Yams Market Size 2024-2028

The yams market size is forecast to increase by USD 29.9 million at a CAGR of 3% between 2023 and 2028.

- The yam market is experiencing significant growth due to the increasing demand for profitable and nutritious food products. Health-conscious consumers are turning to yams for their numerous health benefits, leading to a rise in demand. However, supply chain disruptions caused by economic conditions and natural calamities pose a challenge to market growth. To gain a competitive advantage, players In the market are focusing on technological advances in labeling and design to cater to emerging markets. Food safety remains a top priority, with companies implementing stringent measures to ensure the highest standards. As the market evolves, technological innovations and design trends are expected to play a crucial role in shaping the future of the yam industry.

What will be the Size of the Yams Market During the Forecast Period?

- The market is a significant player In the agricultural sector, with a substantial presence in various regions worldwide. Yam is a tuberous root vegetable, rich in essential nutrients, and is widely consumed for its unique taste and health benefits. This article provides an in-depth analysis of the global yam market, focusing on production, industry trends, and market drivers. Production of Yam: The yam market witnesses a steady supply due to the extensive cultivation of yams in countries like Nigeria, China, and Cote d'Ivoire. The production process involves planting yam cuttings, nurturing the vines, and harvesting the tubers once they reach maturity.

- The harvested yams undergo a curing process to improve their shelf life and enhance their flavor. Industry Trends: The yam industry has been witnessing various trends, including the increasing demand for organic yams, the emergence of new products such as yam flour and yam chips, and the growing popularity of yam In the food service industry. Additionally, there is a rising focus on improving the logistics and supply chain management to ensure timely delivery and maintaIn the quality of yams. Market Drivers: The global yam market is driven by several factors, including the growing health consciousness among consumers, the increasing demand for gluten-free and vegan food options, and the rising popularity of ethnic cuisines that feature yams as a staple ingredient.

How is this Yams Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Non-organic

- Organic

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- North America

By Product Insights

- The non-organic segment is estimated to witness significant growth during the forecast period. The conventional segment of the market experiences significant growth due to the increasing demand for affordable and easily accessible yam varieties. In regions where yams are a dietary staple, such as Africa, the Caribbean, and parts of Asia, non-organic yams cater to the mass market. The use of synthetic fertilizers, pesticides, and herbicides In their cultivation allows for higher yields and larger-scale production. This, in turn, supports the increasing demand for yams in both fresh and processed forms, including dried yam flour, chips, and other value-added products. Economic conditions and supply chain disruptions can impact the profitability of this segment.

- However, technological advances in agriculture and innovative design solutions offer competitive advantages to farmers and suppliers. Emerging markets present new opportunities for growth In the market, particularly in terms of food safety and labeling regulations.

Get a glance at the market report of share of various segments Request Free Sample

The Non-organic segment was valued at USD 146.30 million in 2018 and showed a gradual increase during the forecast period.

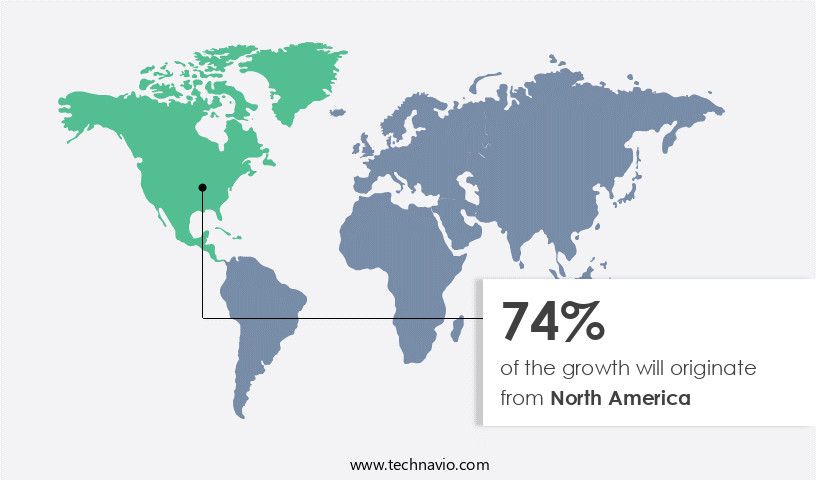

Regional Analysis

- North America is estimated to contribute 74% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. In the North American market, the United States and Canada have emerged as significant contributors to the market. The trend toward healthier eating habits is on the rise, with consumers expressing a preference for natural food products free from synthetic additives and harmful chemicals. This shift is driven by increasing awareness of the long-term health risks linked to processed and synthetic foods, including diabetes, obesity, and gluten sensitivity. Yams, a natural and nutrient-dense food, is gaining popularity as a result.

For more insights on the market size of various regions, Request Free Sample

The health benefits of yams, such as boosting immunity, promoting healthy aging, and enhancing cognitive ability, have been attracting consumers' attention. Yams can be consumed in various forms, including as fruit cake, yam chips, or even in ice cream, offering versatility for consumers following different dietary preferences. The demand for yams is on the rise In the US and Canadian markets due to their numerous health benefits. Consumers are increasingly seeking out organic alternatives to processed foods, and yams provide a nutritious and delicious option. Additionally, the use of yams as dietary supplements has gained traction, further fueling the market's growth.

Yams offer numerous health benefits, such as improving immunity, promoting healthy aging, and enhancing cognitive ability. These benefits have led to an increase In the consumption of yams in various forms, including fruit cake, yam chips, and ice cream. The versatility of yams caters to diverse dietary preferences, making them a popular choice among health-conscious consumers.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Yams Industry?

