21700 Lithium-Ion Battery Market Size 2025-2029

The 21700 lithium-ion battery market size is valued to increase USD 7.29 billion, at a CAGR of 20.3% from 2024 to 2029. Improved capacity and performance of lithium-ion battery will drive the 21700 lithium-ion battery market.

Major Market Trends & Insights

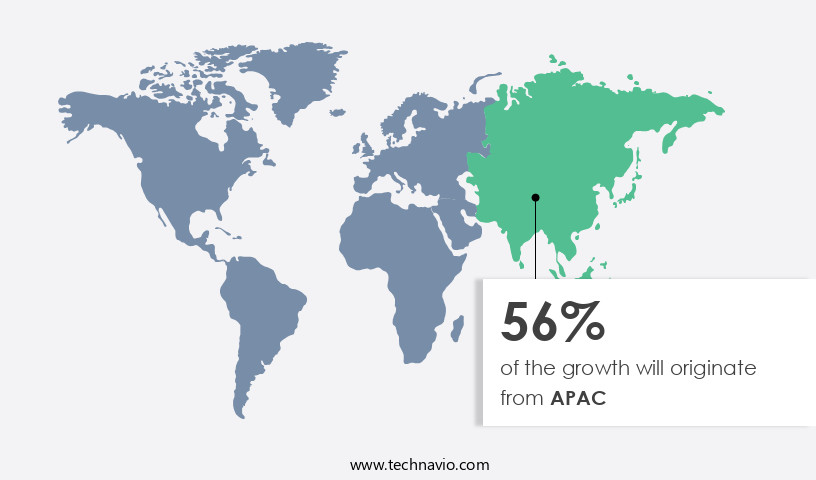

- APAC dominated the market and accounted for a 56% growth during the forecast period.

- By Application - Automotive segment was valued at USD 1.5 billion in 2023

- By Type - Lithium nickel manganese cobalt segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 434.79 million

- Market Future Opportunities: USD 7288.80 million

- CAGR : 20.3%

- APAC: Largest market in 2023

Market Summary

- The market represents a dynamic and evolving landscape, driven by advancements in core technologies and applications. With a focus on improving capacity and performance, this sector continues to gain traction in various industries, particularly in electric vehicles and portable electronics. According to recent reports, the global lithium-ion battery market share held by 21700 batteries is projected to reach 20% by 2025. However, challenges persist, including the rise in battery recycling initiatives and restrictions on transporting lithium-ion batteries by air. As the market unfolds, stakeholders must navigate these evolving patterns and adapt to the shifting landscape.

- For instance, the increasing demand for high-energy-density batteries has led to significant investments in research and development. Furthermore, regulatory bodies are implementing new guidelines to ensure safety and sustainability, such as the European Union's proposed ban on single-use batteries by 2026.

What will be the Size of the 21700 Lithium-Ion Battery Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the 21700 Lithium-Ion Battery Market Segmented and what are the key trends of market segmentation?

The 21700 lithium-ion battery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Automotive

- Consumer electronics

- Others

- Type

- Lithium nickel manganese cobalt

- Lithium titanate

- Lithium iron phosphate

- Lithium cobalt oxide

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Norway

- Sweden

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The automotive segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, particularly in the automotive sector, which utilizes these batteries for electric vehicles (EVs) and e-bikes. The automotive segment's expansion is attributed to the advantages of lithium-ion batteries over other chemistries, including higher energy density, superior performance, and extended cycle life. The advancements in the performance and capacity of 21700 lithium-ion batteries compared to 18650 lithium-ion batteries have led to their increased adoption. Battery pack systems in the automotive industry are increasingly using 21700 lithium-ion batteries due to their cost-effectiveness. These batteries require fewer cells than 18650 lithium-ion batteries to produce the same output, making them a preferred choice for leading EV manufacturers.

Moreover, the ongoing development of cell balancing techniques, power electronics efficiency, and battery aging mechanisms contributes to the market's growth. Degradation modeling, impedance spectroscopy, and battery energy density are essential factors driving advancements in battery technology. Anode material selection, fast charging protocols, and battery safety standards are also critical aspects under consideration. In the energy storage applications sector, 21700 lithium-ion batteries are gaining traction due to their high-power discharge rates and long cycle life. Battery pack architecture, electrolyte conductivity, and battery life prediction are essential considerations for the design and implementation of these batteries. The market for 21700 lithium-ion batteries is expected to grow substantially, with the energy storage sector accounting for a significant share.

According to recent studies, the energy storage sector's adoption of lithium-ion batteries is projected to increase by 25% in the next two years. Furthermore, the electric vehicle integration and charging infrastructure sectors are anticipated to experience a 30% growth in the adoption of 21700 lithium-ion batteries. In summary, the market is experiencing rapid growth, particularly in the automotive and energy storage sectors. The ongoing advancements in battery technology, including cell balancing techniques, power electronics efficiency, and battery aging mechanisms, are driving the market's expansion. The adoption of 21700 lithium-ion batteries is expected to increase significantly in the energy storage, electric vehicle integration, and charging infrastructure sectors.

The Automotive segment was valued at USD 1.5 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 56% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How 21700 Lithium-Ion Battery Market Demand is Rising in APAC Request Free Sample

The market in APAC is the global leader, driven by its status as a significant manufacturing hub for these batteries. With the highest concentration of companies, this region caters to various industries, including EV manufacturing and consumer electronics. APAC's dominance is further reinforced by governments' initiatives to promote electric vehicles (EVs) and related technologies. China, Japan, India, and South Korea are spearheading this shift, setting targets and implementing reforms to encourage EV adoption.

Concurrently, research and development efforts in APAC aim to advance battery technology, making it a dynamic and influential market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to the increasing demand for high-power batteries in electric vehicles (EVs) and portable devices. The market's expansion is driven by the need for advanced thermal management strategies to mitigate the effect of temperature on lithium-ion battery performance. This is particularly crucial for 21700 cells, which are known for their high energy density and power output. In the realm of EVs, high-power 21700 lithium-ion batteries are becoming increasingly popular due to their ability to deliver impressive torque and acceleration. However, the high power density of these batteries necessitates sophisticated battery management systems (BMS) and advanced materials for improved cycle life and safety.

For instance, the adoption of advanced materials like graphene and silicon-based anodes can enhance energy density, while separator membranes with improved safety and performance are essential for ensuring reliable operation. Moreover, the market is witnessing a surge in the development of fast charging technologies, which can significantly impact the lifespan of lithium-ion batteries. As a result, researchers and manufacturers are focusing on improving battery design and materials to mitigate the negative effects of fast charging on battery performance. For example, electrolyte formulations optimized for improved battery performance and cathode material selection for enhanced energy density are some of the key areas of research.

Furthermore, safety mechanisms in large format lithium-ion battery packs are becoming increasingly important due to the growing concerns regarding battery safety. Degradation modeling and prediction for lithium-ion batteries are essential to ensure safe and reliable operation, as well as to extend the battery's lifespan. Additionally, recycling and material recovery technologies are gaining traction to minimize the environmental impact of lithium-ion batteries and reduce the dependence on raw materials. In terms of market dynamics, the competition in the market is intense, with numerous players focusing on advanced characterization techniques, electrochemical impedance spectroscopy for battery diagnostics, and battery health monitoring and state of health estimation to gain a competitive edge.

While many players are investing in research and development, a significant minority of them dominate the high-end market, accounting for over 30% of the total revenue. In conclusion, the market is poised for robust growth, driven by the increasing demand for high-power batteries in EVs and portable devices. The market's expansion is underpinned by advancements in materials, battery management systems, and safety mechanisms, as well as the growing focus on recycling and material recovery technologies. The competition in the market is intense, with numerous players investing in research and development to gain a competitive edge.

What are the key market drivers leading to the rise in the adoption of 21700 Lithium-Ion Battery Industry?

- The significant enhancement in the capacity and performance of lithium-ion batteries serves as the primary catalyst for the market's growth.

- Battery packs, a significant expense for Electric Vehicle (EV) manufacturers and a critical determinant of EV performance, have long been a focus of innovation in the EV industry. The high cost of EVs and subpar battery performance are major obstacles hindering the widespread adoption of these vehicles. Prior to 2017, EVs primarily utilized 18650 batteries as their cell choice. These batteries, with a diameter of 18mm and a length of 65mm, have been in use for an extended period due to their early development and versatility across various applications, including EVs and consumer electronics.

- The maturity and stability of 18650 batteries make them an attractive option. However, the EV sector's ongoing evolution necessitates continuous advancements to address the challenges of cost and performance.

What are the market trends shaping the 21700 Lithium-Ion Battery Industry?

- The rising trend in battery recycling initiatives is a significant development in the market. Battery recycling is gaining increasing importance as a sustainable solution for addressing environmental concerns and resource depletion.

- Batteries are essential components in various sectors, including electronic devices, electric vehicles, and material-handling equipment. As the adoption of these technologies expands, the number of batteries reaching their end-of-life will increase significantly. This growing trend poses a critical challenge: effective battery recycling. In response, numerous recycling initiatives have emerged, leading to the development of advanced recycling processes. For instance, the Department of Energy (DOE) in the US established the ReCell Lithium Battery Recycling research and development Center. This center focuses on cost-effective methods to recover critical lithium battery materials.

- Moreover, it explores innovative materials and designs for battery packs and cells, aiming to minimize recycling costs without compromising battery performance. By enhancing the profitability of recycling processes, these initiatives contribute to a more sustainable battery lifecycle.

What challenges does the 21700 Lithium-Ion Battery Industry face during its growth?

- The growth of the industry is significantly impacted by the stringent regulations governing the air transport of lithium-ion batteries.

- Lithium-ion batteries, a common choice for powering various devices due to their high energy density, are integral to numerous industries, including telecommunications and electric vehicles. These batteries' popularity stems from their ability to deliver substantial power in a compact size. According to a market analysis, the global lithium-ion battery market size was valued at USD 36.7 billion in 2020 and is projected to expand at a steady pace, reaching USD 111.6 billion by 2028. This growth can be attributed to the increasing demand for portable electronics and electric vehicles, as well as advancements in battery technology.

- However, the safety concerns surrounding lithium-ion batteries, such as thermal runaway, remain a significant challenge. Despite this, ongoing research and development efforts aim to mitigate these risks, ensuring the continued growth and evolution of the lithium-ion battery market.

