Acoustic Hailing Devices Market Size 2024-2028

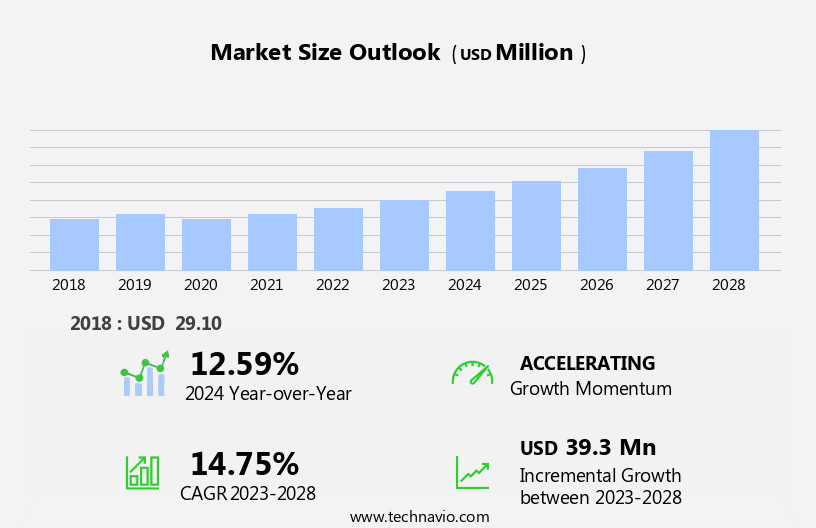

The acoustic hailing devices market size is forecast to increase by USD 39.3 million, at a CAGR of 14.75% between 2023 and 2028.

- The Acoustic Hailing Devices (AHDs) market is experiencing significant growth, driven by increasing government spending on security and surveillance initiatives. These devices, which use sound waves to communicate over long distances, are increasingly being adopted for border control, maritime security, and disaster response applications. Additionally, advancements in technology are leading to the development of superior AHDs with improved sound quality, range, and functionality. However, the market faces challenges related to the potential impact of AHDs, particularly Long Range Acoustic Devices (LRADs), on human health.

- Concerns over the audibility and potential harm to human ears from prolonged exposure to high-decibel sounds have led to regulatory scrutiny and calls for stricter safety standards. Companies operating in the AHD market must navigate these challenges by investing in research and development to create safer and more effective devices, while also complying with evolving regulations and addressing public concerns.

What will be the Size of the Acoustic Hailing Devices Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The acoustic hailing device market continues to evolve, driven by advancements in audio feedback reduction, voice recognition technology, and audio compression techniques. These innovations enable hailing devices to deliver clearer and more efficient audio communication, enhancing their applicability across various sectors. The integration of hailing device efficiency and audio power handling ensures that these devices can project sound over long distances, even in challenging environments. Moreover, low-frequency extension and frequency response curve optimization contribute to improved sound quality, while power amplifier design and phase array technology enable directional audio projection and noise cancellation. Acoustic modeling software and acoustic impedance matching further refine the performance of these devices, ensuring optimal signal-to-noise ratios and sound level measurements.

Electro-acoustic transducer and loudspeaker array design advancements facilitate high-frequency attenuation and weatherproof enclosures, ensuring durability and reliability. Wireless communication protocols and remote monitoring systems enable real-time performance analysis, while beamforming techniques and audio distortion analysis provide insights into system optimization. Directional loudspeaker technology, digital signal processing, and system integration services continue to shape the market landscape, as industry players strive to deliver advanced and customizable solutions. Environmental sound masking and speech intelligibility metrics further expand the scope of applications for acoustic hailing devices, making them an essential tool for effective communication in various industries.

How is this Acoustic Hailing Devices Industry segmented?

The acoustic hailing devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Government sector

- Commercial sector

- Application

- Military and Defense

- Law Enforcement

- Commercial

- Product Type

- Fixed

- Portable

- Technology

- Directional

- Omnidirectional

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

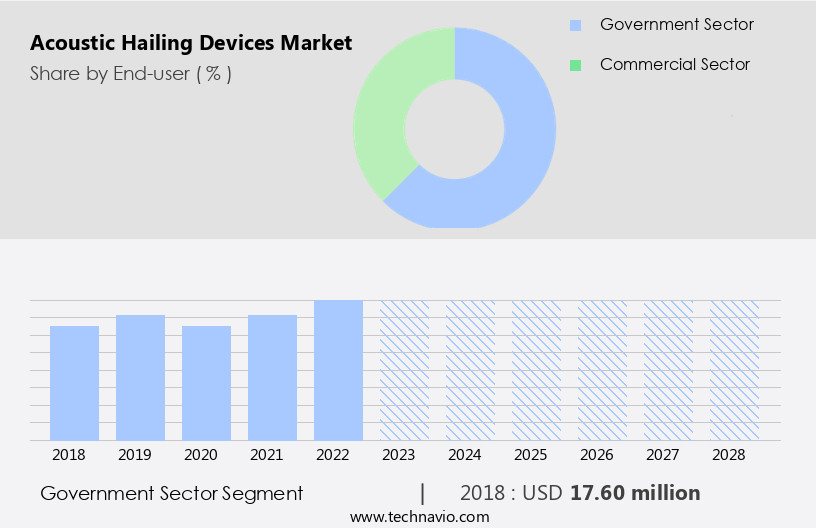

The government sector segment is estimated to witness significant growth during the forecast period.

Acoustic hailing devices have gained significant traction in the government sector for applications including military security, maritime and port security, search and rescue operations, border security, air force, navy, coastal security, law enforcement, public security, crowd control, and homeland security. companies of these devices, such as LRAD Corporation, Ultra Electronics, and Argo-A Security, are capitalizing on the increasing global government spending on defense, public safety, and law enforcement applications. This trend is driving demand for advanced technologies like audio feedback reduction, voice recognition technology, audio compression techniques, hailing device efficiency, audio power handling, and low-frequency extension. Additionally, companies are focusing on improving frequency response curve, power amplifier design, phase array technology, noise cancellation algorithms, acoustic modeling software, acoustic impedance matching, signal-to-noise ratio, sound level measurement, and electro-acoustic transducer technology.

Furthermore, advancements in loudspeaker array design, remote monitoring systems, beamforming techniques, audio distortion analysis, weatherproof enclosures, high-frequency attenuation, wireless communication protocols, long-range audio projection, multi-channel audio systems, horn speaker design, sound propagation modeling, microphone array processing, speech intelligibility metrics, audio quality assessment, acoustic signal processing, directional loudspeaker technology, digital signal processing, system integration services, and environmental sound masking are enhancing the capabilities of acoustic hailing devices. These innovations are enabling companies to cater to the evolving needs of government sectors and expand their market presence.

The Government sector segment was valued at USD 17.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Acoustic hailing devices, also known as Long Range Acoustic Devices (LRADs), have gained significant traction in the APAC market due to their diverse applications in various industries. These devices are increasingly used for bird control, particularly in the aviation sector, where bird strikes pose a major safety concern. By emitting sounds that cause discomfort to birds at long distances, acoustic hailing devices effectively disperse birds, thereby reducing the risk of accidents. In addition to bird control, these devices are also extensively used in APAC for coastal security and maritime applications. For instance, the Japan Coast Guard utilizes LRADs to warn illegal fishing boats from North Korean waters.

Acoustic hailing devices offer several advanced features, such as voice recognition technology, audio compression techniques, and acoustic modeling software, which enhance their efficiency and effectiveness. Moreover, these devices are designed with high audio power handling, low-frequency extension, and directional loudspeaker technology, ensuring clear and long-range audio projection. Phase array technology, beamforming techniques, and digital signal processing further improve the devices' accuracy and precision. Acoustic hailing devices are also engineered with weatherproof enclosures, high-frequency attenuation, and wireless communication protocols, ensuring their functionality in various environmental conditions. Furthermore, multi-channel audio systems, sound propagation modeling, and microphone array processing enable better system integration and performance.

To ensure optimal system efficiency and performance, various technologies such as noise cancellation algorithms, acoustic impedance matching, and signal-to-noise ratio analysis are employed. Speech intelligibility metrics and audio quality assessment are crucial in maintaining clear communication and ensuring effective use of these devices. System integration services and environmental sound masking are also essential aspects of acoustic hailing devices, ensuring seamless integration with other security systems and providing additional benefits such as privacy and noise reduction. Overall, the acoustic hailing device market in APAC is witnessing a surge in demand due to its versatility and effectiveness in various applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Acoustic Hailing Devices Industry?

- The increase in government expenditures represents the primary driving force behind the growth of the Assisted Living Homes for the Elderly (AHDs) market.

- Acoustic hailing devices, also known as loudspeakers used for long-range communication, are experiencing significant growth due to increasing government spending across various sectors. This trend is driven by the necessity for effective communication and crowd control in high-risk environments, such as military operations, public events, and industrial settings. The market's expansion is further fueled by the development of portable acoustic hailing devices and their integration into industrial applications. Speech intelligibility metrics and audio quality assessment play crucial roles in the design and implementation of these systems. Acoustic signal processing and directional loudspeaker technology are essential components, ensuring clear communication over long distances.

- Digital signal processing and system integration services are also vital for optimizing performance and adapting to various environmental conditions. Additionally, environmental sound masking is increasingly being adopted to mitigate background noise and enhance overall audio quality. The market's growth is underpinned by the continuous advancements in technology, enabling more efficient and effective communication solutions.

What are the market trends shaping the Acoustic Hailing Devices Industry?

- The development of superior products is an emerging market trend. It is essential for businesses to prioritize innovation and quality in order to stay competitive.

- The market is witnessing significant advancements, driven by continuous research and development investments from companies. These innovations include the integration of audio feedback reduction technologies, voice recognition systems, and advanced audio compression techniques. Furthermore, the focus on hailing device efficiency, audio power handling, and low-frequency extension is leading to the development of enhanced frequency response curves. Power amplifier designs are being optimized to improve sound quality and reduce distortion. Phase array technology is also gaining traction due to its ability to focus sound waves and increase the effective range of these devices.

- These developments will cater to the growing demand for acoustic hailing devices and encourage competition among market participants. Genasys Inc., for instance, recently introduced a new product in April 2022, showcasing the ongoing innovation in the market.

What challenges does the Acoustic Hailing Devices Industry face during its growth?

- The growth of the industry is significantly influenced by concerns surrounding the potential health effects on humans resulting from the use of Long Range Acoustic Devices (LRAD).

- Acoustic hailing devices, including Long Range Acoustic Devices (LRADs), are utilized extensively in law enforcement for non-lethal applications. These devices generate sound output exceeding 135 decibels, surpassing the human ear's pain threshold of 120 decibels. The high-intensity tones produced by acoustic hailing devices can lead to severe irritation and potential nerve injury due to their impact on the auditory nervous system. To mitigate the negative effects of these devices, advanced technologies such as noise cancellation algorithms, acoustic modeling software, and acoustic impedance matching are integrated. These technologies improve signal-to-noise ratio and sound level measurement, ensuring effective communication while minimizing the potential harm to human ears.

- Electro-acoustic transducers and loudspeaker array designs are optimized for acoustic hailing devices to enhance their performance and efficiency. Remote monitoring systems and beamforming techniques are employed to enable precise control and directionality of the sound output. These advancements contribute to the development of more humane and effective acoustic hailing devices for law enforcement applications.

Exclusive Customer Landscape

The acoustic hailing devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the acoustic hailing devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, acoustic hailing devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

American Technology Corp. - The brand Argo A Security innovates in acoustic hailing technology, delivering clear, authoritative voice commands that penetrate noisy surroundings. Their devices enable effective communication in challenging environments.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Technology Corp.

- Cerberus Black Ltd.

- Directed Sound Technologies

- ELAC Electroacustic GmbH

- Genasys Inc.

- HyperSpike

- Imlcorp LLC

- Larson Davis

- Long Range Acoustic Devices

- Nixalite of America Inc.

- Panphonics Oy

- Silentium Ltd.

- Sonic Concepts Inc.

- Sound Barrier Systems

- Summit Engineering NV

- The Sound

- Toa Corp.

- Torrence Sound

- Ultra Electronics Holdings Plc

- Waveband Communications

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Acoustic Hailing Devices Market

- In January 2024, Thales, a leading technology company, announced the launch of its new Acoustic Hailing Device (AHD), the Sonobuoy 2500, designed for maritime security applications (Thales press release, 2024). This innovative device offers enhanced communication capabilities and improved sonar localization.

- In March 2024, L3Harris Technologies and Elbit Systems formed a strategic partnership to jointly develop and market advanced acoustic hailing devices for various applications, including maritime security and border control (L3Harris Technologies press release, 2024). This collaboration aims to leverage the expertise of both companies in the field of acoustic technology and defense solutions.

- In May 2024, Saab, a leading defense and security company, secured a contract worth approximately USD10 million from an undisclosed European customer for the delivery of acoustic hailing devices (Saab press release, 2024). This significant order underscores the growing demand for advanced acoustic communication systems in the European market.

- In April 2025, Raytheon Technologies announced the successful deployment of its new generation acoustic hailing device, the AHD-Mk2, in the U.S. Navy's fleet (Raytheon Technologies press release, 2025). This technological advancement offers improved voice clarity, enhanced functionality, and increased range, making it a valuable asset for maritime security operations.

Research Analyst Overview

- The market encompasses real-time audio processing and acoustic signal enhancement technologies to effectively communicate with distant targets. Acoustic signal enhancement ensures clear audio transmission, while audio codec selection optimizes system performance. Audio warning systems employ remote control interfaces for efficient operation, and audio data encryption maintains security. System reliability testing, acoustic feedback cancellation, and frequency response analysis are crucial for maintaining optimal performance. Voice clarity improvement and feedback suppression methods enhance communication quality, while speaker placement optimization and multi-speaker synchronization ensure consistent audio transmission.

- Digital audio broadcasting and public address systems are integral applications, with siren design parameters focusing on sound pressure level and frequency response. Intercom system design, emergency notification systems, and acoustic echo cancellation further expand market applications. Acoustic design software, power consumption reduction, waterproof speaker design, and wireless audio transmission are ongoing trends, ensuring the market's continuous growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Acoustic Hailing Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.75% |

|

Market growth 2024-2028 |

USD 39.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.59 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Acoustic Hailing Devices Market Research and Growth Report?

- CAGR of the Acoustic Hailing Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the acoustic hailing devices market growth of industry companies

We can help! Our analysts can customize this acoustic hailing devices market research report to meet your requirements.