Aerosol Propellant Market Size 2024-2028

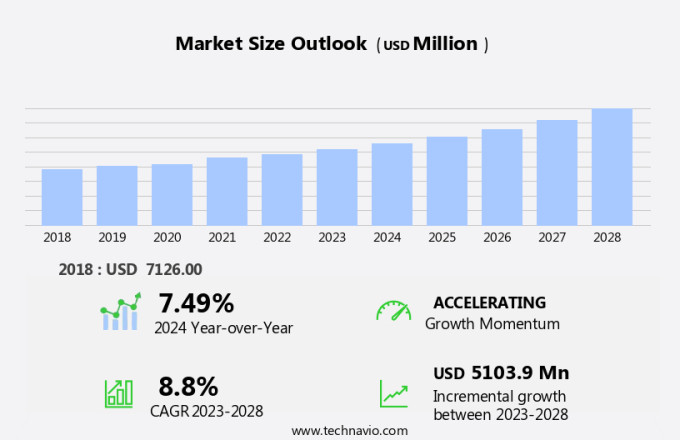

The aerosol propellant market size is forecast to increase by USD 5.1 billion at a CAGR of 8.8% between 2023 and 2028.

- The market is witnessing significant growth due to the rapid expansion of the personal care industry and the increasing demand for male grooming products. The personal care sector's continuous expansion is driving the market for aerosol propellants, as these products offer convenience and ease of use. However, the market is also facing challenges due to the potential ill effects of aerosol propellants on the environment and human health. Aerosol propellants are extensively employed across various industries, including household products, cosmetics, food items, and pharmaceuticals. Household applications encompass air fresheners, fabric care, kitchen cleaning products, and more. These concerns have led to stringent regulations and increasing consumer awareness, necessitating the development of eco-friendly and safer alternatives. Additionally, the rising demand for natural and organic personal care products is also impacting the market dynamics. Overall, the market for aerosol propellants is expected to grow steadily, driven by the expanding personal care industry and the demand for convenient and eco-friendly solutions.

What will be the Size of the Aerosol Propellant Market During the Forecast Period?

- The aerosol propellant market encompasses a diverse range of applications, including cosmetics, shaving foams, shampoos, deodorants, and antiperspirants, as well as food products such as whipped creams, mayonnaise, chocolate, and other pressurized items. In the personal care sector, aerosol propellants provide convenient, easy-to-use dispensers for various products, offering consumers a more hygienic and efficient alternative to traditional tubes or bottles. Beyond personal care, aerosol propellants are also utilized in industrial applications, including automotive industries for rust-inhibiting coatings and automotive tire sealants, as well as in medical devices like inhalers and nebulizers.

- Additionally, food items like olive oil, vinegar, and creams benefit from aerosol technology for convenient and precise dispensing. The market is driven by factors such as increasing consumer demand for convenient and portable products, technological advancements in propellant formulations, and the growing popularity of aerosol packaging in various industries.

How is this Aerosol Propellant Industry segmented and which is the largest segment?

The aerosol propellant industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Compressed gas

- Liquified gas

- Application

- Personal care

- Household

- Medical

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- South America

- Middle East and Africa

- North America

By Type Insights

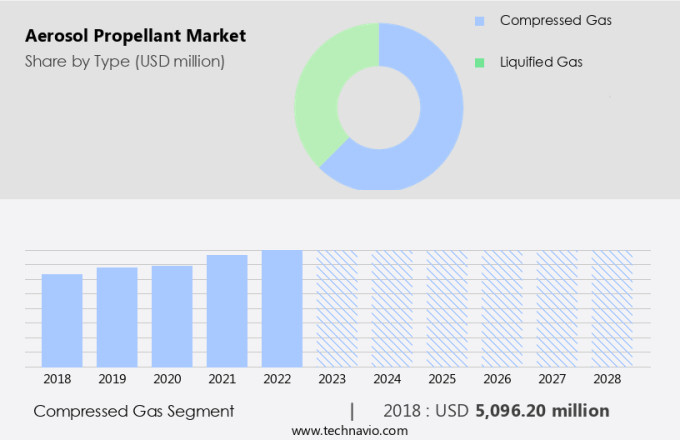

- The compressed gas segment is estimated to witness significant growth during the forecast period.

Compressed gases, such as nitrogen and carbon dioxide, account for the largest share In the market. These propellants expel product concentrates In their original form by utilizing the pressure of the compressed gas In the aerosol can. Consumer preference for convenient and efficient cleaning solutions, coupled with increasing health consciousness, fuels the demand for aerosols. In the healthcare sector, aerosol inhalers are gaining popularity due to their ability to deliver quick relief to patients suffering from respiratory conditions.

Get a glance at the Aerosol Propellant Industry report of share of various segments Request Free Sample

The compressed gas segment was valued at USD 5.1 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

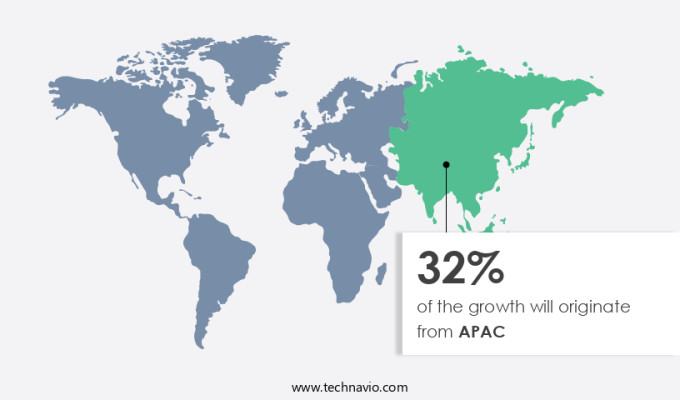

- APAC is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is the largest global contributor, driven by the presence of numerous companies and increasing consumer expenditure on personal care products, particularly In the US and Canada. Urbanization in North America, with its large population base, leads to significant spending on various personal care segments, including skincare products, which in turn fuels the demand for aerosol propellants. The market encompasses various applications, such as cosmetics, shaving foams, shampoos, deodorants, antiperspirants, food products, whipped creams, mayonnaise, chocolate, household products, air fresheners, insect repellents, disinfectants, and pharmaceuticals.

Furthermore, hydrocarbons, dim ethyl ether, compressed gas, nitrogen, carbon dioxide, methanol, coal, natural gas, carbon, and other propellants are used In these applications. Environmental and health risks associated with certain propellants have led to the development of low-VOC (volatile organic compound) products and airless dispensers. The personal care segment, including mouthwash, breath freshener, teeth whitening treatments, and pharmaceutical aerosols, is a significant contributor to the market's growth. Other applications include paints, hair sprays, dental creams, ointments, and various industrial and automotive products.

Market Dynamics

Our aerosol propellant market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Aerosol Propellant Industry?

The rapid growth of the personal care industry is the key driver of the market.

- The aerosol propellants market is experiencing significant growth due to the expanding personal care segment and increasing demand for aerosol-based household products. In the personal care industry, aerosol propellants are extensively used in cosmetics, shaving foams, shampoos, deodorants, antiperspirants, and anti-aging cosmetic products. Additionally, food applications, including whipped creams, mayonnaise, chocolate, and cooking oil, utilize aerosol propellants. Household products, such as air fresheners, insect repellents, disinfectants, and cleaning sprays, also rely on aerosol propellants for their dispersal. The market is further driven by the adoption of aerosol propellants in various industries, including automotive, medical devices, and inhalers. In the automotive sector, aerosol propellants are used in pain treatments, aromatherapy, and detailing applications.

- In the medical sector, aerosol propellants are used in pharmaceutical aerosols, inhalers, and dental creams. Product innovations, such as the development of airless dispensers and low-VOC (volatile organic compound) propellants, are expected to boost the market growth. However, environmental and health risks associated with certain propellants, such as hydrocarbons, dim ethyl ether, methanol, and hydrofluorocarbons, may pose challenges to market growth. The market is diverse, encompassing various types of propellants, including compressed gases (nitrogen, carbon dioxide), hydrocarbons, halogens, and water-based aerosols.

- Furthermore, key applications include cosmetics, shaving foams, shampoos, deodorants, antiperspirants, food products, household products, automotive products, industrial products, and technical products. Manufacturing companies are focusing on developing eco-friendly and sustainable propellants to cater to evolving consumer preferences and regulatory requirements. The market is expected to continue its growth trajectory during the forecast period, driven by increasing demand for aerosol-based products across various industries and applications.

What are the market trends shaping the Aerosol Propellant Industry?

Increasing demand for male grooming products is the upcoming market trend.

- The aerosol propellants market is witnessing significant growth due to the increasing demand for various consumer and industrial applications. In the personal care segment, the popularity of male grooming products, including shaving foams, deodorants, and antiperspirants, is driving market expansion. The rise in disposable income and the trend of using personal care products as part of daily routines, particularly in developed countries like the US and the UK, are key factors fueling this growth.

- Additionally, the food industry utilizes aerosol propellants for whipped creams, mayonnaise, chocolate, and other food items, contributing to market expansion. Household products such as air fresheners, insect repellents, disinfectants, and cleaning sprays also rely on aerosol propellants for their dispersal. The market scope includes hydrocarbons, dim ethyl ether, nitrogen, carbon dioxide, methanol, coal, natural gas, and other gases as propellants. Environmental and health concerns have led to the development of low-VOC (volatile organic compound) products and airless dispensers, which are gaining traction in various applications.

- Furthermore, the pharmaceutical industry utilizes aerosol propellants for inhalers, mouthwashes, breath fresheners, and teeth whitening treatments. The market also caters to various industrial applications, including automotive, medical devices, pain treatment, and technical products. Overall, the aerosol propellants market is poised for strong growth due to its wide applicability across various sectors.

What challenges does the Aerosol Propellant Industry face during its growth?

The ill-effects of aerosol propellant are a key challenge affecting the industry growth.

- Aerosol particles can penetrate deep into the lungs during inhalation, leading to health issues such as ventricular tachyarrhythmias, acute heart failure, arterial hypotension, and asphyxia. Additionally, low-VOC products, Airless dispensers, and alternative propellants like hydro-fluorocarbons are gaining popularity due to environmental concerns. Manufacturers must balance profitability with safety and eco-friendliness, which can impact their profit margins significantly. This challenge may hinder the growth of the market during the forecast period.

- Furthermore, the market includes applications in various sectors, including the personal care segment, food applications, automobile industries, medical devices, inhalers, and commercial items. Products range from aromatherapy to automotive sprays, pressurized dosage forms, and active components in various product concentrates. The market also includes propellant, dispersion, and gaseous medium in various applications like paints, hair sprays, nitrous oxide, ammonium nitrate, dental creams, ointments, skincare products, perfumes, and hydro-fluorocarbons. The market caters to various industries, including household application categories, fabric care, furniture polish, oven cleaners, leather care, tin, commercial items, and consumer items.

- Thus, the market also includes food items like cream, olive oil, and vinegar, manufacturing companies, aerosol drugs, ethyl chloride, asthma, chlorofluorocarbons, and hydrochlorofluorocarbons, and personal care business offerings like colognes, fragrances, zero-ODP, and pressurized dosage forms.

Exclusive Customer Landscape

The aerosol propellant market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aerosol propellant market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aerosol propellant market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akzo Nobel NV

- Arkema Group.

- Aztec Aerosols Ltd.

- Bharat Petroleum Corp. Ltd.

- Brothers Gas Bottling and Distribution Co. LLC

- DuPont de Nemours Inc.

- Emirates National Oil Co. Ltd. LLC.

- Grillo Werke AG

- GTS SPA

- Harp International Ltd.

- Honeywell International Inc.

- Linde Plc

- Mexichem UK Ltd.

- Mitsubishi Gas Chemical Co. Inc.

- National Gas Co.

- Repsol SA

- Shell plc

- Sumitomo Corp.

- The Chemours Co.

- Viatris Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of applications, catering to various industries and consumer goods. This market plays a significant role In the production and delivery of numerous products, including those within the personal care segment such as shaving foams, shampoos, deodorants, and antiperspirants. Additionally, aerosol propellants are utilized in food products, including whipped creams, mayonnaise, chocolate, and various food applications like cooking oil, ketchup, salad dressing, mustard, icing, cheese spreads, and colorants. Furthermore, aerosol propellants find extensive use in household products, air fresheners, insect repellents, disinfectants, and various industrial applications. These include adhesives, sealants, lubricants, skincare products, perfumes, and hydro-fluorocarbons used in personal care goods and various technical products. The automotive industries also rely on aerosol propellants for applications like automotive paints, hair sprays, and nitrous oxide used in car engines. In the medical sector, aerosol propellants are utilized in pharmaceutical aerosols, inhalers, and aerosol drugs for treatments like ethyl chloride and asthma medication. Hydrocarbons, dim ethyl ether, compressed gas, nitrogen, carbon dioxide, methanol, coal, natural gas, carbon, and various other gases serve as the primary propellants in the aerosol industry.

Furthermore, these gases provide the necessary pressure to dispense the product from the aerosol can. The market for aerosol propellants experiences dynamic market forces, driven by factors such as evolving consumer preferences, environmental concerns, and technological advancements. The shift towards low-VOC (volatile organic compound) products and the increasing popularity of airless dispensers have significantly impacted the market. Moreover, the market caters to a wide array of industries and consumer goods, making it a versatile and essential component in various sectors. From cosmetics and personal care to food and household products, and from automotive and industrial applications to medical and technical products, aerosol propellants play a crucial role In their production and delivery. The environmental and health risks associated with certain propellants have led to increased focus on the development and adoption of alternative, eco-friendly propellants.

Thus, this includes the use of hydrocarbon-based propellants, water-based aerosols, and the growing popularity of zero-odor propellants like dimethyl ether and methyl ethyl ether. The market is a dynamic and diverse industry, catering to a wide range of applications and industries. Its role In the production and delivery of various consumer and industrial goods makes it an essential component in numerous sectors. As market trends and consumer preferences continue to evolve, the market will continue to adapt and innovate to meet the demands of the modern world.

|

Aerosol Propellant Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.8% |

|

Market growth 2024-2028 |

USD 5.10 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.49 |

|

Key countries |

US, China, Germany, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aerosol Propellant Market Research and Growth Report?

- CAGR of the Aerosol Propellant industry during the forecast period

- Detailed information on factors that will drive the Aerosol Propellant growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aerosol propellant market growth of industry companies

We can help! Our analysts can customize this aerosol propellant market research report to meet your requirements.