Absorption Chillers Market Size 2024-2028

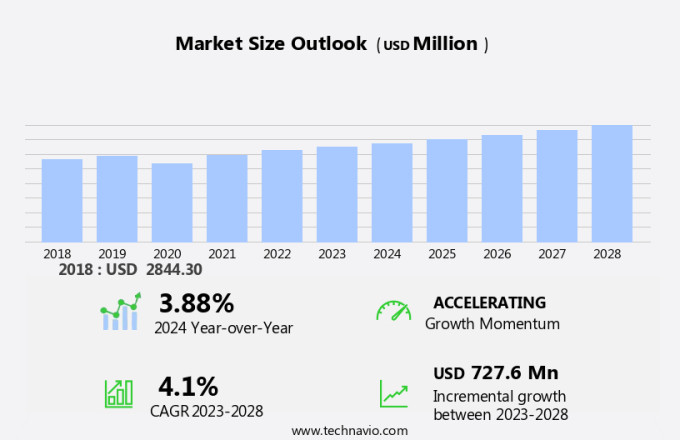

The absorption chillers market size is forecast to increase by USD 727.6 million at a CAGR of 4.1% between 2023 and 2028. Absorption chillers, an air conditioning device that utilizes heat to produce cooling, are gaining traction in various industries due to their energy efficiency and cost savings. Solar-powered absorption chillers, in particular, are becoming increasingly popular as businesses strive for carbon neutrality. The industrial sector, including food processing and petroleum, is a significant contributor to the absorption chiller market's growth. The demand for energy reduction and cost savings is driving market expansion. However, high capital and maintenance costs remain challenges. The trend towards F-gas laws and regulations is also impacting the market, with many companies turning to absorption chillers as a viable alternative to traditional refrigeration systems. The frozen food industry is a significant end-user, as absorption chillers provide consistent cooling and can operate efficiently even in extreme temperatures. Turbines used in absorption chillers offer further energy savings, making them an attractive option for businesses seeking to reduce their carbon footprint and lower operating costs.

What will the size of the market be during the forecast period?

Absorption refrigeration is a cooling process that utilizes mechanical energy and a heat source to produce refrigerant vapor. In this technique, a sorbent solution absorbs the refrigerant vapor, which is then separated from the solution to produce cool liquid refrigerant. This refrigerant is then circulated through a system to provide cooling. The absorption refrigeration market is driven by several factors. Urbanization and developing nations' growing demand for electricity and cooling systems are significant contributors to the market's growth. Waste heat from industries such as petrochemical and power generation can be utilized as a heat source for absorption refrigeration systems, making them an attractive alternative to traditional refrigeration systems that rely on electricity.

Additionally, absorption refrigeration systems can use various heat sources, including steam, hot water, natural gas, and wastewater. These systems are particularly useful in industries where waste heat is abundant and can be harnessed for cooling purposes. The use of absorption refrigeration systems can help reduce electricity consumption and greenhouse gas emissions, making them an environmentally friendly alternative to traditional refrigeration systems that rely on ozone-depleting chlorofluorocarbons (CFCS). The absorption refrigeration market is expected to grow steadily due to the increasing demand for energy-efficient and eco-friendly cooling solutions. The market is also being driven by rising electricity rates and the need to reduce energy costs in various industries.

Moreover, absorption refrigeration systems offer a cost-effective solution to cooling requirements while also reducing the carbon footprint of industrial processes. Absorption refrigeration systems can be used in various industries, including food and beverage, pharmaceuticals, and chemicals. These systems are particularly useful in applications where large quantities of cooling are required, such as in data centers and large commercial buildings. The market for absorption refrigeration systems is expected to grow significantly in the coming years due to the increasing demand for sustainable and energy-efficient cooling solutions.

In conclusion, the absorption refrigeration market is expected to grow due to the increasing demand for energy-efficient and eco-friendly cooling solutions. The market is being driven by various factors, including urbanization, developing nations' demand for electricity and cooling systems, and the availability of waste heat in industries. Absorption refrigeration systems offer a cost-effective and sustainable solution to cooling requirements while also reducing greenhouse gas emissions.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Industrial

- HVAC

- Type

- Lithium bromide

- Ammonia

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

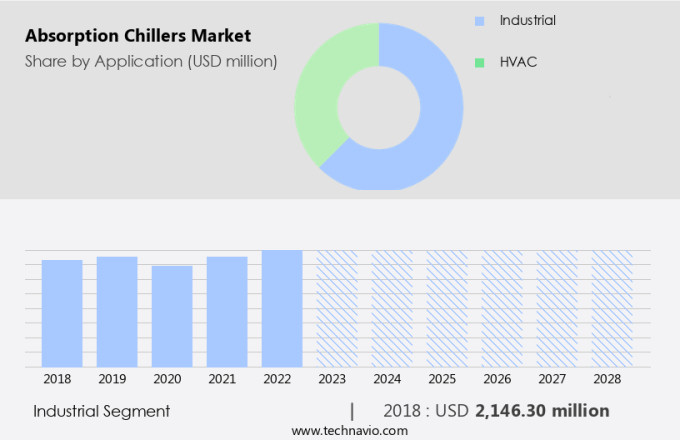

The industrial segment is estimated to witness significant growth during the forecast period. Absorption chillers play a crucial role in the industrial sector by managing the temperature requirements of various processes and refrigeration needs for chemicals, food, beverages, and other temperature-sensitive materials. Major industries such as plastic, chemical, pharmaceutical, oil and gas, food and beverages, and printing are significant consumers of absorption chillers. These chillers can be integrated directly into industrial processes, making optimal use of the low-grade heat sources generated by equipment, including flue gases, wastewater, reflux condensers, compressor interstage, and expander plants.

Additionally, by utilizing this waste heat, industrial facilities can enhance energy efficiency, decrease fuel consumption, and minimize heat rejection to the environment. Absorption chillers are compatible with various energy sources, including cogeneration systems, solar thermal energy, and natural gas combustion. This integration not only benefits the industrial processes but also contributes to the overall sustainability and cost savings of the facility.

Get a glance at the market share of various segments Request Free Sample

The industrial segment was valued at USD 2.15 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

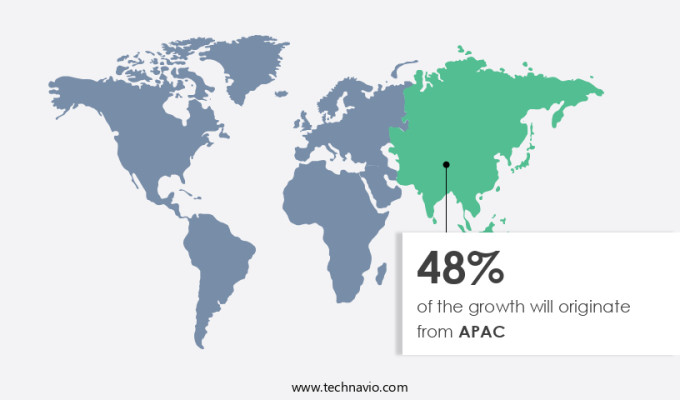

APAC is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Absorption chillers are gaining significant traction in various industries due to their energy-efficient cooling process that utilizes electricity and a refrigerant, rather than relying on traditional compressor technology. The market for absorption chillers is experiencing substantial growth, particularly in the Asia Pacific (APAC) region. This expansion can be attributed to the region's rapid population growth, industrialization, and urbanization, leading to an increase in commercial and residential construction. Moreover, the adoption of green building initiatives in countries like China and India is driving the demand for eco-friendly cooling solutions, such as absorption chillers. Key industries, including pharmaceuticals, power plants, petrochemical industries, and metal fabrication, are major consumers of absorption chillers.

Additionally, these industries require large-scale heating, ventilation, air conditioning, and refrigeration (HVAC and R) systems, which absorption chillers effectively provide. Additionally, absorption chillers offer an alternative energy source by utilizing a sorbent solution, making them an attractive option for industries seeking to reduce their carbon footprint and minimize greenhouse gas emissions. In conclusion, the market is thriving in the APAC region due to the region's economic growth and the increasing demand for energy-efficient and eco-friendly cooling solutions. Industries such as pharmaceuticals, power plants, petrochemical industries, and metal fabrication are key contributors to the market's growth. Absorption chillers' ability to provide large-scale cooling while using a sorbent solution as an energy source makes them a valuable asset for businesses seeking to minimize their environmental impact.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The growing use of absorption chillers across various industries is the key driver of the market. Absorption chillers hold significant importance in heating, ventilation, air conditioning, and refrigeration (HVAC and R) systems due to their numerous advantages over traditional chillers. These benefits include the integration with combined heat and power (CHP) generation and district cooling infrastructure, quiet operation, and enhanced efficiency. Absorption chillers have gained popularity among various industrial sectors, enabling them to minimize expenses and adhere to environmental goals. One of the primary advantages of absorption chillers is the elimination of ozone-depleting refrigerants, such as chlorofluorocarbons (CFCs).

Simultaneously, in absorption chillers, water serves as the refrigerant, while lithium bromide acts as the absorbent. The use of absorption chillers in industries like petrochemical, steam, hot water, natural gas, and wastewater treatment, has become increasingly common due to their energy efficiency and environmental friendliness. Additionally, absorption chillers can operate independently of electricity rates and power shortages, making them a reliable choice for industrial cooling needs.

Market Trends

The demand for reducing energy consumption and operating costs is the upcoming trend in the market. In the United States, energy consumption for heating, cooling, and climate control in industrial, commercial, and residential buildings is a substantial expense for property owners and operators. Absorption chillers offer an efficient solution to minimize energy usage and lower operating costs in numerous applications.

Additionally, the EU reports that heating and cooling energy demand accounts for approximately half of their overall energy consumption, with 70% of this energy being used in buildings. Absorption chillers can effectively address this energy demand, contributing to significant energy savings and cost reductions. These chillers operate by utilizing waste heat to generate chilled water, making them an eco-friendly alternative to traditional cooling systems. By implementing absorption chillers, businesses and organizations can enhance their energy efficiency and reduce their carbon footprint while optimizing their operational expenses.

Market Challenge

The high capital and maintenance costs is a key challenge affecting the market growth. Absorption chillers, an energy-efficient air conditioning technology, are gaining popularity in various sectors due to their potential to reduce energy costs and emissions. Solar-powered absorption chillers, in particular, are attracting significant attention as they utilize renewable energy sources. However, the high initial investment and maintenance costs are significant barriers to entry for many industries, especially price-sensitive ones.

However, these costs may be a major challenge for the growth of the market, particularly in emerging economies. The industrial sector, including food processing and petroleum, is expected to drive market growth due to stringent F-gas laws and the need for carbon neutrality. Despite the challenges, they offer substantial energy savings over time, making them a worthwhile investment for energy-conscious businesses. To maximize the benefits, it is essential to consider the total cost of ownership and the potential energy savings over the long term.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BROAD Group: The company offers absorption chillers such as the BDH Model, BDE Model, and BDS Model

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Berg Chilling Systems Inc.

- Carrier Global Corp.

- Century Corp.

- CNIM SA

- Daikin Industries Ltd.

- EAW Energieanlagenbau GmbH

- Ebara Corp.

- Helioclim

- Johnson Controls International Plc.

- Kirloskar Pneumatic Co. Ltd.

- LG Electronics Inc.

- Mitsubishi Heavy Industries Ltd.

- Robur Spa

- Shuangliang Eco Energy Systems Co. Ltd.

- THE PAR GROUP

- Thermax Ltd.

- Trane Technologies plc

- World Energy Co. Ltd.

- Yazaki Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Absorption refrigeration is a cooling process that utilizes mechanical energy from a heat source to produce refrigerant vapor, which then cools down a liquid to create chilled water or air. This method is increasingly popular due to its energy efficiency and ability to use low-grade heat sources, such as waste heat from industrial processes and cogeneration systems, solar thermal energy, and natural gas combustion. The market is driven by the demand for sustainable cooling solutions in various sectors, including commercial buildings, industrial facilities, and district cooling systems. Energy efficiency regulations and sustainability initiatives are major factors driving the adoption of absorption chillers, as they help reduce electricity consumption and greenhouse gas emissions.

In conclusion, industrial processes in sectors like pharmaceuticals, power plants, petrochemical industries, metal fabrication industries, and food processing also rely on absorption chillers to meet their cooling needs. The market is also witnessing growth in developing nations due to urbanization, increasing electricity rates, and power shortages. Absorption chillers use non-ozone-depleting refrigerants like ammonia and lithium bromide. These chillers are also compatible with various energy sources, including steam, hot water, natural gas, wastewater, and even renewable energy sources like solar-powered absorption chillers. The market is expected to grow further as more industries and facilities adopt absorption chillers to meet their cooling requirements while reducing their carbon footprint.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market growth 2024-2028 |

USD 727.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.88 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 48% |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Berg Chilling Systems Inc., BROAD Group, Carrier Global Corp., Century Corp., CNIM SA, Daikin Industries Ltd., EAW Energieanlagenbau GmbH, Ebara Corp., Helioclim, Johnson Controls International Plc., Kirloskar Pneumatic Co. Ltd., LG Electronics Inc., Mitsubishi Heavy Industries Ltd., Robur Spa, Shuangliang Eco Energy Systems Co. Ltd., THE PAR GROUP, Thermax Ltd., Trane Technologies plc, World Energy Co. Ltd., and Yazaki Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch