Waterproof Breathable Textile Market Size 2024-2028

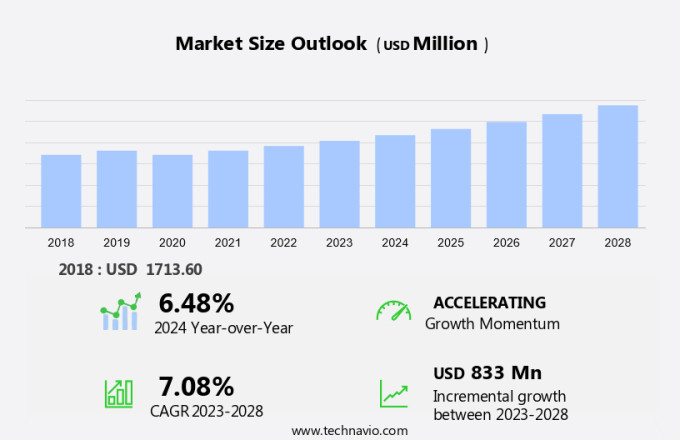

The waterproof breathable textile market size is forecast to increase by USD 833 million at a CAGR of 7.08% between 2023 and 2028. The market is experiencing significant growth due to increasing consumer demand for high-quality garments and accessories that provide protection against harsh weather conditions, specifically rain and wind. Technological advancements have led to the development of advanced membranes and coated fabrics that offer superior comfort and breathability. However, the high cost of manufacturing these densely woven fabrics poses a challenge for market growth. Consumers are investing in waterproof breathable textiles for various applications, including gloves and other accessories, to enhance their outdoor experiences. As disposable income increases and health and wellness awareness rises, the demand for these products is expected to continue growing market. To stay competitive, manufacturers must focus on innovation and cost-effective production methods to meet the evolving needs of consumers.

What will be the Size of the Market During the Forecast Period?

The waterproof breathable textile market is witnessing significant growth due to the increasing demand for high-performance apparel in various sectors, including outdoor activities and protective clothing. The market is driven by the need for advanced fabrics that can effectively protect against natural elements such as wind and rain, while allowing for breathability and comfort. Membrane technology plays a crucial role in the production of waterproof breathable textiles. These membranes are typically coated or densely woven, utilizing materials such as polyurethane and polypropylene. Membranes are essential in preventing water penetration while allowing moisture vapor to escape, ensuring optimal comfort for the wearer.

Further, stringent regulations regarding textile production and environmental sustainability are also influencing the market. Manufacturers are focusing on using ePTFE raw materials and other sustainable alternatives to produce waterproof breathable textiles. This not only meets regulatory requirements but also appeals to consumers who prioritize eco-friendly products. Smart textiles are gaining popularity in the market due to their ability to adapt to various conditions. These textiles can be integrated with sensors and other technologies to provide additional functionality, such as temperature regulation and moisture management. This makes them ideal for a wide range of applications, including fitness-related sports, outdoor recreational activities, and protective clothing.

Further, the garments segment, including outerwear and gloves, dominates the waterproof breathable textiles market. Outerwear, in particular, is expected to witness significant growth due to the increasing popularity of active lifestyles and outdoor pursuits. Consumers are seeking high-performance apparel that can withstand harsh weather conditions while allowing for optimal comfort and breathability. In conclusion, the waterproof breathable textiles market is experiencing steady growth due to the increasing demand for advanced fabrics in various sectors. Membrane technology, stringent regulations, and smart textiles are key trends driving the market. The garments segment, including outerwear and gloves, is expected to remain the largest market for waterproof breathable textiles.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Coating

- Membrane

- Densely woven fabric

- Geography

- Europe

- Germany

- France

- North America

- US

- APAC

- China

- India

- Middle East and Africa

- South America

- Europe

By Product Insights

The coating segment is estimated to witness significant growth during the forecast period. The market is driven by the increasing demand for textiles that offer protection against UV radiation, airborne contaminants, and moisture build-up. Two primary types of waterproof textiles are membrane fabrics and coated fabrics. Membrane fabrics have a dense weave that allows water vapor to pass through while blocking water droplets. Coated fabrics, on the other hand, have a polyurethane coating applied to one surface, providing both waterproofing and breathability. Coated fabrics dominate the market due to their durability, lightweight nature, and superior attributes. These textiles offer better permeability of air and water vapor, optimal heat and moisture regulation, rapid moisture absorption, and rapid drying.

