Diabetes Management Devices Market Size 2024-2028

The diabetes management devices market size is forecast to increase by USD 13.98 bn at a CAGR of 7.68% between 2023 and 2028.

What will be the Size of the Diabetes Management Devices Market during the Forecast Period?

How is this Diabetes Management Devices Industry segmented and which is the largest segment?

The diabetes management devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Blood glucose monitoring devices

- Insulin delivery systems

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- Asia

- China

- Rest of World (ROW)

- North America

By Product Insights

The blood glucose monitoring devices segment is estimated to witness significant growth during the forecast period. Diabetes management devices play a crucial role in monitoring and managing blood glucose levels for individuals with diabetes. These devices include a range of products such as insulin delivery systems, continuous monitoring systems, and glucose monitoring devices. Insulin delivery devices, including insulin pumps and pens, facilitate precise insulin administration. Continuous monitoring systems, such as continuous glucose monitoring systems (CGMs) and Mobi insulin pumps, provide real-time glucose level data through wireless transmission and dedicated apps. Glucowear, a continuous glucose monitoring system, offers non-invasive transdermal sensors and spectroscopy technology. Hospital pharmacies, retail pharmacies, and online pharmacies stock these diabetes care devices. The increasing prevalence of diabetes among the obese, elderly population, and those with conditions like high cholesterol levels, smoking, and inactive lifestyles necessitates effective diabetes management.

Disease management is essential to prevent complications like kidney failure, gangrene, lower limb amputation, heart attack, blindness, and stroke. Diabetes tracker devices, such as diabetes monitoring software and artificial pancreas systems, help healthcare providers analyze glucose patterns and create treatment plans. User-friendly interfaces, visual representations, and medication adherence features enhance the efficacy of treatment. In summary, diabetes management devices, including insulin delivery devices, continuous monitoring systems, and glucose monitoring devices, are essential tools for managing diabetes and preventing complications. These devices offer precision, flexibility, and smart features, making diabetes care more accessible and convenient for individuals with diabetes. Hospital segment, diagnostic centers, diabetes clinics, and healthcare professionals utilize these devices to improve patient care and outcomes.

Get a glance at the market report of various segments Request Free Sample

The Blood glucose monitoring devices segment was valued at USD 12.92 bn in 2018 and showed a gradual increase during the forecast period.

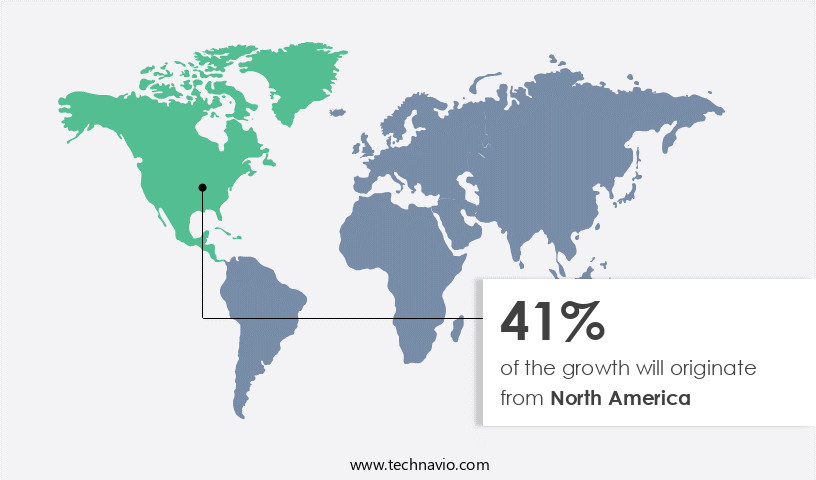

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American the market is a substantial and expanding sector, encompassing products like blood glucose meters, continuous glucose monitoring (CGM) systems, insulin delivery devices, and related accessories. Factors fueling market growth include the escalating diabetes prevalence, growing recognition of glycemic control's significance, and technological innovations in diabetes management. Key players include Abbott Laboratories, Medtronic, and Dexcom, Inc. The market expansion is influenced by the elderly population's increasing diabetes incidence, rising obesity rates, and the need for affordable healthcare options. Diabetes management devices, such as insulin pumps, continuous monitoring systems, and diabetes tracker devices, improve patient outcomes by enabling real-time monitoring, wireless transmission, and dedicated apps.

These devices aid healthcare providers in creating personalized treatment plans based on glucose patterns and medication adherence. Additionally, non-invasive technologies like transdermal sensors, spectroscopy, and artificial intelligence enhance diabetes care. The market is further segmented into hospitals, specialty clinics, diagnostic centers, hospital pharmacies, retail pharmacies, ambulatory surgery centers, home care, and hospital information systems.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of market?

Rising global burden of diabetes is the key driver of the market.Diabetes, a chronic condition characterized by high blood sugar levels, affects over 537 million adults worldwide. This number is projected to increase to 643 million by 2030 and 783 million by 2045. The rise in diabetes prevalence is attributed to factors such as obesity, smoking, sedentary lifestyles, and urbanization. Diabetes can lead to severe complications, including kidney failure, lower limb amputation, heart attack, blindness, and stroke, if left untreated. Diabetes management involves disease management, insulin delivery devices, and glucose monitoring systems. Insulin delivery devices include insulin pumps, insulin pens, and continuous insulin infusion systems. Glucose monitoring systems consist of continuous glucose monitors, testing strips, and glucose monitoring devices.

Mobile health technologies, such as Mobi insulin pumps and Glucowear, offer real-time monitoring and wireless transmission of data to healthcare providers. Hospital pharmacies, retail pharmacies, and online pharmacies provide affordable healthcare options for insulin and diabetes care devices. Hospitals, specialty clinics, diagnostic centers, and diabetes clinics offer treatment plans tailored to individual needs. Minimally invasive devices, such as diabetes lancet devices and diabetes care devices, provide precision and flexibility. The elderly population, particularly those with type 1 diabetes, an autoimmune disease, benefit from user-friendly interfaces and visual representations of glucose patterns. The market for diabetes management devices is driven by the efficacy of treatment, the need for medication adherence, and the growing demand for smart technology.

Healthcare professionals use data analytics, artificial intelligence, and electronic health records to optimize treatment plans and improve patient outcomes. Ambulatory surgery centers, home care, and hospital information systems facilitate seamless data-sharing capabilities and connectivity. Pharmaceutical manufacturers invest in research and development to create innovative diabetes management devices, such as artificial pancreas systems and smart insulin pens.

What are the market trends shaping the Diabetes Management Devices market?

Growing focus on artificial pancreas is the upcoming market trend.The market is experiencing significant growth due to the increasing focus on advanced technologies for diabetes care. Artificial pancreas systems, which integrate continuous glucose monitors (CGMs) and insulin pumps, are gaining popularity for their ability to automatically regulate blood glucose levels. These systems, which effectively manage glucose levels, particularly during overnight hours, are expected to see substantial growth due to technological advancements and rising demand for effective diabetes management solutions. Artificial intelligence algorithms and machine learning techniques have been integrated into these systems, enabling them to learn and adapt to individual glucose patterns, thereby improving glycemic control and reducing the risk of hypoglycemia.

The market for diabetes management devices is driven by the diabetic population's increasing need for minimally invasive, user-friendly, and real-time monitoring solutions. The obesity rates, smoking, high cholesterol levels, and inactive lifestyles contribute to the rising prevalence of diabetes, leading to an increased demand for affordable healthcare options and disease management devices. The market includes various devices such as insulin delivery devices (insulin pumps, insulin pens), glucose monitoring devices (CGMs, testing strips, lancets), diabetes tracker devices, and diabetes care devices (insulin syringes, diabetes lancet devices). Healthcare providers, hospitals, specialty clinics, diagnostic centers, hospital pharmacies, retail pharmacies, ambulatory surgery centers, home care, and online pharmacies are key players In the market.

The market is expected to grow significantly In the forecast period due to the increasing prevalence of diabetes, especially among the elderly population, and the need for effective diabetes management solutions.

What challenges does the market face during its growth?

Prohibitive cost of diabetes care devices is a key challenge affecting the industry growth.Diabetes management devices play a crucial role in ensuring effective diabetes care for the growing diabetic population. Insulin delivery devices, such as insulin pumps and continuous monitoring systems, have gained popularity due to their ability to provide real-time glucose level readings and flexible insulin administration. For instance, mobi insulin pumps and glucowear offer minimally invasive solutions for continuous glucose monitoring. However, the high cost of these devices poses a challenge for many patients, particularly those in developing countries. Traditional diabetes care devices, including insulin syringes, lancets, and insulin pens, remain widely used due to their affordability. The healthcare industry continues to innovate, offering advanced solutions like artificial pancreas systems and non-invasive transdermal sensors.

These devices enable more precise insulin administration and real-time monitoring, improving patient outcomes. Despite these advancements, diabetes management remains a significant challenge due to factors like obesity rates, smoking, high cholesterol levels, and an aging population. The hospital segment, including hospitals, specialty clinics, diagnostic centers, and ambulatory surgery centers, plays a critical role in diabetes care. These facilities provide access to healthcare professionals, point-of-care testing devices, and electronic health records, enabling effective disease management and data-sharing capabilities. The increasing prevalence of diabetes, driven by lifestyle factors and an aging population, necessitates the development of affordable healthcare options. Online pharmacies and retail pharmacies offer accessible solutions for patients, while hospital pharmacies and medical devices companies collaborate to provide integrated diabetes care solutions.

Diabetes management devices have become essential tools for managing blood glucose levels and improving patient outcomes. These devices offer user-friendly interfaces, visual representations, and medication adherence features, ensuring effective treatment plans. With the integration of smart technology, continuous glucose monitors, testing strips, and CGM systems provide real-time data, enabling healthcare providers to make informed decisions and adjust treatment plans accordingly. The diabetes care market is expected to grow significantly due to the increasing prevalence of diabetes, the need for effective disease management, and the development of innovative solutions. The market dynamics are driven by factors like an aging population, increased stress levels, unhealthy diets, and sedentary lifestyles.

The market is also influenced by technological advancements, such as artificial intelligence, data analytics, and wireless transmission capabilities. In conclusion, diabetes management devices play a vital role in ensuring effective diabetes care for the growing diabetic population. With the integration of smart technology and continuous monitoring capabilities, these devices offer improved patient outcomes and more precise treatment plans. However, affordability remains a significant challenge, necessitating the development of accessible solutions for patients. The diabetes care market is expected to grow significantly, driven by factors like an aging population, technological advancements, and the need for effective disease management.

Exclusive Customer Landscape

The diabetes management devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the diabetes management devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, diabetes management devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Abbott Laboratories - The company provides a range of diabetes management devices for both personal and healthcare settings. These include the FreeStyle Freedom Lite, FreeStyle Lite, and FreeStyle Libre glucose monitoring systems for individual use. For hospitals and healthcare facilities, the company offers the FreeStyle Optium Neo and FreeStyle Precision Pro blood glucose and ketone monitoring systems. These devices enable effective diabetes management through accurate and timely glucose level monitoring, contributing to improved patient outcomes and overall healthcare efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- ACON Laboratories Inc.

- B.Braun SE

- Becton Dickinson and Co.

- Bionime Corp.

- Dexcom Inc.

- Eli Lilly and Co.

- F. Hoffmann La Roche Ltd.

- iHealth Labs Inc.

- Insulet Corp.

- LifeScan IP Holdings LLC

- Medtronic Plc

- Nemaura Medical Inc.

- Nipro Corp.

- Nova Biomedical Corp.

- Novo Nordisk AS

- PHC Holdings Corp.

- Prodigy Diabetes Care LL

- Tandem Diabetes Care Inc.

- WellDoc Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Diabetes, an autoimmune disease characterized by elevated blood glucose levels, affects a significant population worldwide. The prevalence of diabetes continues to rise due to various factors, including an increasing obesity rate, sedentary lifestyles, and unhealthy dietary habits. This chronic condition poses various health risks, such as kidney failure, lower limb amputation, blindness, heart attack, stroke, and even mortality. To manage diabetes effectively, various devices and technologies have emerged In the market. Insulin delivery devices, such as insulin pumps and insulin pens, have gained popularity due to their precision and flexibility in insulin administration. These devices offer users the ability to manage their blood glucose levels more effectively, leading to improved health outcomes.

The integration of mobile health technology in diabetes management has revolutionized the way healthcare is delivered. Mobi insulin pumps, continuous monitoring systems, and diabetes tracker devices allow users to monitor their glucose levels in real-time, enabling them to make informed decisions regarding their treatment plans. Hospitals and specialty clinics have adopted diabetes devices to improve patient care and reduce hospital stays. Diabetes care devices, such as glucowear, are used extensively in hospitals and diagnostic centers to monitor and manage patients' blood glucose levels. Hospital pharmacies and retail pharmacies stock a wide range of diabetes devices, including insulin pumps, insulin syringes, lancets, and testing strips, to cater to the needs of diabetic patients.

The elderly population is particularly vulnerable to diabetes, and the market for diabetes devices caters to their unique needs. Minimally invasive devices, such as transdermal sensors, have gained popularity due to their ease of use and non-invasive nature, making them suitable for elderly patients. The diabetes devices market is driven by the increasing prevalence of diabetes and the need for affordable healthcare options. Artificial pancreas systems, continuous glucose monitors, and glucose monitoring devices are becoming increasingly popular due to their efficacy in managing diabetes. These devices offer real-time monitoring, wireless transmission, and dedicated apps, making diabetes management more accessible and user-friendly.

Healthcare providers play a crucial role In the adoption of diabetes devices. The integration of diabetes devices into electronic health records, hospital information systems, and point-of-care testing devices enables healthcare professionals to access patient data and provide personalized treatment plans. The future of diabetes device technology lies In the integration of artificial intelligence and data analytics. These technologies enable precision insulin dosing, real-time glucose pattern analysis, and personalized treatment plans. Smart technology, such as smart insulin pens and smart pumps, offer connectivity and data-sharing capabilities, enabling seamless communication between healthcare providers and patients. In conclusion, the diabetes devices market is driven by the increasing prevalence of diabetes, the need for affordable healthcare options, and the integration of mobile health technology and artificial intelligence.

These devices offer precision, flexibility, and user-friendly interfaces, making diabetes management more accessible and effective for patients. The future of diabetes device technology lies In the integration of advanced technologies, such as artificial intelligence and data analytics, to provide personalized and effective treatment plans for diabetic patients.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.68% |

|

Market growth 2024-2028 |

USD 13.98 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.22 |

|

Key countries |

US, Germany, France, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Diabetes Management Devices Market Research and Growth Report?

- CAGR of the Diabetes Management Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the diabetes management devices market growth of industry companies

We can help! Our analysts can customize this diabetes management devices market research report to meet your requirements.