Adult Vitamin Gummies Market Size 2025-2029

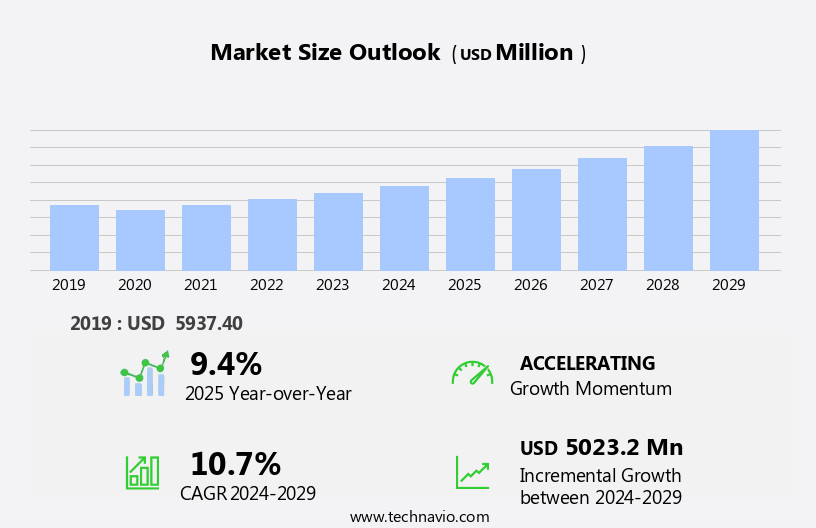

The adult vitamin gummies market size is forecast to increase by USD 5.02 billion at a CAGR of 10.7% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. The high demand for convenient on-the-go dietary supplements is driving market growth. Additionally, the increasing popularity of e-commerce channels is providing a boost to market sales. However, the high cost of production is a major challenge for market players. Despite this, the market is expected to continue its growth trajectory, offering opportunities for new entrants and existing players alike. The market trends and analysis report provides a comprehensive overview of these factors and more, helping stakeholders make informed decisions in the dynamic and evolving market landscape.

What will be the Size of the Market During the Forecast Period?

- The market is experiencing significant growth due to increasing health and wellness awareness and the desire for convenient, enjoyable supplements. These gummies cater to various demographics, including vegans, pregnant and breastfeeding women, seniors, and individuals with dietary restrictions such as gluten-free and lactose-intolerance. The market encompasses a wide range of applications, including immunity support, energy boost, skin health, heart health, stress relief, and personalized nutrition. Vitamin gummies are also popular among athletes for muscle recovery and weight loss. Essential minerals and natural ingredients are key features in this market, with offerings for specific health concerns like sleep, hair growth, and digestive health.

- The market's expansion reflects the trend toward wellness supplements and nutraceuticals that cater to diverse lifestyles and health needs. High-quality gummies, plant-based options, and natural flavors further add to their appeal.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Vitamin deficiency

- Food supplements

- Others

- Distribution Channel

- Offline

- Online

- Product

- Multi vitamins

- Single vitamins

- Others

- Source

- Animal

- Plant

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

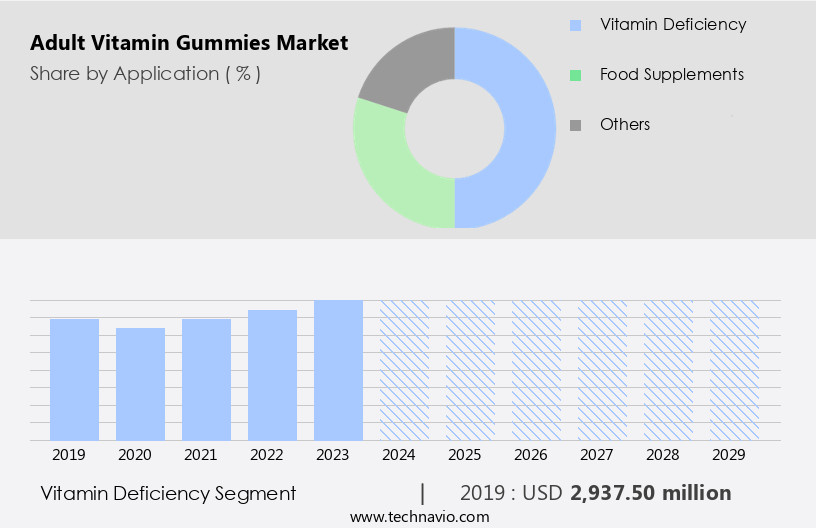

By Application Insights

- The vitamin deficiency segment is estimated to witness significant growth during the forecast period.

Adult vitamin gummies have gained popularity as a convenient solution for addressing nutritional deficiencies in today's busy lifestyle. These gummies cater to various micronutrient requirements, including choline, vitamin A, iron, zinc, and folic acid. Healthy lifestyles, sports activities, and body weight management are some factors driving the demand for these gummies. Online platforms offer doorstep deliveries, customer assistance services, and payment gateways for seamless purchasing. Nutritional products stores, specialty stores, pharmacies, supermarkets, and convenience stores stock a wide range of vitamin gummies. Adults with specific vitamin deficiencies, such as anemia or chronic diseases, may opt for these gummies for immune support and stress alleviation.

Get a glance at the market report of share of various segments Request Free Sample

The vitamin deficiency segment was valued at USD 2.94 billion in 2019 and showed a gradual increase during the forecast period.

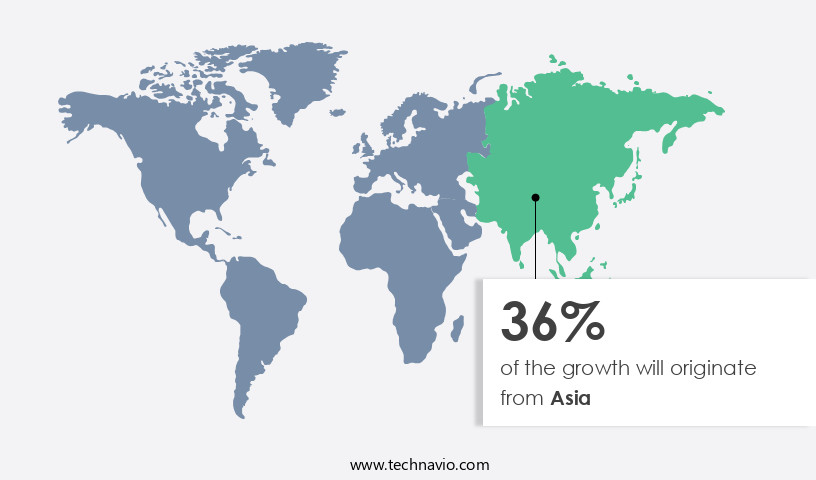

Regional Analysis

- Asia is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market experiences significant growth due to increasing health consciousness and the prevalence of nutritional deficiencies among adults. Consumers prioritize maintaining optimal health through balanced diets and nutritional supplements, leading to the popularity of vitamin gummies. Key dietary supplements in demand include multivitamins, calcium and vitamin D, iron, zinc, and vitamins A, C, D, and B complex. Factors contributing to market expansion include the convenience of gummy vitamins, appealing flavors, and chewy textures. Online platforms, nutraceuticals stores, pharmacies, supermarkets, and convenience stores offer doorstep deliveries and various payment gateways for customer convenience. Health practitioners and fitness regimes recommend vitamin gummies for immune support, energy enhancement, stress alleviation, and metabolic health.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Adult Vitamin Gummies Industry?

High demand for on-the-go dietary supplements is the key driver of the market.

- The market has witnessed significant growth due to the increasing health consciousness among consumers and the rise in consumer awareness regarding nutritional deficiencies. Vitamin gummies, with their chewy texture and appealing flavors, offer a convenient alternative to traditional pill forms, enhancing consumer compliance. Nutritional deficiencies, such as those in choline, vitamin A, iron, folic acid, niacin, zinc, and folate, are common among adults, leading to a growing demand for multivitamins and single vitamin supplements. Several factors contribute to this trend, including the increase in sedentary lifestyles, sports activities, body weight concerns, and chronic diseases. Consumers are turning to online platforms for doorstep deliveries, payment gateways, and customer assistance services to meet their nutritional needs.

- Nutraceuticals, including vitamin gummies, have gained popularity for their immune support, energy enhancement, stress alleviation, and metabolic health benefits. Health practitioners recommend vitamin gummies for adults dealing with nutritional deficits, as they offer improved bioavailability compared to traditional supplements. Specialty stores, pharmacies, supermarkets, convenience stores, and nutritional products stores have started stocking vitamin gummies to cater to the growing demand. With the rise in consumer awareness, marketing efforts focus on branding and promoting the health benefits of vitamin gummies to adult consumers.

What are the market trends shaping the Adult Vitamin Gummies Industry?

Growing popularity of e-commerce channels is the upcoming market trend.

- The global market has experienced substantial growth In the last decade, driven in large part by the rise of online platforms. These digital marketplaces enable consumers to access a wide range of adult vitamin gummies brands from around the world. The proliferation of smartphones and the increasing number of e-commerce companies have contributed to this trend. Online retailers, such as Amazon.Com and vitacost.Com, offer specialized health and wellness portals, making it easier for customers to purchase adult vitamin gummies based on age and category. These platforms also provide real-time chat support and extensive product and nutritional information, enhancing the shopping experience.

- Adult vitamin gummies address various nutritional deficiencies, including those related to vitamin A, C, D, E, iron, folic acid, choline, zinc, and niacin. Consumers are increasingly conscious of their health and are incorporating these supplements into their healthy lifestyles, whether for sports performance, body weight management, immune support, energy enhancement, stress alleviation, or metabolic health. The convenience and appealing flavors and textures of gummy vitamins make them an attractive alternative to traditional pill forms, further boosting their popularity. Dietary supplements, nutraceuticals, and specialty stores also stock adult vitamin gummies, catering to diverse consumer needs and preferences.

What challenges does the Adult Vitamin Gummies Industry face during its growth?

High cost of production of adult vitamin gummies is a key challenge affecting the industry growth.

- Synthetic vitamins have gained significant traction among gummy vitamin manufacturers due to the high production costs and investment requirements associated with naturally-sourced vitamins. Most synthetic vitamins are derived from petroleum extracts or coal tar derivatives, making them more cost-effective. However, consumer preference for naturally-sourced vitamins is on the rise. In 2023, the vitamin supplement industry faced operational challenges, particularly raw material shortages, which caused price volatility and supply disruptions. For instance, the global Vitamin E industry experienced substantial price increases due to the BASF facility incident in Germany in August 2024. Despite these challenges, the market continues to grow as consumers prioritize healthy lifestyles and seek to address micronutrient deficiencies through food supplements.

- They offer convenience and appealing flavors, making them an attractive option for consumers following fitness regimes, engaging in outdoor activities, or dealing with chronic diseases. Nutritional products stores, pharmacies, supermarkets, and convenience stores are popular channels for purchasing these supplements, with online platforms offering doorstep deliveries and customer assistance services. Key nutrients like Vitamin A, C, D, E, iron, folic acid, choline, zinc, and niacin are commonly found in adult vitamin gummies, providing immune support, energy enhancement, stress alleviation, and overall well-being. Brands focus on branding and marketing efforts to cater to the nutritional needs of adults in adulthood, addressing various health issues and nutritional deficits.

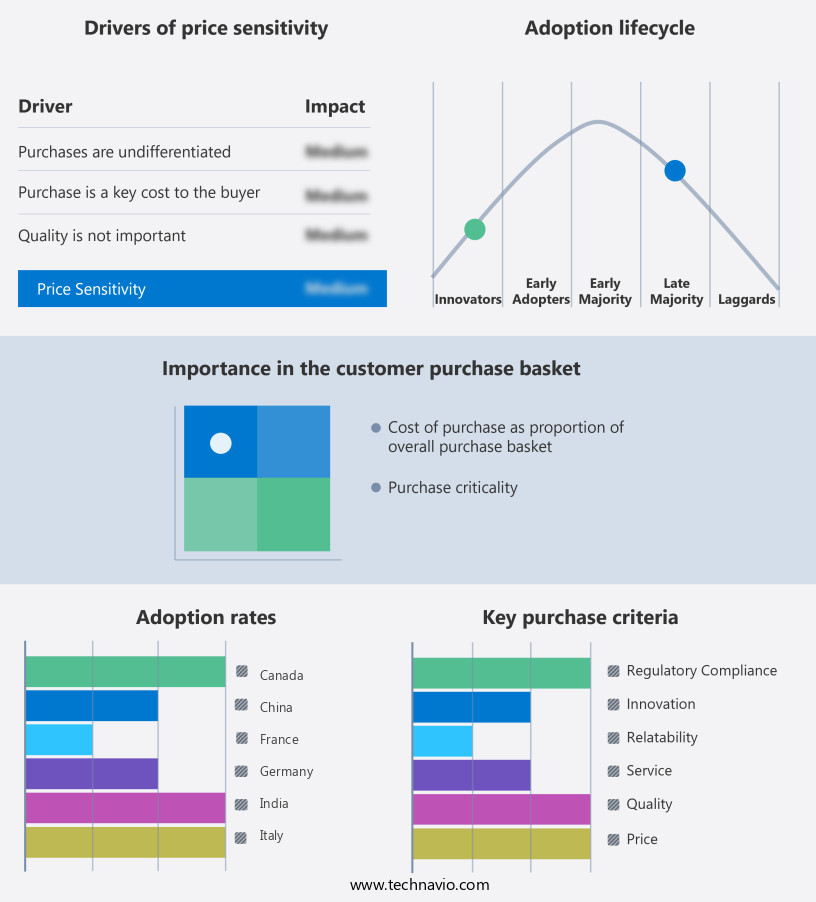

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Aesthetic Nutrition - The company offers adult vitamin gummies such as The beach body gummies, Beard gummies, and Jaw dropping skin gummies.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amway Corp.

- Bayer AG

- Catalent Inc.

- Haleon Plc

- DCC plc

- Herbaland Gummies

- Hero Nutritionals LLC

- Life Science Nutritionals Inc.

- Makers Nutrition LLC

- Mondelez International Inc.

- Mr. Gummy Vitamins LLC.

- Natures Bounty

- Nestle SA

- Nutra Solutions USA

- Pharmavite LLC

- Rainbow Light

- SmartyPants Vitamins

- The Honest Co. Inc.

- Vitafusion

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market for adult vitamin gummies has experienced significant growth in recent years, fueled by the increasing awareness of the importance of maintaining optimal nutritional health in adulthood. This trend is driven by several factors, including the desire for convenient and appealing ways to consume essential vitamins and minerals. Healthy Lifestyles and Nutritional Needs As more adults prioritize their health and well-being, they are turning to vitamin gummies as a convenient and tasty way to address nutritional deficiencies. These deficiencies can arise from various sources, including poor diet, chronic diseases, and metabolic health issues.

In addition, micronutrient Deficiencies and Vitamin Supplements Micronutrient deficiencies, such as those in vitamins A, C, D, E, and minerals like iron and zinc, can lead to a range of health issues. Vitamin gummies offer a solution to these deficiencies, providing adults with essential nutrients in a form that is easy to consume and absorb. Online Platforms and Doorstep Deliveries The rise of online platforms and doorstep deliveries has made it easier than ever for adults to access vitamin gummies and other nutritional supplements. Consumers can now order these products from the comfort of their own homes and have them delivered directly to their doorstep.

Furthermore, specialty Stores and Nutraceuticals Specialty stores and nutraceutical companies have also played a significant role In the growth of the market. These retailers offer a wide range of products, including gummies, multivitamins, and single vitamins, catering to the diverse nutritional needs of adults. Branding and Appealing Flavors The success of adult vitamin gummies can also be attributed to their branding and appealing flavors. Many companies have invested in creating high-quality gummies that not only provide essential nutrients but also taste great. This has led to increased consumer compliance and repeat purchases. Immune Support and Energy Enhancement Adult vitamin gummies are also popular for their immune support and energy enhancement properties.

In addition, with the increasing demand for products that help alleviate stress and improve overall well-being, vitamin gummies have become a go-to choice for many adults looking to maintain their health and vitality. Vegan and Textures The market for adult vitamin gummies also caters to various dietary preferences, including vegan options. Additionally, companies are experimenting with different textures, such as chewy and gummy, to create a more enjoyable experience for consumers. Marketing Efforts and Consumer Awareness Marketing efforts and consumer awareness campaigns have also contributed to the growth of the market. Many companies have invested in targeted advertising and educational initiatives to increase awareness of the importance of maintaining optimal nutritional health and the benefits of vitamin gummies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.7% |

|

Market growth 2025-2029 |

USD 5.02 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Key countries |

US, Canada, China, Germany, UK, Japan, India, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Adult Vitamin Gummies industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.