Wearable Patch Market Size 2025-2029

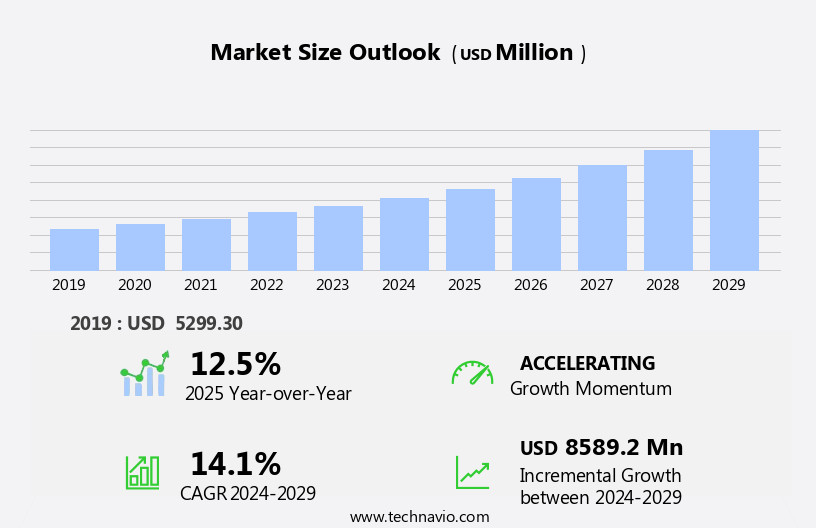

The wearable patch market size is forecast to increase by USD 8.59 billion at a CAGR of 14.1% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing prevalence of chronic diseases and the subsequent demand for continuous health monitoring solutions. These patches, which can be worn discreetly on the skin, offer real-time health data collection and analysis, enabling early detection and intervention. Furthermore, the shift towards cloud-based solutions is driving market expansion, as these technologies enable remote monitoring, data storage, and analysis. However, concerns regarding data privacy and security pose a significant challenge to market growth. Furthermore, the trend towards cloud-based healthcare services is gaining traction, enabling real-time data access and analysis for healthcare providers and patients. As companies seek to capitalize on this market opportunity, it is crucial to prioritize data protection measures and transparent data handling practices to build trust with consumers and regulatory bodies.

- Effective navigation of these challenges, alongside continued innovation in patch technology and design, will be key to success in this dynamic and growing market. The market for electronic skin patches, including nicotine patches, is driven by the increasing prevalence of chronic diseases, which necessitate continuous monitoring and management.

What will be the Size of the Wearable Patch Market during the forecast period?

- The market is experiencing significant advancements, with key focus areas including user interface design and mobile app integration. Biosensing platforms are at the forefront of innovation, leveraging biodegradable materials and standardization for improved patch adhesion and dermal absorption. Manufacturing processes are refining, with sensor calibration and optical sensing techniques advancing organic electronics and electrochemical sensing. Biocompatible polymers and patch validation are crucial for ensuring patch sustainability and biocompatibility. Cloud-based platforms are transforming patch lifecycle management, enabling real-time data interpretation and patch prototyping. Microneedle patches are gaining traction, offering enhanced functionality and sustainability. The integration of biodegradable polymers and printable electronics is further driving market growth. The market is experiencing significant growth, particularly in the connected wearable segment, driven by advancements in myoelectric technology and Bluetooth connectivity.

- Patch prototyping and biocompatibility testing are essential components of the wearable patch design process. Innovations in flexible circuits and sensor calibration are addressing challenges in patch manufacturing, while optical sensing and organic electronics are revolutionizing data interpretation. The market is witnessing a shift towards patch sustainability and patch validation, as companies prioritize biocompatible materials and efficient patch lifecycle management. The future of wearable patches lies in the seamless integration of these technologies, providing businesses with valuable insights and improved patient care solutions. Further, connected wearable patches deliver drugs, such as nicotine, through electronic skin, offering an alternative to traditional methods like nicotine patches.

How is this Wearable Patch Industry segmented?

The wearable patch industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Clinical

- Non-clinical

- Technology

- Regular

- Connected

- End-user

- Healthcare providers

- Individual consumers

- Fitness centers and sports organizations

- Research institutions

- Type

- Glucose monitoring patches

- Cardiac monitoring patches

- Fitness and wellness patches

- Temperature monitoring patches

- Pain relief and drug delivery patches

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

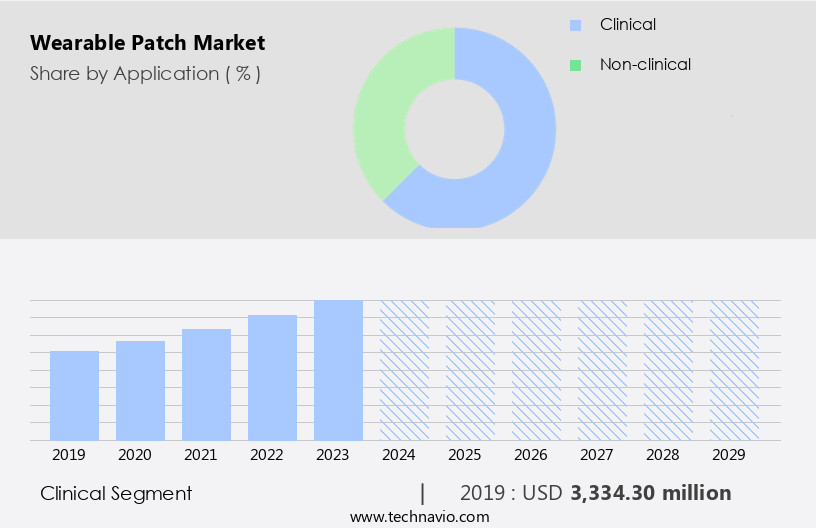

By Application Insights

The clinical segment is estimated to witness significant growth during the forecast period. Wearable patches represent a significant advancement in healthcare technology, enabling continuous monitoring of patients' health conditions. These patches collect biometric data at regular intervals and transmit it to connected devices, such as smartphones and laptops, for real-time analysis. This remote monitoring eliminates the need for frequent physical consultations with healthcare professionals. In the realm of medical innovation, manufacturers are increasingly focusing on developing wearable devices to address the growing prevalence of lifestyle diseases. These devices aim to provide doctors with valuable insights into patients' health issues, enhancing the overall disease management process. Advancements in technology have led to the creation of sophisticated wearable patches, including those powered by artificial intelligence (AI).

However, the adoption of wearable patches and related technologies also raises concerns regarding data security and privacy. Ensuring the protection of sensitive biometric data is essential to maintain patient trust and confidence in these innovative healthcare solutions. As the market for wearable patches continues to evolve, it is essential to navigate the complex regulatory landscape and comply with compliance regulations. The Internet of Things (IoT) and sensor networks play a crucial role in facilitating the seamless integration of wearable patches into healthcare systems, while adhesive technology ensures the patches remain securely attached to the skin.

In summary, wearable patches represent a transformative force in healthcare, offering remote monitoring, personalized medicine, and early disease detection capabilities. As the technology advances, it is crucial to address concerns related to data security, patient compliance, and regulatory compliance to ensure the successful adoption and integration of wearable patches into healthcare systems.

Get a glance at the market report of share of various segments Request Free Sample

The Clinical segment was valued at USD 3.33 billion in 2019 and showed a gradual increase during the forecast period. These AI-driven patches are capable of early detection and diagnosis of conditions such as heart diseases, offering a crucial advantage in preventing potential health complications. Moreover, the integration of transdermal drug delivery systems into wearable patches has given rise to personalized medicine, ensuring effective and efficient treatment plans for patients. Additionally, the development of biocompatible materials and flexible electronics has made wearable patches more comfortable and discreet, increasing patient compliance. The convergence of healthcare and technology has also led to the emergence of digital health solutions, including mobile health applications and body area networks. These technologies facilitate seamless communication between patients and healthcare providers, ensuring timely and accurate diagnosis and treatment.

