Wired Occupancy Sensors Market Size 2024-2028

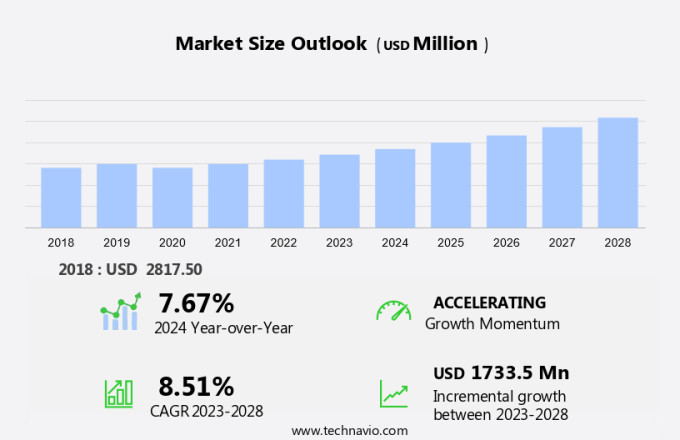

The wired occupancy sensors market size is forecast to increase by USD 1.73 billion at a CAGR of 8.51% between 2023 and 2028. The market is experiencing significant growth due to the rise in global construction and infrastructure development activities, with a particular focus on energy efficiency and cost savings. The real estate sector's increasing construction is also contributing to market expansion. However, high installation and maintenance costs remain a challenge for market growth. Wired occupancy sensors provide energy savings by automatically turning off lights when no one is present, making them an essential component of energy management systems in commercial and industrial buildings. The market is expected to continue growing as the demand for energy efficiency and cost savings increases. Additionally, the integration of advanced technologies such as IoT and AI in occupancy sensors is expected to drive market innovation and growth.

The market is witnessing significant growth due to the increasing adoption of energy-saving devices and the implementation of energy codes. These sensors, which include Passive Infrared (PIR), Ultrasonic (US), and DT sensors, are designed to detect the absence or presence of occupants in a room or area, automatically controlling lights, HVAC systems, and other energy-consuming devices. Sensing technology plays a crucial role in wired occupancy sensors, with PIR sensors being the most common due to their ability to detect body heat and motion. US sensors, on the other hand, use sound waves to detect occupancy.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Hotels

- Residential

- Corporate offices

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- Middle East and Africa

- South America

- North America

By Application Insights

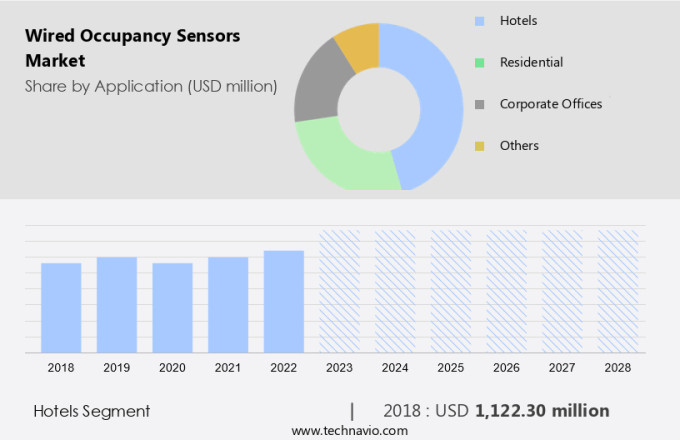

The hotels segment is estimated to witness significant growth during the forecast period. Vacancy sensors, a crucial component of energy-saving devices, are gaining significant traction in various sectors due to their ability to automatically switch off lights and HVAC systems when no occupancy is detected. These sensors employ different sensing technologies such as Passive Infrared (PIR), Ultrasonic (US), Dual-technology (DT), Microwave sensors, and Camera-based sensors. Companies like Leviton, Wattstopper, Acuity Brands, Hubbell, Cree, and Power and Communication offer a range of vacancy sensors with special features and accessories to cater to diverse applications. PIR sensors detect body heat and motion, while US sensors use sound waves to detect occupancy. DT sensors combine PIR and US technologies for enhanced accuracy.

Moreover, microwave sensors use radio waves, and camera-based sensors use image processing to detect occupancy. Special features include time delay, energy codes compliance, and compatibility with other building automation systems. These sensors are widely used in the real estate sector, construction, washrooms, and smart city initiatives. Power saving and reducing CO2 emissions are major drivers for their adoption in commercial, residential, educational, and healthcare buildings. Wireless sensors offer added convenience and flexibility. Intelligent occupancy sensors, free from microphonics, are essential for maintaining optimal energy consumption and minimizing light pollution. Companies like Wired Occupancy Sensors provide solutions that meet the needs of various industries and contribute to energy efficiency and sustainability.

Get a glance at the market share of various segments Request Free Sample

The hotels segment was valued at USD 1.12 billion in 2018 and showed a gradual increase during the forecast period.

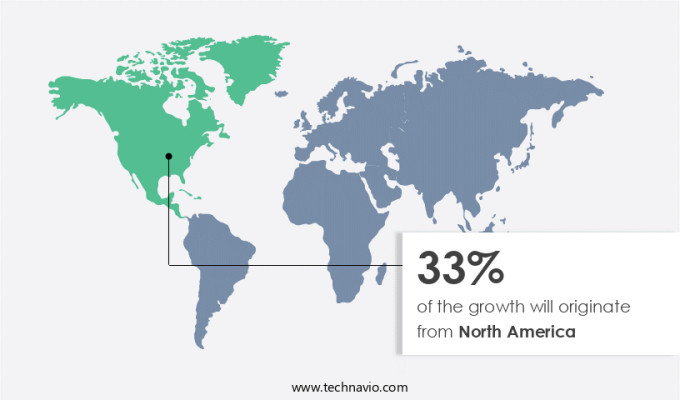

Regional Insights

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Vacancy sensors, a vital component of energy-saving devices, are increasingly being adopted across various sectors including education express courses, construction, real estate, and smart city initiatives. Companies like Leviton, Wattstopper, Acuity Brands, Hubbell, Cree, and Power and Communication offer a range of vacancy sensors employing different sensing technologies such as Passive Infrared (PIR), Ultrasonic (US), Dual-technology (DT), Microwave sensors, and Camera-based sensors. These sensors detect the absence of occupancy in rooms and automatically turn off lights, HVAC systems, and other appliances, thereby reducing energy consumption and CO2 emissions. Special features of these sensors include time delay, accessory compatibility, and integration with energy codes.

Additionally, PIR sensors, US sensors, and DT sensors are commonly used in residential and commercial buildings, washrooms, and power saving applications. In the hotel and hospitality industry, wireless sensors are gaining popularity due to their ease of installation and integration with smart city initiatives. Intelligent occupancy sensors ensure energy efficiency while minimizing light pollution. Accessories like mounting brackets, wiring harnesses, and test switches are also available for these sensors. Microphonics, a common issue with some sensors, can be mitigated through proper installation techniques and sensor selection.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The special features like time delay, energy consumption, and CO2 emissions monitoring add value to these sensors. Accessories such as inputs, outputs, and power and communication interfaces further enhance their functionality. Microphonics, a common issue in wired sensors, is being addressed through advancements in sensor design and technology. The market is driven by the smart city initiative and the hospitality industry, where energy savings and intelligent building management are essential. Residential and commercial buildings are significant end-users, with the latter accounting for a larger market share due to the need for energy efficiency in larger spaces. Wired occupancy sensors contribute to reducing energy consumption and CO2 emissions, making them an essential component of energy-efficient buildings and sustainable cities.

Market Driver

A rise in global construction and infrastructure development activities is the key driver of the market. The market is experiencing significant growth due to the increasing construction activities in retail and hospitality buildings worldwide. The recovery of the economy, particularly in developed countries like the US, has led to a growth in new building projects, including residential and commercial properties.

Additionally, this trend is driven by the rising demand for energy efficiency and home automation systems, which are increasingly being integrated into new constructions. Bluetooth and Bluetooth Low Energy (BLE) technologies are becoming popular solutions for occupancy sensing in these applications due to their low power consumption and ease of use. The integration of these sensors in building automation systems enables the efficient management of energy consumption and enhances the overall comfort and convenience for occupants. The growing adoption of these technologies is expected to fuel the demand for wired occupancy sensors in the retail and hospitality sectors.

Market Trends

The rising construction in real estate sector is the upcoming trend in the market. Energy conservation has emerged as a critical factor in economic growth, leading governments worldwide to implement measures to minimize energy consumption. Wired occupancy sensors, when integrated with energy-efficient lighting, can save up to 30% of electricity usage. The increasing construction of retail and hospitality buildings is a significant driver for the market, with occupancy sensors being installed in public areas such as metro station restrooms and hallways to reduce electricity consumption.

Additionally, the adoption of wired occupancy sensors in public structures like hospitals, railway stations, parks, airports, and residential buildings is fueling market demand. Bluetooth and Bluetooth Low Energy (BLE) technologies are also gaining traction in home automation applications, further expanding the market's scope. Wired occupancy sensors offer energy savings and convenience, making them an attractive option for various sectors.

Market Challenge

The high costs of installation and maintenance is a key challenge affecting the market growth. Wired occupancy sensors are advanced devices used in retail and hospitality buildings for energy management and home automation. These sensors employ software that necessitates regular maintenance, leading to higher costs compared to other solutions. The installation process involves various hardware components, such as sensors, communication devices, and control systems, adding to the overall expense.

Moreover, the effectiveness of wired occupancy sensors relies on their facing angles and mounted locations, requiring large clearances and flat surfaces for optimal performance. Any obstructions may result in errors. In contrast, non-intrusive Bluetooth and Bluetooth Low Energy sensors offer cost-effective alternatives, making them increasingly popular in the market. Despite their limitations, wired occupancy sensors continue to play a role in energy conservation and automation solutions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Acuity Brands Inc. - The company focuses on occupancy sensors, which can be implemented as a part of building management systems that make spaces smarter, safer, and greener.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alan Manufacturing Inc.

- BLP Technologies Inc.

- Crestron Electronics Inc.

- Eaton Corp. Plc

- Honeywell International Inc.

- Hubbell Inc.

- Intelligent Lighting Controls Inc.

- IR TEC International Ltd.

- Johnson Controls International Plc.

- Koninklijke Philips N.V.

- Legrand SA

- Leviton Manufacturing Co. Inc.

- Lutron Electronics Co. Inc.

- Omicron Sensing LLC

- Schneider Electric SE

- Signify NV

- Steinel America Inc.

- TALOSYS INC.

- Telkonet Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Buildings Wired occupancy sensors have become essential components in modern buildings, enabling power savings and optimizing energy consumption. These sensors use various technologies such as Passive Infrared (PIR), Ultrasonic (US), Dual-technology (DT), Microwave, and Camera-based, to detect occupancy and automatically switch off lights or HVAC systems when a room is unoccupied. Manufacturers like Leviton, Wattstopper, Acuity Brands, Hubbell, and Cree lead the market with their advanced wired occupancy sensors. These sensors come with special features like time delay, energy saving devices, and accessories to cater to diverse applications in the real estate sector.

Construction, commercial buildings, residential buildings, educational buildings, healthcare buildings, washrooms, hotel and hospitality, and smart city initiatives are significant markets for wired occupancy sensors. Energy codes and regulations mandate the use of occupancy sensors to minimize energy consumption and reduce CO2 emissions. PIR sensors, US sensors, and DT sensors are popular choices due to their reliability and accuracy. However, microphonics and false activations can be issues with some wired sensors, necessitating the need for continuous research and development. Wired occupancy sensors play a pivotal role in power saving, reducing light pollution, and contributing to the overall energy efficiency of buildings. With the increasing focus on intelligent buildings and energy conservation, the demand for wired occupancy sensors is expected to grow significantly in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 1.73 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.67 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 33% |

|

Key countries |

US, UK, Germany, France, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Acuity Brands Inc., Alan Manufacturing Inc., BLP Technologies Inc., Crestron Electronics Inc., Eaton Corp. Plc, Honeywell International Inc., Hubbell Inc., Intelligent Lighting Controls Inc., IR TEC International Ltd., Johnson Controls International Plc., Koninklijke Philips N.V., Legrand SA, Leviton Manufacturing Co. Inc., Lutron Electronics Co. Inc., Omicron Sensing LLC, Schneider Electric SE, Signify NV, Steinel America Inc., TALOSYS INC., and Telkonet Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch