Vinyl Acetate Monomer Market Size 2024-2028

The vinyl acetate monomer market size is forecast to increase by USD 1.57 billion at a CAGR of 3.6% between 2023 and 2028.

- The market is experiencing significant growth due to increasing applications in various industries. Key sectors driving this demand include adhesives, paints and coatings, textiles, films, and construction. In the adhesives industry, VAM is used to produce ethylene-vinyl acetate (EVA) copolymers, which are essential in the production of hot melt adhesives. In the paint and coatings sector, VAM is used as a monomer for producing acrylic polymers, which are widely used in architectural and industrial coatings. Moreover, the rising demand for flexible packaging is another major growth factor for the VAM market. Flexible packaging materials, such as films, are increasingly being used in various industries due to their lightweight, cost-effective, and convenient properties. Additionally, the volatility of raw material prices, particularly acetyl and ethylene, can significantly impact the VAM market. In the construction industry, VAM is used in the production of PVA emulsions, which are used as binders in various applications such as wallpaper paste, waterproofing, and asphalt modification.

What will be the Size of the Market During the Forecast Period?

- The market is a significant contributor to various industries, including adhesives, paints and coatings, textiles, films, construction, and specialty materials. VAM is a versatile raw material used in the production of ethylene-vinyl acetate (EVA) copolymers, polyvinyl acetate (PVA) polymers, and acetyl chain materials. In the adhesives sector, VAM is a crucial ingredient in the production of pressure-sensitive adhesives, hot melt adhesives, and water-based adhesives. These adhesives find extensive applications in various industries such as packaging, labeling, hygiene, and construction. The paints and coatings industry utilizes VAM in the production of low-volatile organic compound (VOC) paints and coatings. These environmentally friendly products help reduce carbon dioxide emissions and environmental pollution. Moreover, the increasing demand for green product development in the paints and coatings industry is expected to drive the growth of the market. In films, VAM is used to produce polyvinyl acetate (PVdC) films, which are widely used in food packaging and other applications. The construction industry uses VAM in the production of EVA-based adhesives and sealants.

- Moreover, these products offer excellent bonding properties, flexibility, and resistance to weathering, making them ideal for use in construction applications. Renewable energy is another emerging application area for VAM. It is used in the production of EVA-based binders for photovoltaic (PV) cells. These binders help improve the efficiency and durability of PV cells, making them an essential component of the renewable energy industry. Moreover, VAM is used in the production of biodegradable plastics, which are gaining popularity due to their eco-friendly nature. The increasing demand for biodegradable plastics is expected to drive the growth of the VAM market. However, the market is also subject to fluctuations in the price of raw materials such as crude oil and ethylene, which can impact the production costs of VAM. VAM (Vinyl Acetate Monomer), along with low-VOC formulations and ethylene-vinyl alcohol copolymers, plays a crucial role in enhancing adhesives performance, while polyvinyl acetate resins contribute to improved bonding strength and versatility in various applications.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Polyvinyl acetate(PVA)

- Polyvinyl alcohol(PVOH)

- Ethylene-vinyl acetate(EVA)

- Ethylene-vinyl alcohol(EVOH)

- Others

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

- The polyvinyl acetate(PVA) segment is estimated to witness significant growth during the forecast period.

Polyvinyl acetate monomer (PVM) is a versatile chemical compound extensively utilized in various industries, including adhesives, paints and coatings, textiles, films, construction, and ethylene-vinyl acetate (EVA). PVM's compatibility with resins makes it an ideal choice for numerous applications. In the adhesives sector, PVM-based adhesives offer superior bonding strength and adaptability to various surfaces. These adhesives are non-toxic and eco-friendly, making them a safe and sustainable option. The expanding e-commerce industry in emerging economies, such as India and China, is anticipated to boost the demand for adhesives and sealants. The packaging industry's shift towards lightweight and strong formulations will further fuel the market growth during the forecast period.

Furthermore, in the paints and coatings industry, PVM is employed as a monomer in producing acrylic polymers, which offer excellent adhesion, flexibility, and resistance to weathering. In the textile industry, PVM is used in the production of textile coatings and sizing agents, enhancing fabric strength and durability. In the films sector, PVM is used to create polyvinyl acetate films, which are widely used in packaging and industrial applications. In construction, PVM is utilized in the production of plastics and adhesives for insulation, roofing, and flooring applications.

Get a glance at the market report of share of various segments Request Free Sample

The polyvinyl acetate(PVA) segment was valued at USD 3.60 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

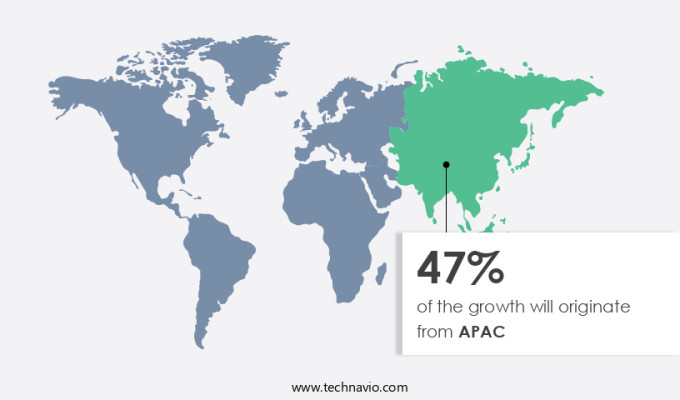

- APAC is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The construction materials sector in the Asia Pacific (APAC) region is experiencing significant growth due to increasing investments in infrastructure development. This expansion is anticipated to drive the demand for products such as paints and coatings, adhesives and sealants, and electronics, which in turn will fuel the need for vinyl acetate monomer (VAM). The economic growth in developing countries like China and rising foreign investments have led to an increase in per capita income, enabling consumers to purchase more goods, including cars. This trend is expected to continue during the forecast period. Moreover, there is a growing focus on green product development in response to concerns over carbon dioxide emissions and environmental pollution.

Moreover, VAM is a versatile monomer used in the production of low-volatile organic compound (VOC) paints and coatings, biodegradable plastics, and other eco-friendly products. Renewable natural resources are being explored as alternatives to traditional fossil fuels in VAM production, making it an attractive option for companies seeking to reduce their carbon footprint and meet sustainability goals. In conclusion, the expanding construction sector, increasing consumer purchasing power, and the shift towards green and sustainable products are key factors driving the demand for vinyl acetate monomer in the APAC region. This trend is expected to continue in the coming years, making it an attractive investment opportunity for companies in the chemicals industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Vinyl Acetate Monomer Market?

Rising residential and commercial infrastructure activities is the key driver of the market.

- The expansion of the residential and construction sector in various regions has resulted in the construction of new office buildings and commercial complexes. For instance, in the United States, Mutual of Omaha Headquarters in Omaha is under development, featuring around 800,000 square feet of office and amenity space, with an investment of USD 495 million. In India, Bengaluru and Hyderabad are leading the way in commercial real estate growth, with Bengaluru accounting for approximately 29% of the total office supply during the forecast period.

- Moreover, this development trend has fueled the demand for specialty materials, including acetyl chain materials such as polymers and resins, in the production of paints and coatings. Among these, Polyvinyl Acetate (PVA) and Polyvinyl Alcohol (PVA) are widely preferred for their excellent adhesive properties and resistance to moisture. As a result, the market for these acetyl chain materials is anticipated to grow significantly in the coming years. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Vinyl Acetate Monomer Market?

Rising demand for flexible packaging is the upcoming trend in the market.

- Vinyl acetate monomer (VAM) plays a significant role in the production of polyvinyl acetate (PVA) and polyvinyl alcohol (PVOH). PVOH is further utilized in the manufacture of water-soluble packaging films. VAM finds extensive applications in extrusion coatings, heavy-duty bags, and food packaging films. The demand for flexible packaging has witnessed a notable rise in the last decade due to its unique combination of properties from paper, aluminum foil, and plastic.

- Flexible packaging enhances the product's shelf life by preserving its freshness, durability, printability, and barrier protection. This makes it an ideal choice for various industries, particularly food, beverages, and pharmaceuticals, where extended shelf life is essential. Ethylene vinyl alcohol (EVOH), a copolymer of ethylene and vinyl alcohol, is another derivative of VAM. It is widely used in the production of PV (photovoltaic) cells due to its excellent barrier properties. Moreover, VAM is also employed in the cosmetics industry for producing water-based adhesives and coatings.

What challenges does Vinyl Acetate Monomer Market face during its growth?

The volatility of raw material prices is a key challenge affecting the market growth.

- The market is influenced by the price volatility of key raw materials, such as methanol, natural gas, carbon monoxide, and ethylene. These inputs experience frequent price fluctuations, which can negatively impact production costs and market stability. Geopolitical tensions, energy policy shifts, and economic downturns are the primary causes of this instability. As a result, manufacturers are forced to adjust their prices to maintain profitability, potentially reducing demand from price-sensitive industries like construction and automotive. Ethylene-vinyl acetate (EVA) and Vinyl Acetate Ethylene (VAE) are common applications of VAM in the adhesives industry. In the US, VAM is primarily produced from ethylene, a raw material derived from crude oil.

- The price fluctuations of crude oil significantly impact the VAM market, as ethylene is a significant component of VAM production. Other applications of VAM include the production of ethylene vinyl Alcohol (EVOH) for packaging and polyvinyl acetate (PVAc) for paints and coatings. To mitigate the impact of raw material price volatility, market participants are exploring alternative feedstocks and production methods. Additionally, regional collaborations and supply chain optimization strategies are being implemented to improve market stability and competitiveness.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Celanese Corp.

- Chang Chun Group

- China Petrochemical Corp.

- Dow Inc.

- Group DF Ltd.

- INEOS Group Holdings S.A.

- Joshi Agrochem Pharma Pvt. Ltd.

- Joyce Lub and Chem LLP

- Jubilant Life Sciences Ltd.

- KURARAY Co. Ltd.

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Group Corp.

- Opes International Ltd.

- Ravago

- Saudi International Petrochemical Co.

- Shin Etsu Chemical Co. Ltd.

- Solventis Ltd.

- Wacker Chemie AG

- West India Chemical International

- Zhengzhou Meiya Chemical Products Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Vinyl acetate monomers (VAM) are essential raw materials used in the production of various industries, including adhesives, paints, coatings, textiles, films, and construction materials. These monomers play a crucial role in creating high-performance adhesives, construction materials, and specialty materials such as ethylene-vinyl acetate (EVA) and polyvinyl acetate (PVA). In the adhesives sector, VAM is used to manufacture adhesives with excellent bonding properties, making them suitable for various applications, including consumer goods and e-commerce. The paints and coatings industry utilizes VAM to produce low-volatile organic compound (VOC) paints and coatings, contributing to reducing carbon dioxide emissions and environmental pollution. The textile industry uses PVA and PVA-based fibers to create biodegradable plastics, making them environmentally friendly alternatives to conventional textiles.

Moreover, in the construction sector, VAM-based materials offer superior performance and durability, making them a preferred choice for green product development. The renewable energy sector also benefits from VAM through the production of EVA copolymers used in the manufacturing of PV (photovoltaic) cells. Furthermore, VAM is used in food packaging to enhance the shelf life and safety of food products. VAM production is derived from crude oil, making it essential to explore alternative renewable natural resources for its production to reduce the carbon footprint and promote sustainable manufacturing. Vinyl acetate monomers, polymers, and resins continue to play a significant role in various industries, offering versatility and superior performance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.6% |

|

Market Growth 2024-2028 |

USD 1.57 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.4 |

|

Key countries |

China, US, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch