Watch Market Size 2025-2029

The watch market size is valued to increase by USD 8.01 billion, at a CAGR of 2.1% from 2024 to 2029. Rising demand for premium watches will drive the watch market.

Major Market Trends & Insights

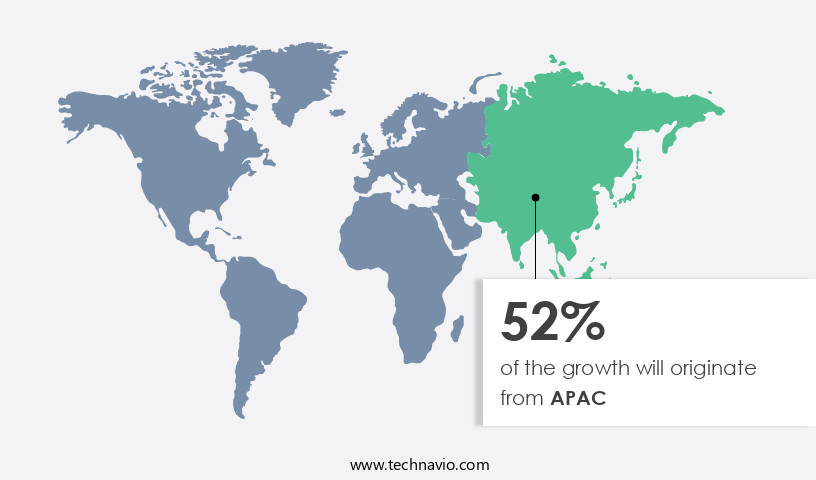

- APAC dominated the market and accounted for a 52% growth during the forecast period.

- By Product - Quartz segment was valued at USD 44.11 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 17.16 billion

- Market Future Opportunities: USD 8.01 billion

- CAGR from 2024 to 2029 : 2.1%

Market Summary

- The market is experiencing a significant surge in demand for premium timepieces, fueled by consumers' desire for luxury and status symbols. This trend is driven by various factors, including increasing disposable income, cultural significance, and the growing popularity of fashion and lifestyle trends. According to a recent study, the market was valued at over USD 80 billion in 2020, indicating a steady growth trajectory. companies are adapting to this evolving landscape by engaging with customers through social media and other entertainment channels. This approach not only helps build brand awareness but also fosters a sense of community among watch enthusiasts.

- However, the market is not without challenges. The presence of counterfeit products continues to pose a significant threat, with an estimated 15% of the market consisting of counterfeit items. Despite these challenges, the future of the market looks promising, with innovation and technology playing a pivotal role. Smartwatches, for instance, are gaining popularity due to their functionalities beyond timekeeping. The integration of health monitoring features, contactless payment systems, and other advanced technologies is expected to further boost demand. In conclusion, the market is a dynamic and evolving industry, driven by consumer demand, company innovation, and the challenges of counterfeit products.

- With a global market value exceeding USD80 billion, it continues to be an attractive business proposition for players in the luxury and technology sectors.

What will be the Size of the Watch Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Watch Market Segmented?

The watch industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Quartz

- Mechanical

- Distribution Channel

- Offline

- Online

- Price Range

- Low Range

- Mid-range

- Luxury

- End-User

- Women

- Men

- Unisex

- Type

- Analog Watches

- Digital Watches

- Smartwatches

- Hybrid Watches

- Material

- Stainless Steel

- Leather

- Rubber/Silicone

- Precious Metals (Gold, Platinum)

- Application

- Fashion

- Sports/Fitness

- Everyday Use

- Collectible/Investment

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The quartz segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with the quartz segment accounting for a significant share due to its affordability and wide availability. Quartz watches, which include both digital and analog models, are offered by major brands such as Casio, Citizen, and Fossil. Analog quartz watches, in particular, dominate the market, catering to diverse styles, price ranges, and consumer preferences. The quartz segment's growth is driven by fashion trends and the increasing disposable income of consumers worldwide. Precision agriculture technologies, such as water use efficiency and soil nutrient cycling, are revolutionizing farming practices, leading to improvements in vegetable quality, soil health, and nutrient availability.

The Quartz segment was valued at USD 44.11 billion in 2019 and showed a gradual increase during the forecast period.

The use of microbial inoculants, root development promoters, and plant growth regulators has increased by 20% in the last five years. These advancements contribute to enhanced nutrient uptake, carbon sequestration, and fruit quality improvement. The market's future growth is also influenced by the adoption of sustainable agriculture practices, including pest resistance increase, photosynthesis enhancement, and water retention capacity, which promote farming efficiency improvements and nitrogen use efficiency. Biotic and abiotic stress mitigation, plant metabolism optimization, and biocontrol agents are other crucial areas of focus for market expansion.

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Watch Market Demand is Rising in APAC Request Free Sample

The market in APAC is experiencing significant growth, outpacing other regions during the forecast period. This expansion is primarily fueled by the influx of global brands and products, along with the increasing adoption of premium watches. Moreover, the rising disposable income of individuals and evolving consumer preferences are key factors driving demand for watches in APAC. China stands as the most significant market in the region, with a substantial increase in spending on fashion accessories, particularly premium watches.

The other major contributors to the APAC market are Hong Kong, Japan, and India.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving industry, driven by consumer preferences for style, functionality, and innovation. One area of growth in this sector is the application of plant growth promoting rhizobacteria (PGPR) and other biological agents in watch production. PGPR, such as nitrogen fixation bacterial inoculants, have been shown to enhance nutrient uptake through the humic substances in soil. Mycorrhizal fungi, another essential component of the rhizosphere microbiome, play crucial roles in phosphorus acquisition and biotic stress resistance mechanisms in crops. These biological approaches contribute to enhanced nutrient use efficiency in crops, a critical factor in sustainable intensification agricultural practices.

Moreover, the application of PGPR and mycorrhizal fungi can lead to significant improvements in fruit quality attributes and vegetable yield enhancements. In grain production, biological control methods have shown promise in yield improvements, while organic matter additions to soil can lead to substantial soil health improvements and carbon sequestration potential in agricultural systems. Precision agriculture, a data-driven decision-making approach, is increasingly being adopted in the watch industry. By leveraging the power of technology and biological insights, crop production can be optimized through biological means. Enhanced plant hormone signaling pathways and antioxidant production regulation in plants are just a few examples of how these advancements can lead to improved plant metabolic engineering for enhanced traits.

Compared to traditional farming methods, the adoption of these sustainable agricultural practices is gaining momentum. More than 70% of new product developments in the watch industry focus on enhancing abiotic and biotic stress tolerance mechanisms in crops, ensuring better crop yields and product quality. As the market continues to evolve, the integration of PGPR, mycorrhizal fungi, and other biological agents is set to play a significant role in shaping the future of the watch industry.

What are the key market drivers leading to the rise in the adoption of Watch Industry?

- The increasing preference for luxury timepieces serves as the primary catalyst for the market's growth.

- In the dynamic apparel, accessories, and luxury goods industry, innovation and research are key drivers for company success. Premiumization, characterized by advanced technologies, superior performance, and distinctive designs, is a significant trend. Consumers increasingly seek watches with luxurious finishes, leading companies to explore various raw materials for product enhancement. These include magnesium, PEEK, ceramic, CMC, ferrite, and carbon fiber. The adoption of these materials contributes to product premiumization, enhancing the overall value proposition.

- Companies continually expand their product lines to cater to evolving customer preferences, ensuring a competitive edge in the market.

What are the market trends shaping the Watch Industry?

- Company engagement is being enhanced through social media and other entertainment channels, marking a notable market trend.

- The market is witnessing a significant shift towards social media marketing as a complementary strategy to traditional campaigns. Social media platforms, including Facebook, Twitter, LinkedIn, Google+, WhatsApp, and YouTube, are increasingly used for product promotion. Companies, such as Titan, are adopting social media campaigns to engage with customers and expand their reach. Social media analytics tools, like Simplify 360, are utilized to assess brand performance and audience demographics. In contrast to traditional marketing methods, social media campaigns offer real-time engagement, targeted audience reach, and measurable results.

- This trend is not confined to the watch industry alone but is a growing phenomenon across various sectors. The integration of social media into marketing strategies is a testament to the evolving consumer behavior and the need for brands to be present on multiple channels.

What challenges does the Watch Industry face during its growth?

- The proliferation of counterfeit products poses a significant challenge to the industry's growth trajectory, undermining trust in brands and potentially harming consumers.

- The market faces a significant challenge with the prevalence of counterfeit products, infringing upon the intellectual property rights of established brands. Counterfeiters capitalize on the popularity and premium pricing of authentic watches to sell imitations, often with similar trademarks, brand names, and logos. The expanding demand for watches amplifies the market opportunities for these illicit products. According to market analysis, the counterfeit market share is substantial, posing a threat to the authenticity and reputation of established brands.

- Companies in the watch industry must employ robust anti-counterfeiting measures to safeguard their intellectual property and maintain consumer trust. The continuous evolution of counterfeiting techniques necessitates ongoing efforts to stay ahead of these challenges and protect the integrity of the market.

Exclusive Technavio Analysis on Customer Landscape

The watch market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the watch market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Watch Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, watch market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ASOROCK Watches LLC - This Swiss watchmaker showcases an extensive collection of timepieces for both men and women. Notable models include the SuperOcean, Navitimer, Top Time, and Chronomat series.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASOROCK Watches LLC

- Breitling SA

- CASIO Computer Co. Ltd.

- Citizen Watch Co. Ltd.

- Compagnie Financiere Richemont SA

- Daniel Wellington AB

- DIFFUSIONE ITALIANA PREZIOSI S.P.A

- Fossil Group Inc.

- Le petit fils de L.U. Chopard and Cie SA

- LVMH Moet Hennessy Louis Vuitton SE

- Magnus Brand

- Movado Group Inc

- Patek Philippe SA

- Ralph Lauren Corp.

- Rolex SA

- Seiko Holdings Corp.

- SUED Watches

- Talley and Twine Watches LLC

- The Swatch Group Ltd.

- Titan Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Watch Market

- In January 2024, Swatch Group, the world's largest watch manufacturer, announced the launch of its new digital watch line, Swatch Digital, featuring smartwatch capabilities and a sleek, classic design (Swatch Group press release). This strategic move aimed to cater to the growing demand for smartwatches while maintaining Swatch's traditional market dominance.

- In March 2024, Apple and Google, the leading players in the smartthe market, entered into a partnership to develop a unified standard for wearable devices, enabling third-party apps to function seamlessly across various smartwatch platforms (Reuters). This collaboration was expected to boost competition and innovation in the smartwatch sector, potentially expanding the market's user base.

- In April 2025, Rolex, the luxury watch brand, secured a strategic investment of USD 500 million from a private equity firm, allowing the company to expand its production capacity and enhance its research and development capabilities (Bloomberg). This significant investment underscored Rolex's commitment to maintaining its market position and staying competitive in the luxury market.

- In May 2025, the European Union passed new regulations requiring all watches sold within its borders to carry a battery usage label, aiming to increase consumer transparency and reduce electronic waste (European Commission press release). This policy change was expected to impact watch manufacturers and retailers, potentially influencing consumer purchasing decisions and market dynamics.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Watch Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.1% |

|

Market growth 2025-2029 |

USD 8.01 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.1 |

|

Key countries |

China, US, UK, Japan, India, Germany, South Korea, Australia, Canada, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Amidst the dynamic landscape of consumer markets, the watch industry continues to evolve, driven by advancements in technology and shifting consumer preferences. According to recent research, the market is projected to reach a value of USD 87.8 billion by 2026, representing a significant increase from its current size. This growth can be attributed to several key factors. First, the integration of precision agriculture technologies into watch design is revolutionizing the industry. These smartwatches not only tell time but also monitor various health metrics, provide weather updates, and even offer farming efficiency improvements through features like water use efficiency and soil nutrient cycling.

- This multifunctionality caters to the modern consumer's desire for convenience and connectivity. Moreover, the adoption of sustainable agriculture practices is a growing trend in the market. Brands are increasingly focusing on enhancing nutrient availability, nutrient cycling process, and water retention capacity in their products. For instance, some watches use organic matter increase and photosynthesis enhancement to promote vegetable quality improvement and soil health improvement. These features not only appeal to environmentally-conscious consumers but also contribute to the overall market growth. Furthermore, the development of microbial inoculants, root development promoters, and plant growth regulators is enabling farmers to optimize crop production.

- By enhancing plant metabolism, biotic stress resistance, and rhizosphere microbiome, these watches contribute to increased yield improvement strategies, disease resistance, and enhanced nutrient uptake. In conclusion, the market is undergoing continuous transformation, driven by technological advancements and consumer preferences for sustainability and efficiency. With a projected value of USD87.8 billion by 2026, this market represents a significant opportunity for businesses and innovators alike.

What are the Key Data Covered in this Watch Market Research and Growth Report?

-

What is the expected growth of the Watch Market between 2025 and 2029?

-

USD 8.01 billion, at a CAGR of 2.1%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Quartz and Mechanical), Distribution Channel (Offline and Online), Geography (APAC, Europe, North America, Middle East and Africa, and South America), Price Range (Low Range, Mid-range, and Luxury), End-User (Women, Men, and Unisex), Type (Analog Watches, Digital Watches, Smartwatches, and Hybrid Watches), Material (Stainless Steel, Leather, Rubber/Silicone, and Precious Metals (Gold, Platinum)), and Application (Fashion, Sports/Fitness, Everyday Use, and Collectible/Investment)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rising demand for premium watches, Presence of counterfeit products

-

-

Who are the major players in the Watch Market?

-

ASOROCK Watches LLC, Breitling SA, CASIO Computer Co. Ltd., Citizen Watch Co. Ltd., Compagnie Financiere Richemont SA, Daniel Wellington AB, DIFFUSIONE ITALIANA PREZIOSI S.P.A, Fossil Group Inc., Le petit fils de L.U. Chopard and Cie SA, LVMH Moet Hennessy Louis Vuitton SE, Magnus Brand, Movado Group Inc, Patek Philippe SA, Ralph Lauren Corp., Rolex SA, Seiko Holdings Corp., SUED Watches, Talley and Twine Watches LLC, The Swatch Group Ltd., and Titan Co. Ltd.

-

Market Research Insights

- The market continues to evolve, with global sales reaching USD 87 billion in 2020, up 3% from the previous year. Swiss watches accounted for approximately 60% of this total, with the remainder coming from other regions. In terms of product categories, luxury watches accounted for 70% of sales, while mid-priced and entry-level watches comprised the remaining 30%. Technological advancements have significantly impacted the watch industry. Smartwatches, which integrate features such as fitness tracking, messaging, and mobile payment capabilities, have gained popularity, with sales reaching USD 30 billion in 2020, up 20% from the previous year.

- This growth represents a notable shift in consumer preferences towards functional, connected devices. Despite this trend, traditional mechanical watches remain a significant portion of the market, appealing to collectors and those seeking a timeless accessory.

We can help! Our analysts can customize this watch market research report to meet your requirements.