Mining Automation Market Size 2024-2028

The mining automation market size is forecast to increase by USD 1.87 billion at a CAGR of 7.92% between 2023 and 2028.

- The market is experiencing significant growth due to the expansion of the mining industry and the increasing adoption of mobile-based technologies. The mining sector's growth is driven by factors such as increasing demand for minerals and metals, rising investment in infrastructure, and advancements in mining techniques. In addition, the use of mobile-based technologies, including autonomous vehicles and drones, is becoming increasingly popular in mining operations to improve efficiency and productivity.

- However, the market also faces challenges, particularly in the area of cybersecurity. With the increasing use of automation and digital technologies in mining, there is a growing risk of cyber attacks, which could result in significant financial and operational losses. Therefore, mining companies must prioritize cybersecurity measures to protect their assets and maintain the trust of their stakeholders. Overall, the market is expected to continue growing, driven by these trends and challenges.

What will be the Size of the Mining Automation Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing adoption of advanced technologies such as remote operations, mine planning software, predictive maintenance, data management, and digital mine transformation. These innovations enable increased safety in open pit and underground mining operations, reducing hazardous environments for workers. Robotics and autonomous equipment are key components of this trend, driving efficiency, cost reduction, and optimization of production levels. Sustainability is a critical focus area, with mining companies investing in sustainable practices, safety regulations, and workforce development. Mine safety training and governance are essential for ensuring compliance with evolving legislation.

- Data analytics and digital mine transformation are essential for improving business strategies, enhancing mine site security, and minimizing environmental impact. Investment opportunities In the mining automation industry are abundant, with ongoing research and development leading to continuous innovation. The economic impact of these advancements is significant, as mining companies seek to stay competitive in a rapidly changing market. Overall, the market is poised for continued growth, with a strong emphasis on safety, optimization, and sustainability.

How is this Mining Automation Industry segmented and which is the largest segment?

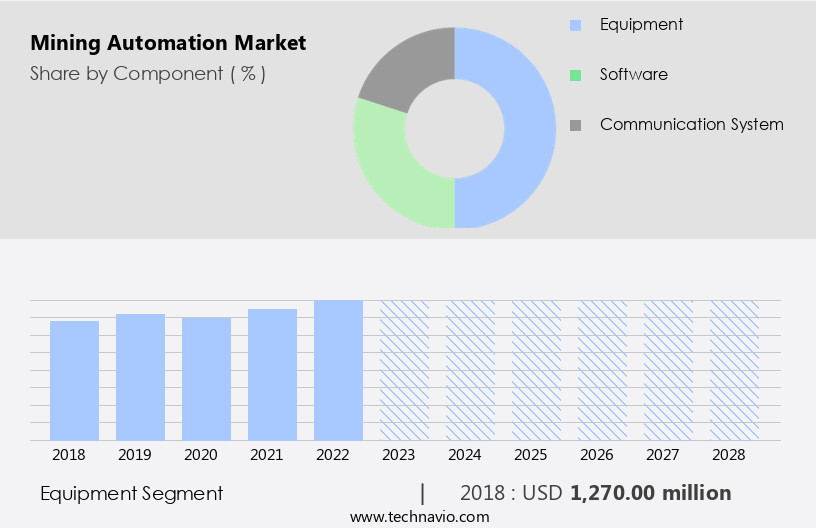

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Equipment

- Software

- Communication system

- Type

- Underground mining automation

- Surface mining automation

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Component Insights

The equipment segment is estimated to witness significant growth during the forecast period. The market encompasses the use of advanced technologies, including artificial intelligence (AI), robotization, wireless sensors, RFID, data communication, and visualization tools, to automate mining operations. This market caters to various mining activities, such as base metals exploration and extraction, drilling in oil sands and underground mines, and waste management. Automated solutions employ autonomous technology to operate equipment, including trucks, drillers, and loaders, in real-time, enhancing production efficiency and safety. Safety integrity level is a crucial aspect, ensuring the safety of workers in hazardous conditions. Hardware automation technology, such as wireless networks and asset management strategies, streamlines operations and minimizes human error.

