US Biotechnology Market Size 2025-2029

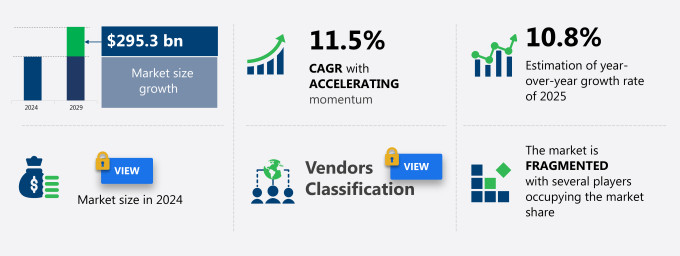

The US biotechnology market size is forecast to increase by USD 295.3 billion at a CAGR of 11.5% between 2024 and 2029.

- The biotechnology market is experiencing significant growth due to several key factors. The rising prevalence of chronic and rare diseases is driving market demand, as biotechnology offers innovative solutions for diagnosing, treating, and managing these conditions. Additionally, the integration of artificial intelligence (AI) and machine learning technologies is revolutionizing the industry, enabling more accurate diagnoses and personalized treatments. However, regulatory hurdles pose a challenge to market growth. Strict regulations and lengthy approval processes can hinder the development and commercialization of new biotechnology products. Despite these challenges, the future of the biotechnology market looks promising, with continued innovation and advancements in technology expected to drive growth.

What will be the Size of the market During the Forecast Period?

- The biotechnology market encompasses a broad range of technologies and applications, including regeneration technologies for neurological disorders such as age-related macular degeneration and Alzheimer's disease, as well as clinical successes in gene therapy for cancer and genetic abnormalities. Agricultural biotechnology also plays a significant role, with advancements in tissue culture technology leading to the development of pest-free banana varieties and insect-resistant seeds. Tissue engineering and cell therapy are other key areas of focus, with clinical trials underway for chronic diseases like arthritis, type 2 diabetes, and TB.

- The regulatory framework for biotechnology is evolving, with approvals for personalized medicine and cell-based assays driving investments in this field. Research activities span from biochemistry and chromatography to proteomics and PCR, with funding opportunities available from both public and private sources. Miniaturized portable instruments and clinical diagnostic tests are also gaining traction, as the industry continues to innovate and address the challenges of clinical studies and regulatory approval processes.

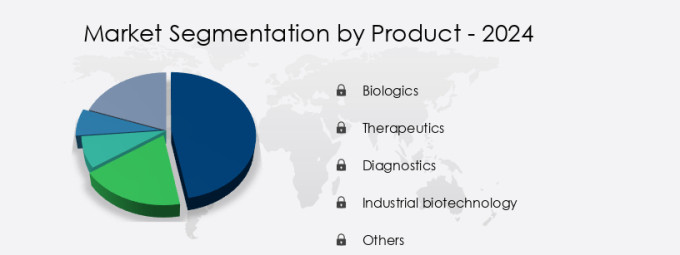

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Biologics

- Therapeutics

- Diagnostics

- Industrial biotechnology

- Others

- Type

- Red biotechnology

- White biotechnology

- Green biotechnology

- Grey biotechnology

- Others

- Geography

- US

By Product Insights

- The biologics segment is estimated to witness significant growth during the forecast period.

The biotechnology market is primarily driven by the segment of biologics, which comprises drugs derived from or containing components of living organisms. This category includes monoclonal antibodies, vaccines, hormones, blood products, and gene therapies. Biologics have revolutionized modern medicine by providing targeted treatments for conditions such as cancer, autoimmune diseases, and genetic disorders. Their higher efficacy and specificity compared to traditional small-molecule drugs have led to significant growth in this segment.

Furthermore, substantial investments in manufacturing and research facilities have further bolstered the biologics market. Biotechnology advancements in areas like gene editing technologies, stem cell therapy, and disease prevention strategies have fueled innovation in medical biotechnology. In agricultural biotechnology, biotech solutions are addressing food security challenges. Clinical trial design and biopharmaceutical development continue to be critical areas of focus for market expansion.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our US Biotechnology Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the US Biotechnology Market?

Rising prevalence of chronic and rare diseases is the key driver of the market.

- The US biotechnology market is experiencing significant growth due to the increasing prevalence of chronic and rare diseases. Approximately 130 million Americans were reported to have at least one major chronic condition in 2023, including heart disease, cancer, diabetes, obesity, and hypertension. Biotechnology offers innovative solutions for managing and treating these conditions through precision medicine, genetic engineering applications, and biomedical engineering. In the field of agriculture, biotechnology is driving sustainability through herbicide-tolerant seeds, plant breeding innovations, and crop improvement strategies. Additionally, biotechnology is making strides in disease prevention strategies, with research focusing on Alzheimer's disease, Parkinson's disease, eye disease, and other conditions.

- Biotechnology investment is also on the rise, with funding for biopharmaceutical development, gene editing technologies, and stem cell therapy. The biotechnology industry is also addressing food security solutions and healthcare advancements through biotechnology trends such as precision agriculture, synthetic biology, and nanotechnology. However, the industry faces challenges related to biotechnology ethics, regulation, and big data management. Despite these challenges, the future of biotechnology is promising, with opportunities in biotechnology patents, biotechnology development, and biotechnology careers.

What are the market trends shaping the US Biotechnology Market?

The incorporation of artificial intelligence and machine learning is the upcoming trend In the market.

- Biotechnology, a field that combines science, technology, and engineering to develop innovative solutions, is experiencing significant advancements with the integration of artificial intelligence (AI) and machine learning (ML). In drug discovery, these technologies are revolutionizing the industry by enhancing data analysis capabilities, shortening development timelines, and increasing efficiency. AI and ML are used to analyze vast datasets, uncovering patterns and insights that were previously unattainable, thereby accelerating the identification of drug targets and biomarkers. In diagnostics, AI-driven tools are improving disease detection by enabling more precise diagnoses and personalized treatment plans based on individual genetic makeup. Biotechnology is also making strides in agriculture, with precision medicine applications in plant science research leading to disease-free banana varieties and herbicide-tolerant seeds.

- Agricultural sustainability is being advanced through plant breeding innovations and crop improvement strategies. Biotechnology is also making a significant impact in medical fields, with biomedical engineering leading to breakthroughs in Alzheimer's and Parkinson's disease research. Gene editing technologies, such as CRISPR, are revolutionizing healthcare, while stem cell therapy and biopharmaceutical development are providing new solutions for disease prevention and treatment. Biotechnology investment is on the rise, driven by the potential for significant returns and the need for food security solutions. Biotechnology trends include the use of big data, nanotechnology, drug development, and biomaterials. Biotechnology education and funding are also crucial to the industry's growth, with a focus on biotechnology careers and opportunities.

What challenges does US Biotechnology Market face during its growth?

Regulatory hurdles is a key challenge affecting the market growth.

- The US biotechnology market encompasses various sectors, including precision medicine, genetic engineering applications, and agricultural biotechnology. Precision medicine utilizes genetic information to develop personalized treatment plans for diseases such as Alzheimer's and Parkinson's. Genetic engineering advances have led to disease-free banana varieties and herbicide-tolerant seeds, revolutionizing plant science research. Biotech startups are at the forefront of agricultural innovation, implementing crop improvement strategies through biomedical engineering and gene editing technologies. Biotechnology investment continues to grow, fueled by breakthroughs in biopharmaceutical development, stem cell therapy, and nanotechnology. Biotechnology advancements in disease prevention strategies, eye disease research, and diagnostics are transforming healthcare.

- Biotechnology policy and regulation are crucial, with the Food and Drug Administration (FDA) overseeing drug, biologic, and medical device approvals. Extensive preclinical and clinical trial data are required to assess safety and efficacy, ensuring the quality of biotech products. Biotechnology trends include precision agriculture, synthetic biology, and bioremediation. Biotechnology careers offer opportunities in research, education, and development. Despite challenges, such as regulation and big data management, the biotechnology industry continues to innovate, providing food security solutions, biotechnology software, and drug development. The future of biotechnology is promising, with opportunities in biomaterials, gene editing, and clinical trial design.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

AbbVie Inc. - The company provides advanced biotechnology offerings, including ACTIGALL - a bile acid therapy that prevents gallstone formation and aids In their dissolution.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amgen Inc.

- Biogen Inc.

- BioMarin Pharmaceutical Inc.

- bluebird bio Inc.

- Eli Lilly and Co.

- Genentech Inc.

- Gilead Sciences Inc.

- Illumina Inc.

- Johnson and Johnson Inc.

- Moderna Inc.

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- Sarepta Therapeutics Inc.

- Thermo Fisher Scientific Inc.

- Vertex Pharmaceuticals Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Biotechnology, a field that encompasses the application of biological systems, processes, and organisms to develop innovative products and technologies, continues to evolve at an unprecedented pace. This dynamic industry is driven by various market forces, including advancements in science, increasing demand for sustainable solutions, and growing investment in research and development. One of the most significant areas of growth in biotechnology is In the realm of precision medicine. This approach, which involves tailoring medical treatments to individual patients based on their genetic makeup and lifestyle factors, holds great promise for improving health outcomes and reducing healthcare costs. Precision medicine applications span from molecular diagnostics and personalized treatment plans to gene editing technologies and stem cell therapy.

In addition, another area of biotechnology that is gaining traction is in agriculture. The industry is witnessing a rise in innovation, driven by the need for sustainable farming practices and food security solutions. Biotechnology is being used to develop herbicide-tolerant seeds, disease-resistant plant varieties, and crop improvement strategies. Plant science research is also focusing on creating disease-free banana varieties and other agricultural biotechnology breakthroughs. Biotechnology is also making strides In the healthcare sector, with biomedical engineering and biopharmaceutical development leading the way. Disease prevention strategies, such as gene editing technologies and vaccines, are being developed to combat various conditions, including Alzheimer's disease and Parkinson's disease.

Furthermore, eye disease research is also a promising area, with potential applications in gene therapy and regenerative medicine. The biotechnology industry is also facing challenges, such as ethical considerations, regulatory hurdles, and big data management. Biotechnology policy and education are essential to addressing these challenges and ensuring the responsible development and implementation of biotechnology solutions. Despite these challenges, the biotechnology industry continues to offer numerous opportunities for innovation and growth. Biotechnology trends include nanotechnology, synthetic biology, and bioremediation, among others. Biotechnology funding and investment are also on the rise, with venture capital firms and governments recognizing the potential of this field to drive economic growth and improve quality of life.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.5% |

|

Market Growth 2025-2029 |

USD 295.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.8 |

|

Key countries |

US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch