US Household Vacuum Cleaner Market Size 2025-2029

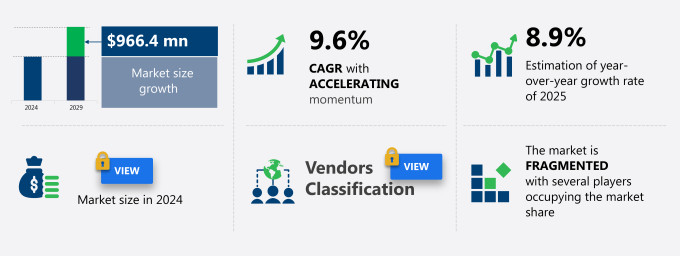

The US household vacuum cleaner market size is forecast to increase by USD 966.4 million at a CAGR of 9.6% between 2024 and 2029.

- The market is witnessing significant growth due to several key factors. One of the primary drivers is the increasing penetration of e-commerce channels, which has made it easier for consumers to purchase vacuum cleaners online. Another growth factor is the continuous launch of new and innovative products, which cater to the evolving needs of consumers. In addition, another trend in the market is the development of self-cleaning vacuum cleaners and those with washable filters, which reduce maintenance requirements and enhance user convenience.

- However, the market also faces challenges such as product recalls due to safety concerns and increasing competition from other floor care devices. To stay competitive, companies in this market are focusing on offering advanced features, such as cordless designs, improved filtration systems, and smart technology integration. These trends and challenges are shaping the future of the market in North America.

What will be the Size of the Market During the Forecast Period?

- The market is a significant segment within the broader home appliance industry, catering to the essential need for maintaining cleanliness and hygiene in modern residences. This market is driven by several factors, including advancements in technology, changing consumer preferences, and the increasing awareness of health and wellness and allergy concerns. Vacuum cleaners have evolved significantly over the years, with various types, features, and technologies catering to diverse consumer needs. Upright vacuum cleaners, renowned for their powerful suction and excellent performance on carpets, continue to dominate the market.

- However, the demand for bagless vacuum cleaners has been on the rise due to their convenience and cost-effectiveness. The market for filtration vacuum cleaners, including HEPA filtration models, has experienced substantial growth, particularly among allergy sufferers. These vacuums effectively trap allergens, ensuring a cleaner and healthier living environment. Smart vacuum cleaners, equipped with self-navigating technology, have gained popularity for their ability to clean homes autonomously, making them an ideal choice for large homes and small spaces alike.

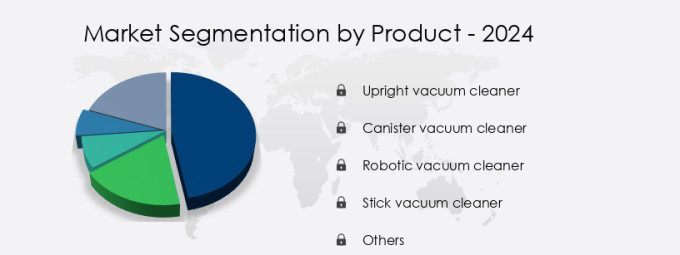

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Upright vacuum cleaner

- Canister vacuum cleaner

- Robotic vacuum cleaner

- Stick vacuum cleaner

- Others

- Type

- Corded

- Cordless

- Distribution Channel

- Offline

- Online

- Geography

- US

By Product Insights

- The upright vacuum cleaner segment is estimated to witness significant growth during the forecast period.

The market is categorized by product type, with upright vacuums holding a substantial market share. These vacuums are renowned for their strong suction abilities and user-friendly design, making them a preferred option for numerous residents. Upright vacuums feature the machine's main body in an upright position, which is maneuvered in front of the user during operation. This configuration is particularly advantageous for cleaning expansive carpeted spaces, as it ensures comprehensive and labor-saving cleaning. Furthermore, the upright design often includes a broad cleaning path, expediting the process by covering larger areas in a shorter time frame.

Technological advancements have significantly influenced the household vacuum cleaner industry, introducing innovations such as cordless models, advanced filtration systems, and intelligent features, thereby driving market penetration and growth.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of US Household Vacuum Cleaner Market?

Increasing penetration of e-commerce channels is the key driver of the market.

- The market is experiencing significant growth, driven by technological developments and increasing consumer awareness of hygiene and cleanliness. Social media platforms are playing a crucial role in promoting new product launches and innovations, such as cordless and canister vacuum cleaners with smart applications like Bluetooth connectivity, voice commands, and self-cleaning features. The working population, particularly those with pets, are key consumers, seeking vacuum cleaners with high vacuum cleaning abilities, filtration features like industrial HEPA filters, and pet hair attachments. Government regulations on emissions and sustainability are also influencing the industry, leading to the production of eco-friendly, water-based vacuum cleaners and self-emptying dustbins.

- Online sales platforms, including Amazon, are transforming the market by offering ease of usage, competitive pricing, and a wide range of options, from handheld to automated vacuum cleaners, catering to various industry verticals and applications. Overall, the market is poised for continued growth, driven by consumer demand for efficient, versatile, and technologically advanced cleaning solutions.

What are the market trends shaping the US Household Vacuum Cleaner Market?

Product launches is the upcoming trend in the market.

- The market is experiencing notable growth, driven by technological developments and increasing consumer focus on hygiene and cleanliness. Smart applications, such as Bluetooth connectivity, voice commands, and self-cleaning features, are gaining popularity among residential consumers. New product launches, including cordless and canister vacuum cleaners, are penetrating various industry verticals, offering ease of usage and versatility. Manufacturers are focusing on efficiency, filtration features, and sustainability to meet evolving consumer demands. For instance, Riccar's recent introduction of the Spirit upright vacuum cleaner showcases these trends, with a mid-range price point, ergonomic design, and advanced filtration system. Additionally, online sales platforms have increased accessibility, allowing consumers to purchase vacuum cleaners with the click of a button.

- Government regulations and concerns over indoor pollution, such as emissions, have led to a demand for sustainable products. This has resulted in the development of water-based vacuum cleaners and self-emptying dustbins. The market is further expected to grow as manufacturers continue to innovate, offering deep cleaning abilities, automated vacuum cleaners, and pet hair attachments to cater to the working population and their various spaces.

What challenges does US Household Vacuum Cleaner Market face during the growth?

Product recalls is a key challenge affecting the market growth.

- The market is witnessing significant growth, driven by technological developments and the increasing working population's need for efficiency and cleanliness. Social media platforms are playing a pivotal role in promoting new product launches and increasing market penetration. Smart applications, such as Bluetooth connectivity, voice commands, and self-cleaning features, are gaining popularity among consumers. Canister and cordless vacuum cleaners dominate the market, with the former offering greater suction power and the latter offering ease of usage and portability. The industry verticals include residential and commercial applications, with the former holding a larger market share.

- Efficiency and hygiene are key considerations for consumers, leading to the demand for vacuum cleaners with advanced filtration features, such as HEPA filters, and innovative deep cleaning abilities. Sustainable products and reduced emissions are also becoming important factors in consumer purchasing decisions. Government regulations and industry standards play a crucial role in ensuring product safety and quality. Product recalls, such as the recent one for Oreck Discover Upright Vacuum cleaners, highlight the importance of adhering to these regulations and maintaining stringent quality control measures. Handheld and water-based vacuum cleaners, self-emptying dustbins, and pet hair attachments are some of the new launches in the market catering to diverse applications and consumer needs.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AB Electrolux - The company offers household vacuum cleaners such as canister vacuum cleaners, handstick vacuum cleaners, wet and dry vacuum cleaners.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BISSELL

- Dustless Technologies Inc

- Dyson Group Co.

- InterVac Design Corp

- Lindsay Manufacturing Inc

- Lux International AG

- Maytag

- metrovacworld

- Midea Group Co. Ltd.

- Riccar

- SharkNinja Operating LLC

- Shop Vac USA LLC

- Techtronic Floor Care Technology Ltd

- The Kirby Co

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to various factors, including the increasing working population and the rising demand for cleanliness and hygiene in residential spaces. This market encompasses a wide range of products, including canister vacuum cleaners, cordless vacuum cleaners, handheld vacuum cleaners, and more. One of the key trends in the market is the integration of smart applications. With the increasing popularity of social media, consumers are looking for vacuum cleaners that offer smart connectivity, Bluetooth capabilities, and voice commands. Moreover, these features enable users to control their vacuum cleaners remotely and monitor their cleaning progress in real-time. Some of the main types of vaccum cleaners include hygiene vacuum cleaner, pet hair vacuum cleaner, HEPA filter vacuum cleaner, indoor pollution vacuum cleaner, deep cleaning vacuum cleaner, quiet vacuum cleaner, self-emptying dustbin.

However, the commercial sector is also expected to witness significant growth due to the rising demand for efficient and versatile vacuum cleaners in offices, hospitals, and other commercial spaces. Government regulations and the push towards sustainable products have also influenced the market. With increasing concerns over indoor pollution and emissions, manufacturers are focusing on developing vacuum cleaners with advanced filtration features and low emissions. Additionally, the use of sustainable materials in vacuum cleaners is gaining popularity, as consumers become more environmentally conscious. Applications of household vacuum cleaners include cleaning carpets, hardwood floors, and other surfaces. The market is evolving with growing consumer demand for superior cleaning performance and health benefits. Cleanliness vacuum cleaners are sought after for their ability to maintain a clean home environment, while hygiene vacuum cleaners play a crucial role in reducing allergens and bacteria. Pet hair vacuum cleaners are gaining popularity due to their powerful suction and specialized features for removing stubborn pet hair. HEPA filter vacuum cleaners are essential for combating indoor pollution, providing cleaner air in homes. For thorough cleaning, deep cleaning vacuum cleaners are in demand, offering advanced features. Additionally, quiet vacuum cleaners provide a peaceful cleaning experience, while self-emptying dustbins and washable filters enhance convenience and efficiency for users.

Furthermore, pet hair attachments have gained popularity due to the increasing number of pet owners. Water-based vacuum cleaners are also gaining traction due to their ability to clean and sanitize floors effectively. Innovation is a key driver of growth in the market. New launches of automated vacuum cleaners and bagless vacuum cleaners have disrupted the market, offering consumers advanced features and improved performance. The market is expected to continue growing due to these technological advancements and the increasing demand for cleanliness and hygiene in residential and commercial spaces. The market is witnessing significant growth driven by advancements in technology and consumer demand for more efficient cleaning solutions. The market is booming with a wide variety of options for every need. Vacuum cleaner reviews are helping consumers make informed decisions, while a detailed vacuum cleaner buying guide ensures the right purchase. Vacuum cleaner comparison tools highlight essential vacuum cleaner features, including options for hardwood floors and carpet cleaning. When choosing a vacuum, vacuum cleaner technology like self-navigating models and powerful vacuum cleaners for carpets is key. For those with allergies, allergen vacuum cleaners equipped with HEPA filters help reduce indoor pollution. Bagless vacuum cleaners, smart vacuum cleaners, and mobile app vacuum cleaners offer modern conveniences, while good suction and deep cleaning abilities ensure thorough cleaning. Affordable vacuum options, lightweight cordless vacuum cleaners, and quiet vacuum cleaners are also popular choices for all.

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.6% |

|

Market growth 2025-2029 |

USD 966.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.9 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch