Acrylic Acid Derivatives Market Size 2024-2028

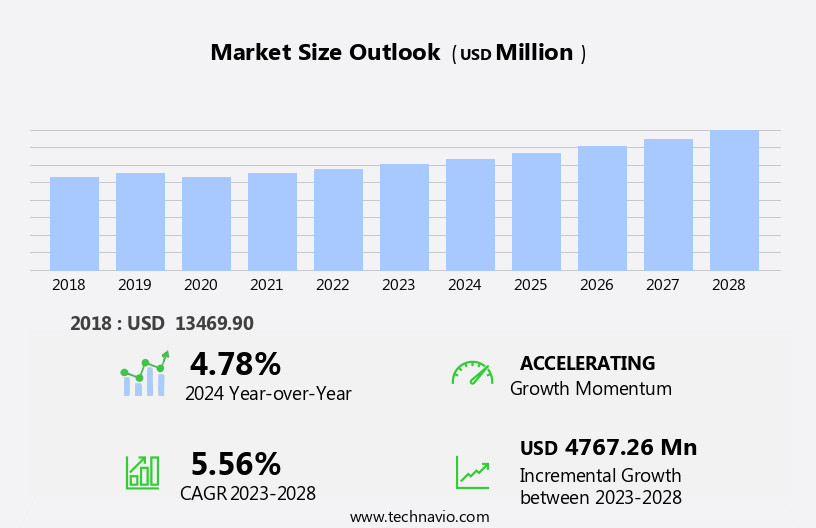

The acrylic acid derivatives market size is forecast to increase by USD 4.77 billion at a CAGR of 5.56% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing demand for these compounds in surface coating applications. The versatility and durability of acrylic acid derivatives make them an ideal choice for various coatings, particularly in the automotive, architectural, and industrial sectors. Another key growth driver is the expanding use of superabsorbent polymers (SAPs) in agricultural applications. SAPs, a type of acrylic acid derivative, play a crucial role in improving water retention and enhancing soil moisture, leading to increased agricultural productivity. However, the market is not without challenges. Fluctuations in crude oil prices pose a significant threat to the market's growth.

- Acrylic acid, a primary raw material for the production of acrylic acid derivatives, is derived from crude oil. Consequently, price volatility in crude oil can significantly impact the cost structure of acrylic acid derivatives, potentially affecting their demand and pricing dynamics. Companies operating in this market must closely monitor crude oil prices and adopt strategic sourcing and pricing strategies to mitigate the impact of price fluctuations on their business.

What will be the Size of the Acrylic Acid Derivatives Market during the forecast period?

- The market continues to evolve, driven by the diverse applications across various sectors. In architectural coatings, acrylic polymers offer superior performance in water-borne coatings, providing excellent adhesion and resistance to weathering. Meanwhile, in healthcare, acrylamide and its derivatives play a crucial role in the production of superabsorbent polymers for use in adult incontinence products. Acrylates, including butyl acrylate and ethyl acrylate, are essential in plastic manufacturing, contributing to the production of recyclable and synthetic rubbers. Acrylic monomers are integral to the creation of biocompatible materials, which find applications in the healthcare industry and electronics. Acrylic esters and acrylate derivatives are essential in adhesives and sealants, enhancing their bonding properties and resistance to various environmental conditions.

- In water treatment, these compounds are used as coagulants and flocculants, improving water quality and making it safe for industrial processes and consumer use. Polymer chemistry continues to advance, with the development of catalysts and plastic additives, enabling the production of high-performance materials for construction, renewable energy sources, and consumer products. Simulation tools and computational modeling play a significant role in optimizing polymer formulations and improving their properties. Acrylic esters, methyl acrylate, and methacrylate are integral to the production of water-resistant coatings, ensuring durability and protection against corrosive compounds. Acrylic esters also find applications in textiles, contributing to the creation of biobased and biodegradable fabrics.

- The ongoing research and development in the market reflect its continuous dynamism, with new applications and innovations unfolding across various sectors. From paints and coatings to healthcare, water treatment, and electronics, the potential for these organic compounds is vast and ever-evolving.

How is this Acrylic Acid Derivatives Industry segmented?

The acrylic acid derivatives industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Acrylic ester

- Acrylic polymer

- Others

- Application

- Surface coatings

- Adhesives and sealants

- Plastic additives

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- APAC

- China

- India

- Rest of World (ROW)

- North America

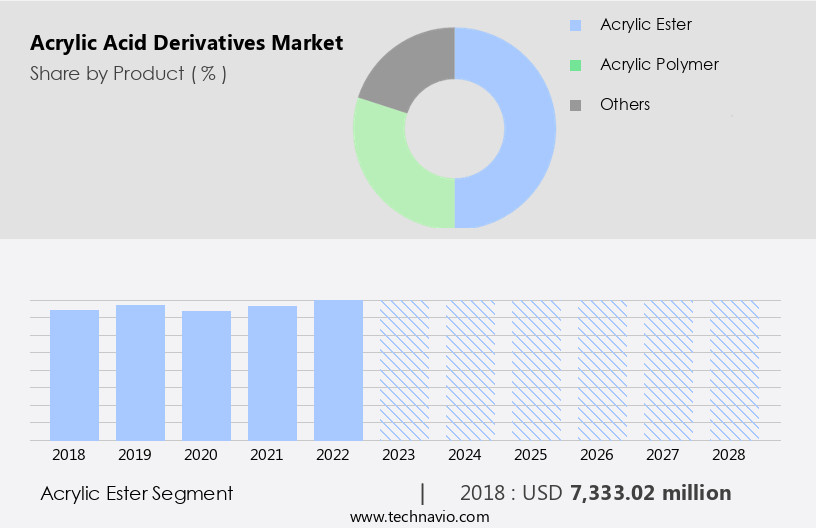

By Product Insights

The acrylic ester segment is estimated to witness significant growth during the forecast period.

In the dynamic global market for acrylic acid derivatives, the acrylic ester segment holds a significant share in 2023. Acrylic esters, derived from acrylic acid, include methyl acrylate, ethyl acrylate, butyl acrylate, and ethyl hexyl acrylate. These esters, also known as acrylate esters, are integral to various industries. In textiles, they function as plastic additives, while in hygiene products, they serve as essential components in adhesives. The construction and automotive sectors' expansion drives the demand for paints and surface coatings, thereby fueling the growth of acrylates.

Moreover, the improving hygiene products industry necessitates more adhesives, further boosting the demand for acrylic esters. In the electronics sector, acrylic esters contribute to water-soluble polymers and computational modeling. Additionally, they find applications in biocompatible materials, renewable energy sources, and high-performance materials. The versatility of acrylic esters ensures their relevance in numerous industries, making them a crucial segment in the market.

The Acrylic ester segment was valued at USD 7.33 billion in 2018 and showed a gradual increase during the forecast period.

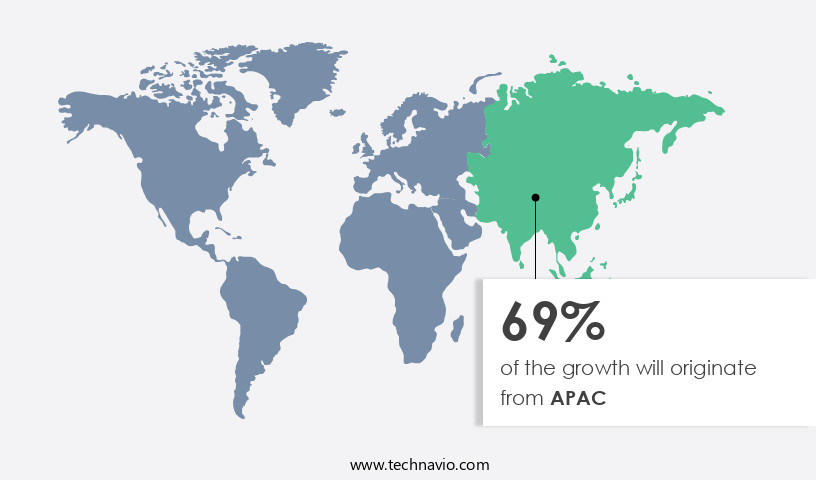

Regional Analysis

APAC is estimated to contribute 69% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, with APAC leading the charge. This region accounted for the largest market share of approximately XX% in 2020, driven by robust demand from China and India. The versatility of acrylic acid derivatives is evident in their applications, which span from surfactants and adhesives to personal care products and surface coatings. In the latter application, the addition of functional monomers enhances the quality, making it a preferred choice. Moreover, the electronics industry's increasing reliance on acrylic acid derivatives for computational modeling and plastic manufacturing further fuels market expansion. Additionally, the healthcare sector's demand for biocompatible materials and water treatment applications contribute to the market's growth.

Acrylic acid derivatives' biobased and biodegradable properties also cater to the renewable energy sector and consumer products. Despite being a corrosive compound, the market for acrylic acid derivatives remains dynamic, with ongoing research in polymer chemistry and the development of simulation tools to optimize production processes.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Acrylic Acid Derivatives Industry?

- The significant surge in demand for acrylic acid derivatives, particularly in surface coating applications, serves as the primary market driver.

- The market is driven by the increasing demand for water-resistant coatings in various industries. Acrylic esters, a key derivative, play a significant role in the production of high-performance materials for surface coatings and sealants and adhesives. The shift towards renewable energy sources and the energy sectors' expansion creates a lucrative market for acrylic acid derivatives. The environmental regulations, such as the EPA's restrictions on volatile organic compounds (VOC) and REACH, have led to a surge in the consumption of acrylic derivatives in industrial coatings and insulation applications. Water-based paints, which are more eco-friendly and have lower VOC emissions, are gaining popularity.

- Acrylic acid derivatives' versatility and excellent chemical resistance make them suitable for various applications, including consumer products like adult incontinence and high-performance materials. The market's growth is further fueled by the increasing demand for acrylic derivatives in coatings applications, offering excellent durability and protection against harsh environmental conditions.

What are the market trends shaping the Acrylic Acid Derivatives Industry?

- The growing adoption of SAPs (Software Application Packages) in agricultural applications is a notable market trend. This sector is witnessing an increasing utilization of SAPs to enhance productivity and efficiency.

- Acrylic acid derivatives, including methyl acrylate and acrylates, play significant roles in various industries such as architectural coatings, healthcare, water treatment, plastics, adhesives, and synthetic rubbers. In the architectural coatings sector, acrylic polymer formulations are widely used due to their excellent adhesion properties and resistance to weathering. In healthcare, methyl acrylate is a crucial component in producing medical-grade plastics and disposable medical devices. In water treatment, acrylic polymers serve as effective coagulants and flocculants, enhancing water clarification and purification processes. Plastic additives derived from acrylic acid are also essential in improving the properties of plastics, such as enhancing their durability and resistance to environmental stressors.

- The healthcare industry's demand for acrylic acid derivatives is driven by the increasing need for biocompatible materials for medical devices and pharmaceuticals. In the water treatment sector, the growing emphasis on sustainable water management and the development of catalysts to optimize treatment processes further boosts the market's growth. Moreover, the recyclable nature of acrylic polymers and their use in producing respiratory tract medical devices contribute to their increasing popularity. The continuous research and development in polymer formulations and catalyst development further expand the applications of acrylic acid derivatives.

What challenges does the Acrylic Acid Derivatives Industry face during its growth?

- The volatility in crude oil prices poses a significant challenge to the growth of the industry.

- Acrylic acid, derived from the oxidation of propylene, a petrochemical byproduct, is converted into various derivatives, including acrylic esters. These derivatives find extensive applications in diverse industries, such as detergent manufacturing, plastic manufacturing, OEM finishes, and adhesives and sealants. Acrylic monomers like butyl acrylate, ethyl acrylate, and acrylamide are key components of acrylic polymers, which are used in the production of superabsorbent polymers and biocompatible materials. The production of acrylic acid and its derivatives involves chemical processes, including the oxidation of propylene, propane, or acetylene. Fluctuations in crude oil prices can impact the production costs and, consequently, the prices of acrylic polymer products.

- To mitigate the effects of rising crude oil prices, manufacturers may adjust their production processes or source alternative feedstocks. Moreover, the increasing focus on environmentally friendly products has led to the adoption of acrylic acid derivatives with low volatile organic compound (VOC) content. These eco-friendly alternatives are gaining popularity due to their reduced environmental impact. In summary, the market is driven by various factors, including the demand for eco-friendly products, raw material costs, and the versatility of acrylic polymers.

Exclusive Customer Landscape

The acrylic acid derivatives market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the acrylic acid derivatives market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, acrylic acid derivatives market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arkema Group - This company specializes in the production and supply of acrylic acid derivatives, specifically acrylic monomers. These innovative chemicals extend the lifespan of water-based formulations, enabling solvent-free applications and contributing to a cleaner environment. Acrylic monomers are integral components in various industries, enhancing product durability and sustainability without compromising performance. By focusing on the development and implementation of these advanced materials, our organization continues to drive industry progression and meet the evolving needs of modern consumers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arkema Group

- BASF SE

- CHEMRA GmbH

- Clariant International Ltd.

- Dow Chemical Co.

- Evonik Industries AG

- LG Corp.

- Merck KGaA

- Mitsubishi Chemical Corp.

- Nippon Shokubai Co. Ltd.

- PCC SE

- PTT Global Chemical Public Co. Ltd.

- Resonac Holdings Corp.

- SIBUR Holding PJSC

- Solventis Ltd.

- Sumitomo Seika Chemicals Co. Ltd.

- Tecnon OrbiChem Ltd.

- The Lubrizol Corp.

- Toagosei Co. Ltd.

- Westlake Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Acrylic Acid Derivatives Market

- In February 2024, DuPont announced the launch of its new acrylic acid derivative, Elvax FG-125, which offers enhanced performance in automotive under-the-hood applications. This innovative product expansion aims to cater to the growing demand for high-performance materials in the automotive sector (DuPont Press Release, 2024).

- In August 2025, BASF and Covestro, two leading players in the market, entered into a strategic collaboration to develop and produce a new line of polycarbonate resins. This partnership is expected to strengthen their market position and broaden their product offerings, providing customers with a more comprehensive range of solutions (BASF Press Release, 2025).

- In November 2024, SABIC, a global leader in the chemical industry, completed the acquisition of GE Plastics, significantly expanding its acrylic derivatives portfolio. This strategic move enables SABIC to increase its market share and enhance its presence in the global acrylic derivatives market (SABIC Press Release, 2024).

- In March 2025, the European Chemicals Agency (ECHA) approved the renewal of the registration of acrylic acid and its derivatives under the European Union's REACH regulation. This approval ensures the continued production and use of these chemicals, maintaining the market stability and providing regulatory certainty for industry players (ECHA Press Release, 2025).

Research Analyst Overview

The market encompasses a wide range of applications, including methacrylate production for superabsorbent polymers, renewable energy sources, surface coatings, and detergent formulations. Acrylates, derived from carboxylic acid and the vinyl group, play a significant role in polymer chemistry, particularly in the production of high-performance materials such as acrylic polymers and acrylate esters. These organic compounds are integral to industrial products, including water-borne coatings, adhesives, and sealants, as well as consumer goods like textiles and water-resistant coatings. Ethylene and acrylates polymers are key raw materials in the synthesis of various acrylic derivatives.

Acrylamide and polymer formulations are also essential components of this market, contributing to the production of plastics, paints, and synthetic rubbers. The market for acrylic acid derivatives continues to evolve, driven by advancements in polymer chemistry and the increasing demand for sustainable, high-performance materials.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Acrylic Acid Derivatives Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.56% |

|

Market growth 2024-2028 |

USD 4767.26 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.78 |

|

Key countries |

US, China, India, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Acrylic Acid Derivatives Market Research and Growth Report?

- CAGR of the Acrylic Acid Derivatives industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the acrylic acid derivatives market growth of industry companies

We can help! Our analysts can customize this acrylic acid derivatives market research report to meet your requirements.