Mining automation technologies also facilitate predictive maintenance and resource extraction through the integration of IoT and data analytics. Key mining sectors include coal, metals, and mineral processing, with applications in drilling, material handling, and materials processing. Safety standards are paramount, addressing equipment failures and hazardous working conditions.

Get a glance at the market report of various segments Request Free Sample

- The equipment segment was valued at USD 1.27 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market In the Asia Pacific (APAC) region experienced steady growth in 2023, driven by the presence of abundant natural resources such as coal, copper, gold, iron ore, and other base metals. Countries like China, India, Australia, and Indonesia have a significant mining industry contribution to their GDPs. APAC's mining sector benefits from the region's high mineral potential and cost-effective labor.

For more insights on the market size of various regions, Request Free Sample

Government regulations also support automation adoption. Consequently, APAC held the largest share of the market in 2022 and is expected to continue growing steadily during the forecast period. Automation solutions' demand in APAC's mining industry will grow due to increasing safety hazards, production efficiency needs, and technological advancements. Safety Integrity Level (SIL) compliance, cloud for robotization, RFID, data communication, high-precision wireless sensors, and autonomous technology are integral to automated mining solutions. Real-time data visualization tools, materials handling, cameras, and hardware automation technology are essential for efficient material processing and asset management.

Wireless networks, robotization operations, autonomous trucks, and autonomous haulage systems are integral to the driverless truck program and AI-driven mining operations. Predictive maintenance, sensors, and mineral processing technologies, including drones, are crucial for accuracy and cost savings. The mining industry's focus on safety standards, profit margins, and waste management necessitates the adoption of automation technologies to mitigate human error, improve commodity price resilience, and enhance operational efficiency.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Mining Automation Industry?

- The growth of the mining industry is the key driver of the market. The mining industry, a significant contributor to the global economy, is experiencing growth following a challenging decade marked by commodity price volatility. Mining automation is a key driver of this revival, with technological advancements in safety integrity level (SIL) cloud for robotization, RFID, data communication, wireless sensors, and autonomous technology improving production efficiency and safety in metal exploration activities. Safety hazards, a persistent concern in mining, are addressed through automated solutions such as autonomous trucks and haulage systems, driverless truck programs, and artificial intelligence (AI). Real-time data and visualization tools enable predictive maintenance, asset management strategies, and waste management.

- Mining machinery, including drilling equipment in oil sands and underground operations, benefits from hardware automation technology, cameras, and teleoperation systems. Communication systems, IoT, and data analytics facilitate efficient resource extraction and processing. Safety standards are upheld through equipment failures, while hazardous working conditions are mitigated through remote-controlled machinery. Mineral processing is enhanced through sensors and drones, ensuring accuracy and precision. Profit margins are improved through technological advancements, reducing human error and increasing operational efficiency. Despite the challenges, the mining industry continues to innovate, adapting to the evolving market dynamics and commodity prices.

What are the market trends shaping the Mining Automation market?

- Increasing adoption of mobile-based technologies is the upcoming market trend. Mining automation is experiencing significant technological advancements, driven by the integration of cloud technology for robotization, safety integrity level systems, and wireless sensors. Safety hazards in mining activities, such as equipment failures and hazardous working conditions, are addressed through automated solutions, including autonomous technology and real-time data visualization tools. Base metals exploration and processing, drilling in oil sands, and underground mining operations are benefiting from these innovations. Mobile technologies, including RFID, data communication, and teleoperation systems, are crucial components of mining automation. Wireless networks enable seamless communication between various mining equipment and systems, enhancing production efficiency and asset management strategies.

- Autonomous trucks and haulage systems, driverless truck programs, and artificial intelligence are key automation technologies reducing human error and increasing accuracy in resource extraction. Predictive maintenance, sensors, and data analytics are essential for minimizing downtime and optimizing mineral processing. Drones provide aerial surveillance and data collection for improved waste management and exploration accuracy. IoT integration facilitates remote-controlled machinery operation and real-time monitoring of mining activities. Mining companies are adopting these automation technologies to streamline their operations, improve safety standards, and maintain profit margins amidst fluctuating commodity prices. The integration of these advanced technologies is transforming the mining industry, enabling more efficient, safe, and cost-effective resource extraction.

What challenges does the Mining Automation Industry face during its growth?

- Risks associated with cybersecurity is a key challenge affecting the industry's growth. The market faces significant challenges in ensuring IT security for its systems, which are integral to the industry's digital transformation. With the increasing adoption of cloud for robotization, data communication through wireless sensors, RFID, and drones, the risk of cybersecurity threats is heightened. Companies in the market must prioritize IT security compliance with regulatory bodies to mitigate these risks. Continuous upgrading of IT systems to adhere to the latest security guidelines adds to the costs for mining automation service providers. Furthermore, complex cybersecurity frameworks can result from outdated IT infrastructure or guidelines, increasing the challenge for companies. In the context of mining automation, the safety integrity level is paramount.

- Automated solutions, such as autonomous technology in trucks and haulage systems, driverless truck programs, and artificial intelligence, enhance production efficiency and safety. However, they also introduce new safety hazards, such as equipment failures and human error. Effective asset management strategies, predictive maintenance, and real-time data visualization tools are crucial for minimizing risks and maximizing profit margins in mining operations. Mining automation technologies, including hardware automation, software automation, and IoT, enable improvements in mineral processing, drilling, oil sands, and waste management. Effective communication systems and data analytics are essential for managing and optimizing resource extraction activities.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- ABB Ltd.

- Antaira Technologies LLC

- Atlas Copco AB

- Autonomous Solutions Inc.

- Caterpillar Inc.

- CiGen

- Hexagon AB

- Hitachi Construction Machinery Co. Ltd.

- Komatsu Ltd.

- Metso Outotec Corp.

- Mitsubishi Electric Corp.

- Rio Tinto Ltd.

- Rockwell Automation Inc.

- Roxia Oy

- RPMGlobal Holdings Ltd.

- Sandvik AB

- Sany Group

- Sarla Advantech Pvt. Ltd.

- Siemens AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The mining industry is experiencing a significant shift towards automation and robotization, driven by the need for increased production efficiency, safety, and cost savings. This trend is particularly prevalent in base metals mining, where safety integrity level (SIL) requirements are high due to hazardous working conditions and potential equipment failures. One of the key technologies driving this automation is the implementation of cloud-based solutions. Cloud technology enables real-time data communication and visualization tools, allowing mining companies to monitor and manage their operations more effectively. This is especially important in large-scale mining operations, where wireless sensors and RFID technology are used to track materials and assets in real-time. Safety hazards are a major concern In the mining industry, and autonomous technology is being increasingly adopted to mitigate these risks. Autonomous trucks and haulage systems, for example, are being used to reduce the need for human operators in dangerous environments. Similarly, drones are being used for mineral exploration activities to minimize the need for personnel in hazardous areas. Automation technologies are also being used to improve accuracy in mining operations. For instance, cameras and AI algorithms are being used to analyze drilling data and identify potential equipment failures before they occur. Predictive maintenance strategies are then employed to prevent downtime and maintain optimal production levels.

Hardware automation technology is also playing a crucial role in mining automation. Wireless networks and communication systems are being used to connect various components of mining equipment, enabling remote-controlled machinery and teleoperation systems. This not only improves safety but also increases efficiency by reducing the need for on-site personnel. Mining companies are also adopting asset management strategies to optimize their use of resources. Data analytics is being used to gain insights into production patterns, equipment performance, and commodity prices. This information is then used to make informed decisions about resource allocation and operational planning. The technological advancement in automation is transforming the mining industry, with significant implications for profit margins and operational efficiency. However, the implementation of these technologies also presents challenges, particularly in terms of integrating disparate systems and ensuring data security. Hence, the mining industry is undergoing a significant transformation, driven by the adoption of automation and robotization technologies. This trend is being driven by the need for increased safety, production efficiency, and cost savings. The implementation of cloud-based solutions, autonomous technology, and data analytics is key drivers of this transformation, with significant implications for the future of resource extraction.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 7.92% |

|

Market growth 2024-2028 |

USD 1.87 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.45 |

|

Key countries |

US, China, Australia, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mining Automation Market Research and Growth Report?

- CAGR of the Mining Automation industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mining automation market growth of industry companies

We can help! Our analysts can customize this mining automation market research report to meet your requirements.