In the sporting goods industry, active sportswear and bags & rucksacks are significant end-users of waterproof breathable textiles. The demand for these textiles is expected to grow due to their ability to protect against various environmental elements and enhance user comfort. In conclusion, the market is expected to grow significantly due to the increasing demand for textiles that offer protection against UV radiation, airborne contaminants, and moisture build-up. Coated fabrics, with their superior attributes, are expected to dominate the market during the forecast period.

Get a glance at the market share of various segments Request Free Sample

The Coating segment accounted for USD 857.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

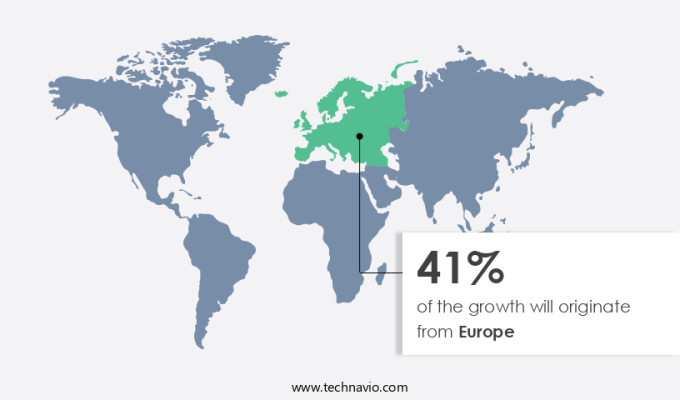

Europe is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The European textile and clothing market is experiencing significant shifts as competition intensifies among manufacturers and new products enter the regional market. This industry sector encompasses a diverse array of fabrics and textiles, including waterproof and breathable textiles. Notable market participants in the EU include Jack Wolfskin, Sympatex Technologies GmbH, Concordia Textiles NV, Schoeller Textil AG, and Stotz and Co. The presence of these established players is contributing to the market's expansion in the region. The market in Europe is expected to grow steadily due to increasing consumer demand for high-performance clothing and advancements in membrane fabric technology.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rising consumer disposable income and growing fitness awareness is the key driver of the market. Waterproof breathable textiles have gained significant traction in the apparel industry due to their effectiveness in keeping wearers dry during outdoor activities. Membranes integrated into synthetic fabrics enable the passage of water vapor while preventing the entry of rain or perspiration. This feature is highly sought after in various sectors, including the garments segment, which comprises outerwear and activewear. Stringent regulations regarding textile quality and environmental sustainability are driving companies to innovate and produce smarter textiles. Smart textiles, which include waterproof breathable fabrics, are expected to witness substantial growth due to their ability to adapt to changing weather conditions and enhance comfort.

Membranes integrated into synthetic fabrics allow water vapor to pass through while preventing rain or perspiration from entering. This feature is highly desirable in various sectors, including the garments segment, which encompasses outerwear and activewear. Stringent regulations regarding textile quality and environmental sustainability are driving companies to innovate and produce smarter textiles. Smart textiles, which include waterproof breathable fabrics, are expected to witness substantial growth due to their ability to adapt to changing weather conditions and enhance comfort. The popularity of outdoor activities, such as hiking, camping, and extreme sports, has fueled the demand for waterproof breathable apparel.

Market Trends

Technological advances for greater comfort is the upcoming trend in the market. Waterproof breathable textiles have gained significant traction in the apparel industry due to their ability to keep wearers dry in inclement weather conditions. These fabrics, which are densely woven or coated with membranes, effectively prevent the penetration of rain and wind while allowing moisture vapor to escape. This technology has been particularly popular among accessories such as gloves and high-performance garments for outdoor enthusiasts, athletes, and professionals. The comfort level of waterproof breathable textiles has improved significantly with recent technological advancements. Consumers increasingly prefer these garments for their superior moisture management capabilities, which help maintain a comfortable body temperature and prevent the formation of sweat.

As a result, companies have been able to charge a premium price for these products. Despite the higher cost, the affordability of waterproof breathable textiles has increased in recent years. With advancements in manufacturing processes and economies of scale, prices have decreased, making these garments accessible to a wider audience. One notable example of a company leading the way in waterproof breathable textile innovation is eVent FABRICS. Their products, including jackets with eVent DVStorm membranes, are highly sought after by adventure enthusiasts, athletes, and professionals for their exceptional breathability and waterproofing capabilities. These advanced fabrics have become essential for those who require high-performance apparel to thrive in challenging weather conditions.