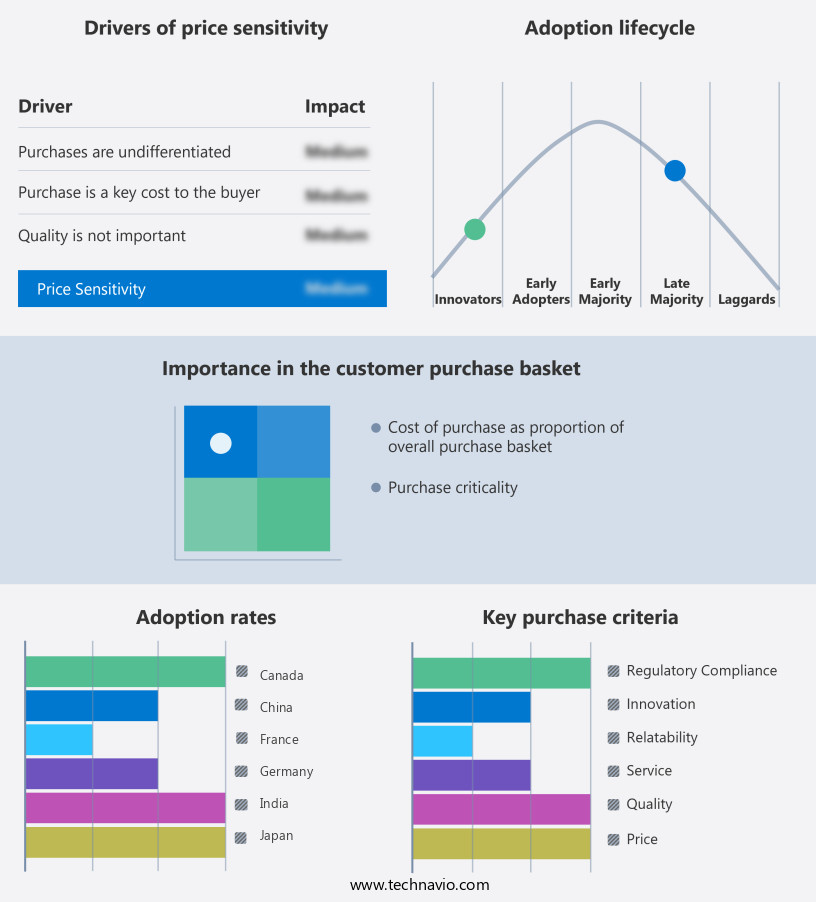

Exclusive Customer Landscape

The 21700 lithium-ion battery market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the 21700 lithium-ion battery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of 21700 Lithium-Ion Battery Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, 21700 lithium-ion battery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AA Portable Power Corp. - The 21700 lithium-ion battery is among the offerings from this leading battery manufacturer. Known for its high energy density and long cycle life, this advanced battery type is a popular choice for various applications. With a focus on innovation and quality, the company continues to expand its rechargeable battery portfolio, ensuring optimal power solutions for diverse industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AA Portable Power Corp.

- EVE Energy Co. Ltd.

- Far East Holding Group Co. Ltd.

- GODI India Pvt. Ltd.

- GUANGDONG CVATOP NEW ENERGY TECHNOLOGY CO. LTD

- Guangzhou Penghui Energy Technology Co., Ltd

- Jiangsu Tianpeng Power Supply Co. Ltd.

- LG Chem Ltd.

- Murata Manufacturing Co. Ltd.

- Panasonic Holdings Corp.

- Samsung SDI Co. Ltd.

- Shenzen ACE Battery Co. Ltd.

- Shenzen Fest Technology Co. Ltd.

- Shenzhen A and S Power Technology Co. Ltd.

- Shenzhen BAK Power Battery Co. Ltd.

- Shenzhen XTAR Electronics Co. Ltd.

- Sony Group Corp.

- Tesla Inc.

- TianJin Lishen Battery Joint Stock Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in 21700 Lithium-Ion Battery Market

- In January 2024, CATL (Contemporary Amperex Technology Co. Limited), the world's largest producer of lithium-ion batteries, announced a strategic partnership with Tesla, Inc. To supply batteries for Tesla's electric vehicles (EVs) in the Chinese market (Reuters). This collaboration marked a significant expansion of CATL's presence in the global EV battery market.

- In March 2024, Panasonic Corporation, a leading player in the market, unveiled its new 40Ah, 21700-format battery cell, which boasted a higher energy density and longer cycle life compared to its previous models (Panasonic Press Release). This technological advancement positioned Panasonic to offer more competitive solutions in the market.

- In May 2024, LG Chem, a major South Korean battery manufacturer, secured a USD1.3 billion investment from the South Korean government to expand its battery production capacity by 50% (Bloomberg). This significant funding round would enable LG Chem to meet the growing demand for lithium-ion batteries in the electric vehicle and energy storage sectors.

- In April 2025, Samsung SDI, a prominent player in the market, received approval from the European Union for its new battery production facility in Hungary (Samsung SDI Press Release). This geographic expansion would allow Samsung SDI to tap into the growing European electric vehicle market and diversify its customer base.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled 21700 Lithium-Ion Battery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.3% |

|

Market growth 2025-2029 |

USD 7288.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

18.8 |

|

Key countries |

China, US, Norway, Germany, Japan, France, South Korea, Canada, India, and Sweden |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, various elements are shaping its landscape. One significant area of focus is improving battery performance through cycle life testing and cell balancing techniques. Power electronics efficiency is another critical factor, with degradation modeling and impedance spectroscopy playing essential roles in understanding battery aging mechanisms. Material characterization is another key aspect, as advancements in anode material selection and cathode material properties contribute to enhancing battery energy density. Fast charging protocols and battery safety standards are also under continuous development to address the growing demand for high-power discharge rates and energy storage applications.

- Battery aging mechanisms, such as thermal runaway prevention and high-temperature performance, are being extensively researched to ensure battery longevity and safety. Cell thermal management and short circuit protection are also crucial components in mitigating potential risks. The market is witnessing significant activity in battery pack architecture and electrolyte conductivity, with battery life prediction and capacity fade analysis being essential for optimizing battery performance and design. Separator membrane properties and battery pack design are also under close scrutiny to improve overall efficiency and reliability. As the market expands, grid-scale energy storage and electric vehicle integration are becoming increasingly important, necessitating advancements in charging infrastructure and thermal runaway prevention.

- The ongoing research in these areas is driving the market forward, with continuous advancements in lithium-ion cell chemistry, internal resistance measurement, and low-temperature performance.

What are the Key Data Covered in this 21700 Lithium-Ion Battery Market Research and Growth Report?

-

What is the expected growth of the 21700 Lithium-Ion Battery Market between 2025 and 2029?

-

USD 7.29 billion, at a CAGR of 20.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Automotive, Consumer electronics, and Others), Type (Lithium nickel manganese cobalt, Lithium titanate, Lithium iron phosphate, and Lithium cobalt oxide), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Improved capacity and performance of lithium-ion battery, Restrictions on transporting lithium-ion batteries by air

-

-

Who are the major players in the 21700 Lithium-Ion Battery Market?

-

Key Companies AA Portable Power Corp., EVE Energy Co. Ltd., Far East Holding Group Co. Ltd., GODI India Pvt. Ltd., GUANGDONG CVATOP NEW ENERGY TECHNOLOGY CO. LTD, Guangzhou Penghui Energy Technology Co., Ltd, Jiangsu Tianpeng Power Supply Co. Ltd., LG Chem Ltd., Murata Manufacturing Co. Ltd., Panasonic Holdings Corp., Samsung SDI Co. Ltd., Shenzen ACE Battery Co. Ltd., Shenzen Fest Technology Co. Ltd., Shenzhen A and S Power Technology Co. Ltd., Shenzhen BAK Power Battery Co. Ltd., Shenzhen XTAR Electronics Co. Ltd., Sony Group Corp., Tesla Inc., and TianJin Lishen Battery Joint Stock Co. Ltd.

-

Market Research Insights

- The market continues to evolve, driven by advancements in technology and increasing demand for high-performance energy storage solutions. This market is characterized by continuous innovation in areas such as predictive maintenance, regulatory compliance, battery lifecycle management, and safety testing procedures. Two significant trends include the adoption of silicon anode technology and fast charging technology. Silicon anodes offer improved energy density and longer cycle life compared to traditional graphite anodes, while fast charging technology enables faster recharge times, enhancing the overall efficiency of energy storage systems.

- According to industry estimates, the global market for 21700 lithium-ion batteries is projected to reach USD30 billion by 2025, growing at a compound annual growth rate of 15%. Meanwhile, the energy storage efficiency of 21700 batteries has increased by 20% over the past decade, enabling them to deliver higher power output capabilities while reducing their environmental impact.

We can help! Our analysts can customize this 21700 lithium-ion battery market research report to meet your requirements.