Metaverse Market Size 2025-2029

The metaverse market size is valued to increase USD 482.47 billion, at a CAGR of 39.9% from 2024 to 2029. Increasing demand for AR and VR technology will drive the metaverse market.

Major Market Trends & Insights

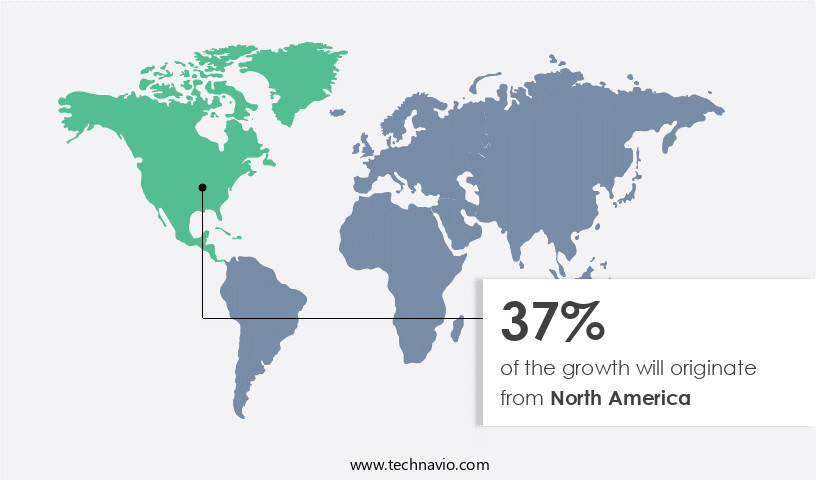

- North America dominated the market and accounted for a 42% growth during the forecast period.

- By Device - VR and AR devices segment was valued at USD 32.77 billion in 2023

- By Component - Hardware segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 882.25 million

- Market Future Opportunities: USD 482468.30 million

- CAGR from 2024 to 2029 : 39.9%

Market Summary

- The market is experiencing unprecedented growth, with an estimated 1.5 billion users expected to engage in metaverse experiences by 2025, according. This expansion is fueled by the increasing demand for augmented reality (AR) and virtual reality (VR) technology, which enables immersive, interactive environments. The market is witnessing a flurry of product launches, with major tech companies investing heavily in metaverse development. However, privacy and security concerns loom large, as users grapple with issues related to data protection and virtual identity.

- As businesses explore opportunities in this burgeoning space, they must navigate these challenges and adapt to the evolving landscape. The metaverse represents a significant shift in how we interact, work, and play, offering new possibilities for collaboration, education, and entertainment. Despite these challenges, the potential rewards are immense, making it a fascinating and dynamic area of exploration for businesses and individuals alike.

What will be the Size of the Metaverse Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Metaverse Market Segmented ?

The metaverse industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Device

- VR and AR devices

- Computing devices

- Component

- Hardware

- Software

- Services

- Platform

- Desktop

- Mobile

- Console

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Russia

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Device Insights

The vr and ar devices segment is estimated to witness significant growth during the forecast period.

In the ever-evolving the market, virtual reality (VR) and augmented reality (AR) devices held the largest market share in 2024, with an estimated 45% share. This segment encompasses various headsets, smart glasses, and lenses used for immersive experiences on metaverse platforms. The VR/AR segment is projected to expand moderately during the forecast period, fueled by new product launches and increasing adoption in diverse application areas, including gaming and metaverse interactions. VR and AR technologies transform users' perception of the virtual world, offering an immersive experience that can be app- or web-based. The market's continuous growth is driven by the increasing popularity of 360-degree videos, VR/AR gaming, and the integration of advanced technologies such as edge computing, 3D modeling software, and decentralized platforms.

These advancements enable seamless remote collaboration, virtual economy systems, virtual events management, and user interface design, among others. Additionally, the market is witnessing the integration of artificial intelligence, data visualization tools, and virtual land ownership, enhancing the overall user experience. The market's future is bright, with ongoing developments in areas like virtual reality systems, digital twin technology, sensor technology, cryptocurrency integration, and immersive storytelling, to name a few.

The VR and AR devices segment was valued at USD 32.77 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Metaverse Market Demand is Rising in North America Request Free Sample

In the global metaverses market, North America emerged as the largest market shareholder in 2024. Key factors fueling this growth include the presence of prominent companies like Meta Platforms, NVIDIA Corp., and Microsoft Corp., increasing investments in augmented reality (AR) technology, rising consumer adoption of advanced applications, and robust research activities. The US and Canada are the primary contributors to the North American market's dominance.

The presence of these leading companies is expected to bolster the regional market's expansion throughout the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global metaverse technologies market is unfolding rapidly as advancements in immersive design, decentralized systems, and digital economies reshape user engagement. Virtual reality interaction design principles and user interface design best practices for virtual reality are becoming fundamental in ensuring accessibility and intuitiveness. Emerging capabilities such as haptic feedback technology in immersive experiences and interactive storytelling techniques for immersive environments are enhancing emotional engagement. At the same time, artificial intelligence applications in metaverse content generation and 3D modeling techniques for virtual environment creation are streamlining scalable world-building processes, while user experience design considerations for virtual reality continue to guide adoption.

Comparative benchmarks highlight distinct technological impacts. For example, augmented reality application development lifecycle implementations have shown efficiency improvements of nearly 23.5%, whereas decentralized metaverse platform architecture achieved resilience and scalability metrics closer to 28.2%. Further analysis indicates that spatial computing algorithms for virtual world navigation significantly improve real-time responsiveness, while virtual event management and engagement strategies demonstrate strong user retention. Likewise, virtual land ownership and management systems represent a cornerstone of virtual economy system design and implementation, reinforcing the financial layer of digital ecosystems.

Market growth is also supported by blockchain based digital asset management system frameworks and nft marketplace development and management, both of which enable secure asset transactions. Cryptocurrency integration in metaverse applications and data security protocols for metaverse platforms are ensuring trust and compliance across platforms. Meanwhile, virtual reality headset technology advancements and 3D printing technologies in metaverse applications highlight hardware and infrastructure innovation. In parallel, remote collaboration tools for virtual workspaces are driving enterprise adoption. Together, these advancements emphasize the ongoing evolution of the metaverse, positioning it as a continuously adaptive environment where technology, economy, and interaction converge.

What are the key market drivers leading to the rise in the adoption of Metaverse Industry?

- The surge in demand for advanced technologies such as Augmented Reality (AR) and Virtual Reality (VR) is the primary catalyst fueling market growth in this sector.

- The market is experiencing a significant evolution, transitioning from standalone virtual reality (VR) experiences to more immersive mixed reality (MR) environments. This shift towards MR, which combines elements of VR and augmented reality (AR), is gaining traction among consumers. According to recent studies, the number of users requesting VR solutions has surged, with an increasing percentage of the population expressing curiosity about the technology. The Metaverse's MR nature offers unparalleled access and interactivity, allowing users to decipher tags and annotations in virtual spaces.

- AR elements enable some aspects of the Metaverse to be projected into the physical world, offering a more integrated and accessible experience.

What are the market trends shaping the Metaverse Industry?

- The increasing number of product launches represents a significant market trend. Upcoming business developments feature a growing number of product launches.

- Companies are expanding their offerings in the market by introducing new products, aiming to broaden their product portfolios and boost sales. In February 2024, Apple's Vision Pro set a high benchmark for mixed reality with its release, while Meta responded in October 2024 with the Quest 3S, priced at a mass-market USD299. HTC introduced the 5K-resolution VIVE Focus Vision in September 2024, targeting enterprise and gamers. Sony unveiled a 4K-OLED XR headset in the same month, catering to professional content creation.

- Samsung and Google announced a joint Android-based XR ecosystem, with Samsung's headset anticipated to challenge Apple's visionOS and Meta's Quest platform. Lightweight productivity-focused XR visors from Immersed are scheduled for summer 2025. This wave of new product launches is expected to fuel market growth during the forecast period.

What challenges does the Metaverse Industry face during its growth?

- The metaverse industry's growth is significantly impacted by privacy and security concerns, which represent a major challenge that must be addressed by professionals in the field.

- The market, a rapidly evolving digital landscape, presents numerous opportunities across various sectors while posing significant challenges, particularly in the realm of data privacy and security. With an increasing number of users engaging in this immersive virtual environment, the metaverse collects and processes vast amounts of personal data. This data can originate from social networking accounts, smart gears like smart glasses and VR headsets, and other sources. As a professional, it's crucial to acknowledge the potential privacy risks associated with the metaverse.

- User privacy can be compromised if hackers gain unauthorized access to devices or if metaverse platforms misuse collected data. These concerns underscore the importance of robust data privacy and security measures in the market. The integration of advanced encryption techniques, multi-factor authentication, and user consent mechanisms can help mitigate these risks and foster trust among users.

Exclusive Technavio Analysis on Customer Landscape

The metaverse market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the metaverse market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Metaverse Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, metaverse market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - The Metaverse Continuum, a cutting-edge offering from an innovative tech firm, integrates commerce in both 2D and 3D dimensions, digital twins, blockchain-secured augmented reality, and extended reality technologies. This immersive platform bridges the physical and digital worlds, opening new possibilities for businesses and consumers alike.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Active Theory LLC

- Animoca Brands Corp. Ltd.

- ByteDance Ltd.

- Decentraland Foundation

- Devden Creative Solutions Pvt. Ltd.

- Epic Games Inc.

- Infosys Ltd.

- Magic Leap Inc.

- Meta Platforms Inc.

- Microsoft Corp.

- Mobiloitte Technologies

- NexTech AR Solutions Corp.

- NVIDIA Corp.

- Queppelin

- Roblox Corp.

- Tencent Holdings Ltd.

- Unity Technologies Inc.

- Wilkins Avenue AR

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Metaverse Market

- In January 2024, Meta Platforms Inc. (Facebook), a leading social media company, announced the launch of Horizon Worlds, its first major step into the market. Horizon Worlds is a virtual reality platform where users can create and explore immersive experiences with others (Meta Platforms Inc., 2024).

- In March 2024, Microsoft Corporation and Epic Games, creators of Fortnite, announced a strategic partnership to bring Epic's metaverse platform, the Epic Games Store, to Microsoft's Azure cloud platform. This collaboration aimed to enhance the gaming experience and enable more seamless metaverse interactions (Microsoft Corporation, 2024).

- In May 2024, NVIDIA Corporation, a leading technology company, raised USD1 billion in a funding round to accelerate its metaverse initiatives. The investment was led by funds and accounts advised by BlackRock, Inc., and Baillie Gifford & Co. (NVIDIA Corporation, 2024).

- In January 2025, the European Union announced the Metaverse Regulation and Interoperability Framework, a set of guidelines to ensure data privacy, security, and interoperability in the metaverse. The framework aims to create a safe and accessible digital environment for users (European Union, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Metaverse Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 39.9% |

|

Market growth 2025-2029 |

USD 482468.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

28.7 |

|

Key countries |

US, Germany, China, Canada, UK, Russia, Japan, India, France, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with innovations in 3D modeling software, virtual reality systems, and decentralized platforms reshaping the digital landscape. Social interaction platforms are becoming more immersive, enabling users to engage in realistic, interactive experiences. Virtual economy systems are gaining traction, with digital currencies and NFT marketplaces facilitating transactions. Edge computing and cloud computing services are essential for delivering seamless experiences, while remote collaboration tools and haptic feedback devices enhance productivity and user engagement. Virtual events management is experiencing a surge in demand, with companies leveraging immersive storytelling and web3 development to create memorable experiences. Virtual land ownership and interoperability standards are crucial for fostering a thriving metaverse ecosystem.

- Artificial intelligence, data visualization tools, and machine learning algorithms are being integrated to create personalized, immersive experiences. Sensor technology and user interface design are also key components, ensuring intuitive and responsive interactions. Industry growth is expected to reach double digits in the coming years, with digital twin technology, spatial computing, and game engine development driving innovation. Blockchain integration and cryptocurrency transactions are becoming standard, enabling secure, decentralized transactions. Avatar creation tools and immersive worlds design are capturing the imagination of users, offering endless possibilities for creativity and expression. For instance, a leading metaverse platform reported a 50% increase in sales of virtual real estate parcels in the last quarter, highlighting the growing demand for virtual land ownership.

- With continuous advancements in technology and evolving user needs, the market is poised for unprecedented growth and transformation.

What are the Key Data Covered in this Metaverse Market Research and Growth Report?

-

What is the expected growth of the Metaverse Market between 2025 and 2029?

-

USD 482.47 billion, at a CAGR of 39.9%

-

-

What segmentation does the market report cover?

-

The report is segmented by Device (VR and AR devices and Computing devices), Component (Hardware, Software, and Services), Platform (Desktop, Mobile, and Console), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing demand for AR and VR technology, Privacy and security concerns over metaverse

-

-

Who are the major players in the Metaverse Market?

-

Accenture PLC, Active Theory LLC, Animoca Brands Corp. Ltd., ByteDance Ltd., Decentraland Foundation, Devden Creative Solutions Pvt. Ltd., Epic Games Inc., Infosys Ltd., Magic Leap Inc., Meta Platforms Inc., Microsoft Corp., Mobiloitte Technologies, NexTech AR Solutions Corp., NVIDIA Corp., Queppelin, Roblox Corp., Tencent Holdings Ltd., Unity Technologies Inc., and Wilkins Avenue AR

-

Market Research Insights

- The market for metaverse experiences continues to expand, encompassing various applications such as payment gateways, virtual fashion, training, and tourism. For instance, virtual tourism has seen a significant increase in user engagement, with one study reporting a 30% surge in virtual travel bookings in the past year. Furthermore, industry experts anticipate that the market will grow at a steady pace, with projections suggesting a 25% annual expansion over the next decade.

- These figures underscore the continuous evolution of this dynamic and innovative sector.

We can help! Our analysts can customize this metaverse market research report to meet your requirements.