Acrylic Surface Coating Market Size 2024-2028

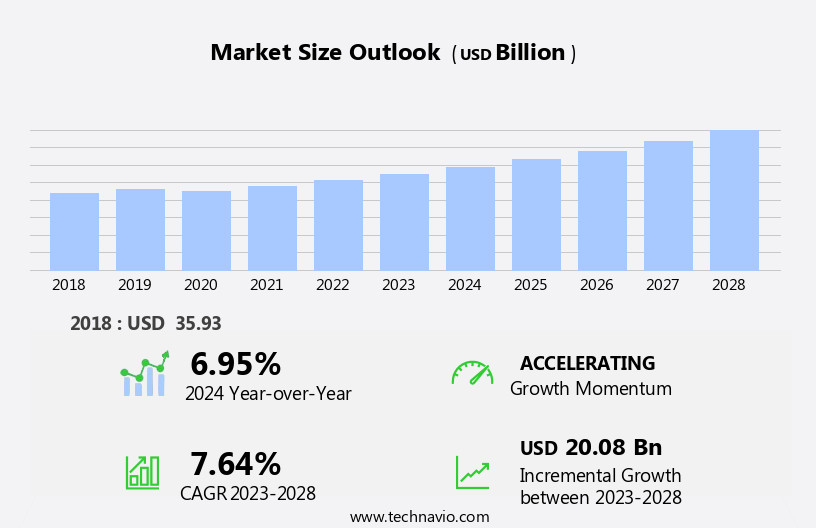

The acrylic surface coating market size is forecast to increase by USD 20.08 billion at a CAGR of 7.64% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the expansion of the real estate and construction industries. This sector's revival has led to increased demand for acrylic coatings due to their durability, resistance to weathering, and ease of application. Another key trend influencing market growth is the rising emphasis on eco-friendly and bio-based products. Consumers and regulatory bodies are pushing for more sustainable solutions, creating opportunities for acrylic coatings manufacturers that can offer green alternatives. However, market growth is not without challenges. Volatility in raw material prices, particularly for key inputs like acrylic polymers and pigments, can significantly impact profitability.

- Companies must carefully manage their supply chains and explore alternative sourcing options to mitigate these risks. To capitalize on market opportunities and navigate challenges effectively, acrylic surface coating companies should focus on innovation, sustainability, and operational efficiency. By investing in research and development to create new, eco-friendly products and optimizing their supply chains, they can differentiate themselves in a competitive market and maintain profitability.

What will be the Size of the Acrylic Surface Coating Market during the forecast period?

- The market in the United States is experiencing significant growth due to the increasing demand for eco-friendly, waterborne coatings. These coatings offer functional purposes such as water resistance, color retention, and high surface hardness, making them ideal for various substrates including buildings and roofs. Acrylic coatings come in various forms, including powder formulations and quick-drying paints, providing ease of application and fast drying times. The acrylic coating market is driven by its broad pigment compatibility, elastomeric finish, and protection against environmental factors. Acrylic polymers, the primary component of these coatings, provide increased hardness and durability, ensuring long-lasting performance.

- The market's size is substantial, with continued expansion expected due to the growing preference for waterborne coatings and the need for sustainable, protective solutions. Acrylic coatings serve both decorative and protective purposes, offering gloss retention and resistance to weathering. Their water-resistant property and quick drying time make them a popular choice for various industries, including architectural and industrial applications. With their versatility and durability, acrylic coatings are a smart investment for those seeking long-term, high-performance solutions.

How is this Acrylic Surface Coating Industry segmented?

The acrylic surface coating industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Construction

- Automotive

- Furniture

- Others

- Technology

- Water-borne

- Solvent-borne

- Powder

- Others

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Russia

- UK

- South America

- Middle East and Africa

- APAC

By Type Insights

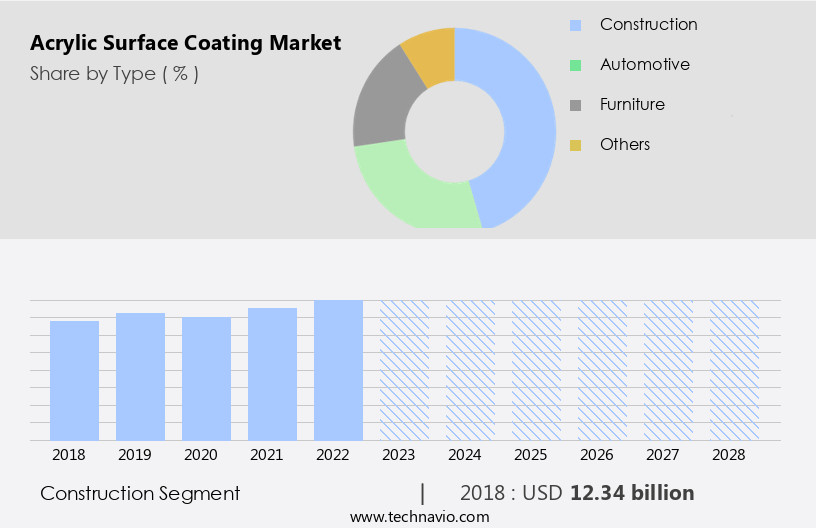

The construction segment is estimated to witness significant growth during the forecast period.

Acrylic surface coatings have gained significant traction in the US construction industry due to their quick-drying property and versatility. These coatings offer environmental-friendly solutions with broad pigment compatibility, making them suitable for various applications, including architectural, protectoral purposes, and interior decoration. Acrylic coatings are available in both solvent-based and waterborne forms, catering to diverse industry requirements. The automotive refinishing industry and furniture industry have extensively used acrylic coatings for their durability and increased hardness. Acrylic protective coatings are widely employed in roof coatings, bridges, electrical & electronics industry, and construction and infrastructure for their water-resistant property, weatherability, and clarity.

They provide excellent protection against mechanical damage, corrosion, and UV radiation. Acrylic surface coatings are also used in industrial finishing, exterior walls, wood, machinery and equipment, and traffic lights for their eco-friendly nature, fast-drying paints, and increased hardness. The automotive and transportation industry, aerospace and defense, and industrial products rely on acrylic coatings for their functional purposes and color retention properties. Waterborne acrylic coatings have gained popularity due to their lower VOC content, ease of application, and reduced environmental impact. Powder formulations offer additional benefits, such as improved surface hardness and resistance to abrasion. Acrylic surface coatings are a durable and sustainable choice for various industries and applications.

Get a glance at the market report of share of various segments Request Free Sample

The Construction segment was valued at USD 12.34 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

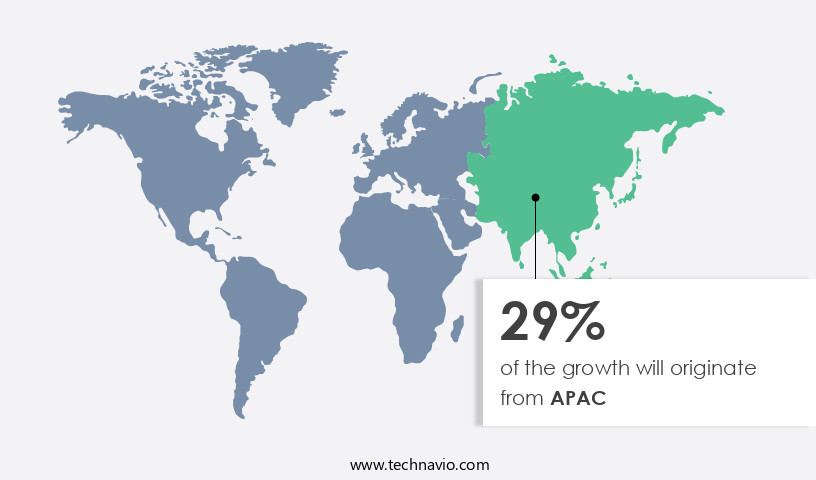

APAC is estimated to contribute 29% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Acrylic surface coatings are in high demand in the APAC region due to its quick-drying property and broad pigment compatibility. China, as the world's largest automobile producer and a significant player in the paints and coatings industry, is the major contributor to the market. Infrastructure development and construction activities in countries like India, China, Japan, Singapore, Thailand, Indonesia, and the Philippines are driving the demand for acrylic surface coatings. The housing market in APAC is expanding, with governments investing in building new homes and renovating existing ones, such as Japan's USD36 billion plan over the next decade.

Acrylic coatings offer increased hardness, weatherability, and color retention properties, making them suitable for various applications, including architectural, decorative, and functional purposes. The automotive refinishing, furniture, and industrial sectors also utilize acrylic coatings for protectoral purposes and to enhance the clarity and gloss of their products. Waterborne acrylic coatings are gaining popularity due to their eco-friendly nature and lower VOC content, aligning with the global push towards sustainability. The roof coatings market also benefits from the water-resistant and durable properties of acrylic coatings. Acrylic protective coatings are used in various industries, including aerospace and defense, electrical & electronics, and machinery and equipment, for corrosion protection and mechanical damage resistance.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Acrylic Surface Coating Industry?

- Growth of real estate and construction industry is the key driver of the market.

- The market has experienced significant growth due to the expansion of the real estate and construction industry. With an increasing number of office spaces, commercial complexes, and residential buildings being constructed, the demand for acrylic surface coatings as architectural coatings in both construction and structural applications has risen. The rapid urbanization and substantial investments in infrastructure development, particularly in developing countries, are driving the growth of the construction industry.

- Acrylic surface coatings are extensively utilized in interior and exterior finishing applications. The surging global population necessitates the development of housing and infrastructure, leading to increased demand for these coatings. The acrylic surface coating's highly reflective and seamless characteristics make it a preferred choice for construction applications.

What are the market trends shaping the Acrylic Surface Coating Industry?

- Increasing focus on bio-based and eco-friendly products is the upcoming market trend.

- The market is experiencing growth due to increasing consumer awareness and preference for eco-friendly and sustainable products. According to , bio-based resins and polymers are gaining popularity in the coatings industry as they offer several benefits, including reduced environmental impact and improved health safety. In developed regions, regulations that promote the use of environmentally friendly products are driving the market's expansion. Moreover, the demand for bio-based, recyclable, and renewable coating materials is increasing in the US and Europe. This trend is particularly noticeable in industries such as food packaging, consumer goods, and others, where bio-based polymer coatings are being adopted to meet growing environmental and food and drug-related regulations.

- The use of these coatings not only helps companies comply with regulations but also appeals to consumers who are increasingly concerned about the environmental and health impacts of the products they purchase. Overall, the market is poised for steady growth as the demand for sustainable and eco-friendly coatings continues to rise.

What challenges does the Acrylic Surface Coating Industry face during its growth?

- Volatility in raw material prices is a key challenge affecting the industry growth.

- The acrylic surface coatings market is influenced by the price volatility of raw materials, primarily derived from crude oil and natural forest products. Acrylic resins, binders, and additives, which are essential components of acrylic surface coatings, experience frequent price fluctuations due to their dependence on petroleum derivatives. The increasing demand for acrylic surface coatings in emerging economies further exerts pressure on the market. Despite these challenges, the market continues to grow due to the versatility and durability of acrylic surface coatings.

- These coatings offer various benefits, such as resistance to UV radiation, chemicals, and weather conditions, making them a preferred choice for various industries, including construction, automotive, and packaging. The market dynamics are complex, with supply and demand factors playing significant roles in shaping the market landscape.

Exclusive Customer Landscape

The acrylic surface coating market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the acrylic surface coating market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, acrylic surface coating market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in applying advanced acrylic surface coatings, including 3M Paint Protection Film SJ8587, 3M Surface Protection Film 3952, and Scotchgard Surface Protection Film 2200, to enhance and safeguard various surfaces. These coatings offer superior resistance to scratches, fading, and environmental elements, ensuring long-lasting durability and an aesthetically pleasing finish. By employing cutting-edge application techniques, our team guarantees a flawless and precise installation, resulting in an enhanced surface protection solution for our clients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Akzo Nobel NV

- Arkema Group

- Asian Paints Ltd.

- Axalta Coating Systems Ltd.

- BASF SE

- Berger Paints India Ltd

- Berkshire Hathaway Inc.

- Brillux GmbH and Co. KG

- Chemilac Paints Pvt Ltd

- Dow Chemical Co.

- Dunn Edwards Corp.

- Jesons Industries Ltd

- Jotun AS

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- The Karnak Corp.

- The Sherwin Williams Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products utilized for various applications due to their desirable properties. These coatings offer quick drying times and are known for their environmental-friendliness, making them popular choices for architectural applications. The broad pigment compatibility of acrylic coatings allows for a vast array of colors and finishes, suitable for both decorative and protectoral purposes. Acrylic coatings are used extensively in various industries, including furniture, residential and commercial buildings, and the automotive refinishing sector. In the furniture industry, acrylic coatings provide increased hardness and clarity, enhancing the appearance and durability of the finished product.

In the case of residential and commercial buildings, acrylic coatings offer excellent weatherability and water resistance, making them ideal for exterior walls and roof coatings. Acrylic coatings are also widely used in the automotive industry, both for automotive production and automotive refinishing applications. Their fast-drying property and ease of application make them a preferred choice for the automotive sector. In addition, acrylic coatings offer excellent color retention properties, making them suitable for use in traffic lights and other industrial applications where color consistency is crucial. Acrylic coatings are also used in the industrial sector for machinery and equipment protection, providing resistance to mechanical damage and corrosion.

In the electrical & electronics industry, acrylic coatings offer radiation curable properties, ensuring the protection of sensitive components. The eco-friendly nature of waterborne acrylic coatings has led to their increased usage in various applications, including bridges and construction and infrastructure projects. These coatings offer excellent surface hardness and durability, making them suitable for heavy-duty applications. Acrylic coatings are also used in the aerospace and defense industry for their excellent mechanical and chemical resistance properties. In the case of metal substrates, acrylic coatings offer excellent adhesion and resistance to environmental factors. Acrylic coatings offer various benefits, including increased hardness, water resistance, and weatherability.

They are also known for their low volatile organic compound (VOC) content, making them an environmentally-friendly alternative to solvent-based coatings. Acrylic coatings are used in various applications, including furniture, architectural, industrial, automotive, and aerospace industries. Their desirable properties, such as quick drying times, broad pigment compatibility, and eco-friendliness, make them a popular choice for various industries. Acrylic coatings offer excellent protection against mechanical damage, corrosion, and environmental factors, making them an essential component in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.64% |

|

Market growth 2024-2028 |

USD 20.08 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.95 |

|

Key countries |

China, US, UK, India, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Acrylic Surface Coating Market Research and Growth Report?

- CAGR of the Acrylic Surface Coating industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the acrylic surface coating market growth of industry companies

We can help! Our analysts can customize this acrylic surface coating market research report to meet your requirements.