Regional Analysis

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing significant growth due to the increasing health consciousness among individuals in the region. Canada and the United States are the primary contributors to this market, driven by the rising prevalence of obesity and lifestyle diseases. With hectic work schedules leading to unhealthy food choices and decreased physical activity, there is a growing demand for technologies that enable continuous health monitoring. Wearable patches, which offer non-invasive sensing capabilities, are gaining popularity as they allow users to track vital signs, biometric data, and other health metrics in real-time. These patches incorporate advanced technologies such as machine learning algorithms, artificial intelligence, and biocompatible materials to provide accurate and reliable health data. These patches utilize advanced technologies like microprocessor controllers, myoelectric technology, and Bluetooth for wireless connectivity.

Moreover, the integration of other emerging technologies, such as transdermal drug delivery, personalized medicine, and flexible electronics, is expanding the applications of wearable patches beyond basic health monitoring. For instance, smart textiles infused with sensors can be used for health monitoring, patient engagement, and disease management. Wearable patches also offer benefits in areas like sports medicine, where they can be used for fitness tracking and performance optimization. However, privacy concerns and patient compliance remain critical challenges in the market. Ensuring data security and maintaining patient privacy are essential to gaining regulatory approval and market acceptance. As the market evolves, addressing these concerns through advanced data analytics, biometric data encryption, and compliant regulatory frameworks will be crucial.

In summary, the North American market is witnessing growth due to the increasing health consciousness among individuals and the integration of advanced technologies. Addressing privacy concerns and ensuring patient compliance will be key to further expanding the market's potential.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Wearable Patch Industry?

- Growing prevalence of chronic diseases is the key driver of the market. The global wearable patches market is experiencing significant growth due to the increasing prevalence of chronic diseases, such as cancer, cardiovascular conditions, diabetes, and asthma. Wearable patches offer a convenient solution for both physicians and patients, making them an attractive alternative to traditional treatment methods. A sedentary lifestyle contributes to the development of various health disorders, including cardiovascular diseases (CVDs), diabetes, sleep apnea, and other chronic illnesses. With an aging population, the number of individuals suffering from these conditions is expected to increase. In 2024, it is estimated that over 1 billion people will be aged 60 or above. The critical nature of treating these diseases has led to increased hospitalization. Among chronic diseases, CVDs remain the leading cause, followed by chronic respiratory diseases and diabetes. The demand for wearable patches is expected to grow as they provide continuous monitoring and timely intervention, ultimately improving patient outcomes and reducing healthcare costs.

What are the market trends shaping the Wearable Patch Industry?

- Increasing demand for cloud-based solutions is the upcoming market trend. The healthcare industry's shift towards advanced technologies is driven by the need for improved patient data management and privacy. Cloud computing, as an economical solution, has gained significant traction due to its flexibility and compatibility with existing systems. This technology allows users to access cloud-based storage solutions from any location through web-based portals, enhancing business agility. Furthermore, cloud computing is easily compatible with various software systems, including security systems, device management systems, databases, and business analytics, simplifying implementation. According to a quantitative analysis, the number of diseases managed through wearable patches is projected to expand, with cardiovascular diseases, diabetes, and atrial fibrillation being major areas of focus. With the increasing pressure to manage patient data securely and efficiently, cloud computing offers a viable solution for the healthcare sector.

What challenges does the Wearable Patch Industry face during its growth?

- Concerns regarding data privacy and security is a key challenge affecting the industry growth. The healthcare industry's digital transformation, marked by the integration of data-generating devices and electronic patient records, has brought about significant advancements in healthcare quality, insights, and cost reduction. However, this shift has also exposed organizational and patient data to increased cybersecurity risks. With healthcare data becoming a valuable asset for various stakeholders, including hospitals, clinics, and insurance companies, securing this data has become a top priority. The proliferation of cyberattacks in the healthcare sector has raised concerns over privacy and data protection. As more medical data is generated and centralized, it becomes increasingly vulnerable to breaches. The digitalization of healthcare workflows and the maintenance of electronic patient records have necessitated cybersecurity measures to safeguard sensitive information. Despite the benefits of advanced technologies in healthcare, security and privacy concerns are hindering their widespread adoption. Ensuring the security and confidentiality of medical data is essential to maintaining trust and building a relationship between patients, healthcare providers, and insurers. Therefore, investing in advanced cybersecurity solutions and implementing best practices to mitigate cyber risks is crucial for the healthcare industry's growth and success.

Exclusive Customer Landscape

The wearable patch market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wearable patch market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wearable patch market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

2M Engineering Ltd. -The company offers wearable health patch which measures and record physiological signals like ECG, bioimpedance, accelerometer and others for research applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 2M Engineering Ltd.

- Abbott Laboratories

- Apple Inc.

- Beneli AB

- Biofourmis Inc.

- DarioHealth Corp.

- Dassault Systemes SE

- DuPont de Nemours Inc.

- Eoflow Co. Ltd.

- GENTAG Inc.

- greenTEG AG

- Kenzen Inc.

- LifeSignals Group Inc.

- Nemaura Medical Inc.

- PKvitality S.A.S.

- Prevent Biometrics

- Qualcomm Inc.

- Samsung Electronics Co. Ltd.

- The Surgical Co.

- VitalConnect Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of technologies aimed at delivering various health-related functionalities. These patches, which can be applied to the skin, represent a significant advancement in the realm of healthcare and wellness. Transdermal drug delivery, a key application of wearable patches, enables the administration of medications through the skin, offering several advantages over traditional methods. Machine learning algorithms are increasingly being integrated into wearable patches to facilitate personalized medicine. By analyzing biometric data collected from patients, these systems can provide customized treatment plans, enhancing patient engagement and improving outcomes. Health monitoring is another significant application of wearable patches, with continuous monitoring capabilities enabling early detection and intervention of potential health issues.

The integration of smart textiles and sensor networks in wearable patches has led to the development of body area networks. These networks facilitate the collection and transmission of data from various sensors, allowing for real-time monitoring and analysis. The advent of wearable patches has also given rise to mobile health and precision medicine, enabling remote patient monitoring and disease management. Regulatory approval is a crucial aspect of the market, with regulatory bodies ensuring the safety and efficacy of these devices. Adherence to compliance regulations is essential for market acceptance and growth. Wearable patches also face privacy concerns, necessitating data security measures to protect sensitive patient information.

Power management and energy harvesting are essential considerations in the design and development of wearable patches. Flexible electronics and wireless communication technologies are key enablers, ensuring the patches remain unobtrusive and comfortable for extended periods. Biocompatible materials are another critical factor, ensuring the patches do not cause skin irritation or allergic reactions. The market is also influenced by the Internet of Things (IoT) and digital health trends. Data analytics and biomarker detection are essential applications, enabling healthcare professionals to make informed decisions based on real-time patient data. Fitness tracking and wellness applications are gaining popularity, with wearable patches offering non-invasive sensing capabilities. The global population is aging, leading to an increased prevalence of chronic diseases such as diabetes, cardiovascular diseases, and atrial fibrillation.

Sports medicine is another significant application area for wearable patches, with these devices providing valuable insights into athlete performance and recovery. Wearable patches are also being explored for use in various industries, including industrial safety and military applications. The market represents a rapidly evolving landscape, with numerous applications and technologies driving growth. From transdermal drug delivery and health monitoring to personalized medicine and remote monitoring, wearable patches offer significant benefits across various sectors. Regulatory approval, privacy concerns, and power management are key challenges, but advancements in technology and materials are addressing these issues. The integration of machine learning, artificial intelligence, and data analytics is set to further revolutionize the market, enabling more personalized and effective healthcare solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

238 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.1% |

|

Market growth 2025-2029 |

USD 8.59 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.5 |

|

Key countries |

US, Germany, Canada, UK, China, France, Japan, Italy, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wearable Patch Market Research and Growth Report?

- CAGR of the Wearable Patch industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wearable patch market growth and forecasting

We can help! Our analysts can customize this wearable patch market research report to meet your requirements.