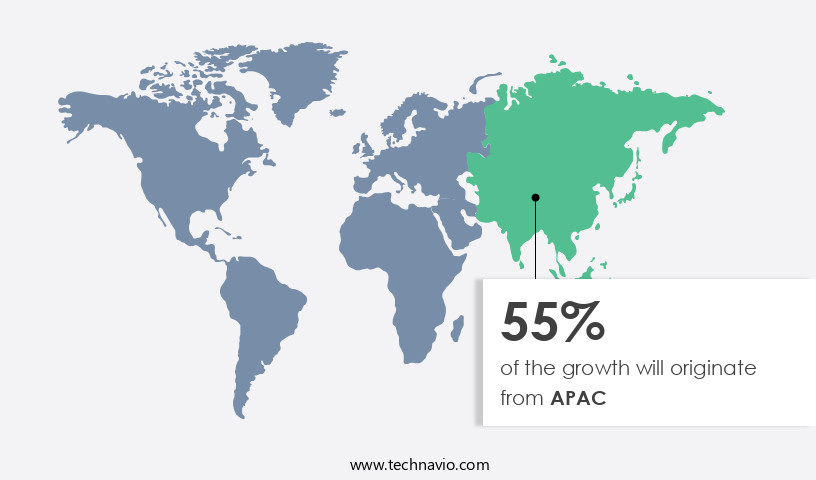

APAC is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Uranium mining market in Asia Pacific (APAC) is expected to expand due to the rising demand for nuclear power for clean electricity generation. According to the World Nuclear Association (WNA), APAC is a significant region for nuclear power production, with over 135 operating reactors and around 30-35 under construction, and plans to build an additional 50-60 reactors. The primary driver for uranium mining in APAC is the increasing demand for nuclear power to reduce carbon emissions and ensure energy security. Several countries, including Kazakhstan, Australia, China, and India, are contributing to the growth of the regional uranium mining market.

Mining methods used include open-pit and block cave expansion. Development work, exploration projects, and production are ongoing to meet the increasing demand from utilities and nuclear power plant operators. Long-term contracts and agreements, subsidies, and fixed prices are key factors supporting the market's growth. The transition towards next-generation reactors and sustainable energy sources is also expected to impact the market dynamics. Uranium mining is essential for nuclear power generation, and its production is crucial for meeting the increasing electricity consumption in APAC while reducing carbon emissions.

Market Dynamics

Our researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Uranium Mining Industry?

- Rising focus on clean energy technologies is the key driver of the market. The International Energy Agency (IEA) reports a 6% increase in global energy-related CO2 emissions in 2021 compared to the previous year. This growth is primarily due to the escalating energy demand and the continued reliance on fossil fuels, which accounted for 70% of the energy demand expansion in 2021. In response to the growing concern over carbon emissions, the demand for clean energy technologies, including nuclear power, is experiencing a global up. Unlike conventional fossil fuel-powered plants, nuclear power plants do not emit CO2, methane, or other harmful greenhouse gases.

- For instance, these plants prevent the emission of 13,972.60 tons of SO2 and 6,575 tons of NOx annually. The shift towards cleaner energy sources is crucial to mitigate the environmental impact of energy production and consumption.

What are the market trends shaping the Uranium Mining Industry?

- Technological advances is the upcoming market trend. Uranium mining market dynamics are shaped by the increasing digitization in mining operations and stringent safety regulations. The global uranium mining industry is focusing on enhancing employee safety and fostering machine and process productivity. Automation plays a crucial role in this regard, enabling the capture of real-time data for monitoring processes and making informed decisions. For instance, Cameco Corp. Is enhancing safety and efficiency through the integration of robots, artificial intelligence, and advanced process control.

- In the context of on-site underground mining operations, uranium mining companies are adopting automation solutions such as remotely controlled systems to operate equipment and machinery, thereby eliminating safety risks. The implementation of these technologies is essential for maintaining regulatory compliance and ensuring the sustainability of uranium mining operations.

What challenges does the Uranium Mining Industry face during its growth?

- Competition for nuclear power from other energy sources is a key challenge affecting the industry growth. The global electricity generation market has witnessed a notable shift towards renewable energy sources, with renewables and natural gas accounting for 52% of the total electricity production in 2020, according to the International Energy Agency (IEA). Renewables, including geothermal, solar, wind, hydropower, and biomass, gained significant popularity and contributed 28% to global electricity generation.

- The trend towards adopting clean energy sources for electricity production is on the rise, driving the demand for renewable energy harnessing technologies. The share of renewables in global electricity production increased from 17.60% in 2003 to 28% in 2021, making them the largest contributors to the change in electricity production by source for the same period. The European Union (EU) has set a target of achieving a 35% share of the total power generation from renewables by 2030. This shift towards renewable energy sources is a significant development in the global electricity market.

Exclusive Customer Landscape

The uranium mining market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the uranium mining market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, uranium mining market market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A Cap Energy Ltd. - The company specializes in uranium mining services, focusing on the exploration and evaluation of potential deposits in Botswana.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A Cap Energy Ltd.

- ActivEX Ltd.

- Adavale Resources Ltd.

- African Energy Ltd.

- Alligator Energy Ltd.

- Altius Minerals Corp.

- ALX Resources Corp.

- Aurora Energy Metals

- Berkeley Energia Ltd.

- Cameco Corp.

- CGN Mining Co. Ltd.

- China National Nuclear Corp.

- Deep Yellow Ltd.

- General Atomics

- Jindalee Resources Ltd.

- Joint Stock Co. Navoi Mining and Metallurgical Co.

- National Atomic Co. Kazatomprom Joint Stock Co.

- Orano

- State Atomic Energy Corp. Rosatom

- State Enterprise Eastern Mining and Processing Plant

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Uranium mining is a critical sector in the nuclear power industry, supplying the essential fuel source for generating clean, low-carbon electricity. The global uranium mining market is characterized by ongoing development work and expansion projects, driven by the increasing demand for nuclear power as a key energy source in various emerging economies. The mining industry employs two primary methods: open-pit and block cave. Open-pit mining is the most common method, which involves extracting uranium ore from an open pit or borrow. In contrast, block cave mining is a more complex and expensive method, which involves extracting uranium from a large, subterranean cavern created by mining out the surrounding rock.

Exploration plays a vital role in the uranium mining market, with producers continually seeking new deposits to meet the growing demand for nuclear power. Climate change and the need for carbon emission reduction have further bolstered the demand for nuclear power as a sustainable energy source. Nuclear power utilities are the primary consumers of uranium, entering into long-term contracts and agreements to secure their fuel supply. Fossil fuel prices and energy security concerns have also contributed to the increasing demand for uranium. The nuclear power sector is undergoing a technological revolution, with next-generation reactors offering improved safety, efficiency, and sustainability.

These new reactors are expected to drive the demand for uranium in the coming years. Environmental goals and regulations are becoming increasingly important considerations in the uranium mining market. Producers are under pressure to minimize their environmental impact and adhere to sustainable mining practices. Subsidies and incentives from governments are also playing a role in promoting the development of uranium mining projects. The uranium mining market is subject to various market dynamics, including production costs, supply and demand, and geopolitical factors. Production costs can fluctuate based on mining methods, exploration success, and regulatory requirements. Supply and demand are influenced by factors such as nuclear power plant construction, decommissioning, and fuel stockpiling.

Geopolitical factors, such as political instability and trade policies, can also impact the market. The uranium mining market is a complex and dynamic industry, with various stakeholders and market drivers shaping its future. Producers, utilities, governments, and consumers all play a role in the market's development, and the industry is expected to continue evolving in response to changing market conditions and technological advancements. The uranium mining market is a critical component of the nuclear power industry, supplying the fuel source for clean, low-carbon electricity generation. The market is characterized by ongoing development work, expanding demand, and technological innovation, with various market dynamics shaping its future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 1.39% |

|

Market growth 2023-2027 |

3490.06 t |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

1.31 |

|

Key countries |

Canada, Namibia, Kazakhstan, Australia, and Uzbekistan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Uranium Mining Market Market Research and Growth Report?

- CAGR of the Uranium Mining industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2023 and 2027

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Middle East and Africa, North America, Europe, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the uranium mining market market growth of industry companies

We can help! Our analysts can customize this uranium mining market market research report to meet your requirements.