- Health benefits associated with yam is the key driver of the market. The market is experiencing growth due to rising consumer awareness regarding the health advantages of incorporating yams into their diet. This awareness is fueling the demand for yams worldwide. Some of the nutritional benefits of yams include their rich supply of essential vitamins and minerals, such as vitamin C, magnesium, potassium, manganese, copper, and fiber. Consumption of yams has been linked to improved brain function and relief from arthritis symptoms. The unique compound found in yams, called diosgenin, is known to promote neuron growth, boost brain function, and impede the progression of both osteoporosis and rheumatoid arthritis.

- Additionally, yams aid in maintaining healthy cholesterol levels. Consequently, the health advantages of yams are expected to fuel the expansion of the market throughout the forecast period.

What are the market trends shaping the Yams Industry?

- Increasing demand for organic yams is the upcoming market trend. The market is experiencing growth due to the rising preference for organic yams among consumers In the United States. Consumers believe that organic yams are healthier than conventionally grown yams, leading to an increase in demand for organic variants. To meet this demand, market players are introducing new organic yam products.

- The cultivation of organic yams does not involve the use of pesticides and insecticides, making the resulting products free of residues and perceived as safer and healthier. To ensure the quality and freshness of yams, effective packaging and sales monitoring are crucial. Inflation and fluctuations in raw material prices can impact operational maintenance costs, necessitating close monitoring. Millennials, who prioritize health and wellness, are a significant consumer demographic for organic yams. As such, market players must keep abreast of consumer trends and preferences to remain competitive.

What challenges does the Yams Industry face during its growth?

- Fluctuating the price of yam is a key challenge affecting the industry growth. The price fluctuations In the market pose a considerable challenge for all involved parties, including farmers and consumers. Unforeseen factors, such as seasonal weather conditions and pest infestations, significantly impact yam production and, consequently, pricing. Yam is a starchy staple that is sensitive to climate, making it vulnerable to extreme weather events like droughts or heavy rains, which can drastically reduce yields and lead to price increases. On the other hand, favorable growing conditions can result in surpluses, causing prices to decrease, potentially impacting farmers' profitability. Market dynamics, including supply chain disruptions, also contribute to price instability. For example, transportation delays or export restrictions can create supply bottlenecks, adding to the cost pressures and contributing to price hikes in import-dependent regions.

- Yams, particularly yellow yams, are rich in essential nutrients like Vitamin B6. Consumption options for yams are diverse, including yam sticks, boiled, roasted, or mashed. They are often used as a substitute for potatoes or rice in various cuisines. Incorporating yams into your diet can provide a significant energy boost due to their high carbohydrate content. To mitigate the impact of price instability, it is crucial to explore alternative sources and consumption options. For instance, exploring regional markets or alternative crops, such as maize, can help diversify your supply chain and reduce reliance on any single commodity. Additionally, value-added processing and storage solutions can help extend the shelf life of yams and reduce waste, ensuring a consistent supply and stable pricing.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amruth Organics and Natural Store

- BDS Natural Products Inc.

- Bio Botanica Inc.

- Dabur India Ltd.

- Dr. Willmar Schwabe GmbH and Co. KG

- Frontier Co op

- Green Amrut

- McCall Farms Inc.

- Novoherb Technologies

- Penn Herb Co. Ltd.

- Provital SA

- Wellgreen Technology Co. Ltd.

- Xtend Life

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Yams are a popular starchy root vegetable, widely consumed in various parts of the world, particularly in emerging markets. The production of yams involves careful operational maintenance to ensure optimal growth and high-quality output. Economic conditions, such as inflation and raw material prices, can significantly impact the profitability of yam farming. Social impact is an essential consideration In the market. Millennials, in particular, are driving demand for innovative food products made from yams, such as flour, cake, and chips. Technological advances in labeling and food safety have improved the supply chain, ensuring the availability of fresh yams and extending their shelf life.

Moreover, the health benefits of yams are numerous. They are rich in vitamin B6, which contributes to cognitive ability, immune system function, and the production of energy. Yam flour is a popular alternative to maize and is used in various consumption options, including cakes, curd, and ice cream. However, the market is not without challenges. Supply chain disruptions due to factors such as monetary values and logistical issues can impact the availability and affordability of yams. In addition, food safety concerns and the potential for infections, such as those caused by fungi, can pose risks to consumers. Despite these challenges, the market offers significant opportunities for competitive advantage. Yam sticks for dogs can be a healthy snack, and incorporating them into your pet's diet may help with overall health, while cancer prevention and infection prevention are important areas to focus on for both humans and animals.

Furthermore, Yam flour for diabetics is becoming increasingly popular due to its low glycemic index, while yam flour for keto diets is also gaining attention for its low carb content. Additionally, yam flour for hair is being used in natural hair care products, and the yam product market forecast predicts significant growth in the coming years. When considering yam flour nutrition facts, it's clear that it is a rich source of fiber and vitamins, making it a valuable addition to many diets. The yam product market has expanded, and yam flour for weight loss is being touted as an effective alternative to traditional flours. For seniors, yam flour offers easy digestibility and essential nutrients, contributing to their overall health. The yam product market size continues to rise, with yam flour for pregnant women being a popular option for its nutrient-dense properties. Yam flour for babies is increasingly being recommended due to its softness and health benefits, while yam flour for athletes provides an excellent source of energy. Furthermore, yam flour for vegans is an ideal choice for those avoiding animal products, and it is also used in skincare products as yam flour for skin helps with hydration and nourishment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3% |

|

Market growth 2024-2028 |

USD 29.9 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

2.8 |

|

Key countries |

US, Canada, UK, China, Taiwan, Japan, India, France, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Yams Market Research and Growth Report?

- CAGR of the Yams industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the yams market growth of industry companies

We can help! Our analysts can customize this yams market research report to meet your requirements.