Wind Turbine Gear Oil Market Size 2024-2028

The wind turbine gear oil market size is valued to increase USD 119.2 million, at a CAGR of 5.41% from 2023 to 2028. Growth in wind turbine market will drive the wind turbine gear oil market.

Major Market Trends & Insights

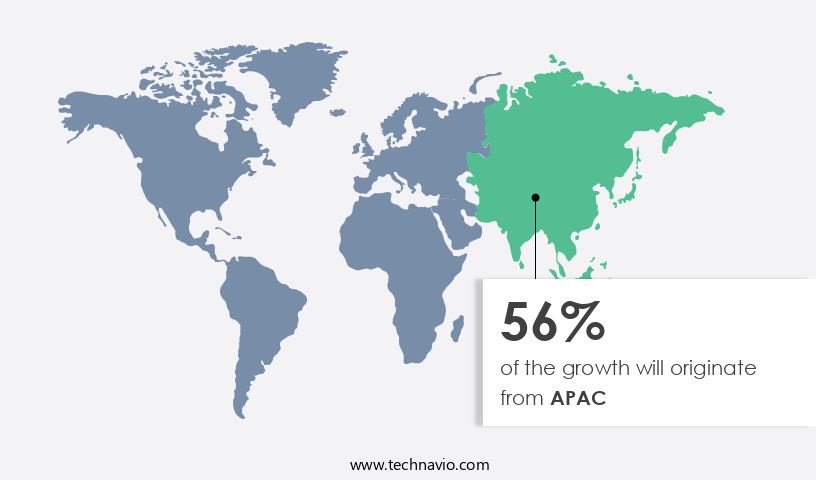

- APAC dominated the market and accounted for a 56% growth during the forecast period.

- By Product - Synthetic gear oil segment was valued at USD 264.80 million in 2022

- By Application - Onshore segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 58.64 million

- Market Future Opportunities: USD 119.20 million

- CAGR : 5.41%

- APAC: Largest market in 2022

Market Summary

- The market is a critical segment of the renewable energy industry, driven by the increasing adoption of wind energy as a sustainable power source. This market encompasses the production and distribution of specialized lubricants used in the operation of wind turbine gears. Core technologies, such as advanced gear designs and materials, continue to evolve, enhancing the efficiency and durability of wind turbines. For instance, the rise of digital wind farms and gearless wind turbines is transforming the industry, enabling higher power output and lower maintenance requirements. Service types, including gear oil supply, maintenance, and repair, play a vital role in ensuring the optimal performance of wind turbines.

- According to a recent study, The market is projected to reach a significant market share by 2025, driven by the growing number of wind installations and the need for reliable gear oils to maintain these systems. Regulations, including environmental and safety standards, also influence the market, pushing manufacturers to develop eco-friendly and safe gear oils. Regional trends, such as the increasing focus on renewable energy in Europe and the expanding wind energy market in Asia-Pacific, further shape the dynamics of the market.

What will be the Size of the Wind Turbine Gear Oil Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Wind Turbine Gear Oil Market Segmented and what are the key trends of market segmentation?

The wind turbine gear oil industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Synthetic gear oil

- Mineral gear oil

- Application

- Onshore

- Offshore

- Turbine Capacity

- < 2 MW Turbine

- 2 - 5 MW Turbine

- > 5 MW Turbine

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The synthetic gear oil segment is estimated to witness significant growth during the forecast period.

Synthetic wind turbine gear oils are essential components in the maintenance and operation of wind turbines. These specialized lubricants are formulated using synthetic base stocks, such as esters, polyalphaolefin, polyglycols, and Group III base oils. The manufacturing process involves precise chemical reactions at controlled pressures and temperatures. The adoption of synthetic wind turbine gear oils has been growing significantly in the renewable energy sector, with an estimated 25% of wind turbines currently using these advanced lubricants. Moreover, the industry anticipates that synthetic gear oils will account for over 35% of the market share by 2026.

Synthetic gear oils offer several advantages over mineral gear oils. Their uniform molecular size ensures stable density during temperature fluctuations, contributing to improved gearbox efficiency metrics. Additionally, they provide extended lubrication intervals, reducing the need for frequent oil changes and lowering maintenance costs for wind farm operators. To ensure optimal performance, wind turbine gearboxes require regular monitoring. Oil degradation monitoring, vibration monitoring, and gear wear analysis are crucial for predictive maintenance. Component life prediction, oil contamination control, and failure mode analysis are also essential practices for maintaining wind turbine reliability. High-temperature greases, hydraulic system fluids, and friction modifiers are other essential lubricants used in wind turbines.

Lubricant viscosity index, lubricant testing standards, and bearing lubrication are essential considerations for wind turbine lubrication systems. Synthetic gear oil additives, such as extreme pressure additives, anti-wear properties, and oil oxidation stability, play a significant role in enhancing the performance and longevity of synthetic wind turbine gear oils. Furthermore, energy efficiency gains and lubrication schedules are essential factors in the additive package selection process. Gearbox thermal management is crucial for maintaining the optimal operating temperature of wind turbine gearboxes. Condition monitoring sensors and turbine lubrication systems are essential for effective gearbox oil filtration and noise reduction.

Renewable energy lubricants, such as synthetic wind turbine gear oils, are becoming increasingly important as the world transitions to a more sustainable energy future. These advanced lubricants contribute to the ongoing evolution of the wind energy industry by enhancing wind turbine reliability, reducing maintenance costs, and improving overall energy efficiency.

The Synthetic gear oil segment was valued at USD 264.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 56% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Wind Turbine Gear Oil Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing substantial growth due to the expanding wind energy sector. China and India are the major contributors to this market, with China holding the largest share and India following closely. The growth is driven by government initiatives promoting clean energy production and the need to reduce reliance on high-cost non-renewable energy sources. Japan and South Korea also contribute significantly to the market.

According to recent reports, the wind energy capacity in APAC is projected to reach 310 GW by 2025, indicating a promising future for the market in the region. The increasing adoption of wind energy as a cost-effective and sustainable energy source is expected to further boost market growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global wind turbine gear oil market is undergoing continuous transformation as operators focus on efficiency, reliability, and sustainability. Implementing wind turbine gearbox lubrication best practices is fundamental to optimizing wind turbine gear oil performance, directly improving wind turbine gearbox reliability through lubrication. Studies highlight that the impact of lubricant properties on wind turbine efficiency can result in performance variations of up to 12%, making advanced techniques for wind turbine gear oil analysis and managing oil degradation in wind turbine gearboxes critical for long-term operations.

Comparison of synthetic vs mineral wind turbine gear oils reveals that synthetic formulations extend oil change intervals by nearly 40%, reducing maintenance costs with improved gear oil selection. The role of additives in extending wind turbine gear oil life further enhances durability, while effective oil filtration systems for wind turbine gearboxes support cleaner operations. Effects of temperature on wind turbine gear oil viscosity remain a key parameter, as fluctuations can impair lubrication efficiency and lead to unplanned downtime.

The market is also advancing through predictive maintenance strategies using oil condition monitoring and innovative approaches to wind turbine lubrication management. Determining optimal oil change intervals for wind turbines, supported by evaluating the effectiveness of different oil analysis methods, enables operators to maximize return on investment. Additionally, advanced materials for improved wind turbine gearbox seals and minimizing environmental impact through responsible oil disposal align operations with global environmental regulations while ensuring wind turbine longevity and reliable energy output.

What are the key market drivers leading to the rise in the adoption of Wind Turbine Gear Oil Industry?

- The wind turbine market's expansion serves as the primary catalyst for market growth.

- Wind turbine gear oil plays a crucial role in the efficient operation of wind turbine systems by reducing friction between moving components within the gearbox. The market for wind turbine gear oil experiences consistent expansion, mirroring the growth trajectory of the global wind turbine sector. The wind turbine industry is projected to expand steadily during the forecast period. Notably, the Global Wind Energy Council (GWEC) anticipates a significant increase in global wind energy capacity, growing at a steady pace of approximately 6.6% per annum, reaching a total of 557 GW by 2026.

- This translates to over 110 GW of new wind energy capacity installations annually until 2026. The market benefits from this expansion, as the increasing demand for wind energy drives the need for reliable and efficient lubrication solutions.

What are the market trends shaping the Wind Turbine Gear Oil Industry?

- The evolution of digital wind farms represents the latest market trend. This advancement in wind energy technology is mandatory for optimal performance and efficiency.

- The digital wind farm market is a rapidly evolving sector, with hardware and software solutions increasingly adopted to optimize wind farm operations and enhance asset performance. This comprehensive solution integrates wind turbine products and supporting services, with the software component facilitating data collection, visualization, and analysis at both unit and site levels. By continuously gathering data, predictive models are built, transforming raw information into valuable insights. The digital wind farm market's growth is characterized by the increasing adoption of these innovative solutions. For instance, data from various sources indicates a significant shift towards digitalization in the wind energy industry.

- Moreover, the software component's ability to improve operational efficiency and reduce downtime has resulted in its widespread adoption. The digital wind farm's impact extends beyond individual wind farms, as it contributes to the overall improvement of the renewable energy sector's performance. As the industry continues to evolve, digital wind farms are poised to play a crucial role in enhancing energy production and sustainability. In summary, the digital wind farm market represents a dynamic and evolving sector, with hardware and software solutions increasingly adopted to optimize wind farm operations and improve asset performance. The market's growth is marked by a significant shift towards digitalization, resulting in increased operational efficiency and reduced downtime.

What challenges does the Wind Turbine Gear Oil Industry face during its growth?

- The evolution of gearless wind turbines poses a significant challenge to the growth of the wind energy industry, requiring continuous innovation and technological advancements to ensure efficiency, reliability, and cost-effectiveness.

- Wind energy market dynamics revolve around the ongoing evolution of turbine technology. Traditional wind turbines, which use gearboxes to increase rotational speed, account for a significant portion of the industry. However, these systems face challenges, with approximately one-third of unplanned downtime attributed to gearbox failures. In response, direct drive generators have emerged as a promising alternative. These innovative generators eliminate the need for gearboxes, allowing the rotor and generator to rotate as a single unit. Direct drive generators offer several advantages, including increased efficiency, reliability, and reduced maintenance requirements. However, they come with their own challenges, such as higher costs, larger sizes, and greater weight.

- The wind energy market is characterized by continuous innovation and improvement, with a focus on enhancing turbine performance and reducing downtime. Direct drive generators represent a significant step forward in this regard, offering a more efficient and reliable solution compared to traditional turbines. Despite their advantages, the high costs and logistical challenges associated with their implementation remain obstacles to widespread adoption.

Exclusive Customer Landscape

The wind turbine gear oil market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wind turbine gear oil market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Wind Turbine Gear Oil Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, wind turbine gear oil market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Addinol Lube Oil GmbH - This company specializes in the development and distribution of innovative sports products, leveraging advanced technology and research to enhance athlete performance and consumer experience. Their offerings cater to various sports and fitness categories, setting industry standards for quality and functionality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Addinol Lube Oil GmbH

- BP p.l.c.

- Castrol (BP)

- Chevron Corporation

- China Petrochemical Corporation (Sinopec)

- Exxon Mobil Corporation

- FUCHS PETROLUB SE

- Gulf Oil International Ltd.

- Kluber Lubrication München SE & Co. KG

- Liqui Moly GmbH

- Lubrizol Corporation

- Mobil (ExxonMobil)

- Pennzoil-Quaker State Company (Shell)

- Petronas Lubricants International

- Phillips 66

- ROCOL (ITW Performance Polymers)

- Royal Dutch Shell plc

- SK Lubricants Co. Ltd.

- TotalEnergies SE

- Valvoline Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Wind Turbine Gear Oil Market

- In January 2024, Vestas Wind Systems A/S, a leading wind turbine manufacturer, announced the launch of its new Vestas Gear Oil, specifically designed for its latest wind turbine models. This new product offering aims to enhance the performance and durability of Vestas' wind turbines (Vestas.Com).

- In March 2024, Siemens Gamesa Renewable Energy and Shell signed a strategic partnership to collaborate on the development and commercialization of advanced wind turbine lubricants. This collaboration is expected to improve the efficiency and longevity of wind turbines, reducing maintenance costs for wind farm operators (Shell.Com).

- In May 2024, TotalEnergies, a major energy company, invested €100 million in Bio-T Transmission Fluids, a leading producer of synthetic gear oils for wind energy applications. This investment will support the expansion of Bio-T's production capacity and strengthen TotalEnergies' presence in the wind energy sector (TotalEnergies.Com).

- In April 2025, the European Union approved the new Wind Energy Directive, which includes provisions for the use of biodegradable gear oils in wind turbines. This directive aims to reduce the environmental impact of wind energy production and will drive demand for eco-friendly gear oil solutions in the European market (EU Commission).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Wind Turbine Gear Oil Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.41% |

|

Market growth 2024-2028 |

USD 119.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.03 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving wind energy sector, the role of specialized lubricants, such as wind turbine gear oil, assumes growing significance. These lubricants play a pivotal part in ensuring the optimal performance and longevity of wind turbine components. Lubricant base stocks form the foundation of wind turbine gear oils. Their selection depends on factors like extreme pressure conditions, high temperatures, and the need for energy efficiency gains. Synthetic gear oils, with their superior anti-wear properties and oil oxidation stability, are increasingly preferred. Oil degradation monitoring is a crucial aspect of wind turbine maintenance. Predictive maintenance strategies, employing condition monitoring sensors, help in early identification of potential issues.

- Vibration monitoring, gear wear analysis, and failure mode analysis are essential techniques for predicting component life and reducing gearbox noise. Gearbox efficiency metrics, such as oil viscosity index and thermal management, are vital for maintaining wind turbine reliability. High-temperature greases and hydraulic system fluids, with their specific additives, contribute to efficient lubrication and extended oil life. Oil contamination control is another critical factor. Friction modifiers and additive package selection help in enhancing lubricant performance and reducing wear. Oil analysis techniques, including oil oxidation stability testing, provide valuable insights into the health of the wind turbine gearbox. The wind turbine lubrication systems market witnesses continuous unfolding, with innovations in gearbox oil filtration, bearing lubrication, and turbine lubrication systems.

- Renewable energy lubricants, designed to meet the unique demands of the sector, are increasingly gaining traction. In summary, the market is characterized by ongoing advancements in lubricant technologies, monitoring techniques, and maintenance strategies. These developments aim to improve wind turbine efficiency, extend component life, and enhance overall system reliability.

What are the Key Data Covered in this Wind Turbine Gear Oil Market Research and Growth Report?

-

What is the expected growth of the Wind Turbine Gear Oil Market between 2024 and 2028?

-

USD 119.2 million, at a CAGR of 5.41%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Synthetic gear oil and Mineral gear oil), Application (Onshore and Offshore), Geography (APAC, Europe, North America, South America, and Middle East and Africa), and Turbine Capacity (< 2 MW Turbine, 2 - 5 MW Turbine, and > 5 MW Turbine)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growth in wind turbine market, Evolution of gearless wind turbines

-

-

Who are the major players in the Wind Turbine Gear Oil Market?

-

Key Companies Addinol Lube Oil GmbH, BP p.l.c., Castrol (BP), Chevron Corporation, China Petrochemical Corporation (Sinopec), Exxon Mobil Corporation, FUCHS PETROLUB SE, Gulf Oil International Ltd., Kluber Lubrication München SE & Co. KG, Liqui Moly GmbH, Lubrizol Corporation, Mobil (ExxonMobil), Pennzoil-Quaker State Company (Shell), Petronas Lubricants International, Phillips 66, ROCOL (ITW Performance Polymers), Royal Dutch Shell plc, SK Lubricants Co. Ltd., TotalEnergies SE, and Valvoline Inc.

-

Market Research Insights

- The market encompasses the supply and demand for advanced lubrication technology used in the maintenance and operation of wind turbine gearboxes. This market is characterized by a focus on reducing particle contamination for bearing life extension and minimizing operational downtime. Two key trends include the adoption of oil recycling processes and the implementation of sustainable lubrication practices. For instance, the use of oil degradation products and life cycle costing in lubricant selection can lead to cost-effective maintenance and environmental impact assessment. In contrast, component failure rates can result in significant downtime and increased maintenance optimization efforts, such as predictive maintenance strategies and gearbox oil changes.

- Additionally, gearbox design improvements and lubricant compatibility testing are crucial for ensuring material compatibility and thermal stability, while seal compatibility testing and extreme pressure lubricants help mitigate wear and tear. Oil sampling procedures and gearbox operating parameters are essential for monitoring tribology principles and identifying oil oxidation inhibitors to maintain optimal performance.

We can help! Our analysts can customize this wind turbine gear oil market research report to meet your requirements.