Wheat Gluten Market Size 2024-2028

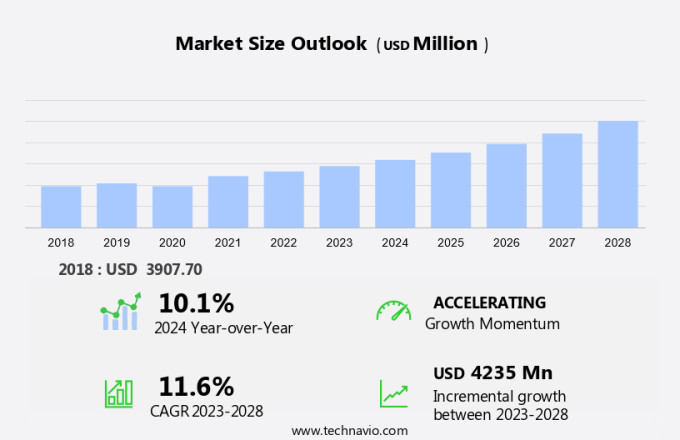

The wheat gluten market size is forecast to increase by USD 4.23 billion at a CAGR of 11.6% between 2023 and 2028.

- The market is experiencing significant growth due to several key drivers. The rising vegan population and increasing awareness of celiac disease and gluten intolerance are major factors fueling market expansion. Autoimmune reactions to gluten, which can cause symptoms such as muscle pain, abdominal pain, nausea, bloating, fatigue, and weight gain, have led many individuals to seek out gluten-free alternatives.

- Furthermore, the link between gluten consumption and chronic diseases, including diabetes and high blood pressure, has also contributed to the market's growth. The trend towards plant-based food, regenerative food, and sustainable food production is also driving demand for gluten-free options. However, the market faces challenges from a complex regulatory environment and the need for continuous innovation to meet consumer demands. Despite these challenges, the market is expected to continue growing as consumers prioritize their health and wellness.

What will be the Size of the Market During the Forecast Period?

- Wheat gluten, a protein found in wheat, has gained significant attention in the food industry due to its unique properties and versatility. This protein, primarily composed of gliadins and glutenins, offers visco-elastic properties that make it an essential ingredient in various food items, including baked pastas and processed meat products. This article provides an in-depth analysis of the factors influencing the market. Consumer Trends: The increasing preference for organic and natural foods among health-conscious consumers is driving the demand for wheat gluten. As more people adopt high-protein diets and seek plant-based protein sources, the demand for wheat gluten as a functional protein is expected to grow. The vegan population's continued expansion also contributes to the market's growth, as meat substitutes increasingly rely on wheat gluten as a key ingredient.

- Furthermore, health issues such as diabetes, high cholesterol, and blood pressure are leading consumers to seek alternatives to traditional animal-derived proteins. Wheat gluten, as a fat-free and cholesterol-free protein source, offers a viable option for those looking to maintain a healthy lifestyle. Furthermore, the association between wheat gluten and conditions like celiac disease and non-celiac gluten sensitivity has led to increased research and development in the market, focusing on producing gluten-free alternatives. Functional Properties: The visco-elastic properties of wheat gluten make it an ideal ingredient for various food applications.

- In baked goods, it enhances texture and improves the dough's elasticity, while in processed meat products, it acts as a binding agent, mimicking the texture of meat. These functional properties contribute to the growing demand for wheat gluten in the food industry. Wheat Starch: Wheat starch, a byproduct of wheat gluten production, is also gaining traction in the market due to its potential applications as a functional ingredient. Its ability to thicken and stabilize food products makes it an attractive alternative to traditional thickeners, further expanding the market's scope. Conclusion: the market is experiencing steady growth, driven by consumer preference for healthy and plant-based protein sources, health concerns, and the functional properties of wheat gluten and wheat starch. As the food industry continues to evolve, the demand for wheat gluten is expected to remain strong, making it an essential ingredient in various food applications.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Bakery and confectionery

- Dietary supplements

- Animal feed

- Others

- Geography

- Europe

- Germany

- France

- APAC

- China

- India

- North America

- US

- South America

- Middle East and Africa

- Europe

By End-user Insights

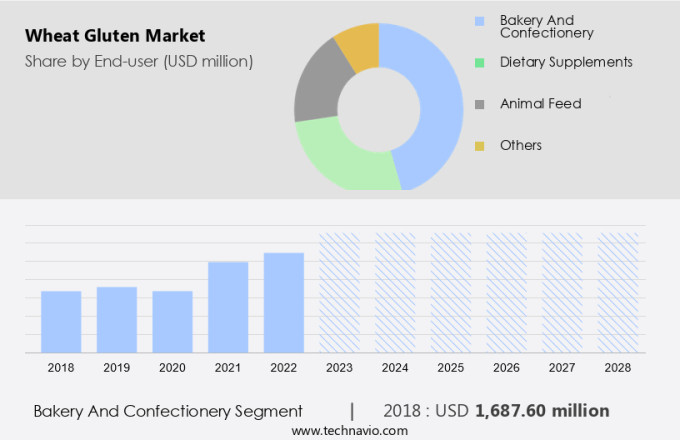

- The bakery and confectionery segment is estimated to witness significant growth during the forecast period.

The bakery and confectionery market is experiencing significant growth due to the increasing vegan population and the rising demand for gluten-free options among individuals with celiac disease or gluten intolerance. Autoimmune reactions to gluten can cause symptoms such as muscle pain, abdominal pain, nausea, bloating, fatigue, and weight gain, leading many to seek out alternative sources of nutrition. This trend is driving companies to produce a wider range of plant-based, regenerative, and sustainable food options. One major player in the bakery industry is Brezelbackerei Ditsch GmbH (Ditsch), based in Germany. They offer a diverse product line including pretzels, croissants, and various types of rolls.

Furthermore, their offerings cater to consumers with dietary restrictions, such as those with gluten intolerance, as well as those seeking convenient and healthy food choices. Products like Pretzel Sticks, Pretzel Rolls, and Ham and Cheese Croissants are among their popular offerings. Additionally, Ditsch's focus on high-quality ingredients aligns with the growing consumer interest in natural and wholesome food options. The bakery and confectionery market is expected to continue its expansion as chronic diseases such as diabetes and high blood pressure becomes more prevalent, further increasing the demand for healthier food alternatives. companies are responding to this trend by introducing new products and expanding their offerings to cater to the evolving needs of consumers.

Get a glance at the market report of share of various segments Request Free Sample

The bakery and confectionery segment was valued at USD 1.69 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 61% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The European market is driven by the health-conscious consumer population in major countries like Germany, the UK, France, and Italy. Consumers in these nations prioritize leading healthy lifestyles and balanced diets, leading to a high demand for wheat gluten. This market trend is further encouraged by governmental and medical institutions that promote fiber-rich foods for managing health issues such as blood pressure, obesity, and heart attacks. Organic goods and clean-label products are increasingly popular, with immunity-boosting components being a significant consumer preference. Companies like Bayer AG and Cargill Inc. Play a crucial role in ensuring the availability and accessibility of organic and natural food products, including wheat gluten. The market's growth can be attributed to the rising demand for fat-free and sugar-free food items, as well as the increasing popularity of fiber-rich foods for overall health benefits.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Wheat Gluten Market?

Increasing adoption of healthy eating habits is the key driver of the market.

- Consumers in the United States are increasingly prioritizing their health and adopting balanced diets. Unprocessed and whole-grain foods, such as wheat gluten, are gaining popularity due to their nutritional benefits. These foods provide essential vitamins and minerals, making them an excellent choice for individuals following dietary restrictions, including those with lactose intolerance, vegans, and vegetarians. Additionally, wheat gluten is used in various food categories, including meat alternatives, confectionery products, frozen food, and animal feed.

- Furthermore, the nutritional value of wheat gluten makes it a valuable ingredient for high-protein and high-fiber diets, contributing to improved overall health. A balanced diet is crucial for maintaining emotional, physical, and cognitive health. Lack of proper nutrition can lead to health issues such as heart disease, stroke, hypertension, atherosclerosis, obesity, type 2 diabetes, osteoporosis, dental caries, gallbladder disease, dementia, and nutritional anemias. Nutritional anemia, for instance, can result in low red blood cell count, impaired red blood cell function, and reduced hemoglobin levels due to poor diet.

What are the market trends shaping the Wheat Gluten Market?

Increased snacking and indulgence consumption are the upcoming trends in the market.

- Consumption trends have shifted significantly in recent years, with an increasing number of consumers opting for healthier food choices. In developed regions like North America and Europe, the preference for organic and healthy food items has grown substantially. The busy lifestyles of modern consumers often lead them to forgo regular meals and opt for convenient, on-the-go food alternatives. Bakery products, such as bread, rolls, pies, and pastries, have gained popularity as quick and easy snacks. Bread, in particular, is a versatile food item that can be transformed into various healthy snacks, including French toast, bruschetta, puddings, garlic bread, bread salad, and breakfast toasts.

- Wheat gluten, a key protein component of wheat, plays a significant role in these food items. Gluten is a complex protein made up of two primary components, gliadins, and glutenins. These proteins provide visco-elastic properties to the dough, making it possible to create various textures and structures in baked goods. Wheat gluten is also used in high-protein diets and as a functional protein in animal feed. In addition, it is used as gum gluten in various food applications, including pasta production and meat and bread processing. Plant-based proteins, such as wheat gluten, are increasingly being adopted as alternatives to animal-derived proteins due to their environmental sustainability and ethical considerations. As a result, the demand for wheat gluten is expected to remain strong in the coming years.

What challenges does Wheat Gluten Market face during the growth?

The challenging regulatory environment is a key challenge affecting the market growth.

- The expanding market in the United States necessitates stricter government regulations and oversight in the production, certification, and labeling of these products. The FDA has seen an uptick in labeling violations regarding wheat gluten, leading manufacturers to exercise caution when making nutritional claims and ensuring product efficacy. Manufacturers must adhere to rigorous safety standards throughout the production process to meet consumer expectations. These expectations include maintaining clean-label products for those following plant-based diets, vegan populations, and individuals with celiac disease or gastric problems. Key industries such as nutritional supplements, bodybuilders, and athletes rely on wheat gluten as a primary source of plant-based protein.

- Major players in the market, like Ardent Mills and Firebird Artisan Mills, offer gluten-free specialty grains and pulses to cater to this demand. To stay competitive, companies must comply with regulations and provide accurate, truthful information about their wheat gluten products. This includes adhering to guidelines set by organizations such as the FDA, as well as industry-specific certifications like the Gluten-Free Certification Organization (GFCO). In conclusion, the market's growth necessitates a strong regulatory framework to ensure product safety, quality, and truthful labeling. Manufacturers must stay informed of these regulations and prioritize transparency to build trust with consumers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anhui Ante Food Co Ltd.

- Archer Daniels Midland Co.

- Ardent Mills LLC

- Bryan W Nash and Sons Ltd.

- Cargill Inc.

- Crespel and Deiters GmbH and Co. KG

- CropEnergies AG

- Jäckering-Group

- Kroner Starke GmbH

- Manildra Flour Mills Pty. Ltd.

- Meelunie BV

- MGP Ingredients Inc.

- Permolex Ltd

- Pioneer Industries Pvt Ltd

- Roquette Freres SA

- Royal Ingredients Group BV

- Sedamyl

- Shandong Qufeng Food Technology Co Ltd

- Tereos Participations

- Z and F Sungold Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Wheat gluten, a protein found in wheat, is a crucial component in various food items and animal feed. It is composed of two main proteins: gliadins and glutenins. These proteins provide visco-elastic properties, making wheat gluten an essential ingredient in pasta, meats, breads, and bakery products. The demand for wheat gluten is on the rise due to the increasing trend of high-protein diets, organic food consumption, and the growing vegan and gluten-free population. Consumers are increasingly opting for plant-based proteins and functional foods, which offer health advantages such as fiber-rich, clean-label products, and immunity-boosting components. Wheat gluten is used in various food applications, including gum gluten, liquid form, and powder form, in the production of baked pastries, processed meat products, and nutritional supplements.

Furthermore, it is also used in the production of soy-based food, meat alternatives, and confectionery products. The health benefits of wheat gluten extend beyond food applications. It is used in the medical industry for the treatment of celiac disease and other autoimmune reactions, which can cause symptoms such as muscle pain, abdominal pain, nausea, bloating, fatigue, weight gain, and chronic diseases. Wheat gluten is also used in animal feed to improve the nutritional value and enhance animal welfare. The growing awareness of sustainable food and regenerative food practices is further fueling the demand for wheat gluten as a functional protein source. In conclusion, the market is driven by various factors, including consumer eating habits, health issues, and the growing demand for plant-based proteins and functional foods. The market is expected to grow significantly in the coming years, offering numerous opportunities for businesses in the food and feed industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.6% |

|

Market growth 2024-2028 |

USD 4.23 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.1 |

|

Key countries |

China, US, India, France, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch