Uncoated Woodfree (UWF) Paper Market Size 2024-2028

The uncoated woodfree (uwf) paper market size is forecast to increase by USD 10.38 billion, at a CAGR of 3.2% between 2023 and 2028.

- The market is experiencing significant growth dynamics, driven by the rising literacy rates in emerging economies and the increasing popularity of 3D printing technology. The expansion of literacy programs in developing regions is fueling the demand for printed materials, leading to increased production and consumption of UWF paper. Additionally, the shift towards global digitization has not diminished the relevance of paper; instead, it has diversified its applications. UWF paper, with its superior print quality and environmental sustainability, is gaining traction in various industries, including publishing, packaging, and graphic arts. However, the market faces challenges as well.

- The emergence of digital alternatives, such as e-books and online documents, poses a significant threat to the traditional paper industry. Furthermore, the increasing adoption of 3D printing technology in various sectors could potentially reduce the demand for 2D printed materials like UWF paper. To capitalize on the market opportunities and navigate these challenges effectively, companies must focus on innovation, sustainability, and diversification. By investing in research and development, they can create value-added UWF paper products that cater to evolving consumer needs and preferences. Moreover, collaborating with 3D printing technology providers could open up new revenue streams and create synergies.

- Ultimately, the UWF Paper Market presents a compelling landscape for strategic business decisions and operational planning, offering opportunities for growth and innovation.

What will be the Size of the Uncoated Woodfree (UWF) Paper Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution, with market dynamics unfolding in various sectors. Ink absorbency testing plays a crucial role in ensuring optimal print quality, while brightness standardization maintains consistency in paper appearance. Moisture content control and water retention value are essential for paper durability, as they impact dimensional stability. Fiber bonding strength and surface sizing methods enhance paper strength properties and surface smoothness, respectively. Paper density control and color uniformity assessment are integral to producing visually appealing and high-quality UWF paper. Whiteness index measurement and paper grammage control ensure consistency in paper color and weight, respectively.

Paper roll dimensions and paper recycling process are key considerations for paper manufacturers and consumers alike. Paper aging properties, tear strength measurement, and printing ink interaction are critical factors in assessing UWF paper's long-term performance. Coating weight control, coating composition analysis, and fiber type identification are essential in optimizing paper production processes. Paper stiffness testing, sheet breaking resistance, and burst strength testing are crucial in evaluating paper strength and durability. Basis weight variation and wood fiber characteristics impact UWF paper's overall quality and performance. The sheet formation process and opacity measurement methods are essential in producing UWF paper that meets the evolving demands of the market. The UWF paper industry continues to innovate, with ongoing research and development in pulp refining methods, paper pulp processing, and surface smoothness testing, among others.

How is this Uncoated Woodfree (UWF) Paper Industry segmented?

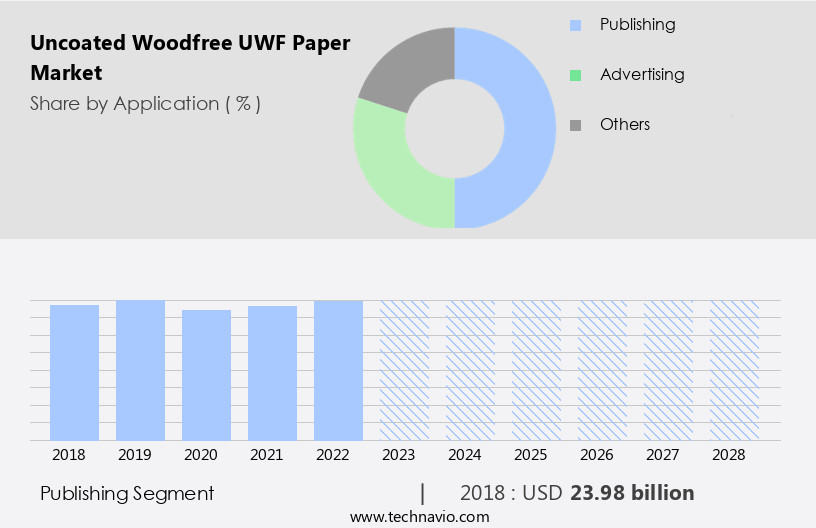

The uncoated woodfree (uwf) paper industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Publishing

- Advertising

- Others

- Type

- Ordinary paper

- Special paper

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The publishing segment is estimated to witness significant growth during the forecast period.

The market in the publishing sector experiences significant growth, driven by the increasing demand for high-quality print materials. Calendering techniques are employed to enhance the paper's smoothness and uniformity, while paper caliper measurement ensures consistency in thickness. Print quality assessment is crucial, as UWF paper must meet stringent industry standards for color uniformity and whiteness index. Pulp refining methods, such as pulp beating and screening, optimize fiber length distribution and improve paper strength properties. Surface sizing methods, like rosin sizing and starch sizing, enhance printability and ink absorbency. Brightness standardization and moisture content control maintain uniformity and prevent discoloration.

Paper dimensional stability is essential, as UWF paper must maintain its shape and size during printing and handling. Fiber bonding strength is crucial for ensuring the paper's durability and tear resistance. Coating weight control and coating composition analysis are essential for optimizing the paper's printability and ink interaction. Paper pulp processing involves various stages, including pulping, bleaching, and papermaking. Understanding the wood fiber characteristics and sheet formation process is vital for producing high-quality UWF paper. Opacity measurement methods assess the paper's ability to hide the show-through of text and images. The recycling process is a sustainable solution for UWF paper production, reducing raw material costs and environmental impact.

Paper aging properties, such as yellowing and brittleness, are crucial factors in determining the paper's long-term durability. Tear strength measurement ensures the paper can withstand handling and transportation without damage. Basis weight variation and paper density control maintain consistency in the paper's weight and thickness, ensuring uniformity in printing and binding. Burst strength testing assesses the paper's ability to withstand external pressure, ensuring its durability for various applications. In the publishing sector, UWF paper's versatility and high-quality properties make it a preferred choice for print magazines, books, and newspapers.

The Publishing segment was valued at USD 23.98 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 51% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing moderate growth due to the region's abundant raw material supply and cost-effective labor. Countries like India, China, Japan, the Philippines, Vietnam, and Thailand are driving this growth. In response, paper manufacturers are relocating their production facilities to APAC. Moreover, governments and private enterprises in countries with low literacy rates, such as India and China, are investing in education initiatives to improve literacy levels. For example, in 2017, the Jack Ma Foundation pledged USD45 million to encourage graduates of normal schools to teach in rural areas between 2017 and 2027. Calendering techniques are used to improve the paper's surface smoothness, affecting print quality.

Paper caliper measurement is crucial for determining the thickness of the paper, influencing paper density and grammage control. Pulp refining methods, such as pulp beating and screening, affect fiber length distribution and paper strength properties. Ink absorbency testing, brightness standardization, and moisture content control are essential for maintaining consistent print quality. Surface sizing methods enhance paper's dimensional stability and printing ink interaction. Coating weight control and coating composition analysis are crucial for optimizing paper's surface properties. Paper pulp processing involves various stages, including pulping, bleaching, and papermaking. Fiber type identification and paper stiffness testing help understand the paper's composition and properties.

Tear strength measurement, sheet breaking resistance, and burst strength testing assess paper's durability. Basis weight variation and opacity measurement methods ensure uniformity and consistency in paper production. Wood fiber characteristics and sheet formation processes impact paper's overall quality and performance. The UWF paper market's evolution is influenced by these factors and the region's economic and educational trends.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the realm of uncoated woodfree (uwf) paper production, the intricacies of creating high-quality paper with optimal surface protection for surgical site applications are of paramount importance to US consumers seeking exclusivity and trust in their healthcare solutions. The uncoated woodfree paper market is characterized by a constant pursuit of innovation, focusing on critical elements such as uncoated woodfree paper production process, wood fiber properties influence on paper quality, and controlling paper caliper during manufacturing. Advanced coating techniques for uncoated woodfree paper play a significant role in improving paper opacity through fiber modification. Measuring paper brightness using standardized methods ensures consistency and reliability in the final product. Key areas involve optimizing sheet formation for improved paper properties, achieving uniform coating weight across paper rolls, and paper surface smoothness testing using various instruments. The correlation between fiber length and paper strength is a crucial consideration in the production process. Improving paper ink absorbency for better printability is essential for meeting the demanding requirements of the surgical site infection control market. The impact of pulp refining on paper strength and its effect on paper recycling and its impact on paper quality are also critical aspects of the manufacturing process. Sustainable practices in uncoated woodfree paper production, such as monitoring and controlling moisture content in paper and assessing the quality of recycled paper fibers, are increasingly important to meet the evolving needs of the market. Advanced techniques for paper quality control, including evaluating the effect of different pulping methods and testing paper for resistance to aging and degradation, are integral to maintaining the trust and exclusivity that US consumers demand. In conclusion, the uncoated woodfree paper market for surgical site infection control applications is a dynamic and complex industry, requiring a deep understanding of various aspects, including uncoated woodfree paper production process, wood fiber properties, controlling paper caliper, improving paper opacity, measuring paper brightness, advanced coating techniques, optimizing sheet formation, achieving uniform coating weight, paper surface smoothness testing, fiber length and paper strength, improving paper ink absorbency, pulp refining, paper recycling, and sustainable practices. By focusing on these critical elements, manufacturers can create high-quality, reliable, and sustainable uncoated woodfree paper solutions that meet the exacting standards of the US surgical site infection control market.

What are the key market drivers leading to the rise in the adoption of Uncoated Woodfree (UWF) Paper Industry?

- In emerging economies, the escalating demand for literacy programs serves as the primary market catalyst.

- The market is experiencing significant growth due to increasing investments in education sectors of various emerging economies. Governments in countries like India and China are implementing initiatives to enhance literacy rates and provide quality education to their populations. These efforts are leading to a surge in demand for educational materials, including books, magazines, and catalogs, which primarily use UWF paper. For instance, the Indian government's Right to Education Act, Sarva Shiksha Abhiyan, and Beti Bachao, Beti Padhao are initiatives aimed at improving education policies and providing access to education for underprivileged children. In China, the Rural China Education Foundation focuses on improving rural education systems.

- The production of UWF paper involves several processes, such as pulp refining methods and calendaring techniques, to ensure desirable paper strength properties, surface smoothness, and dimensional stability. Fiber length distribution and paper grammage control are crucial aspects of UWF paper manufacturing. Proper assessment of print quality is essential to meet the stringent requirements of educational and publishing industries. Therefore, advanced testing methods, including paper caliper measurement and surface smoothness testing, are employed to maintain the highest standards. Overall, the UWF paper market's growth is driven by the educational sector's expansion in emerging economies, leading to a steady demand for high-quality paper products.

What are the market trends shaping the Uncoated Woodfree (UWF) Paper Industry?

- The growing popularity of 3D printing technology represents a significant market trend in the professional manufacturing sector. This advanced technology enables the creation of complex and customized products, contributing to its increasing demand and adoption.

- Uncoated Woodfree (UWF) paper is a crucial component in various industries, particularly for printing applications. Ink absorbency testing is essential to ensure optimal print quality, as UWF paper's ability to absorb ink evenly affects the final output's color uniformity. Brightness standardization is another critical factor, as the brightness level of UWF paper significantly impacts the appearance of printed materials. Moisture content control and water retention value are vital for UWF paper's durability and stability. Proper fiber bonding strength is necessary to maintain paper's structural integrity during the manufacturing process and throughout its use. Surface sizing methods are employed to enhance the paper's smoothness and resistance to moisture.

- Paper density control is essential for achieving the desired weight and thickness, ensuring consistent quality in various printing applications. The whiteness index measurement is a critical indicator of UWF paper's brightness and opacity, which significantly impacts the final appearance of printed materials. Assessing color uniformity and ensuring accurate representation of colors is crucial for UWF paper users. By adhering to these quality standards, UWF paper manufacturers provide their clients with high-quality products that meet the demands of various industries.

What challenges does the Uncoated Woodfree (UWF) Paper Industry face during its growth?

- The increasing focus on global digitization poses a significant challenge to industry growth, requiring organizations to adapt and integrate advanced technologies into their operations to remain competitive.

- Uncoated Woodfree (UWF) paper, a key player in the printing industry, continues to face challenges due to technological advancements and shifting consumer preferences. The proliferation of cloud-based storage solutions and digital document management systems have led to a decrease in the demand for printed materials. Corporations are increasingly converting hardcopy documents into digital formats for enhanced data security and ease of storage. Furthermore, the widespread use of high-definition cameras on smartphones and applications like CamScanner enable users to digitize documents, eliminating the need for paper-based documents. In the advertising sector, social media platforms such as Facebook and WhatsApp have emerged as cost-effective alternatives to traditional advertising methods like hoardings and magazine advertisements.

- Despite these challenges, the UWF paper market remains dynamic. Technological innovations continue to impact the industry, with advancements in paper recycling processes and paper aging properties. Tear strength measurement and printing ink interaction remain crucial factors in the coating weight control of UWF paper. Paper pulp processing techniques and coating composition analysis are essential for optimizing fiber type identification and ensuring product quality. As the industry evolves, understanding these market dynamics will be crucial for stakeholders to remain competitive.

Exclusive Customer Landscape

The uncoated woodfree (uwf) paper market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the uncoated woodfree (uwf) paper market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, uncoated woodfree (uwf) paper market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ahlstrom Holding 3 Oy - The Finnish pulp and paper manufacturer, Ahlstrom-Munksjo, provides high-quality Uncoated Woodfree (UWF) paper options, including PrintClassic, catering to diverse industry needs. This paper delivers superior print results with excellent color reproduction and smooth surface texture.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ahlstrom Holding 3 Oy

- Asia Pulp and Paper APP Sinar Mas.

- Burgo Group SpA

- Domtar Corp.

- Mondi Plc

- Stora Enso Oyj

- Suzano SA

- The Navigator Co. SA

- Torraspapel S.A.

- UPM Kymmene Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Uncoated Woodfree (UWF) Paper Market

- In January 2024, International Paper Company, a leading paper manufacturing firm, announced the launch of its new Uncoated Woodfree (UWF) paper product line, Envivo, aimed at the graphic arts and printing industries (International Paper Company Press Release). This expansion was a strategic response to growing market demand for sustainable and high-performance UWF paper.

- In March 2024, Smurfit Kappa, a European packaging leader, entered into a partnership with a leading UWF paper mill in Poland, expanding its paper production capabilities and enhancing its product portfolio (Smurfit Kappa Press Release). This strategic move allowed Smurfit Kappa to cater to the increasing demand for UWF paper in Europe.

- In May 2024, BillerudKorsnäs, a Swedish forest industry company, secured a significant investment of â¬150 million from its shareholders to expand its UWF paper production capacity (BillerudKorsnäs Press Release). This investment was a testament to the growing demand for UWF paper and the company's commitment to meeting market needs.

- In April 2025, the European Union (EU) passed a new regulation mandating the use of UWF paper for all official documents and publications, effective from 2026 (EU Official Journal). This regulatory approval marked a significant shift towards the adoption of UWF paper in the EU, providing a substantial boost to the market.

Research Analyst Overview

- The market is experiencing significant advancements in various areas, driving market growth and enhancing product offerings. Energy efficiency improvements in UWF paper manufacturing are a key focus, with sustainable paper production methods gaining traction. Deinking techniques and fiber refining technology are essential in producing high-quality UWF papers, while pulp bleaching processes ensure brightness and color consistency. Paper recycling technologies are increasingly important, with waste reduction strategies and quality assurance systems ensuring regulatory compliance and customer satisfaction. Quality control metrics and paper testing standards are crucial for maintaining product consistency and meeting customer expectations. Paper furnish optimization, defect detection methods, and paper handling processes are essential for efficient UWF paper manufacturing.

- Mechanical and chemical pulping methods are used to produce raw materials, with process optimization strategies ensuring production line efficiency. Paper durability testing and process optimization strategies are essential for maintaining product quality and customer satisfaction. Surface treatment methods and coating technology advancements are crucial for enhancing paper properties and meeting evolving customer demands. UWF paper manufacturers are continually investing in research and development to improve paper finishing techniques and meet the needs of diverse industries. Overall, the UWF paper market is dynamic and innovative, with a focus on sustainability, efficiency, and quality.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Uncoated Woodfree (UWF) Paper Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2024-2028 |

USD 10.38 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

3.06 |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Uncoated Woodfree (UWF) Paper Market Research and Growth Report?

- CAGR of the Uncoated Woodfree (UWF) Paper industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the uncoated woodfree (uwf) paper market growth of industry companies

We can help! Our analysts can customize this uncoated woodfree (uwf) paper market research report to meet your requirements.