Market Challenge

The high cost of manufacturing densely woven fabrics is a key challenge affecting the market growth. Waterproof breathable textiles are essential in the production of innerwear and sportswear to ensure protection against moisture and water. Three primary types of waterproof breathable fabrics exist: coating, membrane, and densely woven fabrics. Densely woven fabrics are made using fine cotton yarns that are meticulously piled, combed, and wrapped with threads. This intricate construction results in fabrics with minute pore sizes, effectively preventing water from permeating. However, the high cost of raw materials used in manufacturing densely woven fabrics is a significant challenge. Two common materials used in the production of waterproof breathable textiles are expanded polytetrafluoroethylene (ePTFE) and polyurethane (PU) or thermoplastic polyurethane (TPU).

Polyester and nylon are also frequently used in combination with these materials. EPTFE and PU/TPU membranes offer superior waterproofing and breathability, while polyester and nylon provide durability and strength. Manufacturers often employ a combination of these materials to create garments that offer optimal water resistance and breathability. For instance, a jacket might feature a PU/TPU membrane laminated to a polyester or nylon outer layer, with a densely woven cotton inner lining for added comfort. Similarly, waterproof breathable footwear may incorporate ePTFE membranes sandwiched between layers of synthetic materials. When producing waterproof breathable textiles, manufacturers must build a balance between waterproofing and breathability to ensure the comfort and functionality of the garments.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Columbia Sportswear Co.- The company offers waterproof breathable textile that are equipped with external impenetrable waterproof membrane.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Azure Fabrics Pvt. Ltd.

- Concordia Textiles

- Everest Textile Co. Ltd.

- Formosa Taffeta Co. Ltd.

- G.R.Henderson Co. Textiles Ltd.

- Helly Hansen AS

- Jack Wolfskin

- Mitsui and Co. Ltd.

- Polartec LLC

- Rockywoods Fabrics LLC

- Schoeller Textil AG

- Stotz and Co. AG

- Sympatex Technologies GmbH

- Teijin Ltd.

- Tiong Liong Industrial Co. Ltd.

- Toray Industries Inc.

- VF Corp.

- W. L. Gore and Associates Inc.

- Wujiang Sunfeng Textile Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing popularity of outdoor activities among consumers. Membranes, a crucial component of waterproof breathable textiles, are in high demand in various industries, including apparel, footwear, and accessories. Synthetic fabrics like polyurethane (PU), TPU, polyester, nylon, and cotton are widely used in the production of waterproof breathable textiles. Stringent regulations regarding protective clothing for natural disasters and extreme weather conditions are driving the market growth. Smart textiles, incorporating features like moisture management, UV radiation protection, and airborne contaminant filtration, are gaining traction. The garments segment, including raincoats, windbreakers, and outerwear, dominates the market. Innerwear, sportswear, and protective clothing for specific industries like construction and firefighting also contribute to the market's growth.

Moreover, membrane fabrics, coated fabrics, and densely woven fabrics are popular choices for producing waterproof breathable textiles. The sporting goods industry, with its focus on active lifestyle and fitness consciousness, is a significant consumer of waterproof breathable textiles. Membrane fabrics are used in activewear, bags & rucksacks, hats, socks, and sports goods. The market is expected to grow further with the increasing trend of fitness-related sports and outdoor recreational activities. EPTFE and PU raw materials are commonly used for membrane production, while Ventile fabric and PTFE membranes offer superior waterproofing and breathability. Polypropylene and other natural fibers are also used in combination with synthetic materials to create waterproof breathable textiles. The market is expected to continue growing, driven by technological advancements and increasing consumer demand.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market Growth 2024-2028 |

USD 833 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.48 |

|

Regional analysis |

Europe, North America, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

Europe at 41% |

|

Key countries |

US, Germany, France, China, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Azure Fabrics Pvt. Ltd., Columbia Sportswear Co., Concordia Textiles, Everest Textile Co. Ltd., Formosa Taffeta Co. Ltd., G.R.Henderson Co. Textiles Ltd., Helly Hansen AS, Jack Wolfskin, Mitsui and Co. Ltd., Polartec LLC, Rockywoods Fabrics LLC, Schoeller Textil AG, Stotz and Co. AG, Sympatex Technologies GmbH, Teijin Ltd., Tiong Liong Industrial Co. Ltd., Toray Industries Inc., VF Corp., W. L. Gore and Associates Inc., and Wujiang Sunfeng Textile Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch