Woven Fiberglass Fabric Market Size 2024-2028

The woven fiberglass fabric market size is forecast to increase by USD 2.76 billion at a CAGR of 6.5% between 2023 and 2028.

- Woven fiberglass fabric is a lightweight and durable material gaining significant traction in various industries, particularly in wind energy production. The primary applications of woven fiberglass fabric are in the manufacture of rotor blades, which require high corrosion resistance and electrical insulation properties. Additionally, the material's thermal insulation capabilities make it an ideal reinforcement material for various structures. The global construction industry's growth and increasing capacity additions are driving the demand for woven fiberglass fabric.

- Furthermore, stringent regulations on glass fiber imports have led manufacturers to focus on local production, thereby fueling market growth. The material's exceptional properties, including its resistance to corrosion and thermal insulation, make it a preferred choice for various applications. As the wind energy sector continues to expand, the demand for woven fiberglass fabric is expected to increase, offering significant growth opportunities for market participants.

What will be the Size of the Market During the Forecast Period?

- Fiberglass fabric, a composite material made from glass fibers and a polymer matrix, has gained significant traction in various industries due to its unique properties. This material is widely used in sectors such as aerospace, electrical and electronics, wind energy, and sustainable building materials, among others. In this article, we delve into the market, discussing its applications, benefits, and growth drivers. Applications: The primary applications of woven fiberglass fabric include wind energy production, aerospace, electrical and electronics, and sustainable building materials. In wind energy, fiberglass fabric is extensively used in the manufacturing of wind turbine blades, contributing to electricity generation.

- In the aerospace sector, fiberglass fabric is utilized for advanced coatings, chemical resistance, and fire-retardant properties. In the electrical and electronics industry, fiberglass fabric is employed for electrical insulation and thermal insulation. Lastly, in sustainable building materials, fiberglass fabric is used as a reinforcement material in high-pressure laminates. Benefits: Woven fiberglass fabric offers numerous benefits that make it a preferred choice for various industries. Fiberglass fabric's resistance to corrosion makes it an ideal choice for applications in harsh environments. Its excellent electrical insulation properties make it suitable for use in electrical applications.

Furthermore, fiberglass fabric's thermal insulation properties help maintain temperature control in various applications. Compared to traditional materials, fiberglass fabric is lightweight, making it easier to transport and install. Fiberglass fabric's high strength-to-weight ratio and resistance to weathering and UV radiation make it a durable material. The market is driven by several factors, including the increasing demand for renewable energy, the growth of the aerospace industry, and the need for sustainable building materials. The wind energy sector's expansion, particularly in North America, is expected to boost the demand for fiberglass fabric in the manufacturing of wind turbine blades.

Additionally, the increasing use of fiberglass fabric in advanced coatings, smart textiles, and consumer electronics is expected to contribute to market growth. Conclusion: In conclusion, the market is poised for growth, driven by its applications in various industries and the unique benefits it offers. Its use in wind energy production, aerospace, electrical and electronics, and sustainable building materials is expected to continue, making it a valuable commodity in the manufacturing sector. As the demand for renewable energy sources and sustainable materials increases, the market is expected to expand further.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- E-glass

- S-glass

- C-glass

- D-glass

- Others

- End-user

- Construction

- Aerospace and automotive

- Electrical and electronics

- Marine

- Industrial

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Type Insights

- The e-glass segment is estimated to witness significant growth during the forecast period.

Woven fiberglass fabric, specifically E-glass, is a significant material in various industries due to its unique properties. Originally developed for electrical insulation, E-glass has since expanded its applications, particularly in composite materials. This type of fabric is known for its cost-effectiveness and high production rates, making it ideal for large-scale manufacturing. E-glass offers several advantages, including high strength and stiffness, ensuring durability and reliability. Furthermore, its relatively low density contributes to the production of lightweight composites. E-glass, also recognized as electrical-grade glass, is a preferred choice in industries such as consumer electronics and telecommunications due to its electrical insulation capabilities and temperature stability.

Furthermore, the material's properties make it suitable for high-pressure laminates and various other applications. Its cost-effectiveness and high production rates contribute to its popularity in large-scale manufacturing processes. The lightweight nature of E-glass composites is an added advantage, as it reduces the overall weight of the final product without compromising on strength and durability. In summary, E-glass woven fiberglass fabric is a versatile material with a wide range of applications. Its unique properties, such as high strength, stiffness, and low density, make it a preferred choice in industries like consumer electronics and telecommunications. Additionally, its cost-effectiveness and high production rates make it an attractive option for large-scale manufacturing processes.

Get a glance at the market report of share of various segments Request Free Sample

The e-glass segment was valued at USD 3.25 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

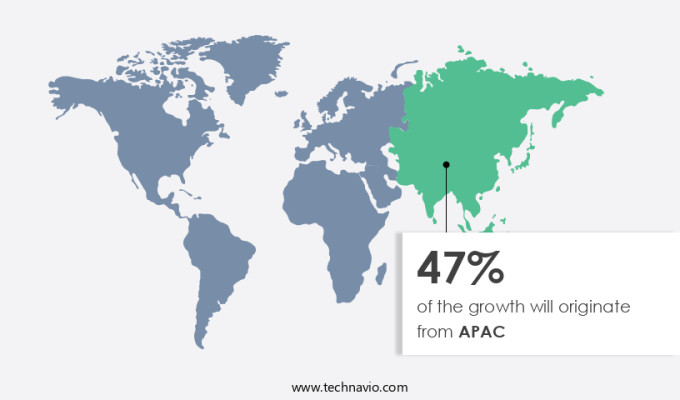

- APAC is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia-Pacific (APAC) region is set to emerge as a major market for woven fiberglass fabric due to technological advancements and substantial infrastructure investments. By 2030, APAC is projected to house around 3,000 data centers, underlining its significance in the global digital economy. Major tech companies are expanding their footprint in Asia's emerging cloud markets, driven by escalating demand for data storage and processing capabilities. Since 2022, China has invested USD6.12 billion in new data centers, highlighting the sector's growth trajectory.

Furthermore, woven fiberglass fabric, with its superior thermal insulation, durability, and fire resistance, is an optimal solution for constructing and maintaining these data centers. In the aerospace, electrical and electronics, and wind energy industries, E-glass fiber, a type of fiberglass, is extensively used in the production of woven fiberglass fabric. This fabric's exceptional properties make it a preferred choice for various applications, including lightweight and strong composite materials.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Woven Fiberglass Fabric Market?

The growth of the global construction industry is the key driver of the market.

- The market holds significant potential for growth in the US construction industry, given its exceptional properties such as strength, durability, and versatility. This material is widely utilized in various applications, including reinforcement, insulation, roofing, and heat and fire protection, making it an essential component in modern building projects. With the increasing demand for sustainable building materials and advanced coatings for chemical resistance, woven fiberglass fabric is gaining popularity in the industry. According to recent market research, the global construction industry is expected to reach a value of USD14 trillion by 2037, up from USD9.8 trillion in 2022. The US, along with China and India, is among the key markets driving this growth.

- Incorporating woven fiberglass fabric in construction projects can contribute to the structural integrity and safety of buildings, while also reducing carbon emissions in the electricity generation sector through the use of wind turbine blades. By utilizing woven fiberglass fabric in construction, builders and architects can create structures that are not only functional and durable but also contribute to a more sustainable future. The use of this material in various applications can help reduce the carbon footprint of buildings and contribute to the overall growth of the construction industry in the US and beyond.

What are the market trends shaping the Woven Fiberglass Fabric Market?

Capacity additions are the upcoming trends in the market.

- In August 2024, Jiangsu Changhai Composite Materials, a prominent Chinese manufacturer of glass-fiber-based composite materials, unveiled ambitious expansion plans. A subsidiary of Jiangsu Changhai, Changzhou Tianma Group Co., Ltd., will upgrade its existing glass fiber pool kiln wire drawing production line. This transformation will enable the line to produce 80,000 tons of glass fiber and special fabric annually, up from its original capacity of 30,000 tons.

- With an investment of approximately USD85 million, this project aims to enhance production capabilities and optimize product performance. This expansion is significant for the lightweight materials industry, particularly in the realm of wind energy production. Woven fiberglass fabric, known for its corrosion resistance, electrical insulation, and thermal insulation properties, is a crucial reinforcement material for rotor blades. The increased production capacity will contribute to the growing demand for these materials in various industries.

What challenges does Woven Fiberglass Fabric Market face during the growth?

Scrutiny on glass fiber imports is a key challenge affecting the market growth.

- The market encompasses the production and sale of fire-retardant textiles made from E-Glass fibers. These fabrics are utilized extensively in various industries, including marine structures, aerospace, and defense, due to their exceptional strength and fire-resistant properties. Two primary types of fiberglass fabric exist: woven and non-woven. Woven fabric, as the name suggests, is created by weaving glass fibers together, while non-woven fabric is produced by bonding fibers through heat or chemicals. Recently, India's Directorate General of Trade Remedies (DGTR) initiated an anti-dumping investigation into glass fiber imports from China, Thailand, and Bahrain. This probe was instigated following a complaint by Owens Corning India, which expressed concerns about the potential harm to the local industry due to low-priced imports.

- However, anti-dumping measures aim to shield domestic manufacturers from the detrimental effects of cheap imports, which can result in price undercutting and market distortions. The outcome of this investigation could significantly impact The market. In summary, the market is a vital sector that specializes in the manufacture and distribution of fire-retardant textiles derived from E-Glass fibers. These fabrics are extensively employed in industries such as marine structures, aerospace, and defense. The current investigation into glass fiber imports in India could potentially influence the market dynamics, with anti-dumping measures intended to protect local manufacturers from the adverse effects of low-cost imports.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3B the fiberglass Co.

- AGY Holding Corp.

- Auburn Manufacturing Inc.

- BGF Industries

- China Jushi Co. Ltd.

- Compagnie Chomarat

- Compagnie de Saint-Gobain SA

- Green Belting Industries Ltd.

- Hexcel Corp.

- Johns Manville Corp.

- Mid Mountain Materials Inc.

- Owens Corning

- SAERTEX GmbH and Co.KG

- Taconic

- Tah Tong Textile Co. Ltd.

- Valmieras Stikla Skiedra AS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Fiberglass fabric, made from E-glass fiber, is a versatile material finding extensive applications in various industries. In the construction sector, it is used as a reinforcement material for high-pressure laminates, providing strength and durability to structures. The aerospace and defense industry utilizes fiberglass fabric for manufacturing lightweight components, including wings and rotor blades, due to its high strength-to-weight ratio and corrosion resistance. The electrical and electronics industry relies on fiberglass fabric for insulation purposes, offering electrical resistance and thermal insulation properties. In the renewable energy sector, fiberglass fabric plays a significant role in wind energy production, with wind turbine blades being a primary application. The fabric's lightweight and high mechanical properties make it an ideal choice for manufacturing rotor blades. In the electrical and electronics industry, fiberglass fabric is employed for electrical insulation and reflective thermal insulation.

Moreover, fiberglass fabric is used in the production of advanced coatings, providing chemical resistance and fire-retardant properties. Smart textiles, a growing sector, utilizes fiberglass fabric for creating innovative textiles with enhanced properties. The fabric's versatility extends to marine structures, consumer electronics, telecommunication, and various other industries. With increasing focus on sustainability and reducing carbon emissions, fiberglass fabric's role as a sustainable building material continues to grow. Fiberglass fabric comes in various types, including woven and non-woven, with plain weave, twill weave, and multiaxial fabrics being common choices. Special-purpose fibers, such as S-glass and E-glass, are used to enhance the fabric's mechanical properties. The fabric is produced using processes like VARTM and autoclaving, ensuring consistent quality and performance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2024-2028 |

USD 2.76 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Key countries |

China